Data Center Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component (Hardware, Software, Services), by Type (Colocation Facilities, Hyperscale Data Centers, Enterprise Owned Data Centers), by Data Center Size (Large Scale, Small and Mid-Size), by Infrastructure (IT Infrastructure, Electrical Infrastructure, Mechanical Infrastructure), by Cooling Type (Air-Based Cooling, Liquid-Based Cooling), by Tier Standard (Tier 1 & Tier 2, Tier 3, Tier 4), by End User (Cloud Service Providers, Enterprises, Government Institutions)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1313 | Industry : ICT & Media | Available Format :

|

Page : 210 |

Data Center Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component (Hardware, Software, Services), by Type (Colocation Facilities, Hyperscale Data Centers, Enterprise Owned Data Centers), by Data Center Size (Large Scale, Small and Mid-Size), by Infrastructure (IT Infrastructure, Electrical Infrastructure, Mechanical Infrastructure), by Cooling Type (Air-Based Cooling, Liquid-Based Cooling), by Tier Standard (Tier 1 & Tier 2, Tier 3, Tier 4), by End User (Cloud Service Providers, Enterprises, Government Institutions)

Data Center Market Overview

The global data center market which was valued at approximately USD 334.80 billion in 2025 and is estimated to rise further up to almost USD 369.21 billion in 2026 is projected to reach around USD 890.56 billion by 2035 expanding at a CAGR of about 10.2% during the forecast period from 2026 to 2035.

Market growth is driven by large scale cloud platform deployment accelerated artificial intelligence workload adoption and rising enterprise migration toward outsourced infrastructure along with increasing integration of edge computing and hybrid IT environments.

Rising demand for data intensive services including digital payments online commerce and public sector digital platforms and sustained investments in government backed digital infrastructure programs are further supporting the sector across North America Europe and Asia Pacific. National initiatives such as the United States Federal Cloud Strategy the European Union Digital Decade Framework and the China New Infrastructure Development Plan are expanding secure data hosting capacity strengthening data sovereignty compliance and supporting long term investment flows across the global data center industry.

Data Center Market Dynamics

Market Trends

The market is undergoing a structural shift toward high density energy efficient and software defined infrastructure models driven by the rapid expansion of cloud platforms and artificial intelligence workloads. National digital infrastructure programs supported by the United States Department of Commerce the European Commission and the China Ministry of Industry and Information Technology are prioritizing sovereign cloud development energy efficient computing and secure data hosting capacity which is accelerating investment in hyperscale and colocation facilities. These frameworks promote standardized architectures advanced cooling technologies and integrated power management systems that improve operational efficiency and sustainability across the global data center landscape.

Operators are increasingly adopting liquid cooling modular facility design and software driven workload orchestration to improve power utilization and capacity scalability in line with government backed carbon reduction and energy efficiency targets. Policies such as the United States Energy Star data center program the European Union Code of Conduct for Data Centers and national green data center initiatives in Asia are encouraging the deployment of renewable powered facilities and intelligent energy management platforms which are reshaping procurement patterns and technology adoption across the sector.

Growth Drivers

The global expansion of cloud computing platforms and enterprise digital transformation remains a primary growth driver for the data center market as organizations continue to migrate mission critical workloads from on premises environments to secure outsourced infrastructure. Government digitalization programs including the United States Federal Cloud Strategy the European Union Digital Decade Framework and large-scale public-sector cloud adoption initiatives in Asia are generating sustained demand for high availability and compliance driven hosting capacity across financial public administration and healthcare systems.

The rapid deployment of artificial intelligence big data analytics and high-performance computing workloads is further accelerating investment in advanced data center infrastructure. National research and innovation programs such as those funded by the United States National Science Foundation the European High Performance Computing Joint Undertaking and China national AI development plans are increasing requirements for high density compute clusters and low latency data processing which supports continuous expansion of hyperscale and enterprise focused data center facilities worldwide.

Market Restraints / Challenges

High capital intensity and rising energy costs remain a key constraint for the market particularly in regions facing power grid limitations and carbon compliance requirements. Reports from the United States Energy Information Administration and the International Energy Agency highlight that electricity demand from large scale computing facilities is increasing at a faster rate than overall industrial consumption which creates pricing volatility and infrastructure bottlenecks that can delay new capacity deployment and reduce project profitability.

