India Isolation Beds Market – Analysis and Forecast (2026-2035)

Industry Insights by Type (Manual, Electric, Hydraulic, Pneumatic), by Usage (Critical, Bariatric, Medical Surgery, Pediatric, Maternal), by End Use (General & Acute Care Hospitals, Multi-Specialty Hospitals, Specialized Hospitals, Ambulatory Surgical Centers, Others)

| Status : Published | Published On : Oct, 2025 | Report Code : VRHC1227 | Industry : Healthcare | Available Format :

|

Page : 278 |

India Isolation Beds Market – Analysis and Forecast (2026-2035)

Industry Insights by Type (Manual, Electric, Hydraulic, Pneumatic), by Usage (Critical, Bariatric, Medical Surgery, Pediatric, Maternal), by End Use (General & Acute Care Hospitals, Multi-Specialty Hospitals, Specialized Hospitals, Ambulatory Surgical Centers, Others)

India Isolation Beds Market Overview

The India isolation beds market is a growing market with a lot of potential. The growth of this market is being driven by a number of factors, including the increasing number of coronavirus patient in the country, rising awareness about the importance of isolation in preventing the spread of infection, and increasing government initiatives to improve healthcare infrastructure. The Indian isolation beds market size in terms of volume is estimated to be 308,519.0 units in 2025 and is predicted to reach 503,929.0 units by 2035, growing at a CAGR 5.8% during 2026–2035. The major factors driving the growth of the market is the increase in the number of coronavirus patient in the country. According to a website www.covid19india.org, the number of confirmed cases in India was 23,421, active cases was 17,598, and the number of recovered patient from coronavirus was 5,095 in April 24, 2022. Companies are focusing on developing innovative isolation beds that meet the needs of patients and healthcare providers. They are also focusing on expanding their distribution network to reach a wider customer base.

In the past decade, various countries in the world have witnessed outbreaks of viral diseases such as severely acquired respiratory syndrome (SARS), E-Bola, H1N1 virus, and COVID 19 (coronavirus). The death rate of COVID-19 appears to be higher in comparison to normal seasonal flu, and it differs with respect to location. For instance, at the epicenter (Hubei province, China) the death rate was 2.9%, whereas in other provinces it was 0.4%, and for India, the death rate was 3.1%.

To contain these outbreaks in hospitals, and other health centers, these facilities need to follow preventive measures of isolating infected patients. Viral infections can spread rapidly to other healthcare workers, visitors, and doctors. So there is a necessity to have separate isolation wards with proper medical facilities and preventive personal equipment for nurses and doctors. For these highly contagious diseases, isolation is the primary step, this is why specialized cabins or isolation wards have been created within the hospital settings. This in turn, increases the demand for isolation beds in the country.

India Isolation Beds Market Segmentation

Insight by Type

- Manual

- Electric

- Hydraulic

- Pneumatic

The manual category would hold the largest share in the Indian isolation beds market in 2025. Usually, the isolation beds across the world in use are the traditional hospital bed placed in isolation wards. Such beds are often equipped with other necessities such as respiratory equipment.

Insight by Usage

- Critical

- Bariatric

- Medical Surgery

- Pediatric

- Maternal

The medical surgery segment is projected to witness the fastest growth in the Indian isolation beds market. This is because of the increasing occurrence of surgical procedures in the country.

Insight by End Use

- General & Acute Care Hospitals

- Multi-Specialty Hospitals

- Specialized Hospitals

- Ambulatory Surgical Centers

- Others

During the historical period (2018–2024), general & acute care hospitals segment were the largest bifurcation in the isolation beds market, on the basis of end use. This is ascribed to the rising need of intensive care units (ICU) due to COVID-19 pandemic. The more presence of general hospitals as compared to specialized and multi-specialty hospitals is the primary factor behind the growth of the segment.

India Isolation Beds Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 308,519.0 Units |

|

Revenue Forecast in 2035 |

U.S.D. 503,929.0 Units |

|

Growth Rate |

5.8% |

|

Segments Covered in the Report |

By Type, By Usage and By End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Tamil Nadu, Andhra Pradesh, Gujrat, Rajasthan, Maharashtra, Telangana, Uttar Pradesh, Kerala, Madhya Pradesh, Karnataka, West Bengal and Delhi |

Industry Dynamics

Industry Trends

This innovation is out most important in the situation where coronavirus is at its peak globally and is further expected to prevail for which vital safety measures are to be implemented. As a result, in the current situation low cost isolation beds in the country, is witnessing significant growth to cater its huge demand across several countries.

