India Solar Energy Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Technology (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), by Grid Type (On-Grid, Off-Grid), by Deployment Type (Utility-Scale, Rooftop Solar), by Installation Type (New Installations, Retrofit / Expansion Projects), by End User (Utilities, Commercial & Industrial, Residential)

| Status : Published | Published On : Feb, 2026 | Report Code : VREP3050 | Industry : Energy & Power | Available Format :

|

Page : 120 |

India Solar Energy Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Technology (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), by Grid Type (On-Grid, Off-Grid), by Deployment Type (Utility-Scale, Rooftop Solar), by Installation Type (New Installations, Retrofit / Expansion Projects), by End User (Utilities, Commercial & Industrial, Residential)

India Solar Energy Market Overview

The India solar energy market which was valued at approximately USD 12.55 billion in 2025 and is estimated to rise further up to almost USD 14.89 billion by 2026, is projected to reach around USD 69.68 billion in 2035, expanding at a CAGR of about 18.7% during the forecast period 2026 to 2035.

Market expansion is primarily supported by national renewable energy targets, accelerated utility scale solar deployment, and large-scale investments in domestic solar manufacturing supported by Production Linked Incentive programs.

Market growth is driven by rising electricity demand, aggressive decarbonization goals, and falling solar module costs, along with increasing adoption of rooftop solar, solar parks, and hybrid renewable systems. Rising demand for clean power from utilities, commercial facilities, and residential consumers and ongoing investments under the National Solar Mission, PM Surya Ghar Muft Bijli Yojana, and state level renewable procurement programs are further supporting market expansion across major regions including Rajasthan, Gujarat, and Maharashtra. Government of India policies led by the Ministry of New and Renewable Energy continue to accelerate grid connected solar capacity, domestic equipment production, and long-term energy security objectives across the country.

India Solar Energy Market Dynamics

Market Trends

The market is experiencing a structural transition driven by policy-backed decarbonization goals, grid-scale renewable integration, and rapid adoption of distributed solar systems. One of the most significant trends is the accelerated deployment of utility-scale and rooftop solar installations under government-led frameworks such as the National Solar Mission and the Ministry of New and Renewable Energy (MNRE) roadmap, which prioritize cost efficiency, scalability, and long-term energy security. Declining module prices, improved module efficiencies, and large-scale competitive bidding conducted by public agencies such as the Solar Energy Corporation of India (SECI) have reinforced the shift toward high-capacity solar parks and hybrid renewable projects.

Another key trend is the increasing alignment of solar deployment with grid modernization and energy storage integration. Central Electricity Authority (CEA) planning documents and National Electricity Plan projections emphasize the need for solar-plus-storage systems to manage intermittency and peak demand. This has encouraged adoption of advanced inverters, monitoring systems, and digital energy management solutions, while also supporting the growth of decentralized solar for commercial, industrial, and residential consumers under net metering and rooftop solar programs promoted by state electricity regulators.

Growth Drivers

The primary driver of growth in the market is sustained government support through policy incentives, capacity targets, and institutional procurement mechanisms. MNRE targets, reinforced by India’s commitment under its Nationally Determined Contributions and long-term energy transition strategy, continue to generate strong demand across utility-scale, commercial, and residential segments. Public-sector investments in transmission infrastructure, including green energy corridors supported by the Power Grid Corporation of India and guided by CEA planning, are further enabling large-scale solar integration.

In addition, rising electricity demand, increasing cost competitiveness of solar power, and the need to reduce dependence on imported fossil fuels are accelerating adoption. Government-backed competitive auctions and long-term power purchase agreements have ensured price visibility and risk mitigation for developers. Industrial and commercial consumers are also driving growth by prioritizing cost optimization and regulatory compliance through captive and open-access solar projects, supported by state-level renewable purchase obligations and policy guidelines issued by electricity regulatory commissions.

