India Green Hydrogen Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Technology (Alkaline Electrolysis, Proton Exchange Membrane Electrolysis, Solid Oxide Electrolysis), by Energy Source (Solar, Wind, Hybrid Renewable Systems), by Distribution Channel (Captive Consumption, Merchant Distribution), by End User (Refining, Fertilisers, Chemicals, Steel, Mobility, Power Generation)

| Status : Published | Published On : Jan, 2026 | Report Code : VREP3048 | Industry : Energy & Power | Available Format :

|

Page : 120 |

India Green Hydrogen Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Technology (Alkaline Electrolysis, Proton Exchange Membrane Electrolysis, Solid Oxide Electrolysis), by Energy Source (Solar, Wind, Hybrid Renewable Systems), by Distribution Channel (Captive Consumption, Merchant Distribution), by End User (Refining, Fertilisers, Chemicals, Steel, Mobility, Power Generation)

India Green Hydrogen Market Overview

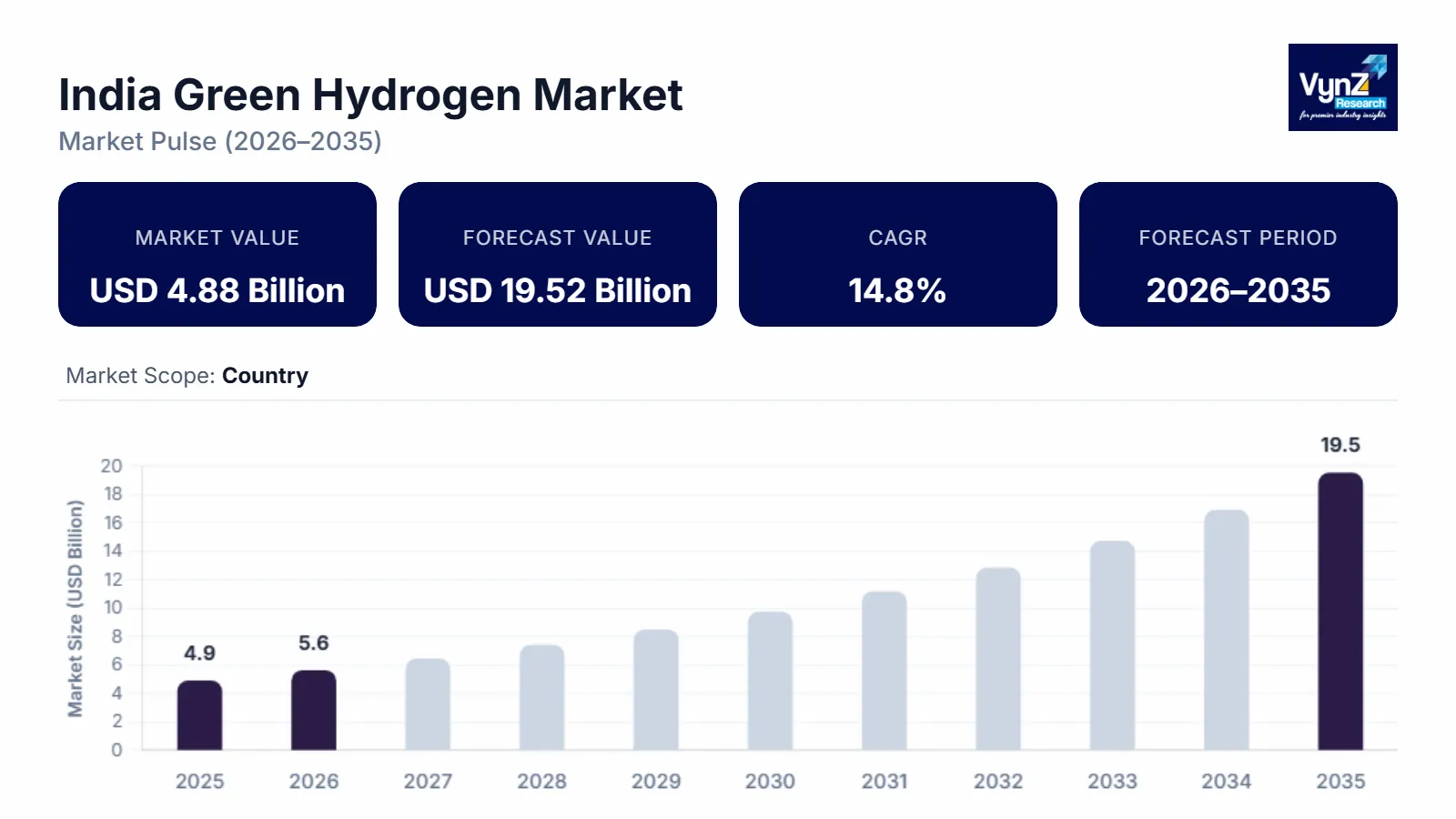

The India green hydrogen market which was valued at approximately USD 4.88 billion in 2025 and is estimated to rise further up to almost USD 5.61 billion by 2026, is projected to reach around USD 19.52 billion by 2035, expanding at a CAGR of about 14.8% during the forecast period (2026–2035).

