Saudi Arabia Pharmaceuticals Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Drug Type (Branded Drugs, Generic Drugs), by Therapeutic Area (Cardiovascular, Diabetes, Oncology, Respiratory, Others), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), by End User (Hospitals, Clinics, Homecare Settings)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1312 | Industry : Healthcare | Available Format :

|

Page : 145 |

Saudi Arabia Pharmaceuticals Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Drug Type (Branded Drugs, Generic Drugs), by Therapeutic Area (Cardiovascular, Diabetes, Oncology, Respiratory, Others), by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), by End User (Hospitals, Clinics, Homecare Settings)

Saudi Arabia Pharmaceuticals Market Overview

The Saudi Arabia pharmaceuticals market which was valued at approximately USD 10.81 billion in 2025 and is estimated to rise further up to almost USD 11.29 billion by 2026 is projected to reach around USD 16.73 billion by 2035 expanding at a CAGR of about 4.4% during the forecast period from 2026 to 2035. Market expansion is primarily supported by rising prevalence of chronic diseases expanding healthcare coverage and sustained government focus on pharmaceutical manufacturing localization supported by increasing adoption of generic medicines and biosimilars across the national healthcare system.

Growth trends are aligned with healthcare priorities outlined by the Saudi Ministry of Health and reinforced by World Health Organization country health profiles which emphasize access to essential medicines supply chain security and long-term capacity development. Public investment programs under Vision 2030 and the National Transformation Program continue to strengthen domestic production capabilities while regulatory oversight by the Saudi Food and Drug Authority supports quality assurance and market stability contributing to sustained demand growth across the pharmaceuticals sector.

Saudi Arabia Pharmaceuticals Market Dynamics

Market Trends

The market is experiencing structural shifts in therapeutic demand manufacturing localization and procurement practices driven by national healthcare reform programs and evolving disease burden profiles. One key trend shaping the market is the accelerated adoption of generic medicines and biosimilars reflecting priorities toward cost optimization treatment accessibility and sustainable healthcare financing. This trend aligns with initiatives promoted by the Saudi Ministry of Health and the National Health Transformation Program which emphasize affordability and expanded access to essential medicines under universal coverage objectives.

Another emerging trend is the expansion of domestic pharmaceutical manufacturing driven by regulatory incentives industrial policy alignment and technology transfer frameworks under Vision 2030. Programs supported by the Ministry of Investment and the Saudi Food and Drug Authority encourage local production clinical research activity and supply chain resilience. These developments are influencing portfolio strategies and encouraging firms to focus on differentiated therapies specialty drugs and integrated treatment solutions thereby redefining competitive positioning across the national market landscape.

Growth Drivers

The growth of the market is primarily supported by rising prevalence of chronic diseases including diabetes cardiovascular disorders and oncology conditions which continues to generate sustained demand across hospital retail and institutional procurement channels. Increasing public investment in healthcare infrastructure expansion of hospital capacity and primary care networks and modernization of treatment pathways are accelerating pharmaceutical consumption. Government spending priorities highlighted in Ministry of Health annual statistical reports and national budget allocations confirm consistent funding toward medicine procurement and healthcare delivery optimization.

Additionally, population growth aging demographics and expanding insurance coverage are contributing to higher treatment uptake across therapeutic categories. As healthcare providers prioritize treatment efficacy regulatory compliance and long-term cost efficiency demand for branded generics specialty drugs and biologics remains strong. Supportive reimbursement frameworks and centralized procurement mechanisms further strengthen volume demand across the sector throughout the forecast period.

Market Restraints / Challenges

Despite favorable growth prospects the industry faces constraints associated with pricing controls reimbursement policy reforms and regulatory compliance requirements which can limit profitability and delay market entry for innovative therapies. Government price referencing frameworks and tender based procurement systems affect margins particularly for multinational manufacturers and premium drug categories. Dependence on imported active pharmaceutical ingredients also exposes the sector to supply chain volatility and foreign exchange risks.

