Global Medical Tubing Market – Analysis and Forecast (2025-2030)

Industry Insight by Material (Plastics (Polyvinyl chloride (PVC), Polyolefin (Polyethylene (PE) and Polypropylene (PP)), Polyamide, Polytetrafluoroethylene (PTFE), Poly ether ketone (PEEK), Perfluoroalkoxy (PFA), and Polycarbonate (PC)), Rubbers (Thermoplastic Elastomer (TPE), Thermoplastic Polyurethane (TPU), Silicone, Polyurethane (PU), Ethylene Propylene Diene Monomer (EPDM), and Latex), and Specialty Polymers (Bioabsorbable polymer and Ethylene-vinyl Acetate (EVA)), by Structure (Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Balloon Tubing, Heat Shrink Tubing, and Braided Tubing), by Application (Bulk Disposable Tubing, Catheters, Cannulas, Drug Delivery Systems, and Specialty Chemicals), and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Dec, 2024 | Report Code : VRHC1253 | Industry : Healthcare | Available Format :

|

Page : 250 |

Global Medical Tubing Market – Analysis and Forecast (2025-2030)

Industry Insight by Material (Plastics (Polyvinyl chloride (PVC), Polyolefin (Polyethylene (PE) and Polypropylene (PP)), Polyamide, Polytetrafluoroethylene (PTFE), Poly ether ketone (PEEK), Perfluoroalkoxy (PFA), and Polycarbonate (PC)), Rubbers (Thermoplastic Elastomer (TPE), Thermoplastic Polyurethane (TPU), Silicone, Polyurethane (PU), Ethylene Propylene Diene Monomer (EPDM), and Latex), and Specialty Polymers (Bioabsorbable polymer and Ethylene-vinyl Acetate (EVA)), by Structure (Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Balloon Tubing, Heat Shrink Tubing, and Braided Tubing), by Application (Bulk Disposable Tubing, Catheters, Cannulas, Drug Delivery Systems, and Specialty Chemicals), and by Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Medical Tubing Market Overview

The Global Medical Tubing Market is anticipated to witness growth from USD 4.76 billion in 2023 to USD 8.35 billion by 2030, registering a CAGR of 10.2% during the forecast period 2025-2030. The medical tubing market refers to the industry involved in the production and distribution of tubing used in medical applications. Medical tubing is a vital component in various medical devices and systems, playing a crucial role in fluid management, drug delivery, and patient monitoring.The market for medical tubing has been witnessing steady growth due to several factors, including the increasing demand for minimally invasive procedures, technological advancements in healthcare, and the rising aging population. Medical tubing is used in a wide range of applications, such as intravenous (IV) administration, catheters, respiratory devices, peristaltic pumps, and diagnostic equipment.

Medical tubing is a polymer-based tube created through the extrusion process. To remove fluids and deliver drugs, medical tubes can be inserted into the human body. They are also used in a variety of medical equipment like catheters and cannulas, as well as peristaltic pumps, to remove fluids or insert drugs. The increased awareness and initiatives by the government to offer high-quality healthcare services will fuel the growth of the global medical tubing market. The development in design has enabled manufacturers to address the medical industry's customized needs. The increasing incidences of respiratory diseases like asthma, lung cancer, and pulmonary fibrosis will propel the demand for medical tubing as it is an important component of respiratory devices like ventilators that facilitate breathing.

Medical Tubing Market Segmentation

Insight by Material

Based on material, the global medical tubing market is segmented into plastics, rubbers, and speciality polymers. The plastics are sub-divided into Polyvinyl chloride (PVC), Polyolefin (Polyethylene (PE) Polypropylene (PP)), Polyamide, Polytetrafluoroethylene (PTFE), Polyether ketone (PEEK), Perfluoroalkoxy (PFA), and Polycarbonate (PC). The rubber is sub-divided into Thermoplastic elastomer (TPE), Thermoplastic polyurethane (TPU), Silicone, Polyurethane (PU), Ethylene propylene diene monomer (EPDM), and Latex. The speciality polymers are sub-divided into Bioabsorbable polymer and Ethylene-vinyl acetate (EVA). Plastic contributes to the largest share in the global medical tubing market owing to its low cost and ease of manufacturing. Because of its low cost, PVC is the most common plastic material used to make medical tubing. It is a favoured material for medical tubing because of its simplicity of manufacture, production, and assembly. Moreover, it has strong chemical resistance, is biocompatible, and is durable, PVC may be employed in a wide range of applications.

