U.S. HVAC Services Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Installation, Maintenance, Repair), by Implementation Type (New installation, Retrofit and replacement), by Pricing Tier (Economy, Mid-range, Premium), by End Use (Residential, Commercial, Industrial, Institutional, Hospitality)

| Status : Published | Published On : Jan, 2026 | Report Code : VRSME9177 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 135 |

U.S. HVAC Services Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Installation, Maintenance, Repair), by Implementation Type (New installation, Retrofit and replacement), by Pricing Tier (Economy, Mid-range, Premium), by End Use (Residential, Commercial, Industrial, Institutional, Hospitality)

U.S. HVAC Services Market Overview

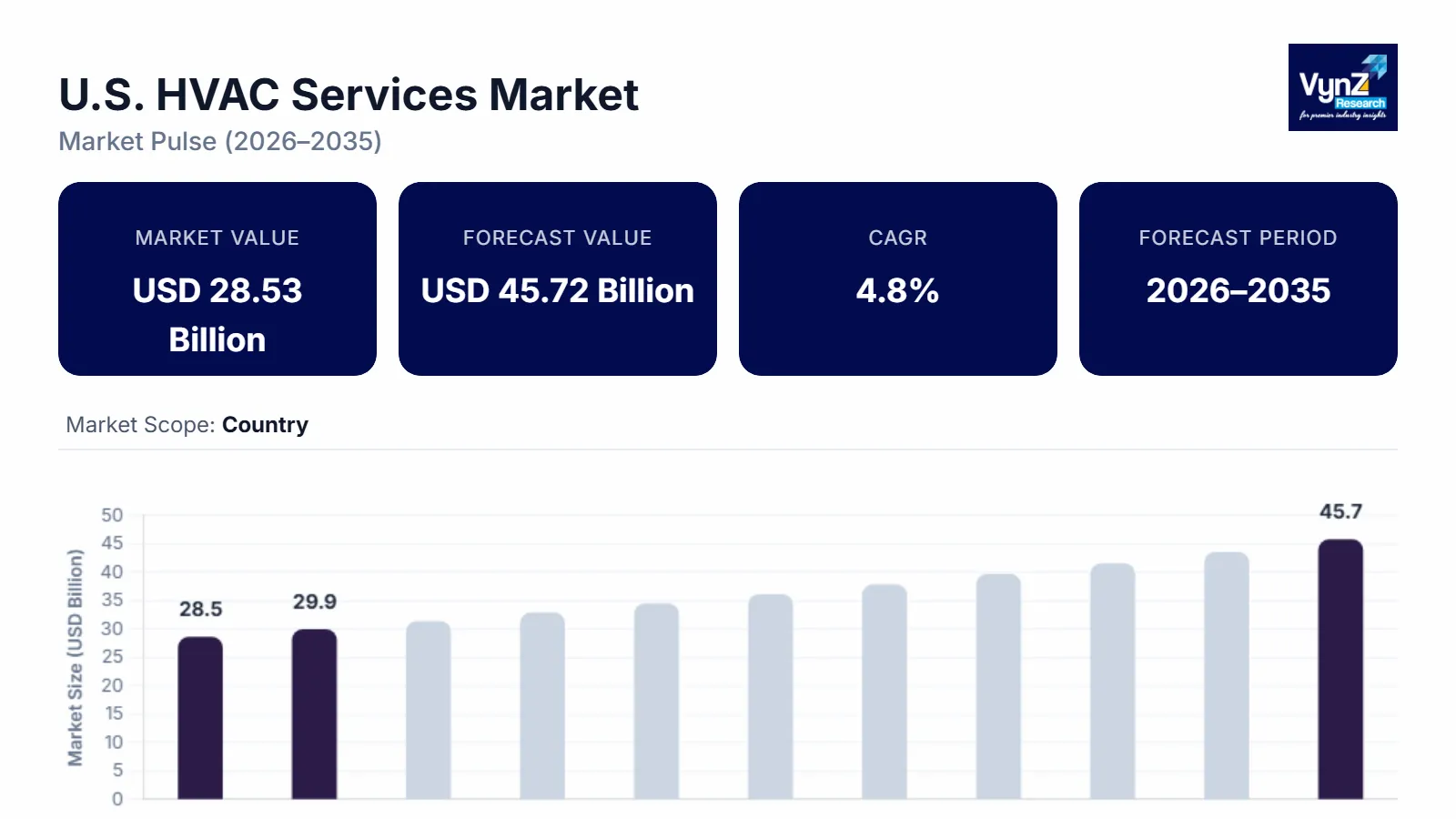

The U.S. HVAC services market which was valued at approximately USD 28.53 billion in 2025 and is estimated to rise further up to almost USD 29.91 billion by 2026 is projected to reach around USD 45.72 billion in 2035 expanding at a CAGR of about 4.8% during the forecast period from 2026 to 2035. The industry is supported by rising replacement demand for aging systems stricter energy efficiency standards and accelerated adoption of smart climate control solutions.

Market expansion is reinforced by federal efficiency programs led by the U.S. Department of Energy and regulatory guidance from the Environmental Protection Agency promoting reduced emissions and optimized building performance. Increasing service demand across commercial residential and institutional buildings in major urban centers such as New York, Los Angeles and Chicago continues to strengthen the national industry landscape.

U.S. HVAC Services Market Dynamics

Market Trends

The market is experiencing a structural shift toward energy efficient system optimization predictive maintenance and digitally enabled service delivery models aligned with federal energy conservation objectives. Increasing adoption of smart thermostats building automation systems and connected diagnostics reflects changing customer preferences toward efficiency compliance and lifecycle cost optimization. Guidance issued by the U.S. Department of Energy under its Building Energy Codes Program and energy efficiency standards administered by the Environmental Protection Agency are accelerating service demand related to system upgrades retrofits and performance audits. These regulatory frameworks are influencing service providers to expand offerings focused on commissioning optimization and long-term maintenance contracts across commercial and institutional buildings.