Regulatory complexity related to data sovereignty cybersecurity and environmental compliance also presents operational challenges for operators and investors. Frameworks such as the European Union General Data Protection Regulation the United States Federal Risk and Authorization Management Program and national data localization policies in Asia require strict governance security controls and localized infrastructure which increases development costs and limits cross border capacity optimization within the global data center industry.

Market Opportunities

The growing adoption of edge computing and regional cloud hubs presents significant opportunities for data center operators as governments and enterprises seek lower latency and localized data processing capabilities. Public sector programs supporting smart cities digital healthcare and industrial automation such as those led by the European Commission the United States Department of Transportation and national digital economy ministries in Asia are creating strong demand for distributed and modular data center facilities that can support real time applications and secure data management.

Another major opportunity lies in the transition toward sustainable and energy efficient data center designs as governments introduce stricter carbon reduction and renewable energy mandates. Initiatives such as the European Green Deal the United States clean energy investment programs and national green computing frameworks in Asia are encouraging investment in renewable powered facilities advanced cooling systems and energy optimized infrastructure which allows operators to achieve cost savings regulatory compliance and stronger long term customer relationships.

Global Data Center Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 334.80 Billion |

|

Revenue Forecast in 2035 |

USD 890.56 Billion |

|

Growth Rate |

10.2% |

|

Segments Covered in the Report |

By Component, By Type, By Data Center Size, By Infrastructure, By Cooling Type, By Tier Standard, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Other Regions |

|

Key Companies |

ABB Ltd., Alibaba Cloud, Amazon Web Services, Inc., AT&T Intellectual Property, Chindata Group Holdings Ltd., China Telecom Americas, Inc., Cisco Systems, Inc, Dell Technologies, Digital Realty Trust, Inc., Equinix, Inc., Google Inc., Hewlett Packard Enterprise Development LP, Hitachi Ltd, Huawei Technologies Co., Ltd., IBM Corporation, Lumen Technologies (CenturyLink), Menlo Equities LLC, Microsoft Corporation, NTT Communications Corporation, Oracle, Schneider Electric |

|

Customization |

Available upon request |

Data Center Market Segmentation

By Component

Hardware represents the largest share of the data center market at approximately 54% in 2025. This dominance is driven by continuous investment in servers, storage systems, networking equipment, and power distribution units that form the physical core of hyperscale and colocation facilities. The hardware segment is expanding at around 10.6% as operators increase rack density and upgrade compute platforms to support artificial intelligence and cloud workloads.

Software accounts for approximately 24% supported by rising demand for virtualization security and data management platforms with growth of about 11.4% driven by automation and compliance requirements.

Services contribute the remaining around 22% with about 10.1% growth supported by installation integration and lifecycle management contracts that sustain long term facility operations.

By Type

Colocation facilities hold the largest market share at approximately 43% in 2025 driven by enterprises shifting away from owned infrastructure toward scalable outsourced capacity. This segment is growing at around 11.2% due to rising demand for cost efficiency compliance readiness and geographic redundancy.

Hyperscale data centers account for around 38% of revenue with growth of nearly 12% supported by cloud service providers expanding global footprints to serve artificial intelligence and digital platform workloads.

Enterprise owned data centers contribute the remaining approximately 19% reflecting gradual consolidation and virtualization with growth moderating at around 7.3% as companies migrate workloads to cloud and colocation environments.

By Data Center Size

Large scale data centers dominate the market with approximately 63% share in 2025 as hyperscale campuses and mega colocation sites continue to absorb most new capacity additions. This segment is growing at around 11.5% supported by centralized cloud architectures and high-density compute clusters.

Small and mid-size facilities account for around 37% primarily serving regional enterprises edge computing and local hosting requirements with growth of about 9.2% driven by distributed digital services and smart city deployments.

By Infrastructure

IT infrastructure contributes approximately 47% of total revenue in 2025 driven by investment in servers, storage and networking hardware which directly generate computing capacity with growth of around 11.3%.

Electrical infrastructure represents about 29% supported by demand for uninterruptible power supplies backup generators and power distribution units expanding at around 10.1% as facilities scale.

Mechanical infrastructure accounts for around 24% reflecting spending on cooling and physical systems with growth of approximately 9.6% driven by efficiency upgrades and high-density design requirements.

