Global Offshore Wind Farms Market – Analysis and Forecast (2025-2030)

Industry Insight by Power Rating, by Installation (fixed and floating) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3029 | Industry : Energy & Power | Available Format :

|

Page : 200 |

Global Offshore Wind Farms Market – Analysis and Forecast (2025-2030)

Industry Insight by Power Rating, by Installation (fixed and floating) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Offshore Wind Farms Market Overview

The Global Offshore Wind Farms Market was worth USD 30.9 billion in 2023 and is expected to reach USD 58.8 billion by 2030 with a CAGR of 13.2% during the forecast period.

Offshore wind farms imply the large-scale wind farms located in waterbodies such as seas and oceans. There are several wind turbines secured to the seabed, each with rotor blades. These turbines harness wind energy. The rotational motion of the blades drives a generator that converts kinetic energy into electric energy. This electrical energy is then transmitted to the substations located onshore via underwater cables to integrate into the electrical grid from where it is distributed to homes and businesses.

These units are usually located offshore because powerful winds blow consistently. This ensures higher efficiency and energy output than onshore farms. These farms reduced dependence on depleting fossil fuels due to sustainable and continuous production of energy to fulfill the increasing needs across a wide range of industries including energy storage, consumer electronics, transportation, and others.

The global offshore wind farms market is divided by the power rating where the > 8 ≤ 10 MW segment is high in demand and is expected to grow in the forecast period at a significantly high rate. It is also divided into fixed and floating segments based on their installation where the fixed segment dominates the market.

According to installation location, the market is divided as well where shallow water segment is expected to surpass others in terms demand and growth. And, according to the components, the market is divided into turbines, electrical infrastructure, and others where the turbine segment holds the larger share and is expected to grow significantly during the forecast period.

Offshore Wind Farms Market Segmentation

Insight by Power Rating

The global offshore wind farms market is divided by the power rating into ≤ 2 MW, >2 ≤ 5 MW, > 5 ≤ 8 MW, > 8 ≤ 10 MW, > 10 ≤ 12 MW, > 12 MW. In 2022, > 8 ≤ 10 MW. Out of these segments, the > 8 ≤ 10 MW segment is high in demand and is expected to grow in the forecast period at a significantly high rate as a result of this high demand. However, the > 10 ≤ 12 MW power rating segment is also emerging fast due to its promising future, especially in deep-sea locations.

Insight by Installation

The global offshore wind farms market is divided into fixed and floating segments based on their installation. Out of these two segments, the fixed segment dominates the market due to its cost-effectiveness and established technology that makes it simple and more economical to anchor the turbines onto the seabed. However, the floating platforms are more efficient in deeper waters.

Insight by Installation Location

The global offshore wind farms market is divided into shallow water, transitional water, and deepwater segments based on the installation location. Out of these three segments, the shallow water segment recorded to hold the largest revenue share and is expected to lead the market in the forecast period due to extensive demand and use and higher accessibility and lower capital investment. Moreover, the ideal weather conditions, easy maintenance, and simpler infrastructure construction propels the expansion of this segment.

However, the deepwater segment is also growing at a reasonably faster rate and will continue to do so in the forecast period due to higher demand and rising investments.

Insight by Components

The offshore wind farms market is divided into turbines, electrical infrastructure, substructure, and other segments based on the different components. Out of these segments, the turbine segment accounts for the larger market share and is expected to grow significantly during the forecast period due to greater utilization.

Global Offshore Wind Farms Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 30.5 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 59.9 Billion |

|

Growth Rate |

15.4% |

|

Segments Covered in the Report |

By Power Rating and By Installation |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Offshore Wind Farms Industry Trends

Major players of the industry are expanding their investments and efforts in the research and development of better models.

Rapid technological advancements are reducing the initial investments as well as the cost of generating electricity from offshore farms.

The rise in demand for generating clean energy has fueled the growth of the market in the European countries like UK, Germany, Denmark, and Belgium.

