TIC Market for IT & Telecom Industry Overview

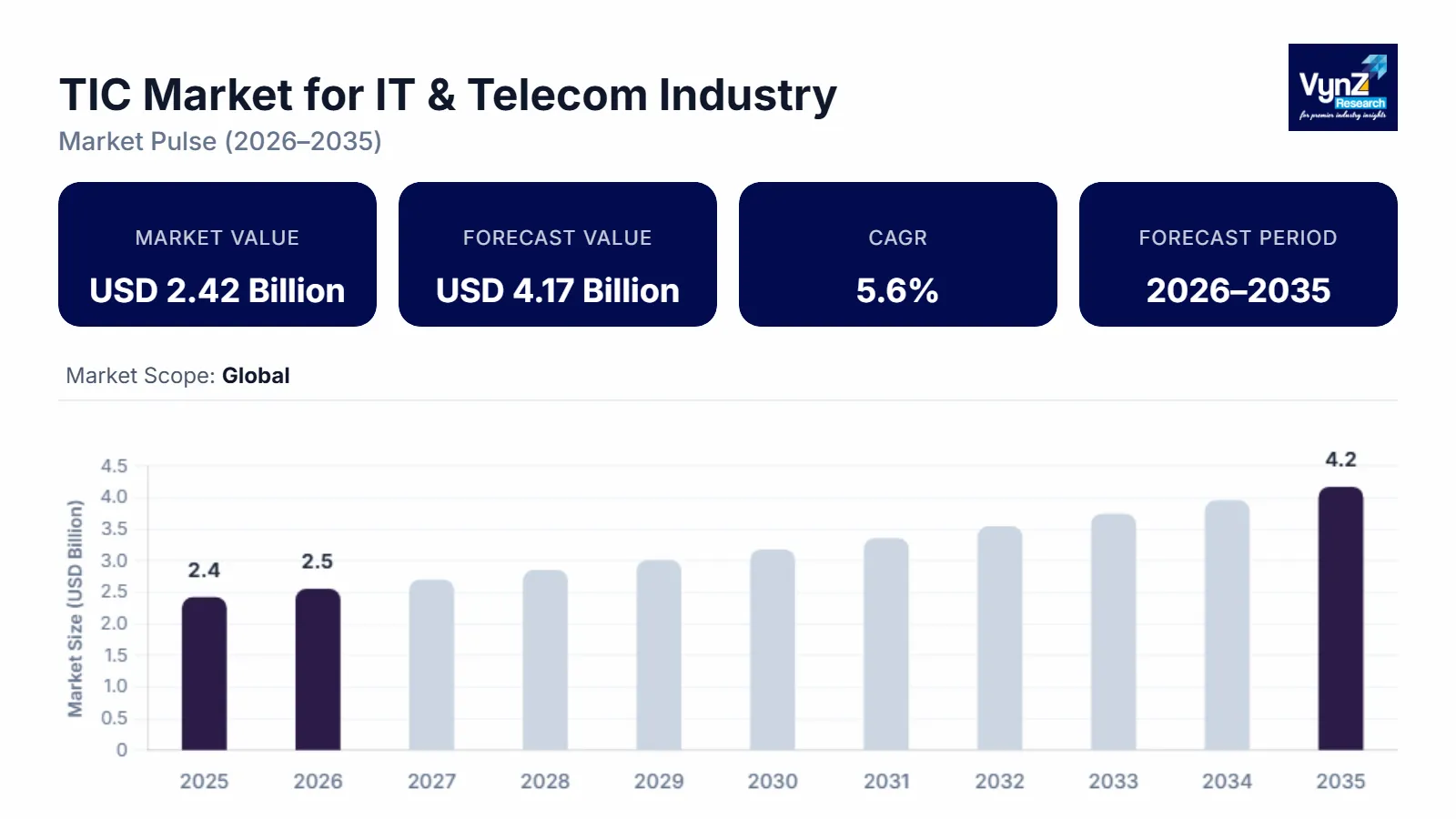

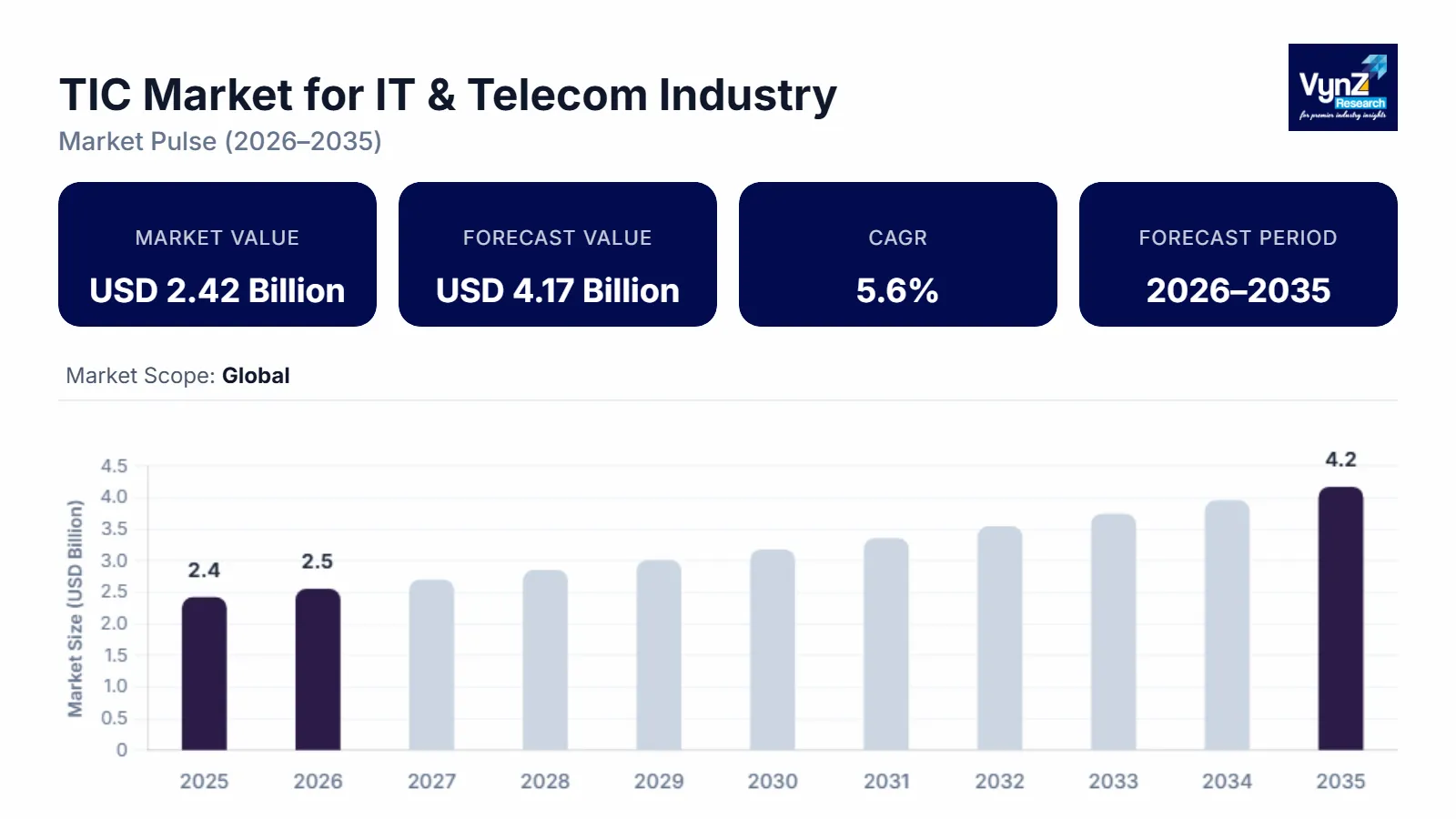

The IT & Telecom Industry’s Testing, Inspection, and Certification (TIC) market was valued at USD 2.42 billion in 2025 and is estimated to reach USD 2.55 billion in 2026, growing at a CAGR of 5.6% during 2025–2030, to reach USD 4.17 billion by 2035.

TIC testing covers products, components, and systems to meet specific requirements. Quality control measures such as inspection and testing play a vital role in cost optimization, productivity enhancement, on-time delivery, and market share, making them essential for manufacturing companies.

