Global Plant Based Meat Market - Analysis and Forecast (2025-2030)

Industry Insights by Raw Material (Soy, Wheat and Pea), by Product (Burger Patties, Sausages, Strips & Nuggets, and Meatballs), by Storage (Frozen, Refrigerated, and Self-Stabled), by Meat Type (Chicken, Pork, Beef, Fish, Other Meat Types), by End User (HoReCa (hotel, restaurant, café), Food industry, Households), by Distribution Channel (Retail Outlets, Foodservice, E-commerce) and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : May, 2024 | Report Code : VRFB11011 | Industry : Food & Beverage | Available Format :

|

Page : 161 |

Global Plant Based Meat Market - Analysis and Forecast (2025-2030)

Industry Insights by Raw Material (Soy, Wheat and Pea), by Product (Burger Patties, Sausages, Strips & Nuggets, and Meatballs), by Storage (Frozen, Refrigerated, and Self-Stabled), by Meat Type (Chicken, Pork, Beef, Fish, Other Meat Types), by End User (HoReCa (hotel, restaurant, café), Food industry, Households), by Distribution Channel (Retail Outlets, Foodservice, E-commerce) and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Plant Based Meat Market Overview

The Global Plant Meat Market is estimated to be USD 14.7 billion in 2023 and is predicted to reach USD 28 billion by 2030, growing at a CAGR of 13.8% during the forecast period 2025-2030.

Plant-based meat, just as the name implies, is derived from plants. The primary components of plant-based meat include coconut oil, beet juice, and vegetable proteins, apart from wheat, pea, and blends being used in such products. The plant-sourced components like soy flour mimics the texture of animal-based meat.

In addition, it also contains protein, fat, vitamins, minerals, and water, which are also found in animal meat. However, these are healthier option than animal-based meat when consumed in moderation with burger patties, sandwiches, and other dishes. Recent innovations claim that plant-based meat offers the same taste and cooking experience as conventional animal-based meat.

The global plant-based meat market is divided into soy, wheat, and pea based on the raw materials with the soy segment dominating the market and into burger patties, sausages, strips & nuggets, and meatballs according to the products where the burger patties product segment dominates the market.

Based on storage, the market is divided into frozen, refrigerated, and shelf-stabled segments where the frozen segment dominates over the others and into chicken, pork, beef, fish, and other meat types where the plant-based chicken segment dominates over others.

As per the end users, the market is divided into HoReCa, food industry, and households’ section where the Hotel, Restaurants, and Café (HoReCa) category is the leader of the market in terms of revenue share with the food industry growing at a fast pace.

The market is also divided according to the different distribution channels into store-based and non-store-based segments where the latter segment eclipses the former in terms of revenue.

Plant Based Meat Market Segmentation

Insight by Raw Material

The raw materials used to make them divide the global plant-based meat market into soy, wheat, and pea.

Out of them the soy segment is expected to dominate the plant-based meat market and contribute the highest share. This is due to the richness in protein, lots of amino acids, and growing popularity. Moreover, the growing concern of people over animal-based protein consumption also propels the market growth.

Insight by Product

Considering the different products, the global plant-based meat market is divided into burger patties, sausages, strips & nuggets, and meatballs.

Out of all these segments, the burger patties product segment is expected to be the largest contributor to the market and will also grow at a significant rate during the forecast period. This is due to the high demand for it among users as a consequence of their shifting preferences. It is also attributed to its low-fat and low gluten content.

Insight by Storage

The global plant-based meat market is divided into frozen, refrigerated, and shelf-stabled segment based on storage.

Out of these, the frozen segment dominates the market due to higher demand for vegetarian products. This has eventually led to new product development in this segment. Apart from that, these products typically have a longer shelf life, resulting in the development and growth of the global plant-based meat industry.

Insight by Meat Type

The global plant-based meat market is divided into chicken, pork, beef, fish, and other meat types.

Ou of all these segments, the plant-based chicken segment holds the leading position in the plant-based meat market and contributes the larger share to it in terms of revenue. This dominance is primarily attributed to the high content of animal proteins, fats, and cholesterol in these products. The nutritional value is pretty similar to traditional animal-based chicken products which propels the popularity and growth of this particular segment.

On the other hand, the plant-based pork meat segment is also expected to grow at a high CAGR during the forecast period due to the growing popularity of pork meat alternatives. Made from soy and pea protein, these particular food items offer high fiber and protein content, lower fat levels, and zero cholesterol, compared to traditional animal-based pork food items.

Insight by End User

The global plant-based meat market is divided into HoReCa (hotel, restaurant, café), food industry, and households.

Out of these three segments of the market, the Hotel, Restaurants, and Café (HoReCa) category is the largest contributor to the market in terms of revenue share. This is mainly due to the rise in popularity of vegan and healthy food choices and changing consumer preferences prompting several food establishments to cater to their needs by offering meat-free options. Moreover, the demand for such food items in this segment is also augmented due to the rising trend of hosting events and celebrations in luxury restaurants and hotels.