Market Restraints / Challenges

Despite strong growth fundamentals, the market faces structural challenges related to supply chain dependence and grid readiness. Dependence on imported photovoltaic modules and critical components has exposed developers to price volatility and procurement risks, as highlighted in MNRE and Department of Commerce assessments. While domestic manufacturing incentives such as production-linked incentive schemes are being implemented, near-term cost pressures and transitional inefficiencies continue to affect project economics, particularly for price-sensitive developers.

Grid integration and land acquisition constraints also pose challenges. CEA and state transmission utility reports indicate that variability in solar generation places operational stress on existing transmission and distribution networks, requiring continuous investment in grid balancing, forecasting, and storage infrastructure. Delays in land clearances, transmission connectivity, and state-level policy implementation can further impact project timelines and financial viability.

Market Opportunities

Significant opportunities exist in decentralized and rooftop solar deployment, driven by government-backed programs targeting residential, commercial, and public-sector installations. MNRE rooftop solar schemes and state subsidy programs are creating incremental demand among urban households, small businesses, and institutional consumers. Companies offering modular, high-efficiency, and digitally monitored solar solutions are well positioned to benefit from this expanding segment.

Another major opportunity lies in solar manufacturing, energy storage integration, and hybrid renewable projects. Government initiatives promoting domestic manufacturing, combined with public investment plans outlined by NITI Aayog and MNRE, are opening avenues for higher value-added participation across the solar value chain. Advancements in digital monitoring platforms, automation, and smart grid integration are expected to improve system performance, enhance investor confidence, and support long-term growth of the India solar energy market under a stable, government-backed policy environment.

India Solar Energy Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 12.55 Billion |

|

Revenue Forecast in 2035 |

USD 69.68 Billion |

|

Growth Rate |

18.7% |

|

Segments Covered in the Report |

By Technology, By Grid Type, By Deployment Type, By Installation Type, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Western India, Southern India, Northern India, Other Regions |

|

Key Companies |

Adani Green Energy Ltd., JSW Energy – Solar, Mahindra Susten Pvt. Ltd., NTPC Renewable Energy Ltd., ReNew Power Pvt. Ltd., SMA Solar Technology AG, Sterling & Wilson Renewable Energy Ltd., Tata Power Solar Systems Ltd., Trina Solar Co. Ltd., Vikram Solar Ltd., Azure Power Global Ltd., Waaree Energies Ltd |

|

Customization |

Available upon request |

India Solar Energy Market Segmentation

By Technology

Solar photovoltaic technology accounted for approximately 94% of total market revenue in 2025, making it the largest and most dominant segment. This dominance is supported by rapid declines in module prices, higher conversion efficiencies, modular scalability, and shorter project execution timelines. Large-scale government auctions and rooftop subsidy programs overwhelmingly favor photovoltaic installations due to their lower levelized cost of electricity and operational simplicity.

The concentrated solar power segment represents the remaining 6% of the market. While CSP offers the advantage of thermal energy storage and dispatchable generation, its adoption remains limited due to higher capital expenditure, longer development cycles, and greater land and water requirements. CSP growth remains moderate with deployment largely restricted to demonstration projects and selective hybrid renewable applications rather than mainstream capacity additions.

By Grid Type

On-grid solar accounted for approximately 86% of total market revenue in 2025, reflecting its position as the largest segment. This dominance is driven by extensive grid connectivity, strong policy support through net metering and power purchase agreements, and large-scale utility installations integrated into state and national transmission networks. On-grid systems benefit from higher capacity utilization and predictable revenue models, particularly for utility-scale and commercial installations.

Off-grid solar systems accounted for the remaining 14% of the market, primarily supported by rural electrification, agricultural pump solarization, and decentralized power generation in remote areas. This segment is expected to grow steadily at an estimated 12% CAGR, driven by declining battery costs and government-backed schemes promoting energy access and diesel substitution. Increasing deployment in telecom infrastructure, rural households, and isolated commercial facilities serve as key growth drivers.