The telecommunication industry is a wide field that provides transmission of information through radio, telephone, video, or other technical communication systems. It is a rapidly changing industry owing to scientific advancements, introducing new developments in technology, resulting in the growth of TIC services in the IT & telecom industry. Globalization will focus on the standardization of products and has provided advanced technologies among various verticals such as IT & telecommunication, electronics, and automotive industries, etc., which will expand the TIC market over the projected period. Furthermore, there is a growth in the middle-class populace, fast urbanization, strict safety regulations, rise in illicit trading of pirated and duplicate products, advancement in networking and communication technology, rising demand of outsourcing testing, inspection, and certification services has driven the demand of the TIC market in the IT & telecommunication industry.

TIC Market for IT & Telecom Industry Dynamics

Market Trends

Demand for TIC services that evaluate carbon footprints, ethical sourcing, and green standards is being driven by the expansion of environmental, social, and governance (ESG) verification. Businesses are depending more and more on third-party TIC services to guarantee adherence to local and international standards as global rules become more stringent and diverse. With digital products and connected systems proliferating, cybersecurity testing and certification services are on the rise, especially for IoT, networked systems, and telecom equipment. AI, IoT and data analytics are increasingly integrated into TIC workflows to automate inspections, speed up testing processes, improve accuracy, and reduce human error.

Growth Drivers

Fast growth in digital systems pushes the TIC sector forward in tech and communications. Because 5G, fiber lines, along with massive data hubs are spreading worldwide, more checks on networks, gear reviews, plus rule-based validations are needed. Instead of skipping inspections, phone carriers today spend about 25–30% of their setup funds on these quality steps - just to keep services strong, stable, and within legal limits.

Cybersecurity rules are boosting TIC needs fast. Tougher privacy laws, combined with more online attacks, force tech and telecom companies to spend on safety checks, hack tests, or official approvals. Services that focus on security within TIC expand by around 10–12% each year - firms want outside experts to verify defenses, while dodging fines and avoiding leaks.

Fancy services plus merged tech keep pushing demand up. Because cloud setups, local hubs, and smart gadgets need constant checks to work well together. If cell networks go down, losses might hit over five grand each minute - so regular scans beat waiting till things break.

Market Restraints / Challenges

The testing, inspection, and certification market faces obstacles like trade wars, growth fluctuations, need for industrial safety systems, huge cost of TIC owing to varied global standards and regulations. Also, there is a lack of testing laboratories and expert personnel may hamper the growth of the TIC market.

Market Opportunities

Specialized testing and certification services encompassing network performance, interoperability, safety, and compliance are in high demand due to the worldwide rollout of 5G networks, the transition to cloud-native and software-defined architectures, and the expanding use of IoT devices. Due to increased regulatory oversight, rapid technological advancement, and growing concerns about security and sustainability, the market for Testing, Inspection, and Certification (TIC) in the IT and telecom industries offers significant opportunities.

Global TIC Market for IT & Telecom Industry Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 2.42 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 4.17 Billion

|

|

Growth Rate

|

5.6%

|

|

Segments Covered in the Report

|

Deployment Model, Service Type, Organization Size, End-User Industry

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia Pacific

|

TIC Market for IT & Telecom Industry Segmentation

By Service Type

Testing, inspection, certification, audits - along with advisory work - make up the IT and telecom TIC sector. Testing’s growing quickest, climbing about 8.6% each year, thanks to demand for checking network speed, app reliability, plus security reviews among carriers and tech firms.

Testing networks and systems grabs the biggest chunk of income - about 38 to 40 percent of the whole market. Before new tech goes live, it must pass checks for speed, delays, heavy load handling, plus how well it works with other tools. This is especially true for 5G, business comms setups, and services running on cloud infrastructure.

Inspection services keep growing since cell towers, wires, and server hubs need regular checkups now and then. Checking equipment often cuts downtime while making systems last longer - this matters most in busy cities or far-off spots where gear runs nonstop.

Certification’s getting more attention - IT and telecom companies want to meet worldwide benchmarks while building confidence with users. When systems are certified, red tape slows them down less, plus they spread quicker across big organizations, which keeps the need for checks rolling.

By Network and Infrastructure Type

Depending on the setup, this sector includes wireless systems, wired connections, fiber lines, storage hubs, plus online services. The wireless testing area expands quickest - about 9.1% each year - as global 5G launches and compact signal boosts spread widely.

Fiber plus wired networks make up a big chunk of TIC needs because of wider broadband rollout along with efforts to connect final stretches to homes. Checking light signals and examining cables matters a lot for keeping speeds high, connections stable, while meeting customer promises.

Data centers are growing fast because big shared sites need steady power, cooling, and safety checks. Since keeping systems running matters so much, inspection services here rise about 8% each year - thanks to backup needs.

