FPGA Market Overview

The Global FPGA Market is expected to reach USD 26.8 billion in 2030 from USD 11.7 billion in 2023 with a compound annual growth rate CAGR of 17.2% throughout the forecast period (2025-2030).

The increasing demand for streaming data processing and efficient data flow in various applications is driving the market growth. The adoption of FPGA architecture is on the rise due to its capabilities, such as high compute density and low power consumption. Also the rising trend for the adoption of field programmable gate array in areas of network processing, deep packet inspection and security is projected to drive their demand over the forecast period. Product launches by major players, such as ultra-low power consumption, handheld and mobile applications are anticipated to drive the market growth over the forecast period.

Market Segmentation

Insight by Configuration

Based on configuration, the FPGA market is segmented into low-end, mid-end and high-end FPGA. The high-end FPGA segment accounted for the largest market share of over as they are attributed to their enhanced features, such as substantial memory capacity, large number of logic elements and a wide array of advanced functionalities.

Mid-range FPGAs are expected to register the highest CAGR over the forecast period, due to their features like small form factor, low power consumption and high performance for FPGA-based devices.

Insight by Node Size

The FPGA Market is segmented by node size as below 16nm, 20-90nm and 90nm. The 20-90 nm segment dominated the market during the forecast period as this node size are recognized for their low power consumption and durability.

Insight by Technology

On the basis of Technology, the FPGA Market is divided into SRAM, Antifuse, Flash. The Static Random-Access Memory (SRAM) segment accounted for the largest market share during the forecast period due to the properties that include re-programmability, high integration and better flexibility for various applications.

Insight by Vertical

Based on application, the FPGA Market is segmented into consumer electronics, telecom, industrial, automotive, healthcare, multimedia, military & aerospace, broadcasting, datacenter and computing. The telecom sector dominated the market during the forecast period. FPGA market expanded due to the growing usage of field programmable gate arrays in telecom sector for numerous applications like data packet processing, optical transport network and packet switching

Global FPGA Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 11.7 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 26.8 Billion

|

|

Growth Rate

|

17.2%

|

|

Segments Covered in the Report

|

By Configuration, By Node size, By Technology, By Vertical

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Asia-Pacific, Europe and Rest of the World