By Deployment Type

Utility-scale solar projects accounted for approximately 71% of total market revenue in 2025, making this the largest deployment segment. Large solar parks, central and state government auctions, and long-term power purchase agreements continue to support capacity additions in this segment. Economies of scale and dedicated transmission infrastructure significantly improve project viability for large-scale installations.

Rooftop solar installations represented around 29% of the market and are the fastest-growing deployment segment, expanding at an estimated 15% CAGR. Growth is driven by rising electricity tariffs, corporate sustainability commitments, and favorable net metering regulations. Commercial and industrial rooftops dominate this segment, as consumers seek cost optimization, energy independence, and regulatory compliance through decentralized solar adoption.

By Installation Type

New installations accounted for approximately 83% of total market revenue in 2025, supported by India’s aggressive renewable capacity targets and continuous pipeline of greenfield solar projects. Centralized procurement, streamlined bidding mechanisms, and expanding transmission corridors continue to reinforce this segment’s dominance.

Retrofit and expansion projects contributed the remaining 17% of the market, driven by capacity augmentation, inverter replacement, and performance optimization of existing solar assets. This segment is gaining importance as early solar installations undergo efficiency upgrades to improve output and extend operational lifecycles. Growth in this segment is particularly visible in states with mature solar capacity bases, where incremental upgrades offer cost-effective performance improvements.

