Global Energy-Efficient Materials Market – Analysis and Forecast (2025-2030)

Industry Insight by Material Type (fiberglass, mineral wool, cellulose, polyisocyanurate, extruded polystyrene, expanded polystyrene, and other materials), by End-use Industry (residential, commercial, and industrial) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3031 | Industry : Energy & Power | Available Format :

|

Page : 200 |

Global Energy-Efficient Materials Market – Analysis and Forecast (2025-2030)

Industry Insight by Material Type (fiberglass, mineral wool, cellulose, polyisocyanurate, extruded polystyrene, expanded polystyrene, and other materials), by End-use Industry (residential, commercial, and industrial) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Energy-Efficient Materials Market Overview

The global energy-efficient materials market was worth USD 26.40 billion in 2023 and is expected reach USD 46.70 billion by 2030 with a CAGR of 8.20% during the forecast period.

Energy-efficient materials are designed to minimize energy consumption in varied applications by improving insulation, lowering heat transfer, and heightening resource utilization. Examples include high-performance insulation, low-emissivity windows, and advanced composite materials. These materials help decrease environmental impact, reduce energy bills, and alleviate climate change, contributing to sustainable practices.

The global market for energy-efficient materials is categorized by material type into fiberglass, mineral wool, and others, by end-use industry into residential, commercial, and industrial sectors, by technologies into insulation materials, energy-efficient windows and doors, and others, by specific applications into residential, commercial, industrial HVAC and more, and by product forms into raw materials, finished products, and components.

Energy-Efficient Materials Market Segmentation

Insight by Material Type

The global market for energy-efficient materials is categorized by material type, including fiberglass, mineral wool, cellulose, polyisocyanurate, extruded polystyrene, expanded polystyrene, and other materials. Fiberglass emerged as the dominant player in 2023 due to its versatility, cost-effectiveness, and superior insulation performance. Owens Corning, a key manufacturer, illustrates this with products like EcoTouch, known for efficiently reducing energy consumption.

Mineral wool represents another important segment due to its excellent fire resistance and sound absorption properties. Brands such as Rockwool offer insulation solutions that improve both energy efficiency and safety. With wide obtainability, proven effectiveness, and established market existence, these materials continue to emphasize their supremacy in the global energy-efficient materials market.

Insight by End-use Industry

The global market for energy-efficient materials is segmented by end-use industry into residential, commercial, and industrial sectors. In 2023, the commercial segment led the market, driven by the considerable demand for materials improving building performance. Main components like high-quality insulation, innovative roofing systems, and effective HVAC solutions are essential. For example, TPO roofing membranes from companies like GAF and Carlisle provide outstanding insulation, lowering heating and cooling costs.

Additionally, innovative insulation materials such as spray foam or rigid foam boards, presented by companies like Dow and Johns Manville, are extremely sought after for commercial buildings. These materials improve energy efficiency, decrease operational costs, and support sustainability purposes, solidifying the commercial segment's dominance in the global energy-efficient materials market.

Insight by Technology Type

Different types of energy-efficient technologies divide the global market for energy-efficient materials intro insulation materials, energy-efficient windows and doors, HVAC systems, lighting solutions, and renewable energy systems.

Within this segmentation, insulation materials represent the dominant segment, owing to their widespread application across various industries and their significant contribution to energy efficiency. Insulation materials such as fiberglass, mineral wool, and foam boards are widely used in buildings and industrial facilities to reduce heat transfer and improve thermal efficiency.

On the other hand, the promising segment for growth is renewable energy systems, including solar panels, wind turbines, and geothermal systems. As the demand for clean energy sources continues to rise, there is significant potential for growth in this segment, driven by increasing environmental awareness and government incentives for renewable energy adoption.

Insight by Application

The global market for energy-efficient materials is divided based on specific applications within each sector, such as residential insulation, commercial building roofing, industrial HVAC systems, etc.

The dominant segment within application-based segmentation is commercial buildings, driven by the substantial need for energy-efficient materials to enhance building performance and reduce operational costs. Commercial buildings, such as office complexes, retail outlets, and hotels, require efficient insulation, HVAC systems, and lighting solutions to meet energy efficiency standards and improve sustainability.