|

Industry Dynamics

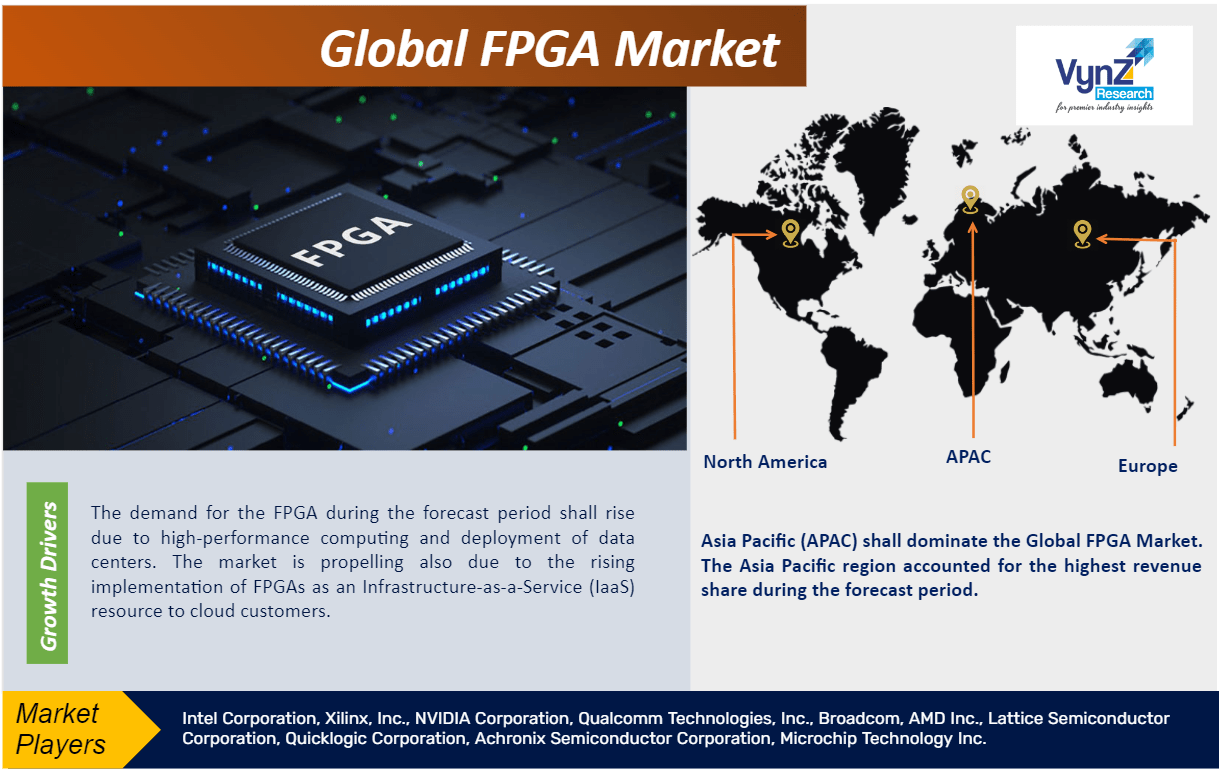

Growth Drivers

The demand for the FPGA during the forecast period shall rise due to high-performance computing and deployment of data centers. The market is propelling also due to the rising implementation of FPGAs as an Infrastructure-as-a-Service (IaaS) resource to cloud customers. Various cloud service providers are deploying field programming gate arrays to enhance their service-oriented tasks such as webpage ranking, memory caching, network encryption, high-frequency trading, deep learning and video conversion. FPGAs are used for machine learning and deep learning in the technology industry. FPGAs provide a combination of speed, and flexibility, programmability, cost effective and complexity to develop custom application-specific integrated circuits (ASICs). In addition, growth and advancement in technology development for 5G networking infrastructure and an increase in the use of FPGA in various end-user industries are some of the factors driving the studied market growth. In addition, many market players are continuously investing in the latest technology to develop innovative products. Furthermore, the automotive industry has too appear as a significant driver for stimulating the market demand. Various companies are entering into collaboration and partnerships to enhance their product offering along with increasing their geographical presence in the market. Also, to align with the evolving requirements of the automotive industry, major players are continuously upgrading their product portfolio.

Restraints

The main constraint of the FPGA Market is the high cost of FPGAs. Other types of programmable logic devices (PLDs) are less expensive than FPGAs. This high cost limits the adoption of FPGAs, especially in small and medium-sized enterprises (SMEs). FPGAs are more complex to design than other PLDs hence their design complexity is also the another restraint for the market which increases the cost and time. The total cost of ownership (TCO) of FPGAs increases as the FPGA market consume more power than other PLDs.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World

Geographically, Asia Pacific (APAC) shall dominate the Global FPGA Market. The Asia Pacific region accounted for the highest revenue share during the forecast period. China accounted for the largest revenue share in the region due to continuous investments and initiatives undertaken by the government to augment the industry growth. In April 2023, China's southern Guangdong province launched the second phase of semiconductor fund with an investment of over USD 4.3 billion which shall help the region to build self-reliance in key technology areas such as semiconductors. Such initiatives are expected to drive the FPGA market in the region.

Competitive Insights

Intel Corp (Intel) designs and develops technology products and components. The company has a large product portfolio that includes chipsets, embedded processors, graphic, microprocessors and microcontrollers, programmable devices, network and communication, laptops, gaming systems and ethernet products.

AMD, founded in 1969 as a Silicon Valley start-up is the high performance and adaptive computing leader, powering the products and services that help solve the world’s most important challenges. AMD has grown into a global company setting the standard for modern computing, with many important industry firsts and major technological achievements.

The key players of the global FPGA Market include Intel Corporation, Xilinx, Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Broadcom, AMD Inc., Lattice Semiconductor Corporation, Quicklogic Corporation, Achronix Semiconductor Corporation, Microchip Technology Inc.

Recent Development by Key Players

Recently, Intel has built the world's largest neuromorphic system, code-named Hala Point, this large-scale neuromorphic system, initially deployed at Sandia National Laboratories, which utilizes Intel’s Loihi 2 processor and focus at supporting research for future brain-inspired artificial intelligence (AI) to tackle challenges related to the efficiency and sustainability of today’s AI.

Lattice Collaborates with NVIDIA to Accelerate Edge AI. This collaboration with Lattice will accelerate innovations in sensor processing and help simplify the deployment of edge-to-cloud AI applications.

The global FPGA Market report offers a comprehensive market segmentation analysis along with estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Configuration

- By Node Size

- By Technology

- By Vertical

- Consumer Electronics

- Telecom

- Industrial

- Automotive

- Healthcare

- Multimedia

- Military & Aerospace

- Broadcasting

- Datacenter and Computing

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- Rest of the World

- Brazil

- Saudi Arabia

- South Africa

- U.A.E

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)