Global TIC Market for Energy & Power Industry – Analysis and Forecast (2025-2030)

Industry Insight by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Industry Vertical (Agriculture, Biofuels, Coal & Solid Fuels, Hydrogen, Minerals, Nuclear, Oil & Gas, Power Equipment, Power Generation, Power Transmission & Distribution, Solar, Wind, Wave & Tidal, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9067 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 150 |

Global TIC Market for Energy & Power Industry – Analysis and Forecast (2025-2030)

Industry Insight by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Industry Vertical (Agriculture, Biofuels, Coal & Solid Fuels, Hydrogen, Minerals, Nuclear, Oil & Gas, Power Equipment, Power Generation, Power Transmission & Distribution, Solar, Wind, Wave & Tidal, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

TIC Market for Energy & Power Industry Overview

In the Energy And Power Industry, The Market For Testing, Inspection, And Certification (TIC) reached USD 8.7 billion in 2023, exhibiting a commendable compound annual growth rate (CAGR) of 4.3% from 2025 to 2030. TIC testing is a vital process that ensures the suitability of manufactured products, individual components, and multi-component systems for their intended purposes.

Inspection and testing are the operating parts of quality control, which is the most critical factor for the survival of any manufacturing company. Quality control directly supports other factors such as cost, productivity, on-time delivery, and market share. The testing, inspection, and certification market report is composed of conformity assessment agencies, which provide services from audit and inspection to testing, verification, quality assurance, and certification.

Globalization has led to product standardization norms and has penetrated developed technologies across various industries such as energy & power industry, food and beverage, electronics and automotive industries, etc., resulting in the growth of the TIC market during the forecast period 2025-2030. Moreover, the growing middle-class population, rapid urbanization, population migration from rural to urban areas globally, mandatory safety regulations, upsurge in the illicit trade of counterfeit and pirated products, advancement in networking and communication technology, growing opportunities in renewable energy projects, the inclination of outsourcing testing, inspection, and certification services has propelled the growth of the TIC market in energy & power industry. Nevertheless, TIC provides various advantages related to its credibility and image, compliance with legal and regulatory requirements, less turnover of employees, high level of cost control improvement, and fast improvement of different processes. There is a need to set up new energy marketplaces by focusing on the safety of people, environment, having reliable operations, and move towards low-carbon culture.

The COVID-19 pandemic resulted in a short-term decline in demand and revenue in the first quarter of 2020. Moreover, TIC is playing a crucial role by offering assurance that the products and services offered to the customers will provide safety and health standards. Business organizations in the TIC market are intensifying IT infrastructures and developing business continuity plans, implying that the testing, inspection, and certification market are holding the substantial potential to bounce back from the COVID-19 outbreak. This is due to the fact that TIC services will enhance and protect brand reputation, verify products’ safety, and enables trade.

TIC Market for Energy & Power Industry Segmentation

Insight by Sourcing Type

Based on sourcing type, the TIC market for the energy & power industry is bifurcated into in-house and outsourced. Among the two segments, the in-house segment dominates the market and is anticipated to hold the largest share during the forecast period 2023-2030. Deploying in-house testing and inspection will offer companies to have complete control over the entire process in terms of technology, skilled personnel, and testing and measurement equipment. The in-house inspection will optimize the cost of maintenance, thus, enabling organizations to handle TIC activities like on-site availability, ability to employ talent, and establish custom practices as per the needs and desires of the organizations.

Insight by Service Type

Based on service type, the TIC market for the energy & power industry is segmented into testing, inspection, and certification. Among these segments, the testing segment holds the largest share in the testing, inspection, and certification market in 2020 owing to the diverse product standards, stringent regulations, increasing need for improved safety, growing industrialization, and a need to protect the brand. Moreover, the certification market is anticipated to have a high CAGR during the forecast period owing to the consumer awareness about the certified products, companies growing need to improve the product value, the surge in demand for quality and safe products, and mandatory regulatory requirements.

Insight by Industry Vertical

Based on industry vertical, the TIC market for the energy & power industry is divided into agriculture, biofuels, coal & solid fuels, hydrogen, minerals, nuclear, oil & gas, power equipment, power generation, power transmission & distribution, solar, wind, wave & tidal, and others. Power transmission and distribution are continuously evolving and technical innovation is taking place, resulting in the need to provide safety, security, and reliability. Moreover, the demand for renewable energy is increasing rapidly owing to certain issues like climate change, security of supply, political and social demand for green energy, and decarbonization, resulting in the growing importance of wind, waves, and tidal segment, thus propelling the growth of TIC in energy and power industry.

Global TIC Market for Energy & Power Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 8.7 Billion |

|

Revenue Forecast in 2035 |

U.S.D. xx.x Billion |

|

Growth Rate |

4.3% |

|

Segments Covered in the Report |

By Sourcing Type, By Service Type and By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

TIC Market for Energy & Power Industry Trends

The TIC market for energy & power is characterized by various industry trends such as growing investment in AR and VR, mounting adoption of connected devices and cloud-based technology, increasing mergers and acquisitions by the industry players, and sustained consolidation of suppliers leading to globalization.