Market growth is driven by strong supportive national policy frameworks under India’s national green hydrogen mission strategic interventions for green hydrogen transition program and fiscal incentives aimed at lowering production costs and scaling electrolyser manufacturing.

The adoption of green hydrogen production is reinforced by the country’s decarbonization commitments renewable energy capacity additions and export ambitions to capture a meaningful share of global demand estimated to exceed 100 million metric tons by 2030, with allocated production capacity awards to multiple firms under frontrunner initiatives. Rising demand from heavy industrial end uses including refining fertilizer steel and transport sectors along with ongoing investments in fueling infrastructure and renewable generation are further supporting market expansion across key regions including North India, South India and West India, reflecting India’s strategic energy transition.

India Green Hydrogen Market Dynamics

Market Trends

The industry is experiencing a structural transition toward large scale electrolyser based production integrated with renewable power assets, reflecting national decarbonisation priorities. One of the key trends shaping the market is the increasing adoption of alkaline and proton exchange membrane electrolysers, aligned with efficiency improvement and long-term cost optimisation objectives under the National Green Hydrogen Mission administered by the Ministry of New and Renewable Energy. Another notable trend is the gradual shift toward domestic manufacturing of electrolysers and balance of plant components, supported by Production Linked Incentive schemes and policy guidance issued by Government of India agencies. These developments are influencing project design, encouraging integrated solutions, and redefining competitive positioning across the market landscape.

Growth Drivers

The growth of the market is primarily supported by strong policy backing and clearly defined national production targets aimed at reducing fossil fuel dependence across industrial sectors. Government initiatives such as the National Green Hydrogen Mission and the Strategic Interventions for Green Hydrogen Transition scheme continue to stimulate demand across refining, fertiliser, steel, and mobility applications. Increasing public and private investments in renewable energy capacity expansion, as outlined by the Ministry of Power and the Central Electricity Authority, are further accelerating market development. Additionally, industrial decarbonisation mandates and international export ambitions are strengthening adoption as enterprises prioritise regulatory compliance, energy security, and long-term operating cost stability.

Market Restraints / Challenges

Despite favorable outlook conditions, the market faces several structural challenges that may moderate growth momentum. High initial capital requirements for electrolyser systems, renewable power integration, and storage infrastructure remain a key restraint, particularly for early stage and price sensitive projects, as highlighted in assessments by Trade.gov and other government backed market intelligence platforms. Furthermore, dependence on imported critical components and limited availability of skilled technical manpower pose operational constraints. These factors can result in elevated project costs, longer commissioning timelines, and scalability challenges, which may impact near term market penetration during periods of macroeconomic and policy transition.

Market Opportunities

The market presents significant opportunities in large scale industrial decarbonisation projects supported by government led demand aggregation and offtake assurance mechanisms. Opportunities are particularly strong in refining, fertiliser, and export-oriented ammonia production, where policy clarity and incentive structures are improving project bankability. Companies offering integrated renewable to hydrogen solutions with improved efficiency and cost control are well positioned to capture incremental demand. Another major opportunity lies in domestic electrolyser manufacturing and technology development, supported by Production Linked Incentives and research programs facilitated by public institutions. Advancements in automation, digital monitoring, and system optimisation are expected to enhance operational performance and long-term competitiveness across the market.

India Green Hydrogen Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 4.88 Billion |

|

Revenue Forecast in 2035 |

USD 19.52 Billion |

|

Growth Rate |

14.8% |

|

Segments Covered in the Report |

By Technology, By Energy Source, By Distribution Channel, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

West India, South India, North India, Other Regions |

|

Key Companies |

Reliance Industries Limited, Adani New Industries Limited, NTPC Limited, Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, GAIL India Limited, Larsen and Toubro Limited, ACME Group, ReNew Energy Global Plc, Greenko Group, Tata Power Renewable Energy Limited, JSW Energy Limited, Ohmium International India Private Limited, Cummins India Limited, Siemens Energy India Limited, Thyssenkrupp Uhde India Private Limited |

|

Customization |

Available upon request |

India Green Hydrogen Market Segmentation

By Technology

Alkaline electrolysis accounted for approximately 57% of the market share in 2025, supported by its commercial maturity, relatively lower capital expenditure, and suitability for large scale continuous hydrogen production. The segment benefits from established supplier ecosystems and ease of deployment in industrial clusters.

