UAE Energy Management Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Solution (Services, Software, Hardware), by Management System / Framework (Industrial Energy Management Systems (IEMS), Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS)), by End User (Commercial / Industrial, Residential, Government / Public Sector)

| Status : Published | Published On : Jan, 2026 | Report Code : VREP3047 | Industry : Energy & Power | Available Format :

|

Page : 125 |

UAE Energy Management Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Solution (Services, Software, Hardware), by Management System / Framework (Industrial Energy Management Systems (IEMS), Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS)), by End User (Commercial / Industrial, Residential, Government / Public Sector)

UAE Energy Management Market Overview

The UAE energy management market which was valued at approximately USD 251.21 million in 2025 and is estimated to rise further up to almost USD 272.06 million by 2026, is projected to reach around USD 557.59 million by 2035, expanding at a CAGR of about 8.3% during the forecast period from 2026 to 2035.

Market expansion is primarily supported by government policies under the UAE Energy Strategy 2050, rising adoption of renewable integration, and initiatives to enhance energy efficiency in industrial, commercial, and residential sectors. Increasing deployment of digital energy management systems, smart grids, and real-time monitoring solutions is driving operational efficiency and cost optimization. Strong demand from Abu Dhabi, Dubai, and Sharjah, alongside public-private partnerships in energy infrastructure, is further supporting market growth.

Adoption is reinforced by regulatory frameworks promoting energy efficiency labeling, mandatory energy audits, and national sustainability targets, aligned with formal government programs such as the Net Zero by 2050 initiative. These programs encourage real-time energy monitoring, peak load management, and optimized resource utilization across all major sectors. Investment in industrial energy optimization, smart buildings, and energy services companies (ESCOs) continues to sustain demand growth, while ongoing initiatives to reduce carbon emissions and improve energy reliability strengthen the long-term prospects for the UAE energy management landscape.

UAE Energy Management Market Dynamics

Market Trends

The market is undergoing a structural shift toward integrated digital solutions and real-time monitoring frameworks, aligned with national energy efficiency and sustainability initiatives. Programs under the UAE Energy Strategy 2050 and the Net Zero by 2050 initiative emphasize energy optimization, renewable integration, and operational efficiency across industrial, commercial, and residential sectors. The market is increasingly adopting smart meters, automated control systems, and building energy management platforms, supporting cost optimization, reduced emissions, and enhanced resource utilization. Government-backed pilot projects and industrial energy audits reinforce adoption of advanced energy management practices.

Increasing digital penetration and cloud-based energy analytics are reshaping product offerings and encouraging solution providers to focus on predictive maintenance, automated demand response, and integrated energy services. Deployment of IoT-enabled sensors, advanced metering infrastructure, and real-time dashboards is enabling enterprises to track consumption patterns, benchmark energy performance, and reduce operational costs. Public-private partnerships and incentives for smart building certification are further enhancing competitive dynamics while promoting standardized energy management protocols across key emirates including Abu Dhabi, Dubai, and Sharjah.

Growth Drivers

The growth of the market is primarily supported by government policies promoting industrial and commercial energy efficiency, which continues to generate consistent demand across factories, commercial buildings, and smart city projects. Investment in energy-efficient lighting, HVAC upgrades, and centralized monitoring systems is accelerating market expansion. Reports from the UAE Ministry of Energy and Infrastructure indicate increasing mandates for energy audits and performance benchmarking, further reinforcing growth.

Rising electricity consumption across industrial and commercial sectors is another key driver. As enterprises and facility managers prioritize cost reduction, regulatory compliance, and operational efficiency, demand for energy management solutions including building energy management systems (BEMS) and industrial energy monitoring platforms remains strong throughout the forecast period. Government incentives, grants, and low-interest financing for energy efficiency projects are supporting adoption at scale.

Market Restraints / Challenges

Despite favorable growth prospects, the market landscape faces challenges related to high initial investment costs for digital energy management infrastructure. Procurement of smart meters, automation systems, and analytics platforms requires substantial capital, which can limit penetration among small and medium enterprises. Reports from the UAE Federal Competitiveness and Statistics Authority highlight budget constraints in certain commercial segments as a key limitation.

