TIC Market for Consumer Goods & Retail Industry Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Sourcing Type (Outsourced TIC Services, In-house TIC Services), by Industry Vertical (Food & Beverage, Apparel & Textiles, Consumer Electronics, Personal Care & Cosmetics, Household Goods & Other Consumer Products)

| Status : Published | Published On : Feb, 2026 | Report Code : VRSME9189 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 180 |

TIC Market for Consumer Goods & Retail Industry Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Sourcing Type (Outsourced TIC Services, In-house TIC Services), by Industry Vertical (Food & Beverage, Apparel & Textiles, Consumer Electronics, Personal Care & Cosmetics, Household Goods & Other Consumer Products)

TIC Market for Consumer Goods & Retail Industry Overview

The TIC market for consumer goods and retail which was valued at approximately USD 34.50 billion in 2025 and is estimated to reach around USD 36.26 billion in 2026, is projected to reach approximately USD 56.73 billion by 2035, expanding at a CAGR of about 5.1% during the forecast period from 2026 to 2035.

Market growth is driven by tightening product safety regulations, rising global trade in consumer goods, and increasing complexity of retail supply chains, along with growing adoption of third-party conformity assessment and compliance assurance services.

Expansion of the market is further supported by rising demand for product quality assurance, sustainability certification, and regulatory compliance across food, apparel, electronics, and household goods. Adoption is reinforced by regulatory oversight and consumer protection frameworks implemented by government and government-backed bodies such as the U.S. Consumer Product Safety Commission (CPSC), the European Commission’s market surveillance authorities, and national standards organizations aligned with ISO and IEC guidelines. Public sector enforcement of product safety laws, traceability mandates, and cross-border trade compliance requirements across North America, Europe, and Asia Pacific continues to sustain demand for testing, inspection, and certification services across global consumer goods and retail value chains.

TIC Market for Consumer Goods & Retail Industry Dynamics

Market Trends

The market is witnessing structural shifts driven by tightening regulatory oversight, evolving consumer safety expectations, and increasing supply chain complexity. One of the key trends shaping the market is the rising emphasis on product safety, quality assurance, and regulatory compliance across food, apparel, cosmetics, electronics, and household goods. Government-backed authorities such as the U.S. Consumer Product Safety Commission (CPSC), European Commission bodies under the General Product Safety Regulation (GPSR), and national standards agencies are reinforcing mandatory testing and certification requirements, increasing demand for third-party TIC services.

Another emerging trend is the growing adoption of digital inspection, risk-based auditing, and data-driven conformity assessment processes. Regulatory alignment initiatives supported by organizations such as the International Organization for Standardization (ISO) and national accreditation bodies are encouraging TIC providers to deploy automated testing platforms, remote inspection tools, and traceability systems. These developments are influencing service offerings and pushing companies to focus on integrated, technology-enabled compliance solutions, reshaping competitive dynamics within the market.

Growth Drivers

Growth of the market is strongly supported by expanding regulatory enforcement and rising global trade in consumer products, which continues to generate consistent demand across manufacturers, importers, and retailers. Increasing cross-border movement of goods has prompted governments and customs authorities to strengthen conformity assessment and pre-market approval requirements. Agencies such as the U.S. Food and Drug Administration (FDA), European Chemicals Agency (ECHA), and national standards organizations mandate testing and certification to ensure compliance with safety, labeling, and environmental regulations.

Additionally, heightened consumer awareness regarding product safety, sustainability, and ethical sourcing is playing a critical role in boosting adoption. As brands and retailers prioritize regulatory compliance, reputational risk management, and supply chain transparency, demand for independent testing, inspection, and certification services is expected to remain strong throughout the forecast period. Government-supported sustainability frameworks and consumer protection laws further reinforce long-term market expansion.

Market Restraints / Challenges

Despite favorable growth prospects, the market faces challenges related to regulatory fragmentation and cost pressures. Variations in testing standards, certification protocols, and compliance frameworks across regions increase operational complexity for manufacturers and TIC providers. Government reviews from trade and standards authorities highlight that overlapping regulatory requirements can raise compliance costs and extend product approval timelines, particularly for small and mid-sized enterprises operating across multiple markets.