Furthermore, operational challenges linked to localization mandates and workforce skill gaps can constrain production scalability. Reports from the Saudi Ministry of Industry and Mineral Resources and national industrial development authorities highlight the need for technology transfer skilled labor development and infrastructure readiness to support manufacturing expansion. These factors contribute to cost pressures and longer commercialization timelines during periods of economic and policy transition.

Market Opportunities

The market presents significant opportunities in specialty therapeutics and biologics particularly driven by rising incidence of oncology autoimmune and rare diseases coupled with unmet clinical demand. Companies offering high efficacy targeted therapies and patient centric treatment models are positioned to capture incremental demand across tertiary care centers and specialized hospitals. National health priorities outlined in Vision 2030 and Ministry of Health strategic plans emphasize advanced care delivery and innovation adoption supporting growth potential in high value segments.

Another key opportunity lies in local manufacturing partnerships and contract development capabilities where sustained government incentives are encouraging private investment. Rising funding toward research development and digital health integration is creating pathways for differentiated offerings improved treatment adherence and enhanced market access. Advancements in regulatory fast track approvals clinical trial infrastructure and health data platforms are expected to strengthen long term sector competitiveness and revenue expansion.

Saudi Arabia Pharmaceuticals Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 10.81 Billion |

|

Revenue Forecast in 2035 |

USD 16.73 Billion |

|

Growth Rate |

4.4% |

|

Segments Covered in the Report |

By Drug Type, By Therapeutic Area, By Distribution Channel, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Central Region, Western Region, Eastern Region, Other Regions |

|

Key Companies |

Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Sipco (Saudi Industrial Products Company), Modern Pharmaceutical Company (MPC), AstraZeneca, GSK plc, Novartis AG, Al Nahdi Medical Company, Jamjoom Pharma, Pfizer Saudi Limited Corporate / Pfizer Inc., Sanofi KSA / Sanofi S.A. |

|

Customization |

Available upon request |

Saudi Arabia Pharmaceuticals Market Segmentation

By Drug Type

Branded drugs accounted for the largest share at approximately 56% in 2025 supported by higher physician preference established therapeutic efficacy and strong presence of multinational pharmaceutical companies within the regulated healthcare system. Demand remains stable across chronic disease therapies oncology and specialty treatments where branded formulations continue to dominate hospital procurement and insurance backed reimbursement frameworks.

Generic drugs represent the fastest growing segment and are estimated to expand at a CAGR of about 9.1% during the forecast period driven by government cost containment measures pricing regulations and increasing focus on treatment accessibility. National procurement policies and initiatives promoted by the Saudi Ministry of Health and the Saudi Food and Drug Authority continue to encourage generic substitution which is accelerating volume growth particularly within primary care and public hospital settings.

By Therapeutic Area

Cardiovascular and diabetes therapies together accounted for approximately 38% of market revenue in 2025 reflecting the high prevalence of lifestyle related and non-communicable diseases across the population. Government backed screening programs and long-term treatment protocols supported by Ministry of Health clinical guidelines continue to sustain consistent demand for these drug categories.

Oncology drugs are expected to witness the highest growth rate at an estimated CAGR of 8.8% driven by rising cancer incidence expanding diagnostic coverage and increased adoption of targeted therapies. Investments in specialized treatment centers and national cancer control strategies aligned with World Health Organization recommendations are strengthening access to advanced oncology medications and supporting segment level expansion.