Additionally, dependence on specialized technical expertise and certified service providers poses operational challenges. Lack of skilled personnel for system integration, commissioning, and ongoing maintenance can lead to delayed deployment and reduced scalability. These factors, combined with regulatory compliance requirements and technology interoperability concerns, impact market performance, particularly in emerging industrial zones and newly developed urban areas.

Market Opportunities

The industry presents significant opportunities in smart building integration and industrial energy optimization, driven by urbanization, sustainability mandates, and rising electricity costs. Companies offering modular, scalable, and IoT-enabled energy management solutions are well-positioned to capture incremental demand from commercial real estate developers, industrial facility operators, and government infrastructure projects.

Another key opportunity lies in digital energy analytics and renewable energy management, where growing investments in solar integration, energy storage, and predictive load management are creating avenues for higher margins and long-term client relationships. Adoption of advanced software platforms, cloud-based monitoring, and AI-driven efficiency tools is expected to enhance decision-making, improve energy utilization, and strengthen engagement with enterprise customers. Government programs such as Dubai Integrated Energy Strategy 2030 and Abu Dhabi’s Esti Dama sustainability initiatives further reinforce growth potential.

UAE Energy Management Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 251.21 Million |

|

Revenue Forecast in 2035 |

USD 557.59 Million |

|

Growth Rate |

8.3% |

|

Segments Covered in the Report |

By Solution, By Management System / Framework, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Abu Dhabi, Dubai, Sharjah, Other Emirates |

|

Key Companies |

Abdul Latif Jameel, Alfanar Group, ABB Ltd., GE, Hanwha Corporation, Honeywell International Inc., International Business Machines Corporation, Saudi Electricity Company, Schneider Electric, Masdar (Abu Dhabi Future Energy Company), Saudi Aramco Power Company (SAPCO) |

|

Customization |

Available upon request |

UAE Energy Management Market Segmentation

By Solution

Services accounted for the largest share in 2025, accounting for approximately 48% of the market. This reflects the ongoing need for professional implementation, monitoring, and optimization services that are critical for meeting national energy efficiency targets and sustainability goals. Service providers support energy audits, benchmarking, and alignment with standards such as ISO 50001, which remains a priority under national strategies, driving demand for expert-led deployment and continuous performance enhancement across commercial and industrial applications.

Software solutions are estimated to grow at an estimated CAGR of about 9.5% during the forecast period, driven by the rising adoption of analytics platforms, real-time monitoring interfaces, and predictive energy optimization tools that support digital transformation roadmaps of large enterprises. Digital platforms enable deeper insights into consumption trends and empower facility managers to achieve energy cost reductions and compliance with regulatory frameworks while enhancing system interoperability and scalability.

Hardware solutions are expected to expand at an estimated CAGR of approximately 7.8%, driven by increasing investments in sensors, smart meters, automation controllers, and communication modules, which support comprehensive energy management infrastructures across building portfolios and industrial campuses.

By Management System / Framework

Industrial energy management systems holding the largest share of about 46% in 2025. This is supported by strong sustainability mandates, adoption of ISO 50001 energy standards, and requirements for large facility energy optimization across manufacturers and utilities. Demand for IEMS is further stimulated by government-backed programs incentivizing efficiency improvements and real-time consumption tracking, aligned with broader national decarbonization objectives.

Building energy management systems are expected to register the fastest growth at an estimated CAGR of about 10.3% over the forecast period, driven by the proliferation of smart buildings and integrated urban infrastructure projects in key emirates including Abu Dhabi and Dubai, where digitalization of building operations is a strategic priority.

Home energy management systems are forecast to grow at an estimated CAGR of approximately 11.0%, reflecting rising consumer awareness of energy cost savings and sustainability, as well as incentive programs promoting residential energy efficiency measures.