Another prominent trend shaping the industry is the growing emphasis on refrigerant transition services driven by federal climate and emissions policies. The American Innovation and Manufacturing Act implemented by the Environmental Protection Agency mandates phasedown of high global warming potential refrigerants and increased adoption of low impact alternatives. This transition is increasing demand for certified refrigerant management system conversion and compliance driven servicing. Contractors are responding by investing in workforce certification digital compliance tracking and integrated service solutions that support regulatory alignment while enhancing customer value propositions and competitive differentiation within the domestic service landscape.

Growth Drivers

Market expansion is strongly supported by rising replacement demand for aging HVAC infrastructure across residential commercial and public buildings in the United States. According to data published by the U.S. Energy Information Administration a significant share of installed heating and cooling systems exceeds recommended efficiency lifecycles driving sustained service requirements related to repair optimization and system replacement. Federal incentives under programs such as the Inflation Reduction Act and DOE administered energy efficiency rebate initiatives are further accelerating investment in HVAC upgrades creating recurring service demand across urban and suburban markets.

Additionally, increasing focus on indoor air quality and building health standards is reinforcing growth momentum. Guidance from the Centers for Disease Control and Prevention and the Environmental Protection Agency highlights the role of ventilation filtration and humidity control in occupant health particularly in school healthcare facilities and government buildings. This has led to higher service utilization for airflow balancing filtration upgrades and continuous monitoring. As building owners prioritize regulatory compliance and occupant wellbeing HVAC service providers benefit from consistent demand for specialized maintenance and performance enhancement services.

Market Restraints / Challenges

Despite favorable fundamentals the market faces constraints related to skilled labor availability and rising operating costs. Reports from the U.S. Bureau of Labor Statistics indicate persistent shortages of licensed HVAC technicians particularly for advanced systems requiring digital and refrigerant specific expertise. Labor scarcity contributes to elevated service costs longer response times and capacity limitations for small and mid-sized contractors affecting service scalability and profitability across price sensitive customer segments.

Regulatory complexity also presents operational challenges particularly related to refrigerant handling energy codes and safety compliance. Federal and state level requirements administered by agencies such as the Environmental Protection Agency and Department of Energy necessitate continuous training certification and documentation increasing overhead burdens for service providers. Compliance driven investments in tools training and reporting systems can constrain margins particularly during periods of economic uncertainty when discretionary maintenance spending may soften across residential and light commercial segments.