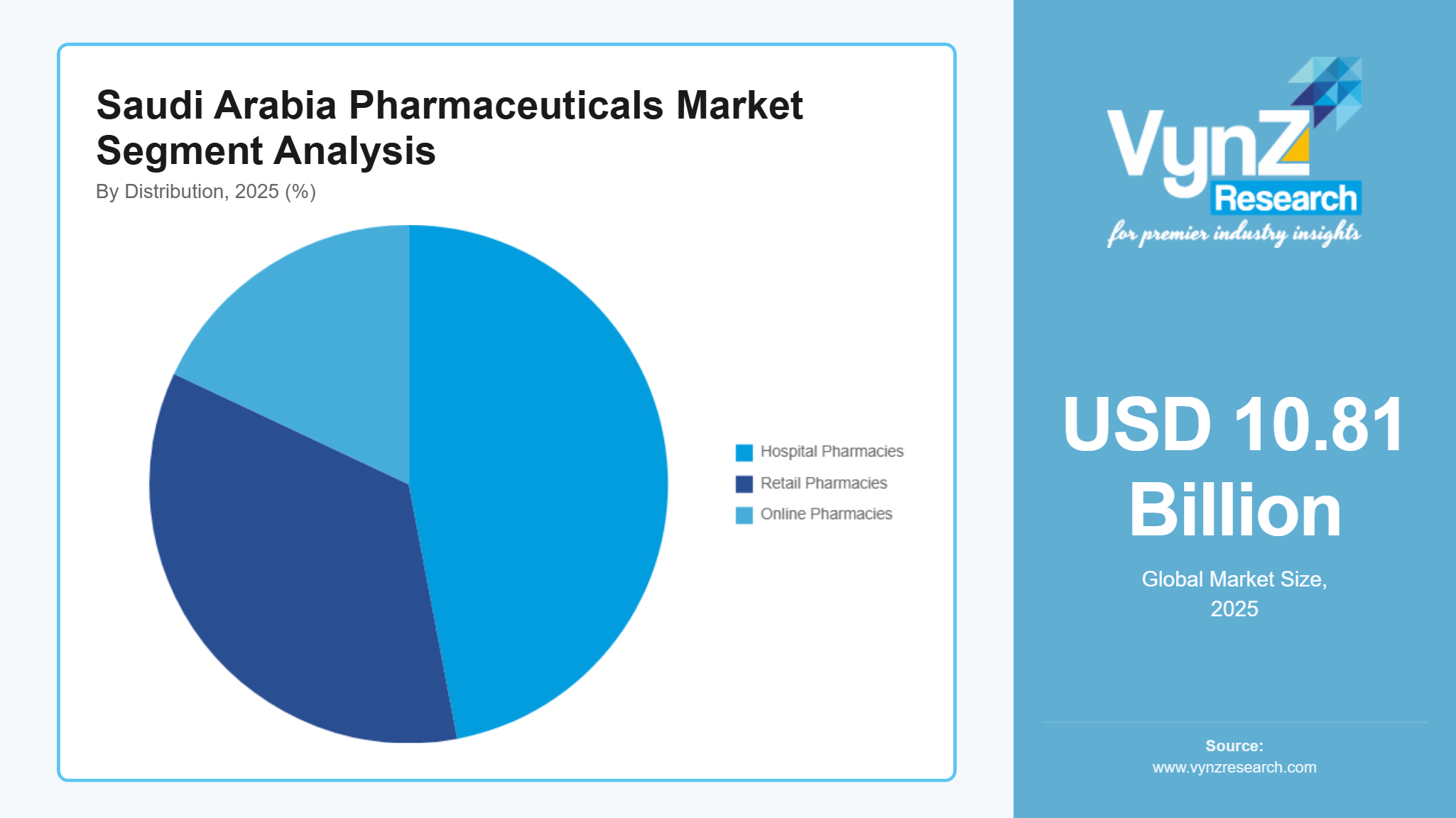

By Distribution Channel

Hospital pharmacies held the dominant share of approximately 47% in 2025 supported by centralized procurement high inpatient volumes and growing utilization of specialty and injectable drugs within tertiary care facilities. Structured purchasing contracts and reimbursement alignment continue to favor hospital-based distribution.

Online pharmacies are witnessing rapid growth with an estimated CAGR of 10.2% driven by digital health adoption regulatory approvals for e pharmacy operations and improved logistics infrastructure. Government initiatives supporting digital healthcare transformation and telemedicine services are enhancing prescription fulfillment efficiency and expanding reach particularly for chronic medication refills and home delivery services.

By End User

Hospitals accounted for the largest revenue share at approximately 52% in 2025 supported by rising inpatient admissions expansion of public and private hospital infrastructure and increasing use of complex drug therapies requiring clinical supervision. Continuous investment under Vision 2030 healthcare expansion plans is reinforcing hospital dominance.

