Global Interactive Display Market – Analysis and Forecast (2025-2030)

Industry Insight by Panel Type (Flat Panel, Flexible Panel, Transparent panel display), by Product (Interactive Kiosk, Interactive Whiteboard, Interactive Table, Interactive Video Wall, Interactive Monitor), by Panel size (17–32” Panel Size, 32–65” Panel Size, 65” and Above Panel Size), by Technology (LCD, LED and OLED), by End User (Transportation, Healthcare, Education, Corporate & Government, Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9142 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 250 |

Global Interactive Display Market – Analysis and Forecast (2025-2030)

Industry Insight by Panel Type (Flat Panel, Flexible Panel, Transparent panel display), by Product (Interactive Kiosk, Interactive Whiteboard, Interactive Table, Interactive Video Wall, Interactive Monitor), by Panel size (17–32” Panel Size, 32–65” Panel Size, 65” and Above Panel Size), by Technology (LCD, LED and OLED), by End User (Transportation, Healthcare, Education, Corporate & Government, Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Interactive Display Market Overview

The Global Interactive Display Market is anticipated to grow from USD 9.56 billion in 2023 to USD 18.64 billion by 2030, growing at a CAGR of 8.7% during the forecast period 2025-2030. Interactive displays find applications through numerous industry verticals, such as retail, BFSI, education, corporate & government, healthcare, sports & entertainment, and hospitality. These displays are extremely valued in the retail sector, wherein they are broadly used as digital signage’s to fascinate customers. Another significant end-user sector for interactive displays is the education division. Interactive whiteboards are broadly executed in schools and colleges to encourage interactive learning. The development of the interactive display market is majorly motivated by rising demand for interactive signage’s & kiosks, declining cost of interactive displays, and growing adoption of interactive learning solutions in classrooms.

The outbreak of the COVID-19 pandemic has produced a widespread economic downturn as some countries forced strict lockdowns to cover the infection. This has affected varied industries; manufacturing is one of the harshly impacted. There has been a substantial impact on technology supply chains worldwide. The crisis has led to decreasing industrial activities leading to the stoppage of production of key semiconductor gears. Displays are one of the sections, which has observed a huge drop in the second quarter of 2020. Due to the extreme fall in demand and supply chain disturbance, manufacturers are reducing down their production.

According to LG Display, it is not likely to predict the period or full magnitude of damage by COVID-19. This pandemic has disturbed the company’s business processes, including a temporary interruption of operations at some of the manufacturing services.

Interactive Display Market Segmentation

Insight by Panel Type Outlook

Based on the panel type outlook, the global interactive display market is distributed into Flat Panel, Flexible Panel, and Transparent panel displays. The Flat Panel is expected to have the largest market share during the forecast period due to the high usage of Flat Panel in interactive flat-panel display. The Flexible Panel segment, on the other hand, would record the fastest CAGR during the forecast period. This is attributed to trends in education and the corporate sector.

Insight by Product Outlook

Based on the product, the market is segmented into interactive kiosks, interactive whiteboards, interactive tables, interactive video walls, and interactive monitors. The interactive kiosks segment grasps the largest market share during the forecast period. Interactive kiosks allow retailers to deliver a high level of satisfaction to consumers by offering them better control over their buying decisions. They are user-friendly and related to other informative devices and can achieve complex tasks in less time on the back of innovative technology.

Insight by Panel Size Outlook

Based on the panel size, the global interactive display market is distributed into 17–32” Panel Size, 32–65” Panel Size, 65” and Above Panel Size. The 32–65” segment contributes the largest share in the interactive display industry. The factors that can be credited to the rising use in the healthcare and hospitality sectors. Additionally, these screens are also used in restaurants as menu boards to indicate prices, ingredients, and waiting time of the orders occupied by customers are driving the demand for this segment.

Insight by Technology Outlook

Based on technology, the market has been distributed into LCD, LED, and OLED. The LCD segment accounted for the major share of the overall interactive display market. The reduced cost of LCD interactive displays is one of the major factors driving the growth of this segment.