By Cooling Type

Air based cooling remains the dominant solution with approximately 68% share in 2025 supported by its cost efficiency and compatibility with most existing facilities. This segment is expanding at around 8.7% as operators continue to optimize airflow and energy management.

Liquid based cooling accounts for around 32% and is the fastest growing segment with nearly 14.2% growth driven by the rapid deployment of high-performance computing and artificial intelligence servers that require advanced thermal management.

By Tier Standard

Tier 3 facilities represent the largest share at approximately 49% as they provide a balance between redundancy and cost efficiency suitable for enterprise and cloud workloads with growth of around 10.8%.

Tier 4 data centers account for around 28% supported by demand for mission critical and zero downtime environments with about 11.6% growth driven by financial services and hyperscale clients.

Tier 1 and tier 2 together contribute the remaining approximately 23% with growth of around 7.5% reflecting their declining use for critical applications.

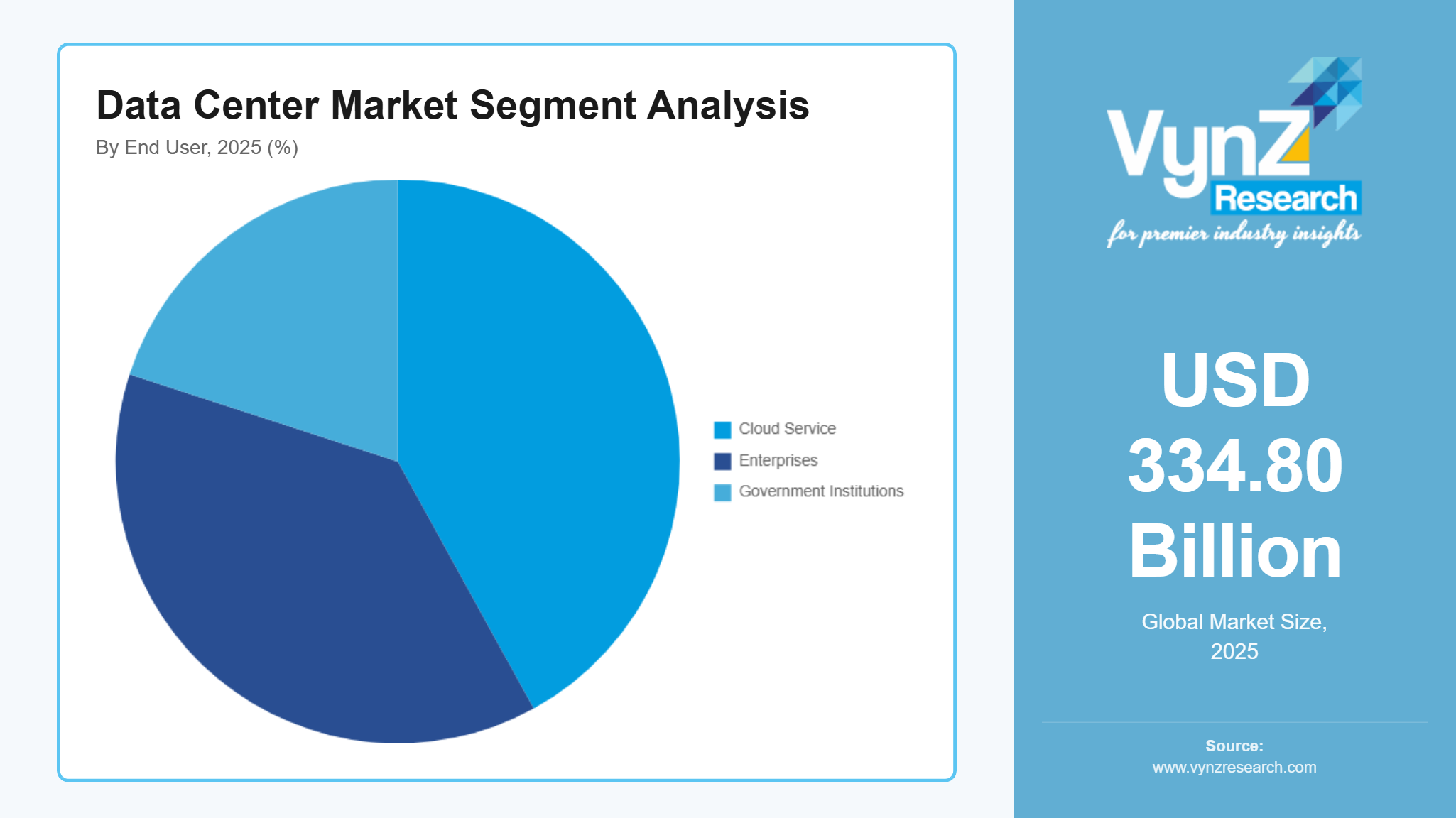

By End User

Cloud service providers represent the largest end user group at approximately 42% in 2025 driven by hyperscale investment and global platform expansion with growth of around 12.2%.

Enterprises account for around 38% supported by digital transformation and outsourcing of IT workloads with growth of about 10.5%.

Government institutions contribute the remaining approximately 20% as national digitalization cybersecurity and data sovereignty initiatives expand secure hosting capacity with growth of around 9.6%.

Regional Insights

North America

North America accounted for approximately 32% of the global market in 2025 supported by the region’s concentration of hyperscale cloud providers advanced digital infrastructure and high enterprise cloud adoption. The United States leads regional capacity deployment driven by strong demand from technology hubs such as Northern Virginia Silicon Valley Dallas and Chicago where cloud service providers and colocation operators continue to expand large scale campuses. Government backed programs including the United States Federal Cloud Strategy and the National Cybersecurity Strategy are strengthening secure cloud adoption across public sector and regulated industries which reinforces sustained demand for compliant data hosting and high availability infrastructure across the regional data center landscape.

Asia Pacific

Asia Pacific is estimated to represent around 28% of the global market in 2025 driven by rapid digitalization expanding internet usage and government led cloud and data localization programs. China India Japan and Singapore are key growth centers as national digital economy strategies and smart city initiatives continue to increase requirements for domestic data storage and low latency services. Programs such as China New Infrastructure Development Plan India Digital India and national data center policies across Southeast Asia are encouraging investment in hyperscale and colocation facilities while supporting strong growth in enterprise and government cloud workloads across the region.