Market Opportunities

Significant opportunities are emerging in energy efficiency driven retrofit and performance-based service models supported by federal decarbonization and building modernization initiatives. Programs led by the U.S. Department of Energy promoting high efficiency heat pumps smart controls and building electrification are creating incremental service demand related to system conversion commissioning and long-term maintenance. Service providers offering integrated efficiency focused solutions are well positioned to capture demand from residential customers public institutions and small commercial facilities seeking to reduce operating costs and emissions.

Another key opportunity lies in digital service platforms and predictive maintenance enabled by connected HVAC systems. Increasing penetration of smart sensors and cloud-based monitoring allows service providers to deliver condition-based maintenance remote diagnostics and subscription driven service contracts. These capabilities enhance customer retention improve asset uptime and support margin expansion. As digital adoption increases across the U.S. building stock HVAC service companies leveraging data driven service models can strengthen long term client relationships and competitive positioning.

U.S. HVAC Services Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 28.53 Billion |

|

Revenue Forecast in 2035 |

USD 45.72 Billion |

|

Growth Rate |

4.8% |

|

Segments Covered in the Report |

Service Type, Implementation Type, Pricing Tier, End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Northeast United States, Southern United States, Midwestern United States, Western United States, Other Regions |

|

Key Companies |

Comfort Systems USA, Inc., Carrier Global Corporation, Daikin Industries Ltd., Danfoss A/S, Electrolux AB, Honeywell International Inc., Johnson Controls International PLC, LG Electronics Inc., Midea Group Co. Ltd., Mitsubishi Electric Corporation |

|

Customization |

Available upon request |

U.S. HVAC Services Market Segmentation

By Service Type

Maintenance services accounting for approximately 46% of total market revenue in 2025 making it the largest segment. This dominance is supported by high service frequency recurring contracts and the large installed base of aging residential and commercial HVAC systems across the country. Routine inspection preventive servicing and performance optimization remain essential for regulatory compliance and energy efficiency targets thereby sustaining stable demand. Maintenance services are estimated to expand at nearly 5.4% annually supported by federal energy efficiency programs and rising emphasis on lifecycle cost management.

Installation services represent around 32% of the market in 2025 driven by system replacement demand and energy efficient upgrades rather than new construction alone. Growth for this segment is estimated at about 6.2% supported by incentives under the inflation reduction act and department of energy backed rebate programs encouraging adoption of high efficiency heating and cooling systems.

Repair services contribute approximately 22% reflecting reactive demand cycles and are projected to grow at a moderate 4.6% due to gradual replacement of legacy equipment reducing emergency repair intensity over time.

By Implementation Type

Retrofit and replacement account for approximately 58% of total revenue in 2025 making it the dominant segment. This structure reflects the maturity of the U.S. building stock where HVAC spending is largely directed toward upgrading inefficient systems to comply with evolving energy codes. Retrofit services are estimated to grow at around 6.0% supported by federal decarbonization goals and utility backed efficiency incentive programs encouraging heat pump adoption and system electrification.

New installation activities represent close to 42% of the market primarily supported by commercial construction healthcare facilities and institutional infrastructure upgrades. Growth for this segment is estimated at approximately 5.1% reflecting steady but controlled expansion in nonresidential construction. Government funded public infrastructure investments and education facility modernization initiatives contribute to sustained demand while residential new builds play a comparatively smaller role due to slower housing starts relative to retrofit activity.

By Pricing Tier

Mid-range services accounting for approximately 49% of total demand in 2025 making it the largest segment. This dominance is supported by balanced pricing standardized service contracts and broad applicability across residential and light commercial customers seeking compliance and efficiency without advanced customization. The mid-range segment is projected to expand at nearly 5.6% supported by mass market adoption of efficiency driven maintenance and replacement programs.

Economy services contribute around 31% largely driven by price sensitive residential customers and small businesses prioritizing basic compliance and essential repairs. Growth in this segment is estimated at 4.3% due to limited margin flexibility and increasing regulatory complexity.

Premium services represent approximately 20% but are expected to register the fastest growth at about 6.8% driven by demand for smart diagnostics predictive maintenance and performance-based contracts among commercial healthcare and institutional clients.