Insight by End-User Outlook

Based on the end-user, the global interactive display market is characterized by BFSI, Transportation, Healthcare, Education, Corporate & Government, and Others. The BFSI segment accounted for the major share during the forecast period. In banks and financial institutions, interactive displays are used to carry financial information. These displays help customers understand financial products to help recruit purchase processes and help respond.

Global Interactive Display Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 9.56 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 18.64 Billion |

|

Growth Rate |

8.70% |

|

Segments Covered in the Report |

By Panel Type, By Product, By Panel Size, By Technology, and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Interactive Display Industry Trends

There is a growth in the number of devices having touch sensors as touch-based devices are easier to enter. The touch-based devices need a display panel to function which in turn helps in the development of the display devices. Hence, an inclusive series of devices in the home applications category, such as refrigerators, washing machines, and chimneys are combined with displays having touch sensors. These displays are combined with touch sensors, which the user can use for navigating and removing other information. Hence, the tendency of touch-based devices is motivating the interactive display market growth.

Interactive Display Market Growth Drivers

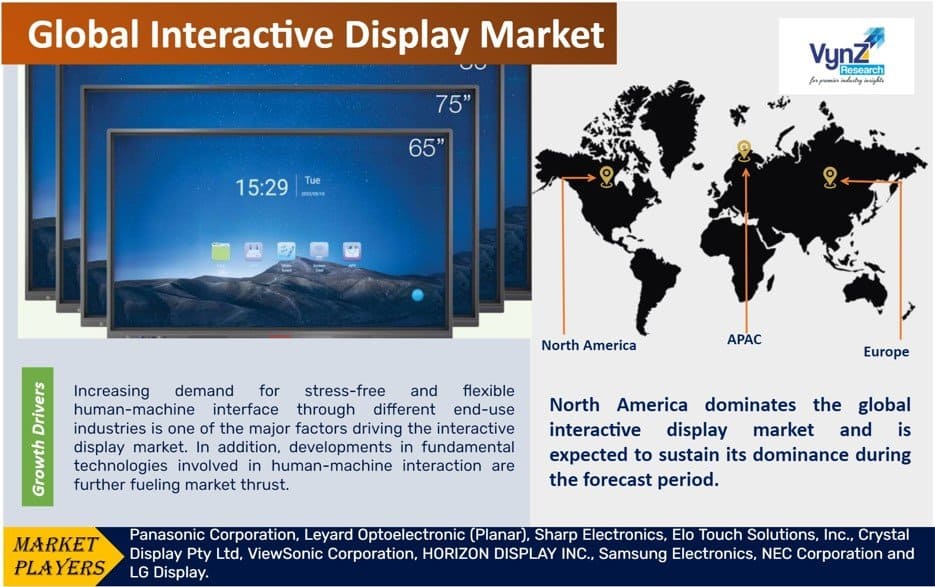

Increasing demand for stress-free and flexible human-machine interfaces through different end-use industries is one of the major factors driving the interactive display market. In addition, developments in fundamental technologies involved in human-machine interaction are further fueling market thrust. Numerous industries worldwide are moving towards automation of several business processes which makes the elasticity and accessibility offered by interactive systems appealing. The declining price of interactive display devices attached to the popularity of HD displays encourages the market. For instance, a simple search on Alibaba shows nearly 600 suppliers selling 47,000 "different" models of Android-based kiosks opening as low as $150.

Interactive Display Market Challenges

Interactive products such as interactive kiosks, video walls, and monitors are becoming progressively common, and new units are being organized each year in a diversity of retail, hospitality, healthcare, and other environments. However, with the evolving technology, displays are also becoming gradually complex, particularly for outdoor applications. Outdoor touch and display technology is not as extremely progressive as that of indoor applications, which is a challenge for outdoor applications. Displays used for outdoor applications have to be strong and should match the environmental conditions and requirements of the applications. They have to be self-adjustable in numerous lighting conditions.