Furthermore, dependence on skilled technical personnel and advanced laboratory infrastructure poses operational challenges. TIC services require continuous investment in accredited facilities, trained inspectors, and updated testing methodologies to meet evolving regulatory standards. Government-backed assessments of quality infrastructure development indicate that limited availability of skilled resources and high capital requirements can constrain service scalability in emerging markets, affecting overall market efficiency.

Market Opportunities

The market presents significant opportunities through expanding regulatory coverage in emerging economies and increased focus on consumer protection enforcement. Government-led initiatives to strengthen quality infrastructure, product surveillance, and import control mechanisms are creating sustained demand for TIC services. Companies offering cost-effective, scalable, and regionally compliant testing and certification solutions are well positioned to capture incremental demand from manufacturers and retailers in developing markets.

Another key opportunity lies in the integration of TIC services with digital compliance management and sustainability verification. Rising public sector emphasis on environmental, social, and governance (ESG) compliance, product traceability, and circular economy frameworks is encouraging adoption of certification services covering sustainability claims, eco-labeling, and responsible sourcing. Advancements in digital audit platforms, remote inspections, and real-time compliance monitoring are expected to enhance service efficiency, strengthen client engagement, and support long-term market growth.

Global TIC Market for Consumer Goods & Retail Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 34.50 Billion |

|

Revenue Forecast in 2035 |

USD 56.73 Billion |

|

Growth Rate |

5.1% |

|

Segments Covered in the Report |

By Service Type, By Sourcing Type, By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Other Regions |

|

Key Companies |

ALS Limited, Applus+ Services S.A., Baltazar Testing Labs SA, Bureau Veritas SA, China Certification and Inspection Group, Core Laboratories N.V., Cotecna Inspection SA, Intertek Group plc, SGS SA, TÜV NORD GROUP, TÜV Rheinland AG, TÜV SÜD AG, UL Solutions Inc |

|

Customization |

Available upon request |

TIC Market for Consumer Goods & Retail Industry Segmentation

By Service Type

Testing services accounted for the largest market share in 2025, estimated at approximately 46%, supported by high testing frequency, mandatory safety validation, and regulatory requirements across food, apparel, cosmetics, toys, and electronics. Government-backed product safety frameworks enforced by agencies such as the U.S. Consumer Product Safety Commission (CPSC) and European regulatory authorities continue to mandate laboratory testing before market entry, sustaining consistent demand.

Inspection services represented around 32% of total market revenue, driven by supply chain audits, factory inspections, and pre-shipment verification requirements. Growth in inspection services is closely linked to expanding global sourcing and retailer-led compliance programs aimed at mitigating quality and reputational risks.

Certification services accounted for the remaining approximately 22%, supported by increasing adoption of quality, sustainability, and compliance certifications aligned with ISO standards and government-recognized accreditation bodies. Certification is expected to grow at a faster pace of about 6.4% CAGR, driven by rising ESG compliance, eco-labeling mandates, and retailer-driven private label assurance programs.

By Sourcing Type

Outsourced TIC services dominated the market in 2025, accounting for nearly 68% of total revenue, as manufacturers and retailers continue to rely on independent, accredited providers to ensure regulatory neutrality, global acceptance, and compliance credibility. Government trade and customs authorities in regions such as North America and Europe increasingly require third-party verification for imported consumer goods, reinforcing demand for outsourced services.

In-house TIC services accounted for approximately 32% of the market, primarily among large multinational manufacturers with high testing volumes and internal compliance capabilities. However, outsourced services are expected to register the highest growth rate of around 6.1% during the forecast period. Growth is driven by increasing regulatory complexity, cross-border trade expansion, and cost optimization strategies, as maintaining accredited laboratories and inspection teams internally involves significant capital and operational expenditure. The growing preference for scalable, on-demand compliance services continues to strengthen the position of third-party TIC providers.

