Global Process Spectroscopy Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Mass Spectroscopy, Molecular Spectroscopy (Near-Infrared (NIR), Fourier-Transform Infrared (FT-IR), Raman, Nuclear Magnetic Resonance (NMR), and Others), and Atomic Spectroscopy) by Component (Hardware and Software), by Application (Polymer, Oil & Gas, Pharmaceuticals, Food & Agriculture, Chemicals, Water and Wastewater Management, Pulp & Paper, Metal & Mining, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9097 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 150 |

Global Process Spectroscopy Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Mass Spectroscopy, Molecular Spectroscopy (Near-Infrared (NIR), Fourier-Transform Infrared (FT-IR), Raman, Nuclear Magnetic Resonance (NMR), and Others), and Atomic Spectroscopy) by Component (Hardware and Software), by Application (Polymer, Oil & Gas, Pharmaceuticals, Food & Agriculture, Chemicals, Water and Wastewater Management, Pulp & Paper, Metal & Mining, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Process Spectroscopy Market Overview

The global process spectroscopy market is expected to grow from USD 17.2 billion to USD 30.3 billion by 2030 at a compound annual growth rate of 8.8% during the forecast from ranging 2025 to 2030.

Process spectroscopy refers to the specific method of scrutinizing the relations between light, electromagnetic radiation, and matter. Typically, benchtop, portable, micro, and hyphenated spectroscopes, amplifiers, microscopes, display units, and signal processors are all used in process spectroscopy. It is adopted in a wide range of processes, such as Fourier Transform Infrared Spectroscopy (FT-IR), Raman spectroscopy, nuclear magnetic resonance (NMR), and Near-Infrared Spectroscopy (NIR). The technology splits radiation into its different wavelengths to examine different ions, protons, and electrons. This technique is extensively used in biological research, healthcare, pharmaceuticals, water and wastewater management, and electronics sectors.

The COVID-19 pandemic has had a moderate impact on the process spectroscopy market owing to its wide adoption in the pharmaceutical sector to detect SARS-CoV-2.

Process Spectroscopy Market Segmentation

Insight by Technology

The global process spectroscopy market is divided by technology into mass spectroscopy, molecular spectroscopy, and atomic spectroscopy categories. The molecular spectroscopy segment will grow at a higher CAGR due to compact design and higher usage for drug development and other specific purposes. It is typically divided into different subsections such as Near-Infrared, Fourier-Transform Infrared, Nuclear Magnetic Resonance, Raman, and other segments. The NMR segment is expected to grow due to rapid development. Raman spectroscopy is expected to grow at a higher CAGR during the forecast period due to higher adoption in the food, agriculture, and pharmaceutical industries.

Insight by Component

The global process spectroscopy market is also divided by components into hardware and software segments. Out of these two segments, the former is expected to grow more and contribute a larger share to the market during the forecast period due to the growing adoption of manufacturing and packaging industries for regulatory compliance and quality standard requirements.

Insight by Application

Different applications also divide the global process spectroscopy market into oil & gas, pharmaceuticals, polymer, food & agriculture, chemicals, water and wastewater management, pulp & paper, metal & mining, and other segments. Out of these, the pharmaceutical segment is expected to contribute a larger share of the market during the projected period due to higher usage by drug companies for testing the porosity of a substance to maintain quality control standards. It is also used extensively to evaluate the state of the compositions. The food, agriculture, water, and wastewater segments are also expected to grow at a higher CAGR due to the higher efficiency of this process to detect impurities in water. In the food & agriculture industry, it is used to monitor materials used in fermentation processing and the reactions to avoid repetition and preserve product uniformity.

Global Process Spectroscopy Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 17.2 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 30.3 Billion |

|

Growth Rate |

8.8% |

|

Segments Covered in the Report |

By Technology, By Component, and By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Process Spectroscopy Industry Trends

One noteworthy trend in the industry is the rising emphasis on lowering variable costs by eradicating errors in the production process and rework requirements. The ability to monitor and control the quality of product most effectively and efficiently by process spectroscopy allows that. Furthermore, there is also an increased emphasis on maintaining international quality standards like ISO by several industries, especially pharmaceutical, food & beverage, chemical, and agriculture.