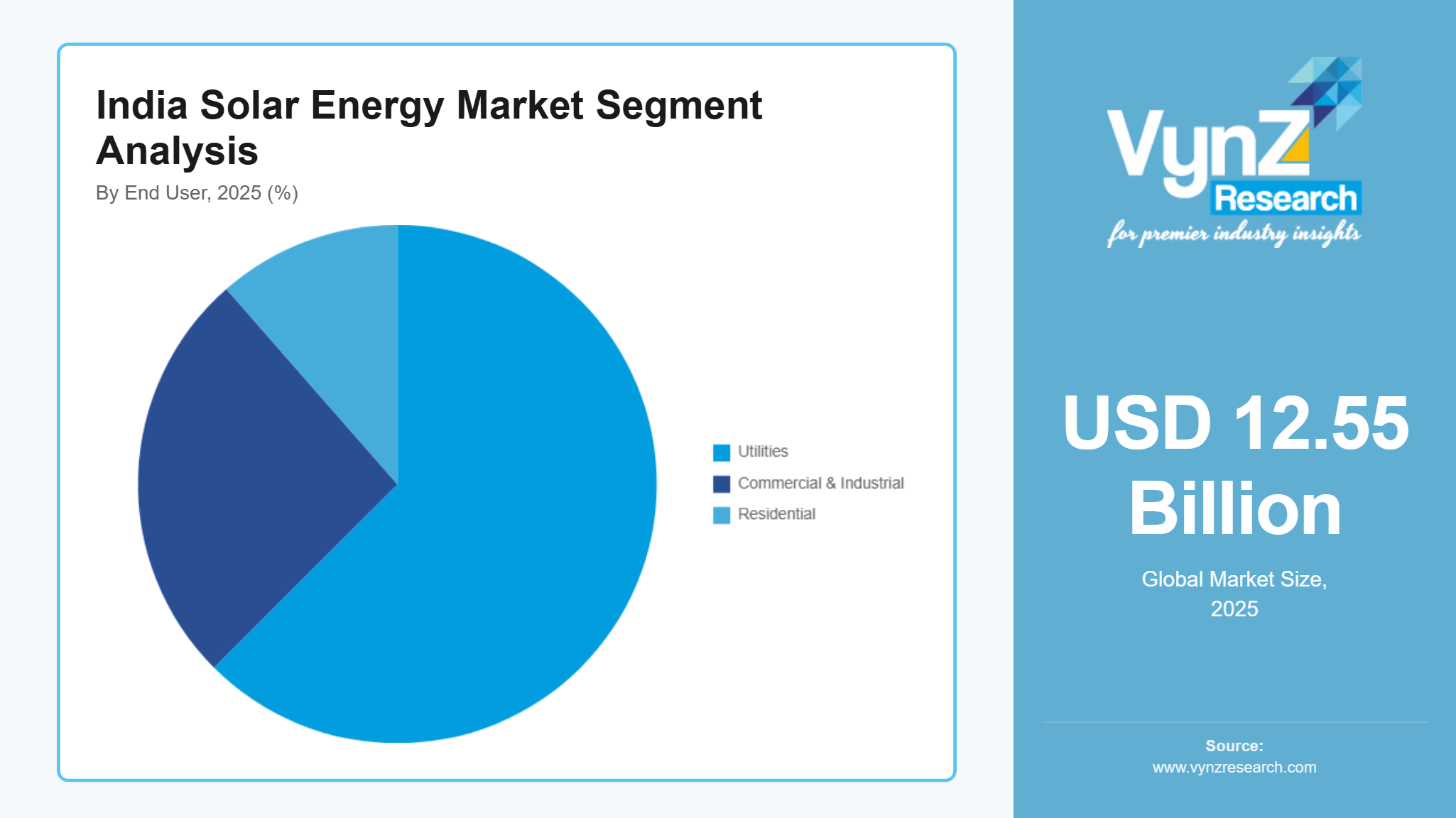

By End User

The utility segment accounted for approximately 64% of total market revenue in 2025, making it the largest end-user category. This dominance is supported by grid-connected solar parks supplying electricity to state distribution companies under long-term contracts, ensuring revenue stability and large-scale capacity deployment.

Commercial and industrial users represented around 25% of the market, driven by captive and open-access solar adoption to reduce power costs and meet sustainability targets. This segment is witnessing strong growth, supported by favorable state policies and financing models.

Residential users accounted for the remaining 11%, supported by rooftop subsidy schemes and rising consumer awareness, with steady growth expected as policy execution and financing access improve.

Regional Insights

Western India

Western India is estimated to account for approximately 32% of the market in 2025, making it the largest regional contributor. This dominance is driven by high solar irradiation levels, availability of large contiguous land parcels, and early adoption of utility-scale solar projects. States such as Rajasthan and Gujarat continue to attract large-capacity installations supported by central and state government solar park development programs and public-sector transmission investments. Strong grid connectivity and established evacuation infrastructure further support high-capacity utilization.

In addition, industrial clusters, refineries, ports, and manufacturing hubs across Western India are increasingly adopting captive and open-access solar systems to manage power costs and meet renewable compliance obligations. Government-backed competitive bidding and long-term power procurement mechanisms continue to reinforce investor confidence, sustaining regional leadership.

Southern India

Southern India is projected to hold approximately 24% of the market in 2025, supported by strong commercial and industrial demand and relatively high rooftop solar penetration. States including Tamil Nadu, Karnataka, Telangana, and Andhra Pradesh exhibit consistent solar adoption due to proactive renewable energy policies, favorable grid integration frameworks, and high electricity consumption from industrial corridors and IT hubs.

Government-supported rooftop solar programs, net metering mechanisms, and distributed generation initiatives are accelerating decentralized installations across urban and semi-urban areas. The region’s comparatively mature transmission and distribution infrastructure enables higher renewable absorption, supporting steady growth across both utility-scale and distributed solar segments.

Northern India

Northern India is estimated to account for approximately 14% of the market in 2025. Growth is driven by rising electricity demand from densely populated urban centers and increasing adoption of rooftop and ground-mounted solar systems across states such as Uttar Pradesh, Haryana, Punjab, and Delhi. Public-sector solar procurement programs and distributed solar initiatives are expanding capacity to support agricultural, residential, and municipal power requirements.

Government-backed schemes promoting solar-powered irrigation, decentralized energy generation, and grid-connected rooftop systems are strengthening adoption in both urban and rural areas. Continued investment in transmission expansion and inter-state connectivity is improving regional solar integration.