Proton exchange membrane electrolysis represented nearly 33% of the market, driven by higher efficiency, faster ramp up capabilities, and compatibility with intermittent renewable energy sources. This segment is expected to register the fastest growth during the forecast period at an estimated CAGR of about 24%, supported by cost optimization initiatives and policy incentives.

Solid oxide electrolysis contributed around 10%, reflecting limited deployment but growing interest due to higher theoretical efficiency in long term applications.

By Energy Source

Solar-based green hydrogen production dominated the market with an estimated share of about 46% in 2025, supported by India’s large scale solar capacity additions and favorable irradiation levels across western and southern regions.

Wind based production accounted for approximately 29%, primarily concentrated in coastal and high wind corridor states where grid connected and captive renewable projects are expanding.

Hybrid renewable systems represented nearly 25% of the market, reflecting increasing adoption to ensure stable power supply and improved electrolyser utilization rates. The hybrid segment is expected to grow at around 23% during the forecast period, driven by government emphasis on round the clock renewable power supply and improved project bankability.

By Distribution Channel

Captive consumption held the dominant share of approximately 64% in 2025, as industrial users continue to prioritize on site hydrogen production to reduce logistics costs and ensure supply reliability. Refineries, fertilizer plants, and chemical manufacturers remain the primary contributors to this segment.

Merchant distribution accounted for nearly 36%, supported by early development of centralized production hubs and hydrogen transportation infrastructure. This segment is expected to witness faster growth at an estimated CAGR of about 22%, driven by planned hydrogen hubs, pipeline development initiatives, and policy frameworks encouraging third party hydrogen supply to mobility and industrial consumers.

