Needle Market – Analysis and Forecast (2026-2035)

Industry Insight by Type (conventional needles and safety needles), Product (suture needles, blood collection needles, ophthalmic needles, dental needles, insufflation needles, pen needles, and other needles), Material (glass needles, plastic needles, stainless steel needles, and polyether ether ketone needles), Delivery Mode (hypodermic needles, intravenous needles, intramuscular needles, and intraperitoneal needles), Distribution Channel (direct tenders and retail) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1280 | Industry : Healthcare | Available Format :

|

Page : 210 |

Needle Market – Analysis and Forecast (2026-2035)

Industry Insight by Type (conventional needles and safety needles), Product (suture needles, blood collection needles, ophthalmic needles, dental needles, insufflation needles, pen needles, and other needles), Material (glass needles, plastic needles, stainless steel needles, and polyether ether ketone needles), Delivery Mode (hypodermic needles, intravenous needles, intramuscular needles, and intraperitoneal needles), Distribution Channel (direct tenders and retail) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Needle Market Overview

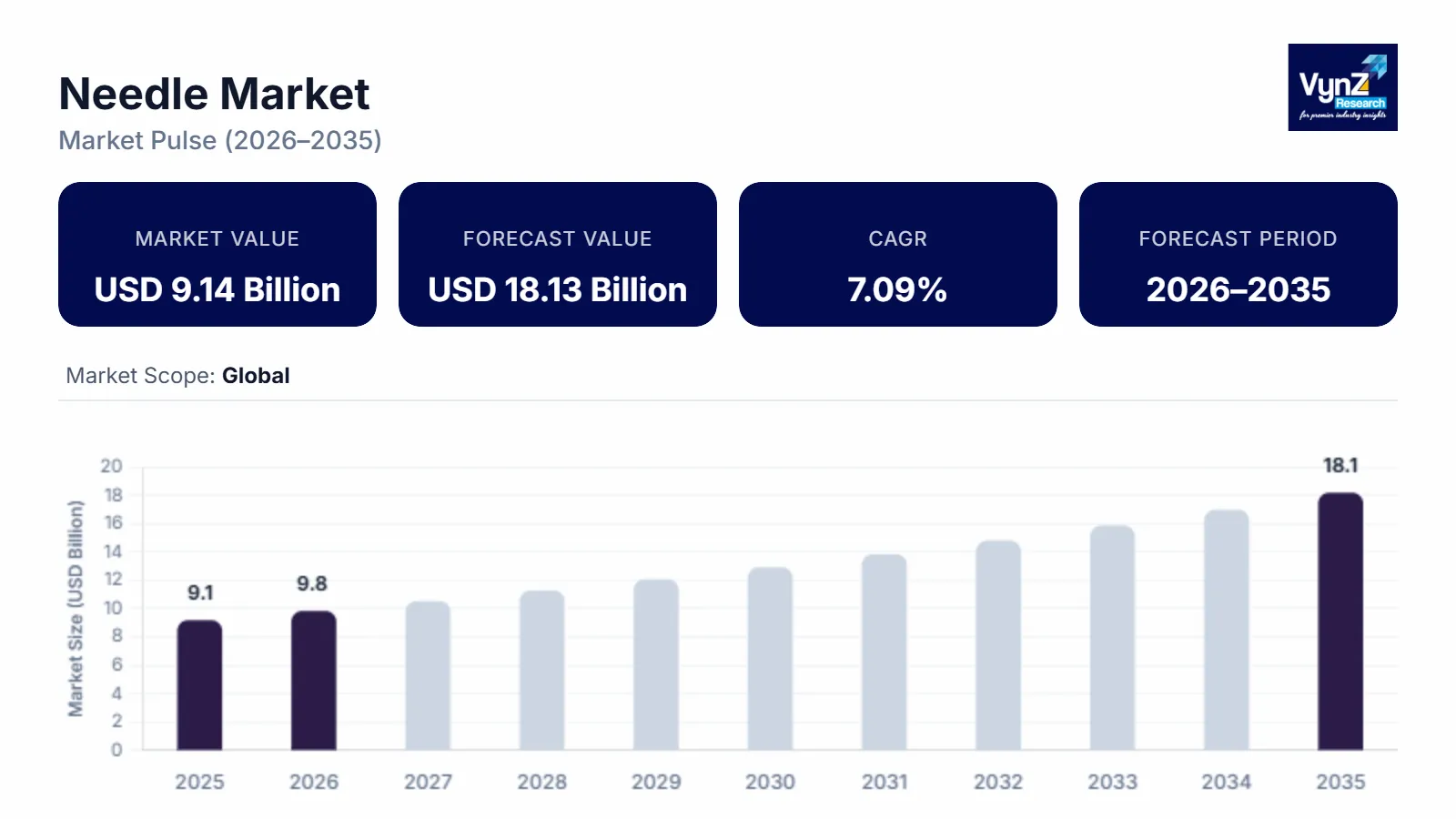

The global Needle Market is expected to grow from USD 9.14 billion in 2025 and is estimated to reach around USD 9.79 billion in 2026. It is projected to reach around USD 18.13 billion by 2035, expanding at a CAGR of about 7.09% from 2026 to 2035.

Needles are typically pointed and slender devices that have different applications, such as sewing, crafting, and medical sectors. These are usually made from metal, but plastic and other materials are also used to make them. These needles have two ends. One is pointed for penetration, and the other end is blunt and is typically attached to threads or syringes. In the medical sector, needles play a crucial role and help in injecting fluids, drawing blood, and several other diagnostic procedures. When used for sewing, these needles help stitch clothes and craft them.

The world, especially the medical sector, cannot be imagined without needles. These pointed and slender devices, usually made of stainless steel, have a wide range of applications including drawing bold, injecting fluids, or stitching incisions.

The global needle market typically thrives on the growing necessity and innovations. While technological advancements ensure safety to patients and providers, necessity for precision-engineered needles for vaccination and other purposes fuel the market growth. Moreover, the growing incidence of chronic diseases among the elderly population especially underscores the higher demand for needles for efficient insulin delivery and other types of medical interventions.

However, like all other markets, the global needle market also faces significant challenges that hinder its growth such as stiff competition from alternatives like jet injectors. Still, growth opportunities are aplenty in the form of growing R&D initiatives by the manufacturers and government investments to improve healthcare infrastructure.