Offshore Wind Farms Market Growth Drivers

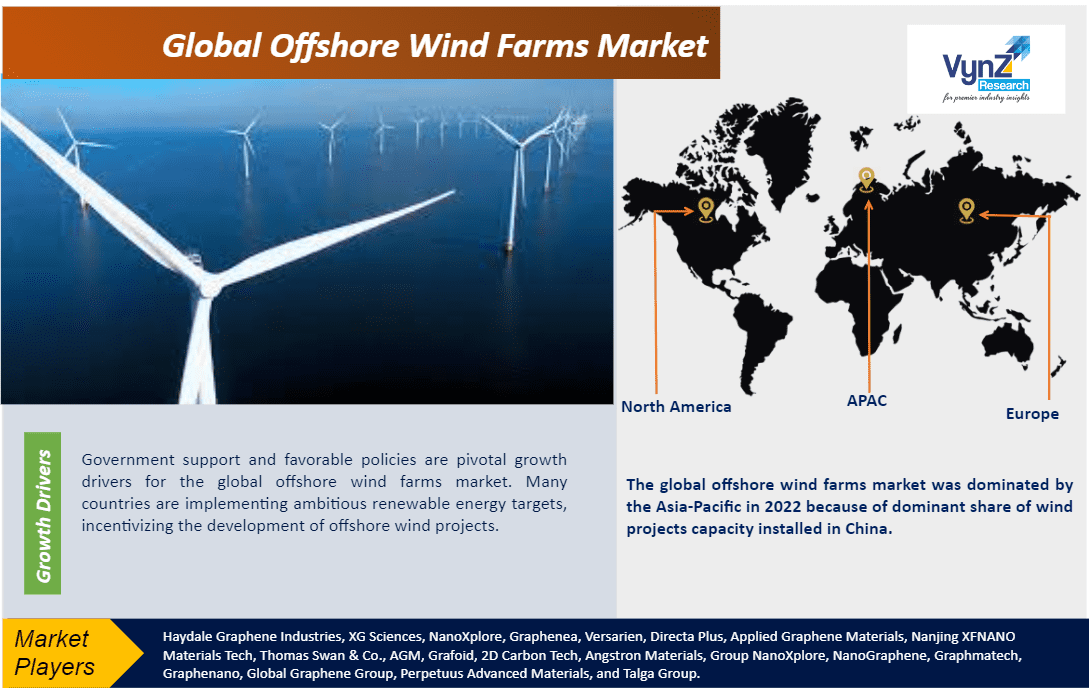

Favorable government initiatives and designing more liberal policies are driving the growth of the global offshore wind farms market.

Several countries are employing ambitious targets to produce renewable energy facilitating the rise in number of several offshore wind projects, and thereby pushing the market forward.

Additionally, collaboration between governments and industry leaders is also accelerating the expansion of offshore wind energy market on a global scale.

Technological advancement is also helping the market to grow due to designing more efficient turbines and streamlining the installation processes. This reduces the cost of the overall project.

Increase in investments and high production targets are also underscoring the growth potential of the global offshore wind farms market.

The rising awareness of the benefits offered by these offshore farms to generate electricity is also fueling the market growth.

Abundance of wind resources over oceans and seas promote the growth of offshore wind farms and allows more consistent wind speeds than onshore locations allowing energy production in a large scale.

Offshore Wind Farms Market Challenge

The high cost of transmission and grid integration infrastructure, high variability of wind patterns at sea, need for more advanced grid management techniques, logistical and technical hurdles hinder the growth of the market.

Offshore Wind Farms Market Opportunities

Progress in technology, reduced cost, economies of scale, and streamlined project development processes creates new opportunities for new investors in the market. Also, the rise in government initiatives and favorable regulatory environment and renewable energy targets, tac incentives, feed-in tariffs, and competitive bidding processes provides opportunities for the market players to expand their projects.

Offshore Wind Farms Market Geographic Overview

The global offshore wind farms market was dominated by the Asia-Pacific due to a large number of projects installed in countries like China and Vietnam. It is expected to grow more during the forecast period due to favorable and supportive government policies, higher investments, and strategic collaborations between key players.

Europe also accounts for a large share of the market and is expected to grow significantly during the forecast period. This is attributed to the rising investments in renewable energy, favorable government policies, and rising demand for generating clean energy.

North America however dominates the market as before due to the increased development of offshore wind energy, government policy support, favorable regulations and incentive programs.

Offshore Wind Farms Market Competitive Insight

Ørsted stands at the forefront of the global offshore wind farm market, holding a dominant position. Renowned for its pioneering role, Ørsted has spearheaded numerous significant projects worldwide including notable partnerships with major energy companies and governments. For instance, in the US, Ørsted collaborated with Eversource to develop critical wind farms like Revolution Wind and South Fork Wind. The company's substantial investment in research and development further solidifies its leadership, enhancing turbine efficiency and lowering costs. With an impressive production capacity and a track record of successful ventures, Ørsted continues to drive the industry's transition towards sustainable energy solutions.

Siemens Gamesa Renewable Energy is formidable in the global offshore wind farm market. The company's strategic collaborations with industry leaders and governments, such as Ørsted and Orsted, have propelled its influence. Noteworthy projects like the Hornsea One and Hornsea Two wind farms in the UK exemplify Siemens Gamesa's technical prowess and scale of operation. Substantial investments in cutting-edge technology and infrastructure underscore their commitment to advancing the sector. With an impressive production capacity and a strong track record of successful ventures, Siemens Gamesa remains a vital force in driving the transition towards sustainable offshore wind energy solutions around the world.

Recent Development by Key Players

Oct 26, 2023 - Statkraft completed the acquisition of Njordr Offshore Wind (NOW) from Vindkraft Värmland and Njordr. NOW holds a pre-permit portfolio of nine offshore wind projects in the Swedish economic zone with a total potential for up to 21 GW of installed capacity and as part of the acquisition agreement, Statkraft has committed to fully fund the maturation of the portfolio in the coming two years.

A consortium of leading Danish players, DTU, DHI, Siemens-Gamesa Renewable Energy, Stiesdal Offshore, Stromning, and Ørsted, established a test lab for floating wind turbines in the 20 MW class. The lab includes wind, waves, and a model scale wind turbine with measurements connected directly to calculation models in a 'Digital Twin' setup.

Key Players Covered in the Report

Ørsted, Siemens Gamesa, Vestas, Equinor, RWE, E.ON, Enbridge, EnBW, Dominion Energy, Vattenfall, SSE, Iberdrola, ScottishPower, Shell, Northland Power, wpd, EDPR, CGN (China General Nuclear Power Group), Macquarie Group, and Copenhagen Infrastructure Partners (CIP).

The Offshore wind farms market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

Power Rating

-

≤ 2 MW

-

>2 ≤ 5 MW

-

> 5 ≤ 8 MW

-

> 8 ≤ 10 MW

-

> 10 ≤ 12 MW

-

> 12 MW

-

Installation

-

Floating

-

Fixed

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

Vietnam

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East and Africa (MEA)

-

Latin America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Offshore Wind Farms Market