Global GaN Power Devices Market – Analysis and Forecast (2025-2030)

Industry Insight by Devices (GaN Power Discrete Devices, GaN Power ICs, GaN Power Module), by Voltage Range (<200 Volt, 200–600 Volt, >600 Volt), by Application (power drive, supply and inverter, radio frequency (RF), and other applications), by End-use Industry (medical, military, renewables, industrial, consumer electronics, IT and telecommunication, automotive, aerospace, and other end-use industries), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9147 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 190 |

Global GaN Power Devices Market – Analysis and Forecast (2025-2030)

Industry Insight by Devices (GaN Power Discrete Devices, GaN Power ICs, GaN Power Module), by Voltage Range (<200 Volt, 200–600 Volt, >600 Volt), by Application (power drive, supply and inverter, radio frequency (RF), and other applications), by End-use Industry (medical, military, renewables, industrial, consumer electronics, IT and telecommunication, automotive, aerospace, and other end-use industries), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

GaN Power Devices Market Overview

GaN (Gallium Nitride) Power Devices represent a cutting-edge class of semiconductor components used in electronics for enhanced power efficiency. Compared to traditional silicon-based devices, GaN devices offer higher electron mobility, enabling faster switching speeds and reduced energy losses. This efficiency improvement makes GaN ideal for power electronics, such as in high-frequency applications like power supplies and RF amplifiers. The technology's compact size and superior performance contribute to smaller, lighter, and more energy-efficient devices. GaN power devices play a crucial role in advancing electronics by delivering improved power handling capabilities, enabling the development of more efficient and compact electronic systems.

Global GaN Power Devices Market was worth USD 20.36 billion in 2023 and is expected to reach USD 28.96 billion by 2030 with a CAGR of 28.10% during the forecast period, i.e., 2025-2030. Increasing demand for energy-efficient electronics, higher power density, and improved performance in applications like power supplies, electric vehicles, and 5G infrastructure are driving the adoption of GaN power devices. Their superior efficiency and compact design contribute to a growing market demand.

Geographically, the global GaN power devices market is expanding rapidly in North America, Europe, and the Asia Pacific due to the growing emphasis on energy efficiency, technological advancements, and increased adoption in key industries like telecommunications, automotive, and electronics; however, the market confronts constraints such as supply chain constraints, cost considerations, and the need for standardized manufacturing processes and regulations. Overall, the GaN power devices market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including semiconductor, telecom, IT, electronics, and others.

Market Segmentation

Insight by Devices

Based on devices, the global GaN power devices market is segmented into GaN Power Discrete Devices, GaN Power ICs, GaN Power Module. In 2023, GaN Power Discrete Devices dominated the global GaN power devices market with companies like EPC (Efficient Power Conversion) and GaN Systems focusing on GaN power transistors for applications such as power supplies, automotive, and RF. EPC's eGaN FETs are widely used in various sectors, showcasing the dominance of discrete GaN devices. GaN Power ICs and Modules are gaining traction but currently hold smaller market shares. For example, Navitas Semiconductor specializes in GaN Power ICs like GaNFast, aiming at fast-charging solutions. While market shares evolve, Discrete Devices presently lead, addressing diverse applications with notable products and industry collaborations.

Insight by Voltage Range

Based on voltage range, the global GaN power devices market is segmented into <200 Volt, 200–600 Volt, >600 Volt. In 2023, GaN power devices with voltage ratings between 200–600 volts dominated the global GaN power devices market as this range caters to diverse applications such as power supplies, automotive systems, and RF devices. Companies like EPC and GaN Systems have a strong presence in this segment, offering GaN power transistors optimized for applications requiring mid-range voltage levels. Collaborations between GaN device manufacturers and key players in industries like electric vehicles and telecommunications contribute to the prominence of the 200–600 Volt segment, reflecting market demand for efficient power solutions in various sectors.

Insight by Application

Based on application, the global GaN power devices market is segmented into power drive, supply and inverter, radio frequency (RF), and other applications. The power drive segment dominated the global GaN power devices market in 2023 owing to its high efficiency and power density, which makes it ideal for applications like data centers and electric vehicles. Navitas Semiconductor's GaNFast power ICs, designed for fast-charging applications, exemplify this trend. Investments and partnerships, such as Infineon's acquisition of GaN Systems in March 2023, indicate the significance of GaN in power supply solutions. While RF applications are also substantial, the increasing demand for energy-efficient power supplies in diverse industries underscores the prevalence of GaN devices in the power supply segment, contributing to the technology's widespread adoption globally.