Interactive Display Market Opportunities

Due to rapid improvements in technology, companies focus on revolution to provide variety and additional features in products. Investigators linked with different corporations focus on integrating new technologies in the conventional interactive whiteboard to mark them as user-friendly and cooperative. Artificial Intelligence (AI) is one such technology, which carries huge opportunities for the interactive whiteboard market to increase.

Interactive Display Market Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

North America dominates the global interactive display market and is expected to sustain its dominance during the forecast period. Due to the large-scale implementation of displays in businesses, such as retail, healthcare, corporate, and among others. Similarly, the quick implementation of interactive displays in the education sector adds to the development of this region. Additionally, the demand for interactive displays has significantly amplified in the entertainment segment for concerts, exhibitions, and sports arenas.

Asia Pacific is projected to observe the fastest growth over the forecast period. This growth can be credited to a broad base of tech-savvy population and growing investments dedicated to digital classrooms. Furthermore, some technology corporations are offering touch tables in China, thus making the regional market an active participant in the overall market.

Interactive Display Market Competitive Insight

The interactive display market is moderately fragmented with separate international companies such as Samsung Electronics, NEC Corporation, and LG Display occupying a significant market share by organizing their solutions in various smartphones.

ViewSonic, established in California, is one of the prominent global providers of visual solutions with operations in over 100 countries. ViewSonic is committed to providing comprehensive hardware and software solutions, such as monitors, projectors, digital signage, ViewBoard® interactive displays, and the myViewBoardTM software ecosystem. ViewSonic has a strong reputation for delivering innovative and reliable solutions for the education, enterprise, consumer, and professional markets, and for assisting customers in "Seeing the Difference."

Horizon Solutions, Inc. provides business results by utilizing interactive solutions. Touch applications and interactive surfaces are intended to help growing startups and national brands gain a competitive advantage. Smart collaboration among creative individuals results in great business solutions that produce results. Horizon’s Touch Surfaces include Multi-Touch Monitors, Interactive Tables, Touchscreen Kiosks, And Interactive Video Walls.

Recent Development by Key Players

In July 2022, ViewSonic Corp., a leading global provider of visual solutions, expanded its Interactive Flat Panel portfolio with the ViewBoard 52 Series, which improves the classroom and learning experience through user-friendly features and design. The Multimedia Sound Bar embedded in the exterior of this Edtech product is its key differentiator, delivering advanced audio.

In June 2022, Samsung Electronics America, Inc. demonstrated the future of education at ISTELive 2022 in New Orleans with its new interactive display, the 2022 Samsung Flip Pro (Model Name: WMB). The Flip Pro, which comes in two large 75- and 85-inch models, allows teachers to deliver dynamic lessons, spark active learning, and inspire better learning outcomes for all students.

LG Display, the world’s foremost innovator of display technologies, announced that it has been selected by South Korea’s Ministry of Trade, Industry and Energy (MOTIE) to lead its national project to progress stretchable displays. LG Display will supervise the large-scale R&D project which is a main part of MOTIE’s push since 2019 to drive South Korea’s next-generation display market by raising the development of core technologies.

ViewSonic announced a novel 10-point touch display, the TD2455 24-inch monitor. With approachable, in-cell touch technology, and progressive design, the ViewSonic TD2455 touch display carries more hands-on control for combined classrooms and more productive workspaces.

Key Players Covered in the Report

Some of the key players operating in the interactive display market: are Panasonic Corporation, Leyard Optoelectronic (Planar), Sharp Electronics, Elo Touch Solutions, Inc., Crystal Display Pty Ltd, ViewSonic Corporation, HORIZON DISPLAY INC., Samsung Electronics, NEC Corporation and LG Display.

The Interactive Display Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Panel Type Outlook

- Flat Panel

- Flexible Panel

- Transparent panel display

- By Product Outlook

- interactive kiosk

- interactive whiteboard

- interactive table

- interactive video wall

- interactive monitor

- By Panel Size Outlook

- 17–32” Panel Size

- 32–65” Panel Size

- 65” and Above Panel Size

- By Technology Outlook

- LCD

- LED

- OLED

- By End-User Outlook

- BFSI

- Transportation

- Healthcare

- Education

- Corporate & Government

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Interactive Display Market