At the same time, the food industry is also expected to witness the fastest growth rate during the forecast period due to the rising consumer demand for packed ready meals.

Insight by Distribution Channel

According to the different distribution channels, the global plant-based meat market is divided into two segments namely, store-based and non-store-based segments.

Out of these market segments, the non-store-based segment holds the larger share of the plant-based meat market revenue. This is primarily due to easier accessibility and greater and better selection possibilities.

Moreover, the growing concern over viral transmission will also result in the growth of this specific segment during the forecast period.

However, people prefer to shop online nowadays and therefore the online distribution channel is expected to do well and grow at a relatively high rate during the forecast period.

Global Plant Based Meat Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 14.7 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 28 Billion |

|

Growth Rate |

13.8% |

|

Segments Covered in the Report |

By Raw Material, By Product, By Storage, Meat Type, End User and Distribution Channel |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East and Rest of the World |

Industry Dynamics

Plant Based Meat Industry Trends

There is a lot of product innovations going on in the market which will see new products are launched with new flavors.

Major players in the market are experiencing significant market growth due to noticeable partnerships and collaborations with other brands.

There is a significant rise in vegan population seen in the world which is also pushing the demand and sales of plant-based meat.

The major players in this market have increased their investments in research and development to come up with better products which is expected to drive the market expansion.

The consumers are now seemingly more aware of the nutritional benefits of the plant-based meat products and concerned about their health.

There is a notable increase in health concerns all over the globe. This has resulted in an increase in specific physical activities like yoga, Zumba, and others that prompt the participants to consume health food such as soy meat for faster muscle recovery and water absorption.

This along with the growing concern over obesity and fat loss are driving people towards plant-based meat products as an alternative to the relatively harmful animal-based meat products.

The government is also taking notable initiatives to promote plant-based meat products which will affect the growth of the plant-based meat market on a global scale.

Plant Based Meat Market Growth Drivers

The growing health concerns and millennials are driving the growth of the global plant-based meat market. These products are not categorized as ‘food for vegans’ anymore which drives the millennials towards them.

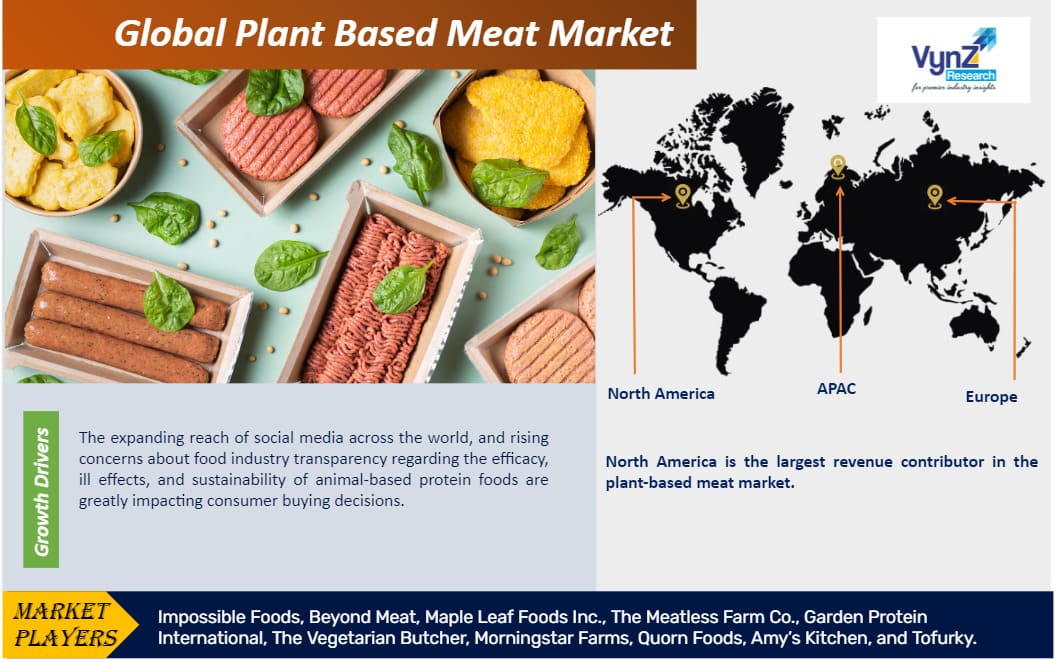

The growth is also attributed to the expanding reach of social media across the world as well as the growing concerns over the transparency about food industry regarding the efficacy, lower sustainability, and ill-effects of animal-based meat.

The growing awareness among people that several diseases and viruses originate from animals has forced them to shift to plant-based meat which is likely to benefit the market and propel its growth.

The plant-based meat offers significant benefits over animal-based meat apart from higher nutritional value and healthy outcomes.

All these are impacting the buying decisions of the consumers who are now more inclined to buy plant-based meat thereby pushing its demand higher and facilitating the market growth.

Growing concerns over the environmental impacts of red and processed meats and cruelty to animals and the awareness of the specific impacts such as deforestation, water usage, and greenhouse gas emissions and intention to reduce carbon footprint has resulted in the shift towards plant-based meat products, thereby propelling the market growth.