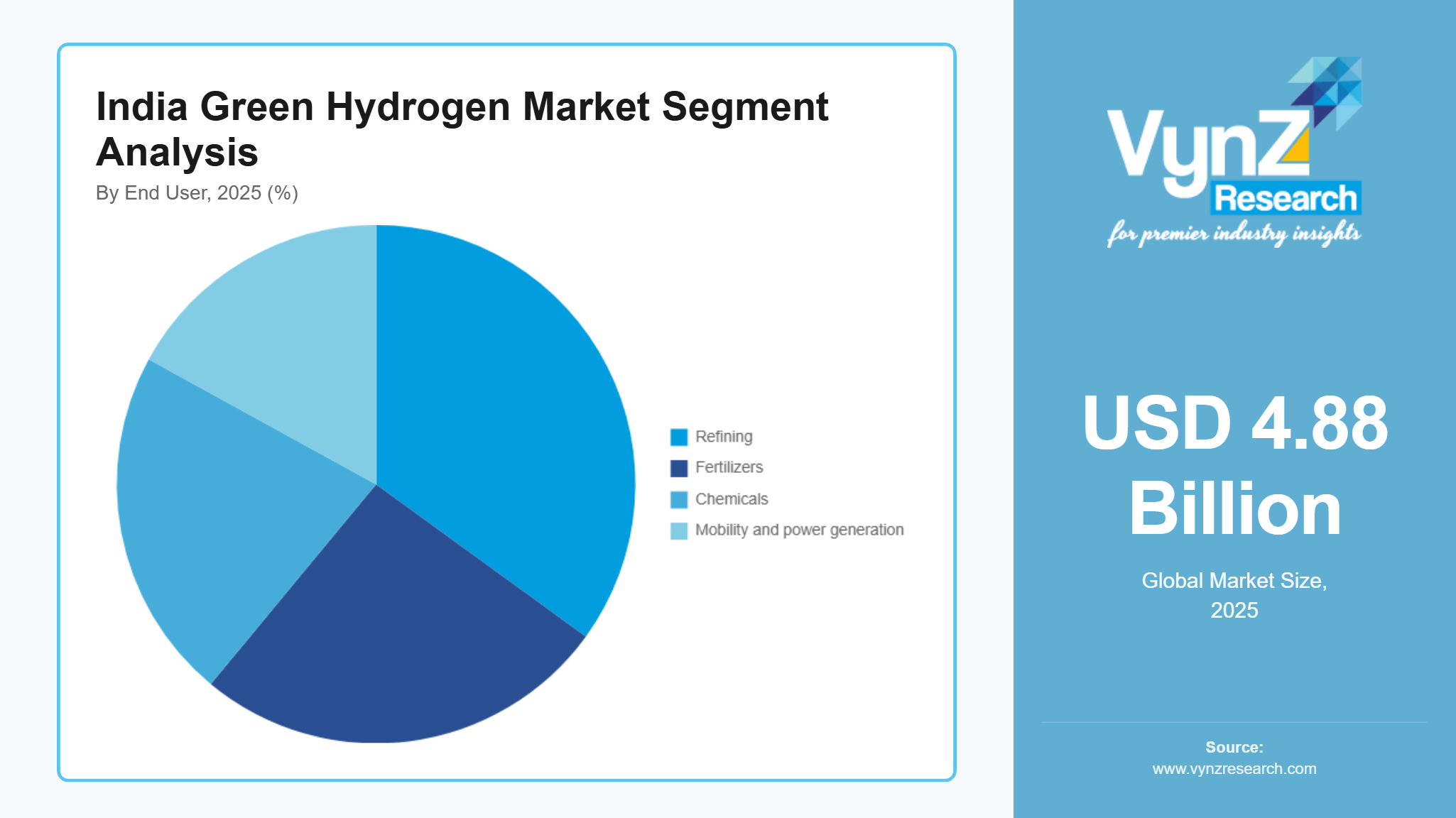

By End User

Refining emerged as the largest end user segment with approximately 35% share in 2025, supported by immediate replacement demand for conventional hydrogen and decarbonization mandates.

Fertilizers accounted for around 26%, driven by ammonia production requirements and government focus on reducing import dependency.

Chemicals and steel together represented nearly 22%, supported by pilot scale adoption and long-term transition strategies.

Mobility and power generation accounted for approximately 17%, reflecting early-stage deployment through public sector initiatives. The mobility segment is expected to record the highest growth at about 25% CAGR, supported by hydrogen corridor development and fuel cell vehicle demonstration programs.

Regional Insights

West India

West India accounted for approximately 34% of the market in 2025, driven by strong renewable energy capacity concentration and early industrial adoption. States such as Gujarat and Maharashtra continue to attract large scale green hydrogen and green ammonia projects due to favorable solar and wind resources port infrastructure and proximity to refineries and chemical hubs. Government backed initiatives led by the Ministry of New and Renewable Energy and state nodal agencies support hydrogen hubs electrolyser manufacturing and export-oriented projects. Policy support under the National Green Hydrogen Mission and port led development frameworks is encouraging investments in large integrated renewable to hydrogen facilities strengthening the region’s leadership position.

South India

South India represented an estimated 26% share of the market in the base year, supported by high renewable penetration industrial demand and proactive state level clean energy policies. Tamil Nadu Karnataka and Andhra Pradesh are witnessing increasing deployment of green hydrogen projects linked to refineries fertilizer units and steel plants. Reports and policy documents from central electricity authority and ministry of power highlight strong grid connected renewable additions in this region supporting electrolyser utilization. Growing focus on industrial decarbonization captive hydrogen production and technology pilot projects is driving steady market expansion across southern industrial corridors.

North India

North India accounted for approximately 17% of the market in 2025, supported by demand from fertilizer production refining and emerging mobility applications. States such as Uttar Pradesh Haryana and Rajasthan are benefiting from policy support and renewable capacity expansion outlined in government backed energy transition roadmaps. Rajasthan’s solar resource potential and northern region fertilizer demand are key contributors to regional growth. Increasing public sector involvement pilot hydrogen mobility projects and industrial offtake agreements are supporting gradual adoption and long-term market development.

Other Regions

The remaining regions including East and North East India collectively contributed approximately 23% of the market. These regions are gradually emerging through pilot projects infrastructure development and policy backed renewable energy expansion. While adoption remains comparatively lower than West South and North India ongoing government initiatives and industrial diversification efforts are expected to create long term growth opportunities beyond the primary regions covered above.

Competitive Landscape / Company Insights

The market is moderately competitive, with the presence of domestic and international players focusing on technology localization, cost reduction, and large-scale project execution. Key participants include NTPC, Reliance Industries, Adani New Industries, Larsen and Toubro, Indian Oil Corporation, and ACME Group, alongside global electrolyser suppliers collaborating through joint ventures. Market activity is supported by government backed programs such as the National Green Hydrogen Mission and production linked incentive schemes issued by the Ministry of New and Renewable Energy, which encourage investment in electrolyser manufacturing, integrated renewable projects, and long-term offtake agreements, strengthening competitive positioning across the domestic market.

Mini Profiles

Reliance Industries Limited focuses on integrated green hydrogen and green ammonia production, supported by large scale renewable assets, strong balance sheet strength, and end to end project execution capabilities across India.