Europe

Europe accounted for approximately 16% of the market in 2025 supported by strong enterprise cloud adoption and strict data protection regulations that encourage local hosting and sovereign data infrastructure. Countries such as Germany the United Kingdom the Netherlands and France are leading capacity additions driven by financial services government platforms and digital commerce. European Union frameworks including the Digital Decade Strategy and General Data Protection Regulation are reinforcing demand for secure compliant and energy efficient data centers which supports continued investment in advanced facilities across major regional hubs.

Other Regions

Other regions including Latin America the Middle East and Africa together contribute approximately 19% of industry revenue supported by expanding internet penetration public sector digitalization and growing demand for regional cloud services. Government initiatives focused on digital economy development cybersecurity and national data sovereignty in countries such as Brazil Saudi Arabia and the United Arab Emirates are driving new facility construction and colocation investments. The remaining approximately 5% of the global market is covered by smaller emerging regions not included in the above analysis which continue to represent long term expansion opportunities for the global data center industry.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on infrastructure innovation, energy efficiency, and geographic expansion. Key vendors including Amazon Web Services, Microsoft, Google, Equinix, and Digital Realty are investing in hyperscale capacity, advanced cooling technologies, and secure cloud platforms. Adoption is supported by government programs such as the U.S. Federal Cloud Strategy, the European Union Digital Decade Framework, and China’s New Infrastructure Development Plan, which drive deployment of compliant, energy efficient, and resilient facilities. These initiatives encourage vendors to strengthen market position and secure long-term enterprise, government, and cloud service contracts across North America, Europe, and Asia Pacific.

Mini Profiles

ABB Ltd. focuses on data center power distribution, automation, and infrastructure solutions, supported by a strong global network, predictive maintenance, and energy management capabilities, enabling clients to optimize efficiency and uptime.

Alibaba Cloud operates in premium cloud computing and hyperscale services, emphasizing high-performance computing, AI workloads, and scalable storage solutions for enterprises and government institutions across Asia and global markets.

Cisco Systems, Inc. leverages strategic partnerships and digital reach to expand market presence, focusing on networking, security, and data center integration while ensuring performance, reliability, and enterprise-grade service delivery.