Insight by End-use Industry

Based on end-use industry, the global GaN power devices market is segmented into medical, military, renewables, industrial, consumer electronics, IT and telecommunication, automotive, aerospace, and other end-use industries. In 2023, the automotive segment dominated the global GaN power devices market due to increasing electric vehicle (EV) adoption as GaN's efficiency benefits EV power systems. Companies like Transphorm provide GaN power transistors for automotive applications, enhancing efficiency and reducing size. Collaborations between ACEpower and GaN Systems in August 2023 to expedite the widespread adoption of GaN technology in electric vehicles (EV), further highlights the growing demand for GaN devices in EVs. While other segments like renewables and industrial applications also demonstrate significant GaN utilization, the automotive industry's rapid electrification and ongoing investments underscore GaN's prominence in advancing automotive power electronics for a sustainable and energy-efficient future.

Global GaN Power Devices Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 20.36 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 28.96 Billion |

|

Growth Rate |

28.10% |

|

Segments Covered in the Report |

y Devices, By Voltage Range, By Application, By End-Use Industry, By Region |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Growth Drivers

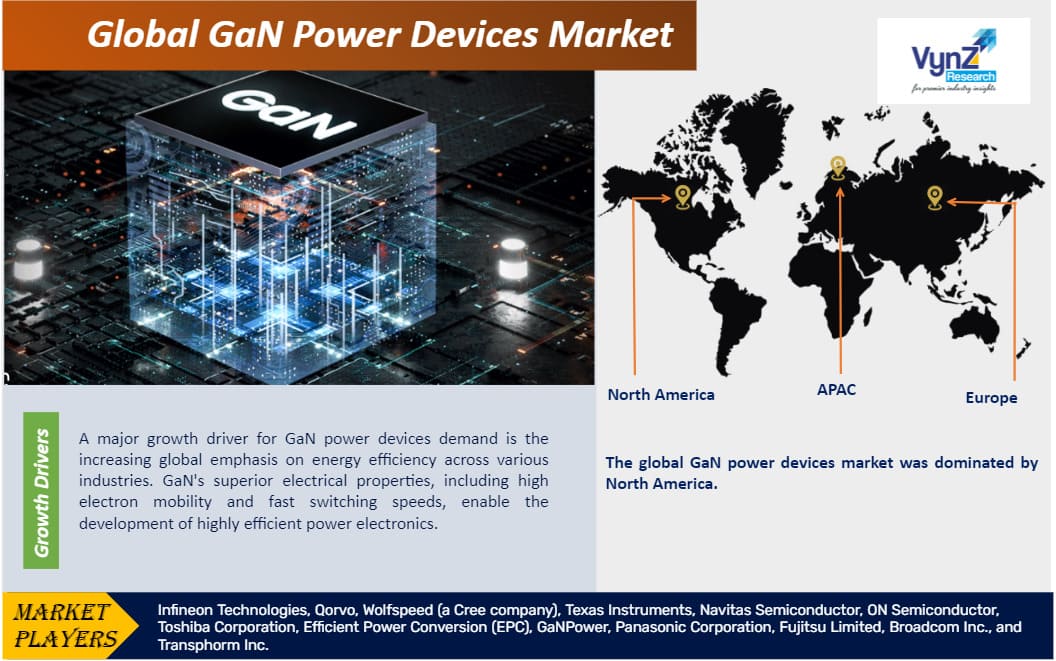

Growing emphasis on energy efficiency

A major growth driver for GaN power devices demand is the increasing global emphasis on energy efficiency across various industries. GaN's superior electrical properties, including high electron mobility and fast switching speeds, enable the development of highly efficient power electronics. As industries strive to minimize energy losses and enhance overall system performance, GaN power devices find extensive applications in sectors such as automotive, telecommunications, data centers, and renewable energy.

For example, the automotive industry's rapid shift toward electric vehicles demands efficient power electronics to optimize battery management and increase vehicle range. In telecommunications, the deployment of 5G networks requires high-frequency and high-power-density solutions, where GaN devices excel. Additionally, the growing demand for compact and lightweight power supplies in consumer electronics and industrial applications further propels GaN's adoption.

As these industries continue to prioritize energy efficiency and compact design, the demand for GaN power devices is expected to surge, driving significant growth in the semiconductor market.

Growing deployment of 5G technology

The expanding deployment of 5G technology is a significant catalyst for the growth of the global GaN power devices market. As 5G networks require higher frequencies and faster data transfer rates, GaN's superior performance characteristics, such as high electron mobility and fast switching speeds, make it an ideal semiconductor material for power amplifiers in 5G base stations. Companies like MACOM Technology Solutions offer GaN-based power amplifiers tailored for 5G applications, ensuring efficient and reliable signal amplification in the RF front-end of base stations. In July 2023, Ericsson and Intel expanded their partnership to advance next-generation optimized 5G infrastructure and it further illustrates the pivotal role of GaN power devices in the evolution of next-generation communication networks.

Moreover, the demand for compact and energy-efficient devices in the 5G ecosystem drives the adoption of GaN power devices in various applications. GaN's ability to handle high-frequency operation makes it suitable for small cell deployments, Massive MIMO (Multiple Input Multiple Output) systems, and other 5G-related components. The ongoing investments and partnerships in the telecommunications sector, such as GaN Systems' collaboration with PowerSphyr in July 2022 to advance GaN technology for GaN-based wireless 5G electronics, underscore the industry's recognition of GaN's crucial role in supporting the rapid and robust deployment of 5G technology worldwide.