India Isolation Beds Market Growth Drivers

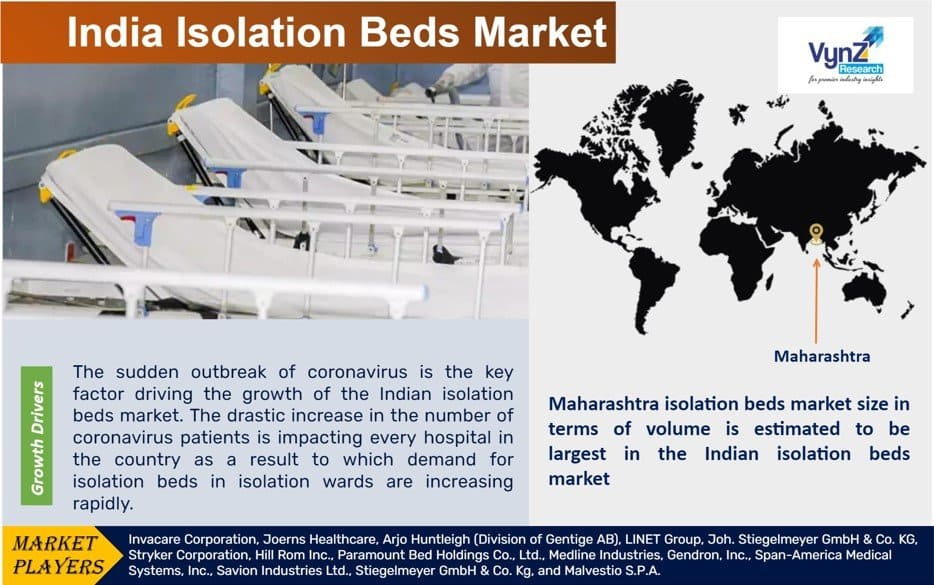

The sudden outbreak of coronavirus is the key factor driving the growth of the Indian isolation beds market. The drastic increase in the number of coronavirus patients is impacting every hospital in the country as a result to which demand for isolation beds in isolation wards are increasing rapidly. World Health Organization (WHO) has urged all the manufacturers of isolation beds globally to increase the production of these equipment on an immediate basis. According to a report by WHO in March 2022, the number of coronavirus patients exceeded to 200000 and in almost after twelve days the number would exceed by 100000.

India Isolation Beds Market Challenges

However, due to the coronavirus preventive lockdown situation in several countries, the manufacturing and the supply chains of the isolation beds have been critically affected. The procurement, transportation and distribution of raw materials to the manufacturing unit and the dearth of laborers in both emerging and developed nations has negatively impacted the desired production flow.

India Isolation Beds Market Geographic Overview

Geographically, Maharashtra isolation beds market size in terms of volume is estimated to be largest in the Indian isolation beds market in 2022, due to the huge number of COVID-19 cases in the state. The demand for isolation beds has been exceeded by Maharashtra government in order to fight against coronavirus. The demand of isolation beds from this state is much higher as compared to other states in India. According to a website www.covid19india.org, the number of confirmed cases in Maharashtra was 6,427, active cases was 5,304, and the number of recovered patient from coronavirus was 840 in April 24, 2020.

The government of India has sanctioned INR 15,000 crore for India Covid-19 Emergency Response and Health System Preparedness Package. The funds approved will be utilized in two parts — around INR 7,774 crore for immediate emergency response and rest for medium-term support (one to four years) to be offered under mission mode approach. As a result of huge initiatives undertaken by government authorities to fight COVID-19 is significantly attributing towards the growth of isolation beds market.

India Isolation Beds Market Competitive Insight

Medline Industries, LP is an American private healthcare company headquartered in Northfield, Illinois. It is a manufacturer, distributor doing business in more than 125 countries and territories around the world.

Joerns is a leading partner in long-term post-acute care (LTPAC), providing access to high-quality products with renowned efficacy and safety.

The key players operating in the Indian isolation beds market are Invacare Corporation, Joerns Healthcare, Arjo Huntleigh (Division of Gentige AB), LINET Group, Joh. Stiegelmeyer GmbH & Co. KG, Stryker Corporation, Hill Rom Inc., Paramount Bed Holdings Co., Ltd., Medline Industries, Gendron, Inc., Span-America Medical Systems, Inc., Savion Industries Ltd., Stiegelmeyer GmbH & Co. Kg, and Malvestio S.P.A.

Recent Developments by Key Players

Medline (US-based healthcare company ) has acquired the surgical solutions business from Ecolab. This partnership shall provide Medline with sterile drape solutions for surgeons and Ecolab’s fluid temperature management system.

The India Isolation Beds Market offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

- Type

- Manual

- Electric

- Hydraulic

- Pneumatic

- Usage

- Critical

- Bariatric

- Medical Surgery

- Pediatric

- Maternal

- End Use

- General & Acute Care Hospitals

- Multi-Specialty Hospitals

- Specialized Hospitals

- Ambulatory Surgical Centers

- Others

Geographical Segmentation

India Isolation Beds Market by State

- Tamil Nadu

- Andhra Pradesh

- Gujrat

- Rajasthan

- Maharashtra

- Telangana

- Uttar Pradesh

- Kerala

- Madhya Pradesh

- Karnataka

- West Bengal

- Delhi

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India Isolation Beds Market