Digital Realty Trust, Inc. provides mass-market colocation, hyperscale, and hybrid cloud services, supported by extensive global facilities, operational expertise, and strong brand recognition, enabling secure, scalable, and compliant data hosting solutions.

Equinix, Inc. focuses on premium interconnection, colocation, and cloud exchange platforms, emphasizing high-density deployments, automation, and sustainability, backed by a global network and strategic partnerships to serve enterprise and cloud clients.

Key Players

- ABB Ltd.

- Alibaba Cloud

- Amazon Web Services, Inc.

- AT&T Intellectual Property

- Chindata Group Holdings Ltd.

- China Telecom Americas, Inc.

- Cisco Systems, Inc

- Dell Technologies

- Digital Realty Trust, Inc.

- Equinix, Inc.

- Google Inc.

- Hewlett Packard Enterprise Development LP

- Hitachi Ltd

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Lumen Technologies (CenturyLink)

- Menlo Equities LLC

- Microsoft Corporation

- NTT Communications Corporation

- Oracle

- Schneider Electric

Recent Developments

In January 2026 - By acquiring CSF Advisers, Digital Realty Trust formally enters the Malaysian market, expanding its commercial presence in Southeast Asia and setting the stage for future expansion. With the purchase of nearby land, the acquired TelcoHub 1 data center—which now runs at 1.5 megawatts—can accommodate up to 14 megawatts of IT load, greatly increasing the company's capacity to process data. In addition to improving its market competitiveness, Digital Realty's development plans may increase investor interest in its potential for future profitability as the need for data centers rises.

In January 2026 - Amazon Web Services, Inc. (AWS) has announced a new arrangement with Nationwide Building Society, the world’s largest building society, to accelerate innovation and improve customer experiences for its over 17 million clients. With the help of this new agreement, Nationwide will be able to provide more individualized member experiences more quickly and efficiently, changing the way it interacts with clients while maintaining the industry-leading service for which the mutual is renowned.

In January 2026 - IBM Enterprise Advantage is a first-of-its-kind asset-based consulting solution that helps companies rapidly create, manage, and run their own customized internal AI platform at scale by combining tested AI technologies and experience. Without requiring modifications to their cloud providers, AI models, or core infrastructure, organizations can now utilize IBM Enterprise Advantage to reinvent workflows, integrate AI into current systems, and scale new agentic applications.

In September 2025 - Equinix, Inc. has opened its first International Business Exchange data center in Chennai, CN1 that shall accelerate India’s digital evolution and also shall expand its AI ecosystem. As Tamil Nadu secures its position as a major hub for innovation, research, and AI investment, Chennai is emerging as the nation's hub for this technological change, paving the way for India to become more globally competitive in digital services and AI development.

Global Data Center Market Coverage

Component Insight and Forecast 2026 - 2035

- Hardware

- Software

- Services

Type Insight and Forecast 2026 - 2035

- Colocation Facilities

- Hyperscale Data Centers

- Enterprise Owned Data Centers

Data Center Size Insight and Forecast 2026 - 2035

- Large Scale

- Small and Mid-Size

Infrastructure Insight and Forecast 2026 - 2035

- IT Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

Cooling Type Insight and Forecast 2026 - 2035

- Air-Based Cooling

- Liquid-Based Cooling

Tier Standard Insight and Forecast 2026 - 2035

- Tier 1 & Tier 2

- Tier 3

- Tier 4

End User Insight and Forecast 2026 - 2035

- Cloud Service Providers

- Enterprises

- Government Institutions

Global Data Center Market by Region

- North America

- By Component

- By Type

- By Data Center Size

- By Infrastructure

- By Cooling Type

- By Tier Standard

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Component

- By Type

- By Data Center Size

- By Infrastructure

- By Cooling Type

- By Tier Standard

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Component

- By Type

- By Data Center Size

- By Infrastructure

- By Cooling Type

- By Tier Standard

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Component

- By Type

- By Data Center Size

- By Infrastructure

- By Cooling Type

- By Tier Standard

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Data Center Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component

1.2.2. By

Type

1.2.3. By

Data Center Size

1.2.4. By

Infrastructure

1.2.5. By

Cooling Type

1.2.6. By

Tier Standard

1.2.7. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. Hardware

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Software

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Services

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Type

5.2.1. Colocation Facilities

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Hyperscale Data Centers

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Enterprise Owned Data Centers