Silicone is estimated to be having a high CAGR owing to its increased adoption in medical implants, feeding tubes, and catheters as it offers gaskets, sealing, and safe fluid transfer properties.

Insight by Structure

The global medical tubing market is divided into single-lumen, co-extruded, multi-lumen, tapered or bump tubing, balloon tubing, heat shrink tubing, and braided tubing based on structure. Single-lumen tubing holds a substantial share in the medical tubing market as it is used to transport liquids, gases, or surgical devices. Urological, IV, and drainage catheters all make use of single-lumen tubing.

Insight by Application

Based on application, the global medical tubing market is divided into bulk disposable tubing, catheters, cannulas, drug delivery systems, and speciality chemicals. Bulk disposable tubing dominates the market owing to the rising need to develop healthcare infrastructure and prevention of infection. This segment is growing at an exponential rate in developing countries, owing to expanding economic growth, augmented disposable income and purchasing power, and improved government investments in providing high-quality healthcare facilities. Tubes used in blood bags for blood transfusion, IV infusion tubing, drug delivery disposables, respiratory disposables, dialysis products, laboratory disposables, and wound management disposables are all examples of bulk disposable tubing.

Catheter demand has increased significantly as a result of the increasing number of chronic conditions that necessitate hospitalization, boosting the catheter segment growth.

Global Medical Tubing Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 4.76 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 8.35 Billion |

|

Growth Rate |

10.2% |

|

Segments Covered in the Report |

By Material, By Structure and, By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The significant increase in the disease among the population increased expenditure and technological development as well as innovation and customization of polymers and tubing structure in the healthcare industry, and increasing purchasing power owing to a rapid surge in the population are the key trends in the medical tubing market. Geographically, the medical tubing market is distributed globally, with major regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America and Europe have traditionally been the dominant markets due to advanced healthcare infrastructure, high healthcare expenditure, and strong regulatory frameworks. However, the Asia-Pacific region is expected to witness significant growth due to the rising healthcare investments and increasing demand for medical devices.In recent years, there has been a growing focus on developing tubing solutions with antimicrobial properties to reduce the risk of healthcare-associated infections. Additionally, advancements in material technology, such as the development of biocompatible and biodegradable materials, are driving innovation in the medical tubing market.