Needle Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the global Needle Market report, along with forecasts at the global, regional and country levels from 2026-2035. Our report has categorized the market based on Type, Product, Material, Delivery Mode, Distribution Channel, and End-User.

Insight by Type

- Conventional Needles

- Safety Needles

The global needle market is divided by needle type into conventional needles and safety needles categories. Out of these, the safety needles segment will dominate the market due to their ability to reduce injuries and infections caused by needlesticks. It is also attributed to the higher emphasis on the safety of healthcare workers and patients and stricter regulations to promote safe medical practices

Insight by Product

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

- Pen Needles

- Others.

The global needle market is also divided by-products into suture needles, blood collection needles, ophthalmic needles, dental needles, insufflation needles, pen needles, and others. Out of these, the suture needles segment will dominate the market due to its widespread use across a wide range of medical procedures, including wound closure and surgeries.

Insight by Material

- Glass Needles

- Plastic Needles

- Stainless Steel Needles

- Polyether Ether Ketone Needles

According to the material, the global needle market is split into glass needles, plastic needles, stainless steel needles, and polyether ether ketone needles segments. Among all these segments, stainless-steel needles dominate the market. They will continue doing so due to their robustness, durability, strength, and widespread applicability across a wide range of medical and industrial sectors.

Insight by Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

The global needle market is divided by delivery modes into hypodermic needles, intravenous needles, intramuscular needles, and intraperitoneal needles segments. Out of all these segments, the hypodermic needles segment will dominate the market due to higher versatility in application and widespread use across a wide range of medical processes, including drug administration and vaccinations. It is also attributed to the prevalence of subcutaneous injections in healthcare.

Insight by Distribution Channel

- Direct Tenders

- Retail

The global needle market is divided by distribution channels into direct tenders and retail segments. Among these two segments, the direct tenders segment will dominate the market due to purchases made in bulk by government organizations and healthcare institutions. The cost-effectiveness of direct tenders also propels its dominance and market growth.

Insight by End-User

- Hospitals

- Diagnostic Centers

- Home Healthcare

- Other End Users

According to the end users, the global needle market is divided into hospitals, diagnostic centers, home healthcare, and other end users. Out of all these segments, the hospitals and diagnostic centers segment is expected to dominate the market during the forecast period due to the growing volume of medical procedures conducted here, such as surgeries, diagnostics, and treatments.