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Data Center Size

5.3.1. Large Scale

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small and Mid-Size

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By Infrastructure

5.4.1. IT Infrastructure

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Electrical Infrastructure

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Mechanical Infrastructure

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By Cooling Type

5.5.1. Air-Based Cooling

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Liquid-Based Cooling

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.6. By Tier Standard

5.6.1. Tier 1 & Tier 2

5.6.1.1. Market Definition

5.6.1.2. Market Estimation and Forecast to 2035

5.6.2. Tier 3

5.6.2.1. Market Definition

5.6.2.2. Market Estimation and Forecast to 2035

5.6.3. Tier 4

5.6.3.1. Market Definition

5.6.3.2. Market Estimation and Forecast to 2035

5.7. By End User

5.7.1. Cloud Service Providers

5.7.1.1. Market Definition

5.7.1.2. Market Estimation and Forecast to 2035

5.7.2. Enterprises

5.7.2.1. Market Definition

5.7.2.2. Market Estimation and Forecast to 2035

5.7.3. Government Institutions

5.7.3.1. Market Definition

5.7.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Component

6.2. By

Type

6.3. By

Data Center Size

6.4. By

Infrastructure

6.5. By

Cooling Type

6.6. By

Tier Standard

6.7. By

End User

6.7.1.

U.S. Market Estimate and Forecast

6.7.2.

Canada Market Estimate and Forecast

6.7.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Component

7.2. By

Type

7.3. By

Data Center Size

7.4. By

Infrastructure

7.5. By

Cooling Type

7.6. By

Tier Standard

7.7. By

End User

7.7.1.

Germany Market Estimate and Forecast

7.7.2.

U.K. Market Estimate and Forecast

7.7.3.

France Market Estimate and Forecast

7.7.4.

Italy Market Estimate and Forecast

7.7.5.

Spain Market Estimate and Forecast

7.7.6.

Russia Market Estimate and Forecast

7.7.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Component

8.2. By

Type

8.3. By

Data Center Size

8.4. By

Infrastructure

8.5. By

Cooling Type

8.6. By

Tier Standard

8.7. By

End User

8.7.1.

China Market Estimate and Forecast

8.7.2.

Japan Market Estimate and Forecast

8.7.3.

India Market Estimate and Forecast

8.7.4.

South Korea Market Estimate and Forecast

8.7.5.

Vietnam Market Estimate and Forecast

8.7.6.

Thailand Market Estimate and Forecast

8.7.7.

Malaysia Market Estimate and Forecast

8.7.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Component

9.2. By

Type

9.3. By

Data Center Size

9.4. By

Infrastructure

9.5. By

Cooling Type

9.6. By

Tier Standard

9.7. By

End User

9.7.1.

Brazil Market Estimate and Forecast

9.7.2.

Saudi Arabia Market Estimate and Forecast

9.7.3.

South Africa Market Estimate and Forecast

9.7.4.

U.A.E. Market Estimate and Forecast

9.7.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. ABB Ltd.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Alibaba Cloud

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Amazon Web Services, Inc.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. AT&T Intellectual Property

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Chindata Group Holdings Ltd.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. China Telecom Americas, Inc.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Cisco Systems, Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Dell Technologies

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Digital Realty Trust, Inc.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Equinix, Inc.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Google Inc.

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Hewlett Packard Enterprise Development LP

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. Hitachi Ltd.

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Huawei Technologies Co., Ltd.

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. IBM Corporation

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Lumen Technologies (CenturyLink)

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. Menlo Equities LLC

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

10.18. Microsoft Corporation

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5. Recent

Developments

10.19. NTT Communications Corporation

10.19.1.

Snapshot

10.19.2.

Overview

10.19.3.

Offerings

10.19.4.

Financial

Insight

10.19.5. Recent

Developments

10.20. Oracle

10.20.1.

Snapshot

10.20.2.

Overview

10.20.3.

Offerings

10.20.4.

Financial

Insight

10.20.5. Recent

Developments

10.21. Schneider Electric

10.21.1.

Snapshot

10.21.2.

Overview

10.21.3.

Offerings

10.21.4.

Financial

Insight

10.21.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Data Center Market