Other Regions

Eastern, Central, and North-Eastern India collectively represent approximately 8% of the market in 2025, bringing the total regional coverage to around 78%, with the remaining share attributed to smaller and emerging pockets across the country. Solar adoption in this region is supported by increasing government focus on renewable capacity addition, rural electrification, and decentralized power systems.

Growth is primarily driven by public-sector initiatives targeting off-grid and small-scale grid-connected solar installations to improve energy access and reduce dependence on conventional power sources. While current capacity remains comparatively lower, improving infrastructure, rising demand, and continued government support position these regions as long-term growth opportunities.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with the presence of large domestic developers, public-sector enterprises, and integrated power companies focusing on cost efficiency, scale expansion, and execution capability. Market participants are investing in project development expertise, supply chain optimization, and operational efficiency to strengthen positioning. Adoption is supported by government-led renewable energy targets, competitive bidding mechanisms, and grid expansion programs administered by national energy authorities and public power institutions, which continue to drive large-scale deployment and long-term power procurement across utility and commercial segments.

Mini Profiles

Adani Green Energy Ltd. focuses on large-scale utility solar development and power generation, supported by strong execution capabilities, integrated infrastructure, and long-term power procurement frameworks across multiple high-capacity projects in India.

Canadian Solar Inc. operates across mass and utility-scale segments, emphasizing high-efficiency modules, bankable project development expertise, and cost-competitive solutions supporting grid-connected and distributed solar deployments.

JA Solar Technology Co. Ltd. leverages advanced cell and module manufacturing, global distribution reach, and continuous efficiency improvements to expand market presence across utility-scale and commercial solar projects.

LONGi Green Energy Technology Co. Ltd. specializes in monocrystalline solar technologies, focusing on performance optimization, large-scale manufacturing efficiency, and technology-led cost reduction to support high-capacity solar installations.

Sterling & Wilson Renewable Energy Ltd. provides turnkey solar EPC services, supported by project execution expertise, integrated engineering capabilities, and a strong track record in utility-scale and rooftop solar projects.

Key Players

- Adani Green Energy Ltd.

- JSW Energy – Solar

- Mahindra Susten Pvt. Ltd.

- NTPC Renewable Energy Ltd.

- ReNew Power Pvt. Ltd.

- SMA Solar Technology AG

- Sterling & Wilson Renewable Energy Ltd.

- Tata Power Solar Systems Ltd.

- Trina Solar Co. Ltd.

- Vikram Solar Ltd.

- Azure Power Global Ltd.

- Waaree Energies Ltd.

Recent Developments

In May 2025 - Bharat Heavy Electricals Limited (BHEL) is actively collaborating with key partners to localize the manufacturing of power equipment essential for renewable energy integration in India. As part of this strategy, BHEL and REC Power Development and Consultancy Limited (RECPDCL) have formed a 50:50 joint venture aimed at developing utility‑scale renewable energy and infrastructure projects, combining REC’s project development expertise with BHEL’s engineering and manufacturing capabilities to advance India’s clean energy transition.

In April 2025, Larsen & Toubro (L&T) introduced a suite of advanced power transmission and automation solutions designed to support high-capacity substations and infrastructure expansion across India. This initiative aligns with the country’s broader power sector development plans, which focus on strengthening the electricity transmission network, integrating large-scale renewable energy, and improving grid reliability.

In March 2025, Power Grid Corporation of India Limited (POWERGRID) announced a comprehensive technology upgrade program aimed at enhancing the digital monitoring, substation automation, and real‑time grid management capabilities of India’s interstate transmission network. This initiative is part of POWERGRID’s broader mission to modernize its transmission infrastructure to support the rapid integration of large‑scale renewable energy, improve operational efficiency, and ensure grid stability.

In February 2025, NTPC Limited launched a new renewable‑linked grid modernization initiative designed to strengthen India’s electricity transmission infrastructure in support of rapidly growing solar and wind power capacity. This initiative focuses on enhancing transmission readiness and evacuation frameworks that can reliably carry large volumes of renewable energy from generation sites especially utility‑scale solar parks to demand centers across the country.