Global Needle Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 9.14 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 18.13 Billion |

|

Growth Rate |

7.09% |

|

Segments Covered in the Report |

By Type, By Product, By Material, By Delivery Mode, By Distribution Channel and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Industry Trends

Technological developments have introduced microneedles that offer painless drug delivery, being minimally invasive. Additionally, specific medical conditions such as multiple sclerosis, rheumatoid arthritis, and even a few specific types of cancers have grown significantly during the past couple of months, needing injectable medications for administering medical treatments.

Needle Market Growth Drivers

The growth of the global needle market is propelled by a large number of factors including the growth of healthcare sector especially in developing economies. It is also attributed to the rising elderly population in need for continual medical interventions that require using needles. Additionally, the stringent government regulations regarding blood safety and increased awareness about screening and blood donation together propels the market growth.

Needle Market Challenges

The growing preference for needle-free injection technology and its higher usage is hindering the growth of the global needle market in the healthcare sector. Apart from that, apprehension among patients about injectable medications prevents higher adoption and hinders market growth.

Needle Market Opportunities

In addition, the adoption of advanced technologies to ensure higher efficiency and the tech developments to produce microneedles also promote market growth. Higher investments from the market players for further development of the products fuel the market expansion as well.

Needle Market Geographic Overview

North America leads the market due to robust healthcare infrastructure and safety protocols, as well as the existence of major industry players offering innovative needles with better safety features. The growth is also attributed to the region's higher commitment to innovative medical practices and a robust regulatory framework.

The Asia-Pacific, European, and other markets are also expected to grow at a reasonably high rate during the forecast period due to developing healthcare infrastructure, higher expenditure in healthcare, and a greater focus on safety protocols and a strict regulatory environment.

Needle Market Competitive Insight

Becton Dickinson and Company (BD) holds a prominent position in the global needle market, showcasing leadership through diverse product lines and strategic initiatives. BD's comprehensive range includes safety needles, insulin syringes, and blood collection needles, reflecting a commitment to innovation and addressing varied healthcare needs. Strategic partnerships, like the collaboration with Apax Partners, highlight BD's efforts in advancing technologies. Additionally, BD's acquisition of C. R. Bard in 2017 broadened its portfolio, strengthening its position in needle-related medical devices. These initiatives signify BD's adaptability, innovation, and commitment to meet evolving market demands, solidifying its influential role in shaping the trajectory of the global needle market.

3M holds a notable position in the global needle market, leveraging its diversified product lines and innovative solutions. 3M's focus on safety and precision is evident in its product offerings like the 3M™ Micronova™ Hypodermic Needle and 3M™ Scotch-Weld™ HiPURformer™ Advanced Composite Applicator, showcasing versatility and reliability. Collaborations with healthcare institutions and organizations demonstrate 3M's commitment to addressing evolving industry needs. For instance, partnerships with the Mayo Clinic exemplify its dedication to advancing medical technologies. 3M's strategic acquisitions, such as the purchase of Acelity in 2019, further reinforce its standing in healthcare solutions. Through a combination of cutting-edge products and strategic initiatives, 3M continues to play a significant role in shaping the global needle market.

Recent Development by Key Players

Becton Dickinson has increased production of medical syringes in the United States after the country's drug regulator recommended not using some China-made syringes as part of its ongoing quality probe.

Medtronic (Global leader in healthcare technology) shall expand in Hyderabad with around USD 350 million investment on its research and development centre.

Key Players Covered in the Report

Becton Dickinson and Company, Terumo Corporation, Baxter International, 3M Company, Smiths Medical, Medtronic, Johnson & Johnson, Novo Nordisk, Nipro Corporation, Retractable Technologies, B. Braun Melsungen, Thermo Fisher Scientific, Ethicon, Boston Scientific, Ypsomed, Owen Mumford, HTL-STREFA, Gerresheimer, Smith & Nephew, Argon Medical Devices, Kamada, and Smith & Wesson Brands.

The Needle Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- By Type

- Conventional Needles

- Safety Needles

- By Product

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

- Pen Needles

- Other Needles

- By Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

- By Material

- Glass Needles

- Plastic Needles

- Stainless Steel Needles

- Polyether Ether Ketone Needles

- By Distribution Channel

- Direct Tenders

- Retail

- By End User

- Hospitals and Diagnostic Centers

- Home Healthcare

- Others

Geographical Segmentation

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Needle Market