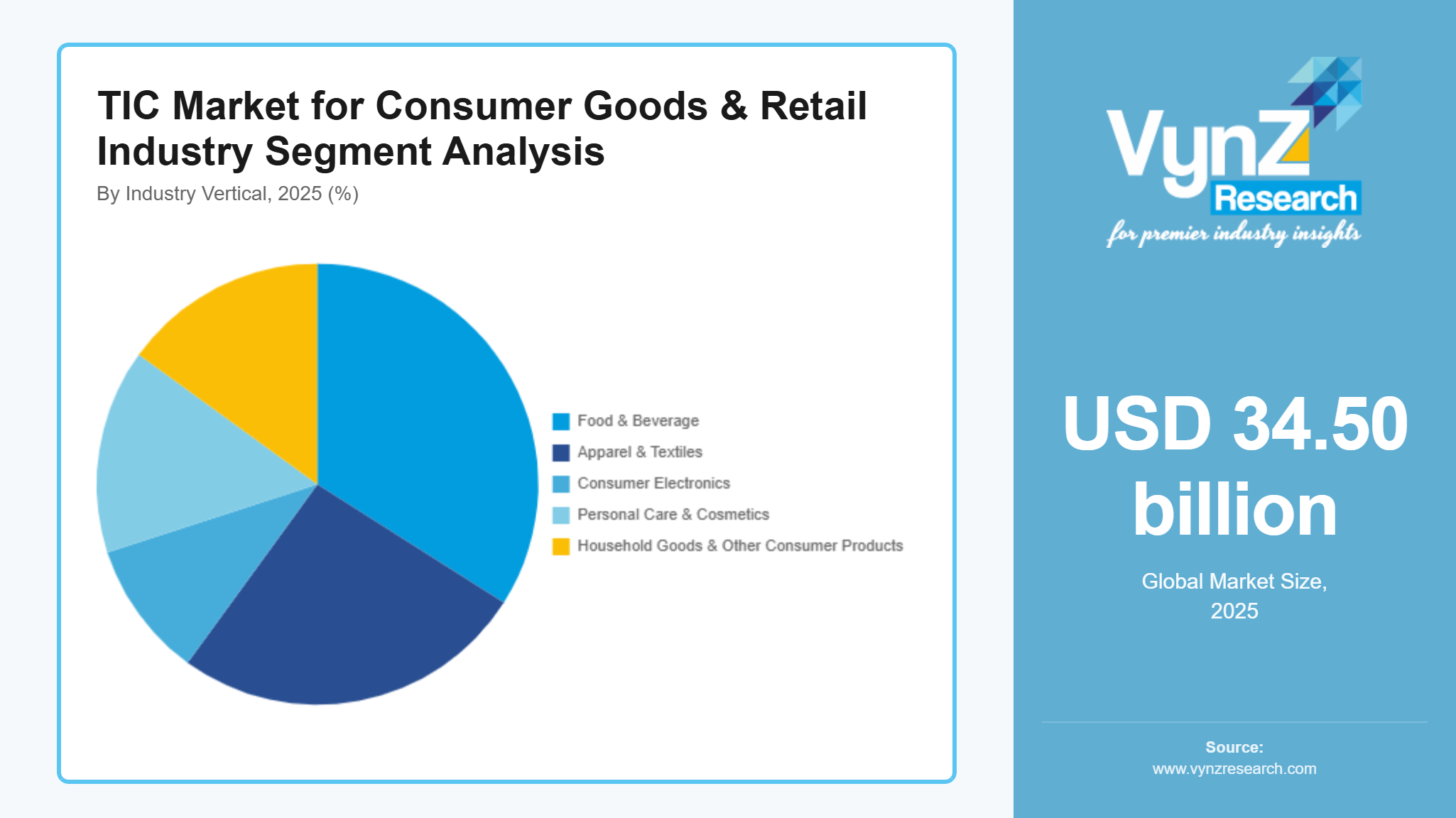

By Industry Vertical

Food and beverage emerged as the largest end-use segment in 2025, accounting for approximately 34% of total market revenue, supported by stringent food safety regulations, traceability requirements, and government-backed surveillance programs enforced by authorities such as the U.S. FDA and European food safety agencies.

Apparel and textiles contributed around 21%, driven by chemical safety compliance, sustainability audits, and retailer-mandated supplier inspections.

Consumer electronics represented nearly 18%, supported by electrical safety testing, energy efficiency certification, and regulatory conformity requirements.