On the other hand, the residential insulation also shows growth potential. With increasing emphasis on energy conservation and sustainable living, there is a growing demand for energy-efficient insulation materials in residential construction. This trend is fueled by incentives for energy-efficient home upgrades and a rising awareness of the benefits of insulation in reducing energy consumption and utility bills.

Insight by Product Form

Based on the different product forms, the global market for energy-efficient materials is divided into raw materials, finished products, and components used in energy-efficient solutions.

Out of these, the finished products segment is more dominant as they offer convenient and ready-to-use solutions for consumers and businesses. Finished products like energy-efficient windows, doors, and appliances are readily available in the market and are often preferred for their ease of installation and immediate benefits.

On the other hand, the promising segment for growth is raw materials, particularly advanced composite materials and eco-friendly alternatives. With a growing focus on sustainability and innovation, there is increasing demand for raw materials that enable the development of new energy-efficient products and solutions. This segment presents opportunities for manufacturers to develop novel materials with improved performance and environmental benefits.

Global Energy-Efficient Materials Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 26.4 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 46.7 Billion |

|

Growth Rate |

8.20% |

|

Segments Covered in the Report |

By Material Type, By End-use Industry, By Technology Type, By Application, and By Product Form |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia-Pacific, Europe, and Rest of the World |

Industry Dynamics

Energy-Efficient Materials Industry Trends

Ther is ana increase in sustainable construction practices is driving demand for energy-efficient materials to reduce carbon footprint and promote environmental commitments.

Rapid advancements in technology results the development of innovative materials and solutions that promises higher energy efficiency and performance.

Strict energy efficiency regulations and government incentives for green building projects are promoting adoption of energy-efficient materials across different industries.

Growing awareness of the benefits of green building certifications is also driving demand for energy-efficient materials to meet certification requirements.

The rise in the concept of net-zero energy buildings produce as much energy as they consume over the course of a year is leading to higher demand for highly efficient materials and systems.

The integration of smart technologies such as IoT and automation systems is also driving the adoption of energy-efficient materials.

Energy-Efficient Materials Market Growth Drivers

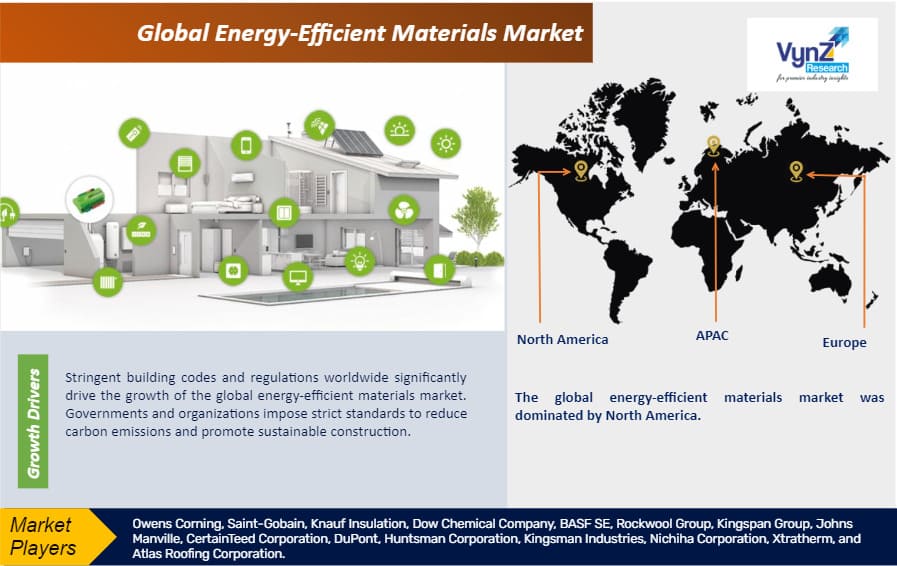

Strict building codes and guidelines globally drive the energy-efficient materials market. Governments impose standards to decrease carbon emissions and encourage sustainable construction. Compliance mandates innovative insulation materials, airtight construction, and high-performance windows, nurturing market innovation.