India Solar Energy Market Coverage

Technology Insight and Forecast 2026 - 2035

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

Grid Type Insight and Forecast 2026 - 2035

- On-Grid

- Off-Grid

Deployment Type Insight and Forecast 2026 - 2035

- Utility-Scale

- Rooftop Solar

Installation Type Insight and Forecast 2026 - 2035

- New Installations

- Retrofit / Expansion Projects

End User Insight and Forecast 2026 - 2035

- Utilities

- Commercial & Industrial

- Residential

India Solar Energy Market by Region

- Western India

- By Technology

- By Grid Type

- By Deployment Type

- By Installation Type

- By End User

- Southern India

- By Technology

- By Grid Type

- By Deployment Type

- By Installation Type

- By End User

- Northern India

- By Technology

- By Grid Type

- By Deployment Type

- By Installation Type

- By End User

- Other Regions

- By Technology

- By Grid Type

- By Deployment Type

- By Installation Type

- By End User

Table of Contents for India Solar Energy Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Technology

1.2.2. By

Grid Type

1.2.3. By

Deployment Type

1.2.4. By

Installation Type

1.2.5. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. India Market Estimate and Forecast

4.1. India Market Overview

4.2. India Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Technology

5.1.1. Solar Photovoltaic (PV)

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Concentrated Solar Power (CSP)

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Grid Type

5.2.1. On-Grid

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Off-Grid

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Deployment Type

5.3.1. Utility-Scale

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Rooftop Solar

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By Installation Type

5.4.1. New Installations

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Retrofit / Expansion Projects

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.5. By End User

5.5.1. Utilities

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Commercial & Industrial

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Residential

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

6. Western India Market Estimate and Forecast

6.1. By

Technology

6.2. By

Grid Type

6.3. By

Deployment Type

6.4. By

Installation Type

6.5. By

End User

6.5.1.

Western India Market Estimate and Forecast

6.5.2.

Southern India Market Estimate and Forecast

6.5.3.

Northern India Market Estimate and Forecast

6.5.4.

Other Regions Market Estimate and Forecast

7. Southern India Market Estimate and Forecast

7.1. By

Technology

7.2. By

Grid Type

7.3. By

Deployment Type

7.4. By

Installation Type

7.5. By

End User

7.5.1.

Western India Market Estimate and Forecast

7.5.2.

Southern India Market Estimate and Forecast

7.5.3.

Northern India Market Estimate and Forecast

7.5.4.

Other Regions Market Estimate and Forecast

8. Northern India Market Estimate and Forecast

8.1. By

Technology

8.2. By

Grid Type

8.3. By

Deployment Type

8.4. By

Installation Type

8.5. By

End User

8.5.1.

Western India Market Estimate and Forecast

8.5.2.

Southern India Market Estimate and Forecast

8.5.3.

Northern India Market Estimate and Forecast

8.5.4.

Other Regions Market Estimate and Forecast

9. Other Regions Market Estimate and Forecast

9.1. By

Technology

9.2. By

Grid Type

9.3. By

Deployment Type

9.4. By

Installation Type

9.5. By

End User

9.5.1.

Western India Market Estimate and Forecast

9.5.2.

Southern India Market Estimate and Forecast

9.5.3.

Northern India Market Estimate and Forecast

9.5.4.

Other Regions Market Estimate and Forecast

10. Company Profiles

10.1. Adani Green Energy Ltd.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. JSW Energy – Solar

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Mahindra Susten Pvt. Ltd.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. NTPC Renewable Energy Ltd.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. ReNew Power Pvt. Ltd.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. SMA Solar Technology AG

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Sterling & Wilson Renewable Energy Ltd.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Tata Power Solar Systems Ltd.

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Trina Solar Co. Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Vikram Solar Ltd.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Azure Power Global Ltd.

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Waaree Energies Ltd.

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India Solar Energy Market