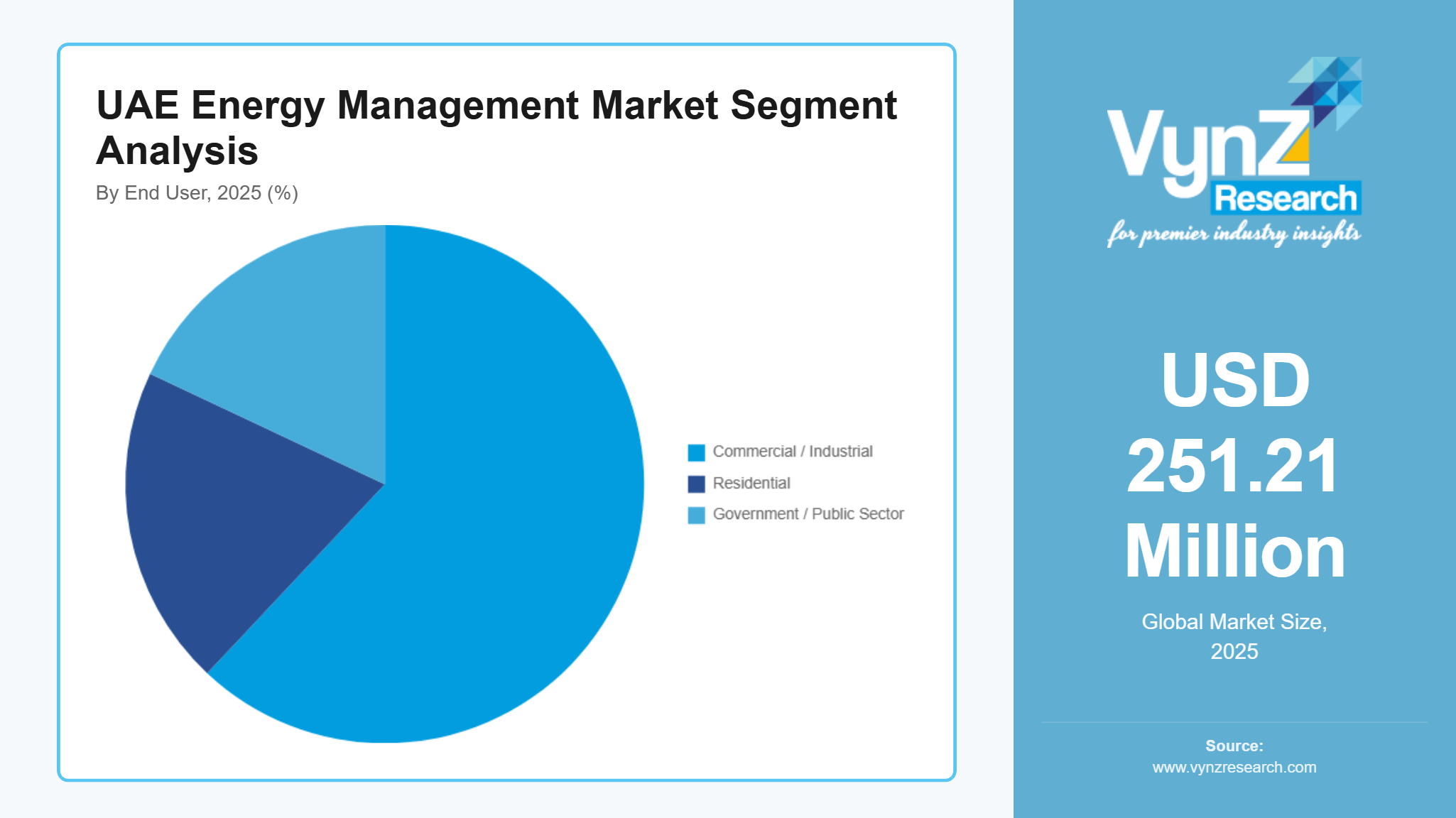

By End User

Commercial and industrial collectively accounting for approximately 62% market share in 2025. This is supported by extensive commercial construction activity, industrial expansion, and mandatory energy efficiency compliance in corporate facilities. Widespread adoption of energy management practices in malls, offices, factories, and logistic hubs contributes significantly to market revenue, while investments in ESCO models and performance-based contracts further reinforce demand.