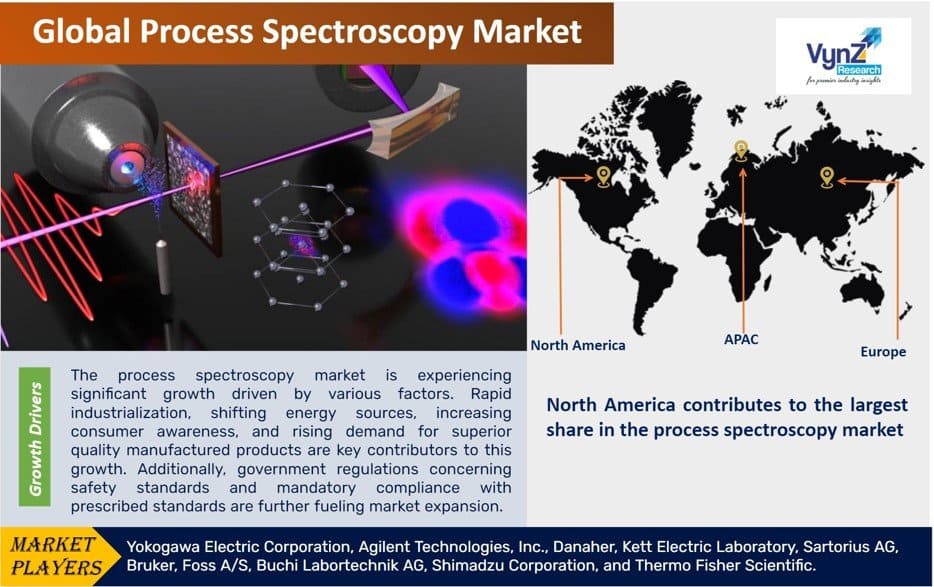

Process Spectroscopy Market Growth Drivers

The growth factors of the global process spectroscopy market include rapid industrialization and the growing demand for better-quality products. The rise in consumer awareness and the shifting energy sources also propels the market growth. Additionally, strict government regulations regarding safety standards and compliance requirements with given standards are further fueling the market growth. The benefits offered by process spectroscopy, such as cost-efficiency, time-saving, low-cost inventory management, and eliminating negative results due to interruption of production at any stage, encourage higher adoption in pharmaceuticals, food, and agriculture industries along with the forensic sector for identifying organic compounds or substances in a crime scene are promoting market expansion. In addition, the growing research and development activities, accuracy in analysis, and prediction of product quality, especially in medicine, packaged food, and chemicals, are also fueling the market growth.

Process Spectroscopy Market Challenges

The most significant hindrance to the growth of the global process spectroscopy market is the large capital requirement in deploying spectroscopic equipment. It is also hindered by issues related to the utilization of and lack of skilled personnel.

Process Spectroscopy Market Opportunities

Growth opportunities are, however, offered by the ongoing innovation in process spectroscopy to reduce the cost of product evaluation. The availability and extensive use of promotional tools by vendors, the growth in the number of research on the microscopic study of chemicals in the pharmaceuticals industry, and the growing adoption of technically developed cloud-based equipment by pharmaceutical firms also create new growth opportunities. Also, the growing emphasis by companies to develop portable spectrometer instruments with wireless connectivity that provide instant results offers opportunities for growth in the process spectroscopy market.

Process Spectroscopy Market Geographic Overview

North America is expected to contribute the largest market share during the forecast period due to a developed infrastructure in the region. It is also attributed to the growing adoption of this technique across a wide range of industry verticals like food, pharmaceutical, and oil industries. In addition, the strict government rules for manufactured products and the presence of major industry players in the region also facilitate its growth.

Asia Pacific is expected to grow at a faster rate during the projected period due to higher R&D initiatives and developed processes, a robust manufacturing hub, and higher application in the extraction, processing, and distribution of oil and gas. It is also attributed to technological developments in spectroscopic techniques such as NIR, FTIR, and Raman, which are making them more user-friendly, accessible, and cost-effective.

Process Spectroscopy Market Competitive Insight

To obtain a competitive advantage, corporations have been cutting prices and boosting quality. Companies with inefficient process control face various problems, including long lead times for manufacturing and inventory, as well as visual faults that can harm a brand's image. Consumer satisfaction, reduced manufacturing and inspection costs, efficient resource usage, and improved sales are all advantages of effective implementation. Furthermore, the industry players are emphasizing R&D activities to improve their product portfolio and are entering into M&A, joint ventures, partnerships, and agreements to expand their geographical presence and sustain themselves in a competitive market.

Yokogawa is one of the major providers, offering research and development of a molecular spectroscopic sensor that would visualize data that would otherwise be unseen. Yokogawa has developed spectroscopic analysis technology, spectrum analysis technology, and nanophotonics technology over many years. Yokogawa produced a sensing device and a prototype of a handheld molecular spectroscopic sensor containing this device by combining these technologies. Quality control and logistics management are likely to benefit from this technology. Yokogawa will continue to research and develop a molecular spectroscopic sensor, to expand its use in a variety of industries.

Agilent’s best-in-class portfolio of spectroscopy systems is more qualified and offers the right solution for a specific challenge. Innovations such as the Cary 3500 UV-Vis and laser direct infrared (LDIR) chemical imaging, 4300 handheld FTIR, and proprietary spatially offset and transmission Raman technologies will provide growth in molecular spectroscopy instruments. Agilent provides a wide range of FTIR instruments, from portable FTIR analyzers and flexible handheld FTIR spectrometers for field applications to dependable benchtop instruments for routine FTIR testing and cutting-edge research. Agilent FTIR instrumentation provides accurate results for specific FTIR analyses.

Some of the key players operating in the process spectroscopy market include Yokogawa Electric Corporation, Agilent Technologies, Inc., Danaher, Kett Electric Laboratory, Sartorius AG, Bruker, Foss A/S, Buchi Labortechnik AG, Shimadzu Corporation, and Thermo Fisher Scientific.

Recent Developments by Key Players

Sartorius has collaborated with NVIDIA to help enable the development of new and better therapies, combining Sartorius’ life sciences and bioprocessing expertise with NVIDIA’s AI-powered computing platforms and software.

Thermo Fisher Scientific has built a new manufacturing facility and expanded capabilities in Singapore to enable the country’s science and technology sector to accelerate research, development and manufacturing of critical medicines and vaccines

The Process Spectroscopy Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Technology

- Mass Spectroscopy

- Molecular Spectroscopy

- Near-Infrared (NIR)

- Fourier-Transform Infrared (FT-IR)

- Raman

- Nuclear Magnetic Resonance (NMR)

- Others

- Atomic Spectroscopy

- By Component

- Hardware

- Software

- By Application

- Polymer

- Oil & Gas

- Pharmaceuticals

- Food & Agriculture

- Chemicals

- Water and Wastewater Management

- Pulp & Paper

- Metal & Mining

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Process Spectroscopy Market