Growing consumer awareness and fondness for eco-friendly, energy-saving supplies also boost market growth. Informed consumers look for sustainable construction options, leading to growing demand for natural and recycled insulation materials. Green building certifications like LEED and BREEAM further inspire adoption of energy-efficient materials, reflecting a tendency towards abating carbon footprints via sustainable practices.

Energy-Efficient Materials Market Challenges

Greater initial expenses in contrast to traditional materials, limited awareness among consumers and businesses, and resistance to change in established industries are significant hindrances to the growth of the energy-efficient materials market.

Energy-Efficient Materials Market Opportunities

However, increasing environmental awareness, stringent regulations promoting sustainable construction, rising demand for energy-efficient solutions, technological advancements, government incentives, and the emergence of new applications presents significant opportunities for growth.

Energy-Efficient Materials Market Geographic Overview

The global energy-efficient materials market spans North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. North America led the market in 2023 due to its mature construction industry, focus on sustainable building practices, stringent energy efficiency regulations, demand for advanced materials, increasing environmental consciousness among consumers and businesses.

The Asia-Pacific region offers significant growth prospects for the global energy-efficient materials market, driven by rapid urbanization, government initiatives promoting green building practices, and increasing environmental consciousness among consumers and businesses. This allows industry players to capitalize on the demand for sustainable construction solutions in this region.

Energy-Efficient Materials Market Competitive Insight

Owens Corning is a powerhouse in the global energy-efficient materials market, holding a leading position. Renowned for its high-quality insulation products, the company's offerings, such as the EcoTouch series, are widely recognized for their superior thermal performance and sustainability. With a strong presence in North America, Europe, and the Asia-Pacific, Owens Corning leverages its extensive distribution network and established reputation to capture a substantial market share. Moreover, the company invests heavily in research and development, ensuring a continuous stream of innovative, energy-efficient solutions that cater to diverse industry needs. This commitment to excellence solidifies Owens Corning's dominance in the global energy-efficient materials market.

Saint-Gobain is another key player, holding a prominent position in the global energy-efficient materials market. The company's extensive product portfolio encompasses a wide range of high-performance materials, including insulation solutions like Isover and Gyproc. With a global presence spanning across multiple continents, Saint-Gobain benefits from a vast customer base and robust distribution channels. Moreover, the company's strong emphasis on sustainability and green building practices resonates with environmentally-conscious consumers and businesses. Saint-Gobain's commitment to reducing environmental impact while delivering top-notch energy-efficient materials further solidifies its position as a market leader, making it a trusted choice for sustainable construction projects worldwide.

Owens Corning, Saint-Gobain, Knauf Insulation, Dow Chemical Company, BASF SE, Rockwool Group, Kingspan Group, Johns Manville, CertainTeed Corporation, DuPont, Huntsman Corporation, Kingsman Industries, Nichiha Corporation, Xtratherm, and Atlas Roofing Corporation.

Recent Development by Key Players

Owens Corning, a global building and construction materials leader, mainly known in Europe for its insulation (PAROC, FOAMGLAS, Pittsburgh Corning) and composites businesses (Owens Corning Composite Materials) joined the European Alliance to Save Energy (EU-ASE) as is newest member to advance energy efficiency and contribute to a more sustainable Europe.

Metecno, an international building products group, expanded its presence in New Zealand with the establishment of a $30 million facility in Te Rapa for producing "thermally efficient" construction materials. New Zealand-based United Industries Group will oversee the development of the new plant in Hamilton, which will produce cladding and roofing panels and boards for both the residential and commercial construction sectors.

The energy-efficient materials market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Material Type

-

Fiberglass

-

Mineral Wool

-

Cellulose

-

Expanded Polystyrene

-

Extruded Polystyrene

-

Polyisocyanurate

-

Other Materials

-

By End-use Industry

-

Residential

-

Commercial

-

Industrial

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Energy-Efficient Materials Market