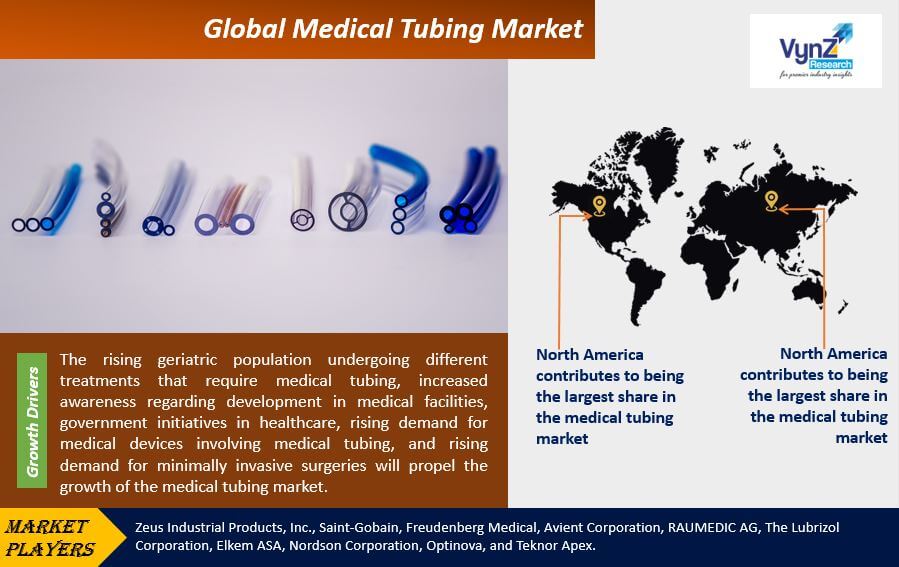

Medical Tubing Market Growth Drivers

The rising geriatric population undergoing different treatments that require medical tubing, increased awareness regarding development in medical facilities, government initiatives in healthcare, rising demand for medical devices involving medical tubing, and rising demand for minimally invasive surgeries will propel the growth of the medical tubing market. Furthermore, the rising incidence of osteoporosis has propelled the demand for surgery and rising occurrences of diseases like cancer, cardiovascular diseases, and arthritis will drive the demand for the medical tubing market. Fluid management and drainage, as well as anesthesiology and respiratory equipment, IVs, catheters, peristaltic pumps, and biopharmaceutical laboratory equipment, are all applications for medical tubing. Nevertheless, the reduced cost, durability, and reliability will bolster the growth of the medical tubing market.

Medical Tubing Market Challenges

Medical tube manufacturing requires massive investment and time and delays in regulatory approvals might increase the development procedure, resulting in a decline in the investment in medical product development technology. Furthermore, increased R&D costs, and strict regulatory standards may pose challenges in the market. All of these challenges could stifle the medical tubing market's expansion.

Medical Tubing Market Opportunities

The healthcare industry is growing at a robust pace owing to the growth in emerging economies like Brazil, Russia, India, China, and South Africa and changes in consumer preferences, increase health awareness, replacement of metals with plastics and growing geriatric population will offer significant opportunities for growth in medical tubing market.

Recent Developments By the Key Players

Zeus, a global leader in advanced polymer solutions and catheter manufacturing, has unveiled StreamLiner NG, the latest addition to the company's StreamLiner series of ultra-thin-walled catheter liners.

Avient Corporation, an innovator of materials solutions, is expanding the production of its Nymax REC Recycled Nylon Formulations to Istanbul, Turkey. This will increase accessibility to these sustainability-supporting, REACH-compliant solutions for customers in Middle Eastern countries.

Medical Tubing Market Geographic Overview

North America contributes to being the largest share in the medical tubing market owing to the well-established healthcare infrastructure, rising geriatric population requiring high-quality healthcare facilities, and focus on R&D activities.

Asia-Pacific is anticipated to be the fastest-growing region owing to the increasing demand for minimally invasive technologies and growing healthcare infrastructure in the region. Furthermore, the rising demand from end-use applications like bulk medical tubing, catheters & cannulas, drug delivery systems will drive the growth in the region.

Medical Tubing Market Competitive Insight

Owing to rising pressure on businesses in the field to create high-quality solutions, the medical tubing market is fiercely competitive. The industry offer expansion, novel product launches, agreement, acquisitions, and contracts to stay competitive in the market.

Some of the industry players in the medical tubing industry include :

- Zeus Industrial Products Inc.

- Saint-Gobain

- Freudenberg Medical

- Avient Corporation

- RAUMEDIC AG

- The Lubrizol Corporation

- Elkem ASA

- Nordson Corporation

- Optinova

- Teknor Apex

The Medical Tubing Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Material

- Plastics

- Polyvinyl cChloride (PVC)

- Polyolefin

- Polyethylene (PE)

- Polypropylene (PP)

- Polyamide

- Polytetrafluoroethylene (PTFE)

- Poly Ether Ketone (PEEK)

- Perfluoroalkoxy (PFA)

- Polycarbonate (PC)

- Rubbers

- Thermoplastic Elastomer (TPE)

- Thermoplastic Polyurethane (TPU)

- Silicone, Polyurethane (PU)

- Ethylene Propylene Diene Monomer (EPDM)

- Latex

- Specialty Polymers

- Bioabsorbable Polymer

- Ethylene-Vinyl Acetate (EVA)

- Plastics

- By Structure

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered Or Bump Tubing

- Balloon Tubing

- Heat Shrink Tubing

- Braided Tubing

- By Application

- Bulk Disposable Tubing

- Catheters

- Cannulas

- Drug Delivery Systems

- Specialty Chemicals

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Medical Tubing Market