Cloud setups plus virtual networks open fresh chances for testing software compatibility - telecom firms shift to flexible, code-based systems.

By Compliance and Standards Area

When it comes to rules, there’s stuff like how well networks run, keeping data safe from hacks, making sure devices don’t interfere with signals, also checks on service reliability. Staying secure online and guarding personal info is blowing up quickest - around 10.5% each year - because attacks are getting worse while laws get tighter.

Network speed, response time, and uptime matter a lot - regulators set clear rules companies must follow. If providers fall short, they risk fines while users might switch services.

Safety checks plus electromagnetic compatibility tests matter a lot for telecom gear. Because they keep networks from messing up nearby electronics while following health rules meant to protect people.

As phone companies race to prove they’re reliable, more now use service checks and performance reviews. Outside audits back up their promises while building stronger confidence with users.

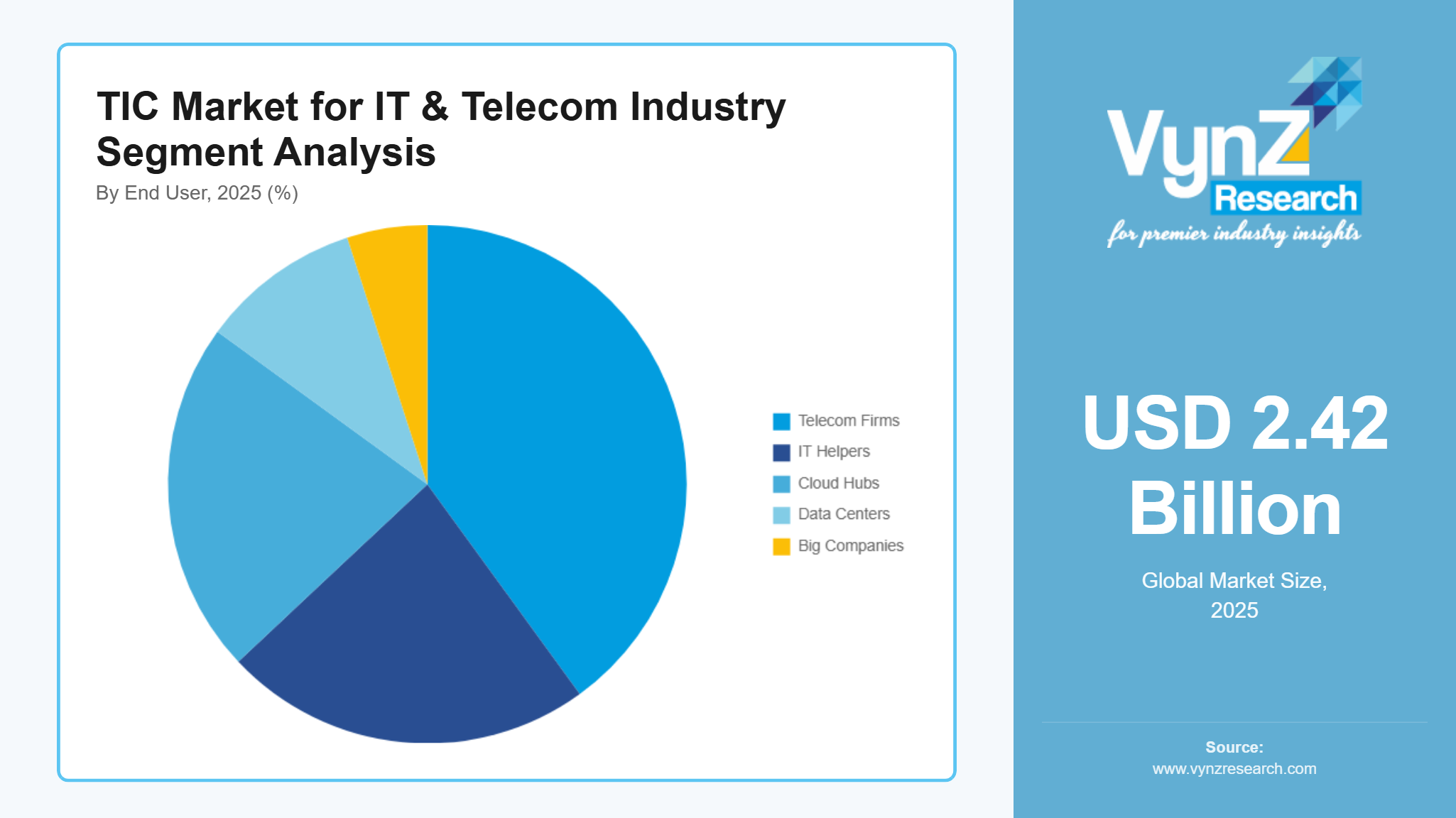

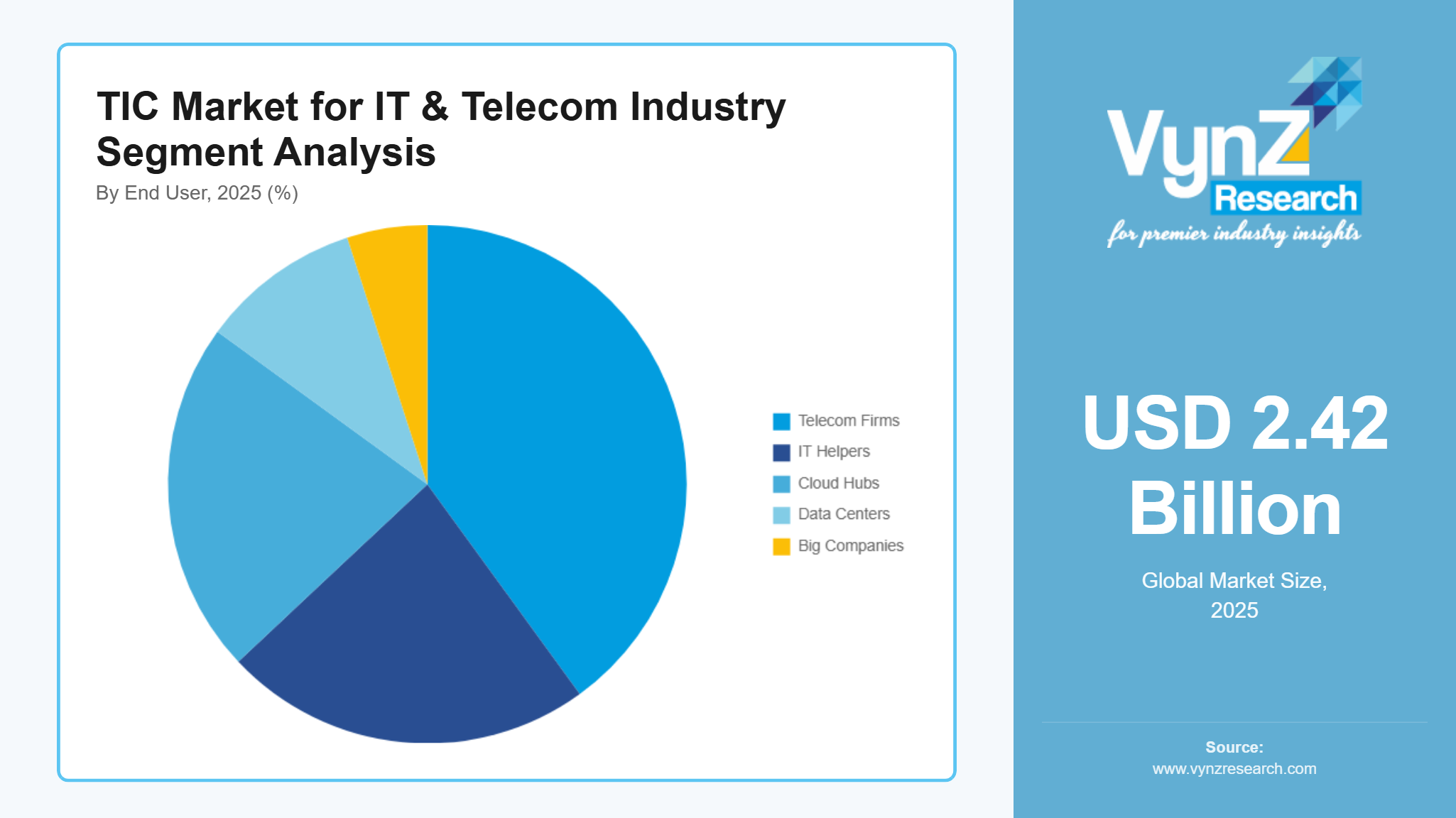

By End-User Industry

Depending on who uses it, this market supports telecom firms, IT helpers, cloud hubs, data centers, plus big companies. Telecom outfits make up the biggest chunk - bringing in more than 45% of all TIC cash - thanks to ongoing upgrades and rules they follow.

