Logistics Automation Market Overview

The global logistics automation market is expected to grow from USD 49.82 billion in 2025 to USD 90.2 billion by 2035 at a CAGR of 10.8% during the forecast period, ranging from 2026 to 2035.

Logistic automation refers to the use of software and automated machinery in logistics services. This specific approach helps in increasing the efficiency of businesses and the logistics procedures. In addition to software solutions, it also includes hardware that helps in automating logistics procedures across a wide range of industry verticals. Logistic automation helps in storage, transport, data management and retrieval processes, which increases efficiency with lower turnaround time and errors. In short, logistic automation solutions help businesses to scale their operations, making it possible to handle large volumes of data easily.

The growing adoption and deployment of autonomous vehicles and drones drive the growth of the global logistics automation market. The higher efficiency and cost-effective product design also promotes the market growth. Advancements in IoT and robotics technology, quick product delivery, and the growth of the e-commerce sector also contribute to the market growth.

.jpg)

The logistics automation market faces hindrances in growth such as growing competition among the market players and a shortage of skilled professionals and workforce to operate the sophisticated systems. Also, the lack of standardization, the complex nature of automation devices and software affect the supply chain process and leads to higher cost of designing dedicated solutions and affect market growth. However, growing adoption of automation solutions and innovative technologies such as robotics and the Internet of Things (IoT) in the logistics sector has offered significant growth opportunities to the market because it allows smoother functioning of warehousing activities in spite of a shortage of workforce.

The global logistics automation market was severely impacted by the COVID-19 outbreak due to the disruption in the supply chain and logistics. The industrial, retail, and consumer goods sectors are just a few that have been severely impacted by the pandemic. Also, the COVID-19 pandemic had an impact on the production of electronic products due to delays in logistics and a manpower shortage. Additionally, a few local e-commerce businesses had stopped offering non-essentials. A reversal in the trend of migration was seen in the area as a result of lockdowns. However, businesses in the logistics sector need to be aware of the specific demand effects that their operations have, develop a short-term synchronization strategy, and get ready for potential shifts, to improve their position in the market.

Logistics Automation Market Segmentation

Insight by Component

The global logistics automation market is divided by components into hardware, software, and services segments. The software segment is further divided into transportation management and warehouse & storage management. The transportation management segment is expected to grow at a higher CAGR during the forecast period due to lower cost and on-time delivery. On the other hand, the warehouse management software segment will grow in demand due to the ability to automate and optimize tracking, receiving, storing, workload planning and other warehouse activities. In addition, the hardware segment is further divided into autonomous robots, conveyor systems, automated sorting systems, automated storage and retrieval systems, de-palletizing/palletizing systems, and automatic identification and data collection segments where the autonomous robots segment will grow more due to higher demand for automated transportation.

Insight by Organization Size

According to the size of the organization, the global logistics automation market is divided into large organizations and small and medium enterprises segments, where the latter will grow at a faster rate due to technical developments, stiff competition among major players, and lower cost of automated warehouses. It is also the result of the higher focus on the SMEs on cost efficiency which is why there is a higher adoption of automation solutions. The large enterprises segment will also grow and dominate the market due to the need to handle large volume of data more efficiently to improve supply chain processes and maintain higher productivity.

Insight by Industry Verticals

The global logistics automation market is also divided by different industry verticals into manufacturing, retail and online sales, pharmaceuticals and healthcare, aerospace & military, chemicals, logistics & transportation, food & beverage, automotive, oil, gas & energy, and other segments. The retail and e-commerce segment will grow significantly during the forecast period due to higher adoption of these solutions to handle the large volumes of orders and deliveries to ensure timely delivery, increased efficiency and higher reliability. The healthcare segment will also grow due to the growing need of higher safety and security, efficient handling of products such as vaccines and medicines, and higher accuracy and accountability.

Insight by Logistics Type

The global logistics automation market is divided by logistics type into production logistics, sales logistics, recovery logistics, and procurement logistics. Among all these segments the sales logistics segment is expected to grow more due to its importance in supply chain for delivering goods to the end users. The production logistics segment will also grow due to growing need by businesses to optimize production procedures, time, and cost as well as enhance profitability.

Insight by Software Application

The global logistics automation market is split by software applications into inventory management, order management, yard management, shipping management, labor management, vendor management, customer support, and more. Among all these segments, the order management segment will dominate and grow due to higher visibility offered to customers and businesses both and higher efficiency. The inventory management segment will also grow due to better tracking and managing of inventory, accurate demand forecasting, and higher accountability. All these allow higher probability for a business.

Global Logistics Automation Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 49.82 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 90.2 Billion

|

|

Growth Rate

|

10.8%

|

|

Segments Covered in the Report

|

By Component, By Organization Size and By Vertical

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and the Rest of the World

|

Industry Dynamics

Industry Trends

There is a growing adoption of IoT technology among organizations to create, process, exchange or store large volumes of data through connected devices. Another significant trend is the growing demand for smart devices and their applications. Robotics technology and the automated vehicle sectors have developed significantly over time and there is a higher usage of them in the warehousing and logistics sector. in addition, in the recent years, there is a significant rise in investments by logistics companies in automation noticed in order to enhance operational efficiency and optimize costs.

