Semiconductor IP Market Overview

The Global Semiconductor IP Market reached USD 6.3 billion in 2023 and is projected to grow to USD 9.8 billion by 2030, with a compound annual growth rate (CAGR) of 5.4% from 2025 to 2030.

Semiconductor intellectual property signifies the unique procedures, designs, and technologies used in manufacturing semiconductors. The categories typically include copyrights, patents, and trade secrets. These are specifically designed to protect innovations in the design process and fabrication of chips and their testing. Semiconductor IP is typically associated with processors, interconnects, memory, and other peripherals and plays a vital role in the development of electronic devices. In a way, it facilitates effective communication and computation along with process automation. Businesses invest a large amount in protecting IP to stay competitive and maintain technological development initiatives.

Semiconductor IP Market Segmentation

Insight by Design IP

The global semiconductor IP market is divided by design IP into processor IP, memory IP, interface IP, and other segments. Out of all these segments, the memory IP is expected to dominate and grow at a higher CAGR during the forecast period due to growth in social networking content and media streaming that propels the demand for local storage and data centers. It is also attributed to the extensive use of different types of memory ICs, such as random-access memory, flash memory, erasable programming memory, and programmable read-only memory.

Insight by IP Core

According to the IP core, the global semiconductor IP market is divided into soft-core and hard-core segments. Among these two segments, the soft-core segment is expected to grow at a higher rate during the forecast period due to affordability, easy implementation, and widespread use across different industries.

Insight by IP Source

The global semiconductor IP market is also divided by different IP sources into royalty and licensing segments, where the former is expected to contribute a larger share to the market due to significant tech development allowing the manufacturers to produce products they wish and pay royalty exclusively for them.

Insight by End User

According to the different end users, the global semiconductor IP market is divided into consumer electronics, telecom & data centers, automotive, commercial, industrial, aerospace & defense, and other segments. Out of these segments, the consumer electronics segment is poised to grow at a higher CAGR during the forecast period due to progress in multicore technology, extensive use of consumer electronic products, growing demand for SoC designs, and reducing the cost of chip design.

Global Semiconductor IP Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 6.3 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 9.8 Billion

|

|

Growth Rate

|

5.4%

|

|

Segments Covered in the Report

|

By Design IP, By IP Core, By IP Source, and By End User.

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Semiconductor IP Industry Trends

A few notable trends in the industry include innovations and developments in technologies such as carbon nanotubes, graphene transistors, and self-organizing molecular machines. There is also a growing trend of quantum computing on a global scale.