Personal care and cosmetics accounted for approximately 15%, driven by ingredient safety validation and regulatory approvals under frameworks such as EU cosmetic regulations.

Household goods and other consumer products made up the remaining share. Among these, personal care and electronics are expected to witness the fastest growth at over 6.5%, supported by rising consumer awareness, product innovation, and stricter regulatory oversight across global retail markets.

Regional Insights

North America

North America accounted for approximately 29% of the global market in 2025, driven by stringent regulatory enforcement, high consumer safety awareness, and mature retail ecosystems. The United States leads regional demand, supported by mandatory compliance with frameworks enforced by agencies such as the U.S. Consumer Product Safety Commission (CPSC) and Food and Drug Administration (FDA), covering product safety, labeling, and chemical testing. Major retail hubs including New York, California, and Texas generate consistent demand for testing and certification services due to high volumes of imported consumer goods and omnichannel retail operations. Government-backed initiatives focused on product traceability, sustainability compliance, and recalls continue to strengthen regional TIC adoption.

Asia Pacific

Asia Pacific is estimated to contribute approximately 33% of global market revenue in 2025, supported by large-scale manufacturing activity, export-oriented consumer goods production, and expanding organized retail. China, India, Vietnam, and Indonesia are key contributors, with growing reliance on TIC services to meet international compliance requirements set by the EU REACH regulation, U.S. CPSIA, and ISO standards. In India, government initiatives such as the Bureau of Indian Standards (BIS) mandatory certification programs and quality control orders are accelerating testing and inspection demand across textiles, electronics, toys, and household goods. Rapid e-commerce expansion and cross-border trade continue to support sustained regional growth.

Europe

Europe represents approximately 17% of the market in 2025, driven by strict regulatory oversight and sustainability-focused policies. Countries including Germany, France, the UK, and Italy maintain strong demand for conformity assessment under CE marking, REACH, and General Product Safety Regulation (GPSR) frameworks enforced by the European Commission. Government-backed initiatives promoting circular economy compliance, eco-labeling, and chemical safety testing are increasing certification requirements across apparel, cosmetics, and household products. Strong consumer preference for certified, sustainable goods further reinforces demand for TIC services across retail supply chains.

Other Regions

Other regions, including Latin America, the Middle East, and Africa, collectively account for approximately 16% of the global market, leaving room for additional regional contributions beyond the core markets. Growth is supported by expanding retail infrastructure, rising imports of consumer goods, and gradual adoption of international safety standards. Government-led quality assurance initiatives and increasing alignment with global trade regulations are creating long-term opportunities for TIC providers, although adoption remains comparatively slower than in North America, Asia Pacific, and Europe. The remaining approximately 5% of the market is distributed across smaller and emerging regional markets not individually quantified in this analysis.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on service portfolio expansion, digital inspection platforms, and geographic reach. Companies are increasingly investing in automation, data-driven compliance tools, and sustainability certification services to strengthen market positioning. Market activity is supported by government-backed regulatory frameworks such as CPSC regulations in the U.S., BIS standards in India, and EU product safety directives, which continue to mandate third-party testing, inspection, and certification across global consumer goods supply chains.

Mini Profiles

ALS Limited focuses on laboratory testing, inspection, and certification services, supported by a strong global laboratory network and cost-efficient testing solutions for consumer goods and retail supply chains.

Bureau Veritas SA operates across mass and premium compliance segments, emphasizing regulatory conformity, product safety testing, and brand assurance services for global retailers and consumer product manufacturers.

Cotecna Inspection SA leverages supply-chain inspection expertise and regional partnerships to support quality assurance, factory audits, and trade facilitation services for consumer goods exporters and retailers.

DEKRA SE focuses on safety testing, product certification, and compliance services, supported by strong technical expertise and regulatory recognition across automotive, consumer electronics, and retail product categories.

Eurofins Scientific SE specializes in advanced laboratory testing and analytical services, leveraging digital platforms and extensive laboratory infrastructure to support consumer goods safety, quality assurance, and regulatory compliance.

Key Players

- ALS Limited

- Applus+ Services S.A.

- Baltazar Testing Labs SA

- Bureau Veritas SA

- China Certification and Inspection Group

- Core Laboratories N.V.