Residential adoption is expected to grow at an estimated CAGR of about 12.2% during the forecast period, as smart home technologies and cost containment measures gain traction among homeowners seeking to reduce utility costs and environmental impact. Government and public sector segments are also projected to expand steadily, supported by national mandates for energy efficiency in public buildings, educational institutions, and healthcare facilities, aligned with UAE sustainability visions and policy frameworks promoting energy conservation practices.

Regional Insights

Abu Dhabi

Abu Dhabi accounted for approximately 34% of the UAE energy management market in 2025, driven by government-led energy efficiency initiatives and large-scale industrial and commercial projects. Strong demand from major industrial hubs, smart city developments, and government buildings continues to support market growth. Federal programs promoting renewable integration, sustainable building codes, and digital energy monitoring systems, combined with increasing adoption of energy management solutions across industrial, commercial, and residential sectors, are further strengthening regional market performance.

Dubai

Dubai is estimated to represent roughly 28% of the market in 2025. Rapid urbanization, high-rise commercial infrastructure, and extensive smart city initiatives are driving adoption of energy management systems. Key drivers include government sustainability targets, incentives for green building certifications, and large-scale hospitality and commercial projects. Investments in digital energy monitoring platforms and integrated energy management solutions are expanding customer engagement and operational efficiency, reinforcing Dubai’s position as a leading regional market.

Sharjah

Sharjah accounted for approximately 14% of the UAE energy management market in 2025. Growth is supported by the presence of industrial zones, mid-sized commercial developments, and rising awareness of energy cost optimization. Government-backed programs promoting industrial energy efficiency, infrastructure upgrades, and adoption of smart metering technologies continue to boost market demand. Strategic investments by private enterprises in sustainable energy solutions are also contributing to long-term market expansion.

Other Emirates

The remaining northern emirates, including Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain, collectively contributed around 24% of the market in 2025. Expansion is driven by industrial development, residential energy efficiency initiatives, and localized government programs promoting smart energy adoption. Although adoption is slower compared with Abu Dhabi, Dubai, and Sharjah, these regions represent strategic growth opportunities for vendors targeting industrial and small-to-medium commercial projects across the UAE.

Competitive Landscape / Company Insights

The UAE energy management market is moderately to highly competitive, with global and regional players focusing on technology innovation, cost optimization, and geographic expansion. Key vendors including Schneider Electric, Siemens, ABB, Honeywell, and Emerson provide integrated energy management solutions, software platforms, and consultancy services. Market adoption is reinforced by UAE government initiatives such as the Dubai Demand Side Management Strategy and Abu Dhabi Energy Efficiency Program, which encourage digital energy solutions, regulatory compliance, and sustainable practices, prompting companies to invest in R&D, smart infrastructure, and long-term client engagement.

Mini Profiles

Schneider Electric focuses on energy management and automation solutions, supported by strong global presence, advanced technology platforms, and extensive UAE distribution networks, enabling efficient and sustainable energy optimization.

Siemens operates in premium and industrial segments, emphasizing innovative automation, smart grid integration, and high-performance energy solutions, leveraging strong brand recognition and established engineering expertise across commercial and industrial projects in the UAE.

ABB specializes in electrification, automation, and digital energy solutions, supported by extensive regional projects, local offices, and strategic partnerships, enabling scalable deployment of energy-efficient infrastructure across utilities and industrial facilities.

Honeywell offers building management, industrial control, and energy optimization systems, backed by global R&D, strong regional service networks, and integration capabilities, supporting efficiency and sustainability objectives across commercial and industrial applications.

GE focuses on energy and automation technologies, leveraging strong local operations, strategic client partnerships, and advanced digital solutions to deliver reliable, optimized, and scalable energy management systems in the UAE market.