Challenge

Limited standardization of manufacturing processes and regulations

A major challenge for the global GaN power devices market is the limited standardization of manufacturing processes and regulations. The absence of universally accepted standards can hinder interoperability and create uncertainties for manufacturers and consumers. Establishing standardized guidelines for GaN device production and usage is crucial for ensuring consistent quality, reliability, and safety across the industry. Harmonizing manufacturing practices would facilitate broader market acceptance, encourage innovation, and address concerns related to product reliability and performance, ultimately fostering the sustainable growth of the GaN power devices market.

Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global GaN power devices market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global GaN power devices market was dominated by North America in 2023 due to technological advancements, strategic partnerships, and a robust demand across diverse industries. The region is a hub for semiconductor innovation, with companies like Cree, a leader in SiC and GaN technology, contributing to the market.

Investments in electric vehicle technology, exemplified by collaboration between BMW Group, General Motors, Honda, Hyundai, Kia, Stellantis and the Mercedes-Benz Group in July 2023 to create one of North America’s largest public EV charging networks and include 30,000 high-powered chargers, showcase North America's influence in driving GaN adoption. Additionally, the region's leadership in telecommunications is evident through companies like Texas Instruments, providing GaN solutions for RF applications, further solidifying North America's pivotal role in shaping the trajectory of the GaN power devices market.

Competitive Insight

Infineon Technologies holds a prominent position in the global GaN power devices market, leveraging its expertise in semiconductor technology. The company has ventured into GaN applications for power electronics, evident in its acquisition of GaN Systems in March 2023 for $830 million. Infineon's CoolGaN technology, a family of GaN-based transistors, targets various applications, including power supplies and automotive solutions. Infineon’s long-standing strategic collaboration with Toyota to advance GaN technology for electric vehicles exemplifies Infineon's commitment to shaping the future of automotive power electronics. This, along with their broader portfolio, underscores Infineon's pivotal role in driving GaN innovation and adoption across diverse industries, contributing significantly to the evolving landscape of power semiconductor solutions.

ON Semiconductor plays a significant role in the global GaN power devices market, leveraging its semiconductor expertise to offer innovative solutions. The company's GaN-based products cater to various applications, including power supplies and automotive systems. In 2022, ON Semiconductor collaborated with Mercedes-Benz to advance electric vehicle technologies, showcasing its influence in automotive electrification. The acquisition of GaN pioneer Fairchild Semiconductor in 2016 for $2.4 billion, further strengthened ON Semiconductor's position in the power electronics domain. With a diversified portfolio and strategic partnerships, ON Semiconductor contributes to the growth and adoption of GaN power devices across different industries, affirming its noteworthy standing in the competitive semiconductor market.

Recent Development by Key Players

In December 2023, Texas Instruments expanded its low-power GaN portfolio, introducing the LMG3622, LMG3624, and LMG3626, addressing thermal challenges in AC/DC consumer power electronics and industrial systems. These GaN FETs with integrated gate drivers enhance power density and system efficiency. The portfolio now boasts industry-leading integrated current sensing, eliminating the need for an external shunt resistor and reducing power losses by up to 94%. The devices enable up to 94% system efficiency for <75W AC/DC applications, with over 95% efficiency for >75W applications, significantly reducing solution size compared to traditional silicon-based solutions in power adapters.

In June 2023, Toyoda Gosei and Powdec collaboratively developed a high-performance horizontal gallium nitride (GaN) power device with an 800V power capacity and one-millionth-of-a-second on/off operation. The jointly developed GaN power device demonstrates potential for enhanced performance in power converters used in solar power generation and other applications. The companies aim for early commercialization by ensuring stable continuous operation and durable quality, anticipating reduced power loss and improved efficiency in solar power systems and similar equipment.

Key Players Covered in the Report

Infineon Technologies, Qorvo, Wolfspeed (a Cree company), Texas Instruments, Navitas Semiconductor, ON Semiconductor, Toshiba Corporation, Efficient Power Conversion (EPC), GaNPower, Panasonic Corporation, Fujitsu Limited, Broadcom Inc., and Transphorm Inc.

The GaN power devices market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Devices

-

GaN Power Discrete Devices

-

GaN Power ICs

-

GaN Power Module

-

By Voltage Range

-

<200 Volt

-

200–600 Volt

-

>600 Volt

-

By Application

-

Power Drive

-

Supply and Inverter

-

Radio Frequency (RF)

-

Other Applications

-

By End-use Industry

-

Medical

-

Military

-

Renewables

-

Industrial

-

Consumer Electronics

-

IT and Telecommunication

-

Automotive

-

Aerospace

-

Other End-use Industry

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

GaN Power Devices Market