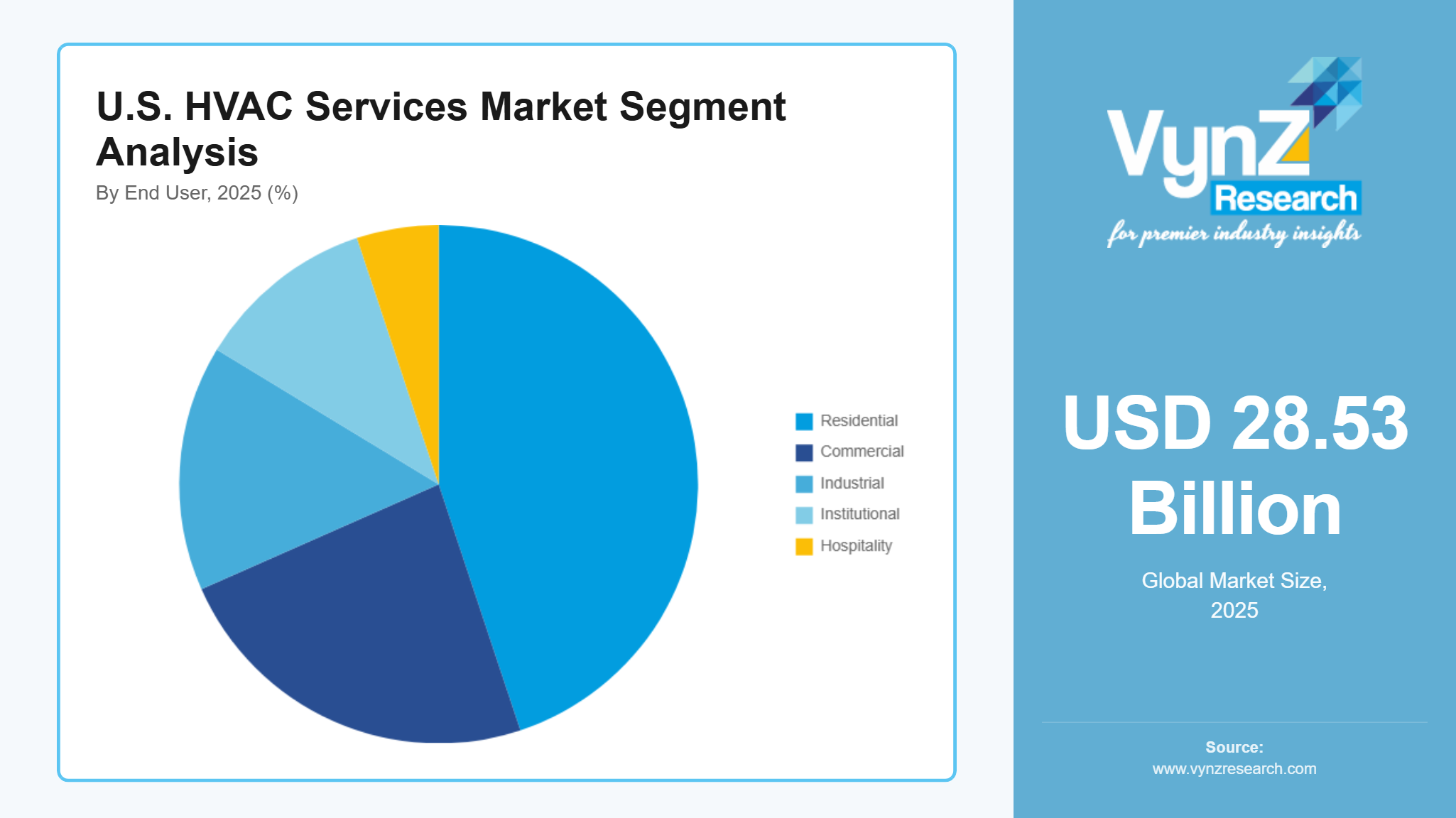

By End Use

The residential segment accounts for approximately 44% of total revenue in 2025 making it the largest contributor. High system penetration frequent servicing needs and widespread adoption of energy efficiency upgrades support this position. Residential services are projected to grow at around 5.7% supported by federal rebate programs and increased consumer focus on indoor air quality and operating cost reduction.