Key Players

- Abdul Latif Jameel

- Alfanar Group

- ABB Ltd.

- ABB Ltd.

- GE

- Hanwha Corporation

- Honeywell International Inc.

- International Business Machines Corporation

- Saudi Electricity Company

- Schneider Electric

- Masdar (Abu Dhabi Future Energy Company)

- Saudi Aramco Power Company (SAPCO)

Recent Developments

January 2026 - Resource Advisor+, a new AI-powered energy and sustainability intelligence platform designed to integrate supply chain sustainability, climate risk, emissions and energy management, and sustainability reporting solutions into a single ecosystem, was introduced by Schneider Electric's SE Advisory Services consulting practice. In order to help businesses manage Scope 1, 2, and 3 emissions and involve suppliers in decarbonization, the new platform is being introduced with two initial core products.

January 2026 - Following fifteen months of co-design with partners, Cisco has introduced the Cisco 360 Partner Program. Cisco's success is based on working closely with its partners to satisfy client demands in the rapidly evolving field of artificial intelligence. Cisco is now improving its assistance for partners while facilitating their customer service. The new program better prepares Cisco partners to deliver client outcomes in the areas of AI-ready data centers, future-proofed workspaces, and digital resilience. It is designed for developers, consultants, managed services providers, resellers, and other partner business models.

January 2026 - In order to support operations at the automaker's Saudi Arabian manufacturing facility, Rockwell Automation, Inc. has extended its partnership with Lucid. In order to manage and coordinate production processes, Lucid will implement Rockwell Automation's enterprise manufacturing software throughout the plant as part of the engagement. All of the factory's primary operations will be covered by the implementation. As Lucid gets ready for future automotive projects, the software platform will offer real-time operational visibility, production traceability, and system-level management to guarantee consistent quality and scalable output.

UAE Energy Management Market Coverage

Solution Insight and Forecast 2026 - 2035

- Services

- Software

- Hardware

Management System / Framework Insight and Forecast 2026 - 2035

- Industrial Energy Management Systems (IEMS)

- Building Energy Management Systems (BEMS)

- Home Energy Management Systems (HEMS)

End User Insight and Forecast 2026 - 2035

- Commercial / Industrial

- Residential

- Government / Public Sector

UAE Energy Management Market by Region

- Abu Dhabi

- By Solution

- By Management System / Framework

- By End User

- Dubai

- By Solution

- By Management System / Framework

- By End User

- Sharjah

- By Solution

- By Management System / Framework

- By End User

- Other Emirates

- By Solution

- By Management System / Framework

- By End User

Table of Contents for UAE Energy Management Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Solution

1.2.2. By

Management System / Framework

1.2.3. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Solution

5.1.1. Services

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Software

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Hardware

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Management System / Framework

5.2.1. Industrial Energy Management Systems (IEMS)

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Building Energy Management Systems (BEMS)

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Home Energy Management Systems (HEMS)

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By End User

5.3.1. Commercial / Industrial

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Residential

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Government / Public Sector

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

6. Abu Dhabi Market Estimate and Forecast

6.1. By

Solution

6.2. By

Management System / Framework

6.3. By

End User

7. Dubai Market Estimate and Forecast

7.1. By

Solution

7.2. By

Management System / Framework

7.3. By

End User

8. Sharjah Market Estimate and Forecast

8.1. By

Solution

8.2. By

Management System / Framework

8.3. By

End User

9. Other Emirates Market Estimate and Forecast

9.1. By

Solution

9.2. By

Management System / Framework

9.3. By

End User

10. Company Profiles

10.1. Abdul Latif Jameel

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Alfanar Group, ABB Ltd.

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. GE

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Hanwha Corporation

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Honeywell International Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. International Business Machines Corporation

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Saudi Electricity Company

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Schneider Electric

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Masdar (Abu Dhabi Future Energy Company)

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Saudi Aramco Power Company (SAPCO)

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

UAE Energy Management Market