Homecare settings are expected to grow at a CAGR of about 8.5% driven by aging population trends increased prevalence of chronic diseases and government supported home healthcare initiatives. Policy frameworks encouraging outpatient care and reduced hospitalization durations are accelerating pharmaceutical consumption within home-based treatment models contributing to sustained end user segment growth.

Regional Insights

Central Region

The central region accounted for approximately 32% of the market in 2025 driven by concentration of advanced healthcare infrastructure regulatory bodies and large-scale public hospitals. Riyadh hosts major government hospitals specialized medical cities and headquarters of key healthcare institutions which sustain high prescription volumes across chronic disease and specialty therapies. Strong demand from tertiary care centers and national referral hospitals continues to support market growth.

Government initiatives led by the Saudi Ministry of Health and National Health Transformation Program emphasize centralized procurement digital health records and expanded access to essential medicines. Investments in pharmaceutical logistics clinical research facilities and national distribution hubs further strengthen regional market performance while policy alignment under Vision 2030 continues to support long term demand stability.

Western Region

The western region represented approximately 24% of the market in 2025 supported by dense population clusters healthcare tourism and seasonal demand linked to religious travel. Cities such as Jeddah and Makkah witness sustained pharmaceutical consumption driven by hospital admissions emergency care and infectious disease management particularly during peak pilgrimage periods.

Government backed public health preparedness programs vaccination initiatives and disease surveillance frameworks supported by the Saudi Ministry of Health and World Health Organization guidelines reinforce pharmaceutical demand. Expansion of hospital capacity and retail pharmacy networks alongside digital prescription platforms is further strengthening regional market growth.

Eastern Region

The eastern region accounted for an estimated 18% of the market in 2025 supported by industrial population bases corporate healthcare coverage and proximity to manufacturing and logistics infrastructure. Demand is driven by chronic disease treatment occupational health needs and private healthcare facilities serving industrial workforces.

Government investment in healthcare infrastructure and industrial city development supported by regional health authorities continues to encourage pharmaceutical consumption. Growth is further supported by expanding insurance penetration and structured employer sponsored healthcare programs contributing to stable long-term demand across the region.

Other Regions

Other regions including the northern and southern provinces collectively contributed approximately 6% of the market in 2025. Growth in these areas is supported by gradual healthcare infrastructure expansion primary care development and increased access to essential medicines through government outreach programs.

According to national health statistics published by the Saudi Ministry of Health these regions continue to benefit from rural healthcare initiatives telemedicine expansion and improved medicine supply chains. The remaining market share is covered by smaller population centers and remote areas dispersed across the country.

Competitive Landscape / Company Insights

The market is moderately to highly competitive with the presence of multinational and domestic manufacturers focusing on portfolio expansion localization strategies and pricing optimization. Key players include Saudi Pharmaceutical Industries Medical Appliances Corporation, Jamjoom Pharma, Tabuk Pharmaceuticals, Pfizer, and Novartis. Competitive positioning is reinforced by investments in local manufacturing research capabilities and regulatory compliance. Government programs led by the Saudi Ministry of Health and oversight by the Saudi Food and Drug Authority encourage domestic production quality assurance and supply security supporting long term market participation and sustained competitive intensity.

Mini Profiles

Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) focuses on branded generics and essential medicines supported by domestic manufacturing strong government procurement relationships and extensive hospital distribution across public and private healthcare systems.

Jamjoom Pharma operates in mass and specialty segments emphasizing ophthalmology and dermatology supported by strong physician trust integrated manufacturing capabilities and expanding regional and international distribution presence.

Tabuk Pharmaceuticals specializes in branded generics and antibiotics leveraging regional manufacturing licensing partnerships and cost-efficient production to serve hospital and retail pharmacy channels consistently.

Pfizer operates in premium and specialty pharmaceutical segments emphasizing innovative therapies vaccines and biologics supported by global research capabilities strong brand equity and collaboration with national healthcare programs.