IT firms use TIC checks to confirm their software, support setups, and security systems work right. Since more companies hire outside tech help, demand for Tic verification climbs - helping meet agreed performance rules.

Cloud and data center providers are growing fast - mostly because clients demand constant operation and regular checks. Getting verified by third-party TIC firms lets these operators land big corporate deals while meeting international rules.

Businesses are using TIC tools more often to check their own systems - particularly banks, hospitals, and public agencies. These areas need tighter oversight due to strict rules they follow.

Regional Insights

North America

North America’s TIC scene stays active even though it's well-established, especially in IT and telecom - growth hovers near 6% to 6.5% each year. Rules are strict here, networks run smoothly, plus new tech like 5G rolls out fast, which keeps testing and inspection work flowing consistently.

The area tops in security checks plus rules approval, pushed by heavy data flow along with tight privacy demands. In North America, safety-focused inspection services climb close to 12% each year because cyber threats keep going up.

Big spending on data hubs and local computing pushes up demand for checks and trials. Firms that give smart, off-site testing tools get ahead - thanks to faster results and fewer delays.

Europe

Europe’s growing at roughly 5.5–6% each year, thanks to tight rules and a big focus on keeping data safe. Meeting GDPR rules along with telecom quality norms keeps TIC needs coming back regularly.

Sustainability rules plus tighter energy norms push more checks for data hubs and web networks. In big EU spots, going green gets noticed when centers earn eco-labels.

European inspection firms target premium work - think cyber checks or permits for international rules. Because these jobs are niche, deals stay pricey even if overall demand grows slowly.

Asia Pacific

Asia Pacific’s growing quicker than anywhere else - close to 9–10% every year - because tech use is surging alongside network upgrades. Places like China, India, South Korea, or Japan need tons of testing right now thanks to heavy rollout of new systems.

Fiber expansion plus big 5G rollouts keep driving demand for constant test checks. On top of that, government rules on safety and speed are pushing more outside audits into play.

The area's buzzing as homegrown TIC players rise while big international names move in. Cheaper lab work plus quicker rollouts turn Asia Pacific into a hotspot for gains.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on product innovation, pricing strategies, and geographic expansion. Companies such as Microsoft, IBM, Google, Amazon Web Services, and Oracle are investing heavily in R&D, cloud infrastructure, and AI model optimization. Government-backed initiatives, including NIST AI guidelines, the EU AI Act, and national AI strategies in APAC, support technology adoption and reinforce vendor positioning across enterprise and public sector clients.

Mini Profiles

MISTRAS can perform inspections on single components, or centralize testing and machining aerospace production milestones in a purpose-built facility.

Bureau Veritas provides electrical safety testing and certification services that help gain access to global markets. This certification program test products against recognized safety standards relating to criteria such as electric shock, excessive temperature, radiation, implosion, and mechanical hazards and fire.

Key Players

- Intertek Group Plc

- Bureau Veritas

- MISTRAS Group

- SGS SA

- Eurofins Scientific SE

- TUV Rheinland

- TUV SUD

- DEKRA SE

- Applus+

- DNV GL

- UL LLC

- ALS Limited

Recent Developments

December 2025 - Solar manufacturer JA Solar and TÜV Rheinland have collaborated on Joint validation of next-generation multi-cut cell technology. Under this agreement, JA Solar will provide product data, cell and module structures, manufacturing process details, and test samples to support TÜV Rheinland’s work on developing testing standards, conducting verification tests, advancing certification procedures, and performing quality assessments related to multi-segmentation technology.

December 2025 - Bureau Veritas Marine & Offshore (BV) has classed its first methanol-fueled containership, CMA CGM ANTIGONE. The 15,000 TEU methanol dual-fuel vessel was built by CSSC Jiangnan Shipyard for the CMA CGM Group.

November 2025 - UL Solutions has launched its landmark AI safety certification services that is aimed at evaluating the safety, ethical considerations, robustness, and accountability of AI-powered products. This initiative includes assessments guided by a new framework (UL 3115) for AI-based product safety, addressing growing concerns around responsible AI adoption in technology sectors including IT and telecom.