Semiconductor IP Market Growth Drivers

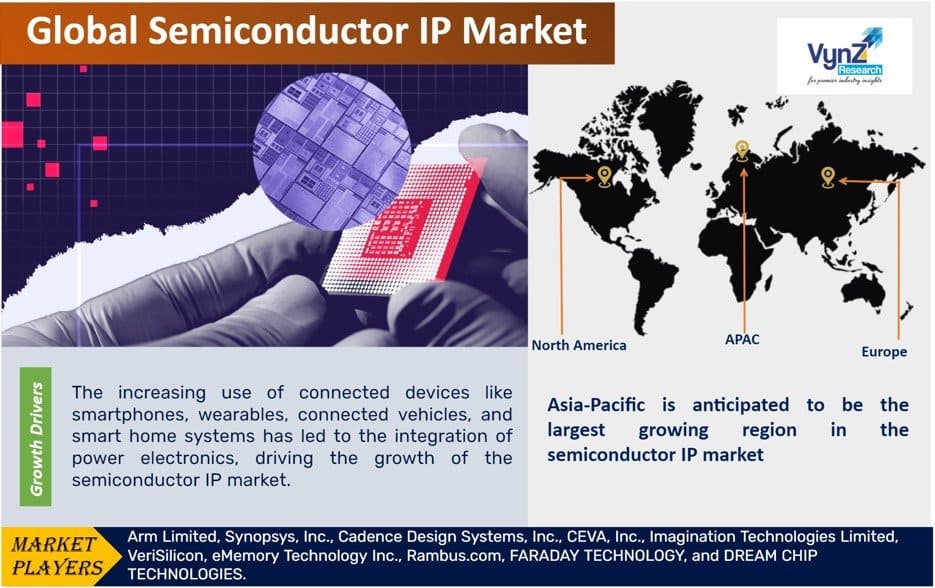

The most significant factor that influences the growth of the global semiconductor IP market is the growing adoption and use of different types of connected devices, such as wearables, smartphones, smart home systems, and connected vehicles, as it has resulted in the integration of power electronics. In addition, the rise in demand for system-on-chip (SoC) design has also prompted the growth of the market. The fact that such an approach reduces the cost of designing and manufacturing also propels market growth. Moreover, the growing popularity and use of consumer electronics in daily life, as well as the higher use of teleconference instruments along with other consumer electronics in the healthcare sector, also drives market expansion.

Semiconductor IP Market Challenges

The shadow semiconductor supply chain hinders market growth since it results in counterfeits, IP theft, and conflicts. The higher designing and development cost of semiconductor IP, along with the complexities involved, also challenges the market expansion. Moreover, the issue with Moore’s law and the temporary influence on the consumer electronics industry also impedes the growth of the semiconductor IP market.

Semiconductor IP Market Opportunities

Growth opportunities to the global semiconductor IP market are offered by programmable DSP IP segment and the growing demand in the aerospace, avionics, and defense sectors. Additionally, rapid growth is expected in the automotive sector due to higher adoption of IP cores and automated processes; applications of microprocessor units, sensors, interfaces, memory, and microcontroller units in premium autonomous vehicles also show promising growth opportunities for the global semiconductor IP market.

Semiconductor IP Market Geographic Overview

Asia-Pacific is expected to dominate the global semiconductor IP market and grow more during the forecast period due to higher investment, growing need for consumer electronics devices, and low labor cost. It is also attributed to the higher production of sophisticated electronic devices with better features, such as better wireless communication, swift processing, RF-ability, and higher storage capacity, which make them more effective.

Semiconductor IP Market Competitive Insight

The strategies adopted by the semiconductor IP industry include product innovation, mergers & acquisitions to remain competitive in the industry. Moreover, the large-scale manufacturers are able to integrate backward and forward and the presence of key players are running their business in domestic and international territories, resulting in the growth of the semiconductor IP market.

Arm Holdings plc is a British semiconductor and software design company based in Cambridge, England, whose primary business is the design of central processing unit cores that implement the ARM architecture family of instruction sets.

Synopsys, Inc. supplies electronic design automation solutions to the global electronics market. The Company provides design technologies to creators of advanced integrated circuits, electronic systems, and systems on a chip. Synopsys also provides consulting services and support to its customers to streamline the overall design process and accelerate time to market.

Some of the key players operating in the semiconductor IP market are Arm Limited, Synopsys, Inc., Cadence Design Systems, Inc., CEVA, Inc., Imagination Technologies Limited, VeriSilicon, eMemory Technology Inc., Rambus.com, FARADAY TECHNOLOGY, and DREAM CHIP TECHNOLOGIES.

Recent Developments by Key Players

Ceva, Inc., the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently has launched Ceva-Waves Links which is a multi-protocol wireless platform IPs. The integrated offering supports the latest wireless standards to address the surging demand for connectivity-rich chips targeting Smart Edge devices in the consumer IoT, Industrial, automotive, and personal computing markets.

SoftBank Group's Arm Holdings develop artificial-intelligence chips to launch the first products. Mass production will be handled by contract manufacturers.

The Semiconductor IP Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Design IP

- Processor IP

- Interface IP

- Memory IP

- Other Design IP

- By IP Core

- By IP Source

- By End-User

- Consumer Electronics

- Telecom & Data Centers

- Automotive

- Commercial

- Industrial

- Aerospace & Defense

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)