- Cotecna Inspection SA

- Intertek Group plc

- SGS SA

- TÜV NORD GROUP

- TÜV RheinlandAG

- TÜV SÜD AG

- UL Solutions Inc.

Recent Developments

In May 2025, SGS Taiwan Ltd. has expanded its accredited laboratory network under OSHA NRTL approval, enabling localized testing and certification in Taiwan and other Asia Pacific hubs for consumer and industrial products, aimed at broadening market access and compliance support.

In December 2025, Mistras Group Inc. was awarded a large-scale non-destructive testing contract by Bechtel for the Woodside Louisiana LNG megaproject, aimed at strengthening inspection services and expanding its presence in energy and infrastructure inspection markets.

In September 2025, Core Laboratories N.V. completed the strategic acquisition of Brazil-based Solintec, aimed at enhancing its analytical and testing capabilities in Latin America and supporting broader quality assurance offerings in energy and related sectors.

Global TIC Market for Consumer Goods & Retail Industry Coverage

Service Type Insight and Forecast 2026 - 2035

- Testing

- Inspection

- Certification

Sourcing Type Insight and Forecast 2026 - 2035

- Outsourced TIC Services

- In-house TIC Services

Industry Vertical Insight and Forecast 2026 - 2035

- Food & Beverage

- Apparel & Textiles

- Consumer Electronics

- Personal Care & Cosmetics

- Household Goods & Other Consumer Products

Global TIC Market for Consumer Goods & Retail Industry by Region

- North America

- By Service Type

- By Sourcing Type

- By Industry Vertical

- By Country - U.S., Canada, Mexico

- Europe

- By Service Type

- By Sourcing Type

- By Industry Vertical

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Service Type

- By Sourcing Type

- By Industry Vertical

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Service Type

- By Sourcing Type

- By Industry Vertical

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for TIC Market for Consumer Goods & Retail Industry Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Type

1.2.2. By

Sourcing Type

1.2.3. By

Industry Vertical

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Type

5.1.1. Testing

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Inspection

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Certification

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Sourcing Type

5.2.1. Outsourced TIC Services

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. In-house TIC Services

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Industry Vertical

5.3.1. Food & Beverage

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Apparel & Textiles

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Consumer Electronics

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Personal Care & Cosmetics

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Household Goods & Other Consumer Products

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Service Type

6.2. By

Sourcing Type

6.3. By

Industry Vertical

6.3.1.

U.S. Market Estimate and Forecast

6.3.2.

Canada Market Estimate and Forecast

6.3.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Service Type

7.2. By

Sourcing Type

7.3. By

Industry Vertical

7.3.1.

Germany Market Estimate and Forecast

7.3.2.

U.K. Market Estimate and Forecast

7.3.3.

France Market Estimate and Forecast

7.3.4.

Italy Market Estimate and Forecast

7.3.5.

Spain Market Estimate and Forecast

7.3.6.

Russia Market Estimate and Forecast

7.3.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Service Type

8.2. By

Sourcing Type

8.3. By

Industry Vertical

8.3.1.

China Market Estimate and Forecast

8.3.2.

Japan Market Estimate and Forecast

8.3.3.

India Market Estimate and Forecast

8.3.4.

South Korea Market Estimate and Forecast

8.3.5.

Vietnam Market Estimate and Forecast

8.3.6.

Thailand Market Estimate and Forecast

8.3.7.

Malaysia Market Estimate and Forecast

8.3.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Service Type

9.2. By

Sourcing Type

9.3. By

Industry Vertical

9.3.1.

Brazil Market Estimate and Forecast

9.3.2.

Saudi Arabia Market Estimate and Forecast

9.3.3.

South Africa Market Estimate and Forecast

9.3.4.

U.A.E. Market Estimate and Forecast

9.3.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. ALS Limited

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Applus+ Services S.A.

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Baltazar Testing Labs SA

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Bureau Veritas SA

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. China Certification and Inspection Group

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Core Laboratories N.V.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Cotecna Inspection SA

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Intertek Group plc

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. SGS SA

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. TÜV NORD GROUP

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. TÜV Rheinland AG

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. TÜV SÜD AG

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. UL Solutions Inc.

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Consumer Goods & Retail Industry