The commercial segment represents nearly 34% driven by offices retail healthcare and education facilities and is estimated to expand at about 6.1% supported by regulatory compliance and building performance mandates.

Industrial and institutional segments together account for approximately 17% while hospitality contributes close to 5% with the remaining share covered by other specialized facilities.

Regional Insights

Northeast United States

The northeast United States accounted for approximately 24% of the market in 2025 driven by dense urban infrastructure aging building stock and stringent energy efficiency regulations. Major metropolitan areas such as New York, Boston and Philadelphia continue to generate strong demand for system retrofits maintenance and compliance related services. Guidance from the U.S. department of energy under building energy codes and state level efficiency mandates administered through regional energy offices are accelerating replacement of inefficient systems. High penetration of commercial office healthcare and institutional buildings further sustains service intensity and long-term maintenance contracts across the region.

Southern United States

The southern United States represented an estimated 27% of the market in 2025 making it the largest regional contributor. High cooling demand driven by climatic conditions population growth and rapid residential development across states such as Texas, Florida and Georgia strongly supports HVAC service utilization. Data from the U.S. energy information administration highlights elevated electricity consumption for space cooling in this region reinforcing frequent servicing requirements. Government backed energy efficiency incentive programs and grid resilience initiatives also support system upgrades particularly in commercial and public buildings exposed to extreme weather conditions.

Midwestern United States

The midwestern region accounted for approximately 15% of the market in 2025 supported by balanced heating and cooling demand across residential industrial and institutional facilities. Cities such as Chicago, Detroit and Minneapolis contribute consistent service demand linked to seasonal system stress and aging infrastructure. Federal support through department of energy efficiency programs and state administered weatherization assistance initiatives encourages system optimization and replacement. The presence of manufacturing facilities healthcare networks and educational institutions further sustains stable service volumes and long-term maintenance engagements across the region.

Western United States

The western United States contributed nearly 12% of total market revenue in 2025 driven by energy efficiency focused policies and high adoption of advanced HVAC technologies. States such as California, Washington and Arizona emphasize low emission systems indoor air quality and smart building integration aligned with environmental protection agency guidelines and state energy commissions. Frequent retrofits performance audits and system optimization services support market growth particularly in commercial and institutional buildings.

Competitive Landscape / Company Insights

The market is moderately to highly competitive with national and regional service providers emphasizing operational scale service quality and digital capability development. Leading participants focus on workforce training energy efficiency compliance and smart diagnostics to strengthen customer retention. Market activity is supported by federal efficiency programs administered by the U.S. Department of Energy and refrigerant regulations enforced by the Environmental Protection Agency which encourage certified service delivery and system upgrades. These policy frameworks reinforce structured competition and support long term service contracts across residential commercial and institutional segments.

Mini Profiles

Carrier Global Corporation delivers residential and commercial HVAC services focused on installation maintenance and energy efficiency upgrades. Strong brand recognition and a wide dealer network support compliance driven retrofits and long-term service contracts aligned with federal efficiency standards.

Trane Technologies plc operates in mid-range and premium segments emphasizing system reliability sustainability and performance optimization. The company supports commercial and institutional clients through advanced controls diagnostics and structured maintenance programs.

Johnson Service Group plc provides integrated HVAC and building services with a focus on commercial and institutional facilities. Digital monitoring performance-based contracts and alignment with government efficiency initiatives strengthen its market position.

Lennox International focuses on residential and light commercial HVAC services supported by an extensive dealer network. Energy efficient upgrades indoor air quality services and standardized maintenance drive consistent demand.

Daikin Industries Ltd offers comprehensive HVAC services across residential and commercial segments. Local manufacturing technical training and efficiency focused service models support regulatory compliance and long-term performance.

Key Players

- Comfort Systems USA, Inc.

- Carrier Global Corporation

- Daikin Industries Ltd.

- Danfoss A/S

- Electrolux AB

- Honeywell International Inc.

- Johnson Controls International PLC

- LG Electronics Inc.

- Midea Group Co. Ltd.