Novartis focuses on specialty pharmaceuticals and oncology therapies leveraging advanced research clinical expertise and strategic hospital partnerships to strengthen presence in high value therapeutic segments.

Key Players

- Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

- Sipco (Saudi Industrial Products Company)

- Modern Pharmaceutical Company (MPC)

- AstraZeneca

- GSK plc

- Novartis AG

- Al Nahdi Medical Company

- Jamjoom Pharma

- Pfizer Saudi Limited Corporate / Pfizer Inc.

- Sanofi KSA / Sanofi S.A.

Saudi Arabia Pharmaceuticals Market Coverage

Drug Type Insight and Forecast 2026 - 2035

- Branded Drugs

- Generic Drugs

Therapeutic Area Insight and Forecast 2026 - 2035

- Cardiovascular

- Diabetes

- Oncology

- Respiratory

- Others

Distribution Channel Insight and Forecast 2026 - 2035

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

End User Insight and Forecast 2026 - 2035

- Hospitals

- Clinics

- Homecare Settings

Saudi Arabia Pharmaceuticals Market by Region

- Central Region

- By Drug Type

- By Therapeutic Area

- By Distribution Channel

- By End User

- Western Region

- By Drug Type

- By Therapeutic Area

- By Distribution Channel

- By End User

- Eastern Region

- By Drug Type

- By Therapeutic Area

- By Distribution Channel

- By End User

- Other Regions

- By Drug Type

- By Therapeutic Area

- By Distribution Channel

- By End User

Table of Contents for Saudi Arabia Pharmaceuticals Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Drug Type

1.2.2. By

Therapeutic Area

1.2.3. By

Distribution Channel

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Drug Type

5.1.1. Branded Drugs

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Generic Drugs

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Therapeutic Area

5.2.1. Cardiovascular

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Diabetes

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Oncology

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Respiratory

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Others

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.3. By Distribution Channel

5.3.1. Hospital Pharmacies

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Retail Pharmacies

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Online Pharmacies

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Hospitals

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Clinics

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Homecare Settings

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. Central Region Market Estimate and Forecast

6.1. By

Drug Type

6.2. By

Therapeutic Area

6.3. By

Distribution Channel

6.4. By

End User

6.4.1.

Central Region Market Estimate and Forecast

6.4.2.

Western Region Market Estimate and Forecast

6.4.3.

Eastern Region Market Estimate and Forecast

6.4.4.

Other Regions Market Estimate and Forecast

7. Western Region Market Estimate and Forecast

7.1. By

Drug Type

7.2. By

Therapeutic Area

7.3. By

Distribution Channel

7.4. By

End User

7.4.1.

Central Region Market Estimate and Forecast

7.4.2.

Western Region Market Estimate and Forecast

7.4.3.

Eastern Region Market Estimate and Forecast

7.4.4.

Other Regions Market Estimate and Forecast

8. Eastern Region Market Estimate and Forecast

8.1. By

Drug Type

8.2. By

Therapeutic Area

8.3. By

Distribution Channel

8.4. By

End User

8.4.1.

Central Region Market Estimate and Forecast

8.4.2.

Western Region Market Estimate and Forecast

8.4.3.

Eastern Region Market Estimate and Forecast

8.4.4.

Other Regions Market Estimate and Forecast

9. Other Regions Market Estimate and Forecast

9.1. By

Drug Type

9.2. By

Therapeutic Area

9.3. By

Distribution Channel

9.4. By

End User

9.4.1.

Central Region Market Estimate and Forecast

9.4.2.

Western Region Market Estimate and Forecast

9.4.3.

Eastern Region Market Estimate and Forecast

9.4.4.

Other Regions Market Estimate and Forecast

10. Company Profiles

10.1. Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Sipco (Saudi Industrial Products Company)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Modern Pharmaceutical Company (MPC)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. AstraZeneca

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. GSK plc

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Novartis AG

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Al Nahdi Medical Company

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Jamjoom Pharma

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Pfizer Saudi Limited Corporate / Pfizer Inc.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Sanofi KSA / Sanofi S.A.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Saudi Arabia Pharmaceuticals Market