Adani New Industries Limited operates across large scale green hydrogen and electrolyser manufacturing segments, emphasizing cost efficiency, vertical integration, and rapid capacity deployment supported by renewable energy infrastructure.

NTPC Limited leverages its public sector scale, pilot hydrogen projects, and power sector expertise to expand green hydrogen adoption, supported by government backing and access to large renewable generation assets.

Indian Oil Corporation Limited focuses on green hydrogen adoption for refinery decarbonization, supported by captive demand strength, nationwide operational footprint, and integration with existing fuel and energy infrastructure.

Larsen and Toubro Limited leverages EPC expertise, electrolyser partnerships, and project execution capabilities to expand its green hydrogen presence, supported by strong industrial relationships and engineering scale.

Key Players

- Reliance Industries Limited

- Adani New Industries Limited

- NTPC Limited

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- GAIL India Limited

- Larsen and Toubro Limited

- ACME Group

- ReNew Energy Global Plc

- Greenko Group

- Tata Power Renewable Energy Limited

- JSW Energy Limited

- Ohmium International India Private Limited

- Cummins India Limited

- Siemens Energy India Limited

- Thyssenkrupp Uhde India Private Limited

Recent Developments

January 2026: At the ₹15,600-crore green hydrogen and green ammonia complex's founding ceremony, Andhra Pradesh Chief Minister N. Chandrababu Naidu proclaimed Kakinada the "Green Hydrogen Valley of India." Supported by the National Green Hydrogen Mission, the facility is among the biggest in the world and is anticipated to put Kakinada on the map of clean energy worldwide.

January 2026: In order to boost pilot-scale hydrogen generation from biomass and alternative feedstocks, India established a new INR 100 crore funding program under the National Green Hydrogen Mission. The program, which is run by BIRAC, offers up to INR 25 crore per project for TRL 5–6 technologies and gives priority to biomass-based pathways, wastewater utilization, and floating solar integration.

India Green Hydrogen Market Coverage

Technology Insight and Forecast 2026 - 2035

- Alkaline Electrolysis

- Proton Exchange Membrane Electrolysis

- Solid Oxide Electrolysis

Energy Source Insight and Forecast 2026 - 2035

- Solar

- Wind

- Hybrid Renewable Systems

Distribution Channel Insight and Forecast 2026 - 2035

- Captive Consumption

- Merchant Distribution

End User Insight and Forecast 2026 - 2035

- Refining

- Fertilisers

- Chemicals

- Steel

- Mobility

- Power Generation

India Green Hydrogen Market by Region

- West India

- By Technology

- By Energy Source

- By Distribution Channel

- By End User

- South India

- By Technology

- By Energy Source

- By Distribution Channel

- By End User

- North India

- By Technology

- By Energy Source

- By Distribution Channel

- By End User

- Other Regions

- By Technology

- By Energy Source

- By Distribution Channel

- By End User

Table of Contents for India Green Hydrogen Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Technology

1.2.2. By

Energy Source

1.2.3. By

Distribution Channel

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Technology

5.1.1. Alkaline Electrolysis

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Proton Exchange Membrane Electrolysis

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Solid Oxide Electrolysis

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Energy Source

5.2.1. Solar

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Wind

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Hybrid Renewable Systems

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Distribution Channel

5.3.1. Captive Consumption

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Merchant Distribution

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Refining

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Fertilisers

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Chemicals

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Steel

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Mobility

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

5.4.6. Power Generation

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2035

6. West India Market Estimate and Forecast

6.1. By

Technology

6.2. By

Energy Source

6.3. By

Distribution Channel

6.4. By

End User

7. South India Market Estimate and Forecast

7.1. By

Technology

7.2. By

Energy Source

7.3. By

Distribution Channel

7.4. By

End User

8. North India Market Estimate and Forecast

8.1. By

Technology

8.2. By

Energy Source

8.3. By

Distribution Channel

8.4. By

End User

9. Other Regions Market Estimate and Forecast

9.1. By

Technology

9.2. By

Energy Source

9.3. By

Distribution Channel

9.4. By

End User

10. Company Profiles

10.1. Reliance Industries Limited

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Adani New Industries Limited

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. NTPC Limited

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Indian Oil Corporation Limited

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Bharat Petroleum Corporation Limited

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Hindustan Petroleum Corporation Limited

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. GAIL India Limited

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Larsen and Toubro Limited

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. ACME Group

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. ReNew Energy Global Plc

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Greenko Group

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Tata Power Renewable Energy Limited

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. JSW Energy Limited

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Ohmium International India Private Limited

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Cummins India Limited

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Siemens Energy India Limited

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. Thyssenkrupp Uhde India Private Limited

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India Green Hydrogen Market