TIC Market for Energy & Power Industry Growth Drivers

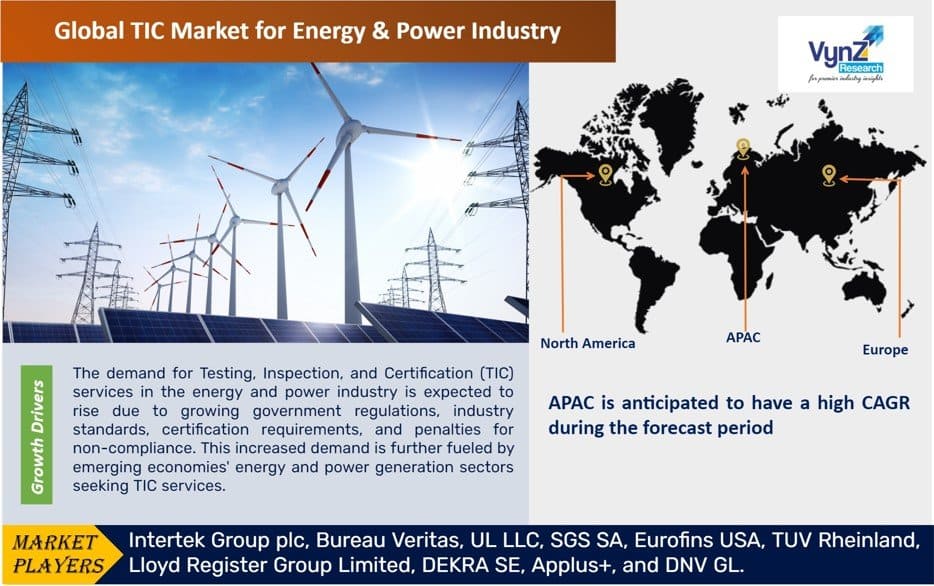

The demand for Testing, Inspection, and Certification (TIC) services in the energy and power industry is expected to rise due to growing government regulations, industry standards, certification requirements, and penalties for non-compliance. This increased demand is further fueled by emerging economies' energy and power generation sectors seeking TIC services. Additionally, specialized equipment for renewable energy projects, such as wind and solar energy, necessitates optimal performance, leading to the deployment of TIC to ensure the effective functioning of essential machine components.

TIC Market for Energy & Power Industry Challenges

The testing, inspection, and certification market face certain challenges like trade wars and growth fluctuations, huge investment for automation and installation of industrial safety systems, high cost of TIC owing to diverse standards and regulations globally. Moreover, grid operators are facing challenges such as a growing share of renewable energy generation, cyber security threats, power demand to meet the demand of electric vehicle charging. Moreover, a lack of testing facilities and skilled personnel may hamper the growth of the TIC market.

TIC Market for Energy & Power Industry Opportunities

Testing, inspection, and certification is a massive market that provides lucrative opportunities in technologies such as AI, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity. The energy industry players are focusing on improving reliability, safety and performance by having a low-carbon future, thus creating opportunities for the TIC market in the energy & power industry.

TIC Market for Energy & Power Industry Geographic Overview

Geographically, APAC is anticipated to have a high CAGR during the forecast period owing to the rising investment in R&D, rapid urbanization & industrialization, huge manufacturing capabilities and exports, rising per capita income among the middle-class population, improved lifestyles, and increasing consumer awareness about the importance of quality certification, testing, and inspection. Moreover, the developed countries have their manufacturing units in the region, especially in China and India. Moreover, the TIC players in renewable energy solutions have set up their testing labs in APAC countries.

TIC Market for Energy & Power Industry Competitive Insight

Key players are adopting technological changes to improve their product portfolio and generate new revenues, optimize the operational cost, and enhance service efficiencies via process upgrades. The industry players are taking the COVID-19 crisis as an opportunity to restructure and revisit their existing strategies, focus on new services and delivery models to access the growing demand for automation, remote service execution, and improved digitization.

The business enterprises have started opening development centers in new locations to enhance market penetration which helps in building business relations with customers and clients. Moreover, the industry players in the TIC market have started building strategies like mergers and acquisitions to generate new revenue channels.

Intertek is a leading provider of testing and analysis services to various industries. Intertek supports manufacturers of energy generation and distribution equipment with testing and certification solutions for access to global markets.

UL Solutions services cover the energy storage industry's entire value chain. Company is a leader in safety testing and certification for battery technology.

Some of the key players operating in the TIC market in the energy & power industry are Intertek Group plc, Bureau Veritas, UL LLC, SGS SA, Eurofins USA, TUV Rheinland, Lloyd Register Group Limited, DEKRA SE, Applus+, and DNV GL.

Recent Developments by Key Players

Intertek (Testing specialist) has opened its new Battery Xcellence Centre in Mestre, Italy. The new facility features the latest technologies for battery and eergy storage systems testing which will meet the industry’s increasing need for fast and reliable testing, certification and assurance services.

DNV GL and WattTime (US), a provider of technology solutions to achieve emission reductions, jointly announced a strategic partnership to incorporate WattTime’s emissions intelligence into DNV GL’s expertise in energy management and digital services for renewables, storage, and efficiency.

The TIC Market for Energy & Power Industry report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- In-House

- Outsourced

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Agriculture

- Biofuels

- Coal & Solid Fuels

- Hydrogen

- Minerals

- Nuclear

- Oil & Gas

- Power Equipment

- Power Generation

- Power Transmission & Distribution

- Solar

- Wind, Wave & Tidal

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Energy & Power Industry