Logistics Automation Market Growth Drivers

The extensive development of the e-commerce sector is propelling the growth of the global logistics automation market. In addition, factors like low operating costs, growing demand for increasing warehouse productivity, development of robotics technology, economic growth, higher disposable income among consumers, and a notable shift in purchasing patterns. It is also attributed to the growing preference among the consumers for online shopping as well as the increase in demand for shorter delivery times. As a result, there is a significant growth in the number of order fulfillment centers to ensure faster last-mile deliveries. It is these fulfillment centers that adopt automation, largely from operator-free equipment to mechanized support, pushing the growth of the market further forward.

Logistics Automation Market Challenges

The absence of standardization in regulations and compliance hinders the growth of the global logistics automation market. It is also challenged by a lack of skills and knowledge of managing modern systems by the operators. In addition, there are also significant concerns over the safety and security regarding the process that discourages widespread adoption, which is further augmented by the high capital requirements.

Logistics Automation Market Opportunities

The market participants offer growth opportunities through their innovative strategies, new product development and launch, strategic partnerships and agreements. Also, rapid development of sophisticated technologies like AI and IoT and their extensive implementation along with the growing demand for logistics automation offer significant growth opportunities. In addition, the growing complexity of supply chains offer novel growth opportunities.

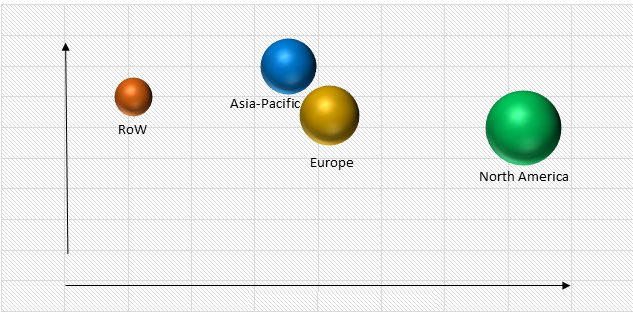

Logistics Automation Market Geographic Overview

North America will lead the market during the forecast period and contribute a larger revenue due to the existence of a large number of users of logistic automation solutions and the growing economy.

The APAC market will, however, grow at a higher CAGR during the projected period due to the growing demand for different materials across a wide range of warehouse and manufacturing sectors as well as the expansion of transportation and logistics sectors in the region.

Global Logistics Automation Market, By Region

On the other hand, the APAC market will have the highest CAGR over the course of the projection period. This can be due to an increase in demand for several materials across a variety of manufacturing and warehouse sectors and the growth of the logistics and transportation sectors in the region.

Logistics Automation Market Competitive Insight

The market for logistics automation is dispersed. Small manufacturers and start-ups have a lot of potential in the logistics automation market to provide effective solutions for the creation of logistics automation goods. The rising customer demand can inspire some start-ups to introduce cutting-edge items in this industry. A few notable companies that are active in this market are Dematic Corporation, Daifuku Co. Ltd., Murata Machinery Ltd., KNAPP AG, SSI Schaefer AG, VITRONIC, Mecalux S.A., BEUMER Group, Honeywell Intelligrated Inc., Toshiba Logistics Corporation, Swisslog Holding AG, Jungheinrich AG, Falcon Autotech, System Logistics Spa, TGW Logistics Group GmbH, WiseTech Global Limited, and Matternet Inc.

Daifuku is the world's leading provider of automated material handling solutions.

Recent Development by Key Players

Recently, Japanese firm Daifuku has invested 450 Cr in India. The facility will produce intra-logistics equipment such as automated storage and retrieval systems, sorting transfer vehicles, conveyors, and sorters.

Toshiba Corporation and Toshiba Infrastructure Systems & Solutions Corporation have developed technologies for the control of robot movement routes based on radio maps as part of NEDO (New Energy and Industrial Technology Development Organization) ’s “Research and Development Project of the Enhanced Infrastructures for Post-5G Information and Communication Systems”. Robots of the same type and size can cooperatively pass and convey a package, through a cooperative transport technology which is been developed to reduce the cost of introducing an automated transportation system and thereby to improve logistics efficiency and resolve the shortages of labor.

The global Logistics Automation Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- By Component

- Transportation Management

- Warehouse Storage Management

- Image Collection and QC

- Digital Image Conversion

- Support and Maintenance

- By Organization Size

- Large Enterprises

- Small and Medium Enterprises

- By Vertical

- Manufacturing

- Pharmaceuticals & Healthcare

- Retail & e-commerce

- Aerospace & Defence

- Logistics & Transportation

- Chemicals

- Food & Beverage

- Oil

- Gas & Energy

- Automotive

- Others

Region Covered in the Report

North America

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.jpg)