- Mitsubishi Electric Corporation

- Recent Developments

Recent Developments

January 2026 - Trane Technologies announced a $150 million investment in January 2026 to build 12 regional centers, hire 500 skilled technicians, and enhance its US service infrastructure. This expansion aims to meet the increasing demand for innovative HVAC services in data center and healthcare corridors. The project is in line with the growing demands of the data center cooling sector.

November 2025 - Johnson Controls managed HVAC systems in 15 hyperscale data centers for ten years at a cost of USD 200 million, with stringent uptime guarantees. The need for specialized, sustainable, and energy-efficient cooling solutions in data centers to handle rising thermal loads is reflected in this contract. Johnson Controls has established itself as a leader in this field by providing technology that supports high-density, AI-driven workloads and lowers energy usage by 40%.

September 2025 - In order to improve equipment dependability and energy efficiency, Daikin and Pacific Gas and Electric (PG&E) collaborated to start a predictive-maintenance pilot program that subsidized IoT sensor installations at 500 commercial locations. This project demonstrates how AI and IoT are increasingly being used in the commercial HVAC industry for proactive, data-driven maintenance and remote monitoring.

February 2025 - In order to increase its market share in the European and American HVAC markets, Midea completed the acquisition of ARBONIA Climate. Midea is forming a new company named MBT Climate by merging ARBONIA Climate with its current business, Clivet. This new company will leverage Midea's strong R&D and ARBONIA Climate's knowledge of sustainable heating and cooling technology to provide a greater selection of regional U.S. HVAC solutions.

U.S. HVAC Services Market Coverage

Service Type Insight and Forecast 2026 - 2035

- Installation

- Maintenance

- Repair

Implementation Type Insight and Forecast 2026 - 2035

- New installation

- Retrofit and replacement

Pricing Tier Insight and Forecast 2026 - 2035

- Economy

- Mid-range

- Premium

End Use Insight and Forecast 2026 - 2035

- Residential

- Commercial

- Industrial

- Institutional

- Hospitality

U.S. HVAC Services Market by Region

- Northeast United States

- By Service Type

- By Implementation Type

- By Pricing Tier

- By End Use

- Southern United States

- By Service Type

- By Implementation Type

- By Pricing Tier

- By End Use

- Midwestern United States

- By Service Type

- By Implementation Type

- By Pricing Tier

- By End Use

- Western United States

- By Service Type

- By Implementation Type

- By Pricing Tier

- By End Use

- Other Regions

- By Service Type

- By Implementation Type

- By Pricing Tier

- By End Use

Table of Contents for U.S. HVAC Services Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Type

1.2.2. By

Implementation Type

1.2.3. By

Pricing Tier

1.2.4. By

End Use

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Type

5.1.1. Installation

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Maintenance

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Repair

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Implementation Type

5.2.1. New installation

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Retrofit and replacement

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Pricing Tier

5.3.1. Economy

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Mid-range

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Premium

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End Use

5.4.1. Residential

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Commercial

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Industrial

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Institutional

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Hospitality

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

6. Northeast United States Market Estimate and Forecast

6.1. By

Service Type

6.2. By

Implementation Type

6.3. By

Pricing Tier

6.4. By

End Use

7. Southern United States Market Estimate and Forecast

7.1. By

Service Type

7.2. By

Implementation Type

7.3. By

Pricing Tier

7.4. By

End Use

8. Midwestern United States Market Estimate and Forecast

8.1. By

Service Type

8.2. By

Implementation Type

8.3. By

Pricing Tier

8.4. By

End Use

9. Western United States Market Estimate and Forecast

9.1. By

Service Type

9.2. By

Implementation Type

9.3. By

Pricing Tier

9.4. By

End Use

10. Other Regions Market Estimate and Forecast

10.1. By

Service Type

10.2. By

Implementation Type

10.3. By

Pricing Tier

10.4. By

End Use

10. Company Profiles

10.1. Comfort Systems USA, Inc.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Carrier Global Corporation

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Daikin Industries Ltd.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Danfoss A/S

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Electrolux AB

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Honeywell International Inc.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Johnson Controls International PLC

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. LG Electronics Inc.

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Midea Group Co. Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Mitsubishi Electric Corporation

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

U.S. HVAC Services Market