Continual product development and innovation efforts by the food producers to enhance the taste, texture, and nutritional profile of plant-based meat products and introduction of new and diverse plant-based meat alternatives has also resulted in the growth of the market.

Major players and venture capitalists in the plant-based meat market are entering into investments and partnerships with other smaller manufacturers and food chains of the traditional food industry to expand the market with greater product offerings and distribution channels.

Retail expansion has widened the availability and accessibility of plant-based meat products in grocery stores and mainstream supermarkets, restaurants, and fast-food chains, resulting in the market growth.

Plant Based Meat Market Challenges

The biggest challenges of the plant-based meat products and market is the unnecessary long comments on the components and over-processing. Moreover, there are several lawsuits that are creates a negative impact and image of the plant-based meat. Most importantly, the fact that the ill effects of these products are not yet deciphered makes it really tough for the plant-based meat market to grow.

In order to enhance flavor, texture, and taste, these food products are highly processed which reduces the overall nutritional value, posing a significant challenge to the market growth. Furthermore, the relatively high (600 mg) of sodium content in most plant-based meat food items, increases the concerns over negative health impact such as high blood pressure. This also opposes the market growth.

Plant Based Meat Market Opportunities

The significant increase in the number of vegetarian populations has resulted in a shift in consumer preference. This has, in turn, resulted in the demand and number of consumers of vegan food who rely on these plant-based meat products. This creates new opportunities for growth of the global plant-based meat market.

The growing popularity of these products among individuals at large and enhanced focus on augmenting the nutritional values in them by the food producers, as well as the rising governmental efforts to prevent cruelty to animals offer additional growth opportunities for the plant-based meat market.

Plant Based Meat Market Geographic Overview

North America is the largest contributor of revenue in the plant-based meat market. This is expected to grow even more during the projected period due to growing demand of these products. It is also attributed to the growing awareness among people about the ill-effects of animal-based meat.

In Europe, the growing trend of veganism among people is driving it market growth. Since Europe has the largest population of vegan people, the demand for these products is therefore very high.

On the other hand, several countries in Europe and Asia have set dietary guidelines that will help in reducing the consumption of animal meat by people.

Canada's Food Guide focuses on plant-based foods over animal proteins. In China's Ministry of Health revised to lower the range of meat consumption to encourage its citizens to reduce their intake of meat. Governments are now beginning to understand the climatic and environmental effects of diets. The expert panel of the review team recommended the inclusion of key material environmental indicators during the most recent revision of the US dietary guidelines. Denmark is considering proposals for imposing a red meat tax. In Sweden's Green Party tabled a motion in the Swedish parliament calling for a climate tax on food. Moreover, The French National Assembly adopted an amendment to the country's Rural Code, where it states that designations relating to animal products cannot be used to market food products of which is a substantial part of vegetables.

The 2022 reform of the Novel Food Regulation aimed to improve the first two of these requirements by creating a consistent mechanism for product authorization and streamlining the process in order to provide for quicker consumer acceptance of goods. The third condition, financial incentives for innovation, lies outside the scope of the Novel Food Regulation itself, although the provision of five-year data protection for proprietary, newly developed scientific evidence or data supporting the application provides manufacturers with a degree of financial assurance by safeguarding their competitive advantage over a period of time.

Recent Development by Key Players

Impossible Foods has converted a Cattle Ranch to Make Meat 'The New Way. The company has taken over a 70-acre farm in South Carolina where it intends to grow the soybeans, sunflowers and coconut trees which is used to make beef, chicken and pork alternatives.

Beyond Meat, Inc. a pioneer in plant-based meat alternatives has announced the nationwide rollout of its latest products the beyond burger and beyond beef. These offerings represent the company’s most advanced iteration to date, boasting enhanced taste and nutritional profiles. Each serving provides 21 grams of plant-based protein and contains only 2 grams of saturated fat.

Plant Based Meat Market Competitive Insight

Key players operating in the global plant-based meat market include Impossible Foods, Beyond Meat, Maple Leaf Foods Inc., The Meatless Farm Co., Garden Protein International, The Vegetarian Butcher, Morningstar Farms, Quorn Foods, Amy’s Kitchen, and Tofurky. These players have broad industry coverage and high operational and financial strength.

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data, and have key opinions from the industry experts. The key profiles approached within the industry include, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads, and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behavior.

The Plant Based Meat Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Raw Material

- Soy

- Wheat

- Pea

- Product

- Burger Patties

- Sausages

- Strips & Nuggets

- Meatballs

- Distribution Channel

- Retail Outlets

- Food Services

- E-Commerce

- Storage

- Frozen

- Refrigerated

- Self-Stabled

- Meat Type

- Chicken

- Pork

- Beef

- Fish

- Other Meat Type

- End User

- HoReCa

- Hotel

- Restaurant

- Cafe

- Food Industry

- Households

- HoReCa

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Plant Based Meat Market