Remote Patient Monitoring Market Size & Share | Growth Forecast Report (2025-2035)

Industry Insight by Component (Hardware, Software, Services), End-User (Hospitals & Clinics, Home Care Settings, Ambulatory Care, Long-Term Care Facilities), Application (Cardiology, Diabetes Management, Respiratory Care, Others (Post-Operative Care, General Wellness)), Business Model (Subscription-Based, Pay-Per-Device / One-Time Purchase, Bundled Solutions, Hybrid Models)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1307 | Industry : Healthcare | Available Format :

|

Page : 180 |

Remote Patient Monitoring Market Size & Share | Growth Forecast Report (2025-2035)

Industry Insight by Component (Hardware, Software, Services), End-User (Hospitals & Clinics, Home Care Settings, Ambulatory Care, Long-Term Care Facilities), Application (Cardiology, Diabetes Management, Respiratory Care, Others (Post-Operative Care, General Wellness)), Business Model (Subscription-Based, Pay-Per-Device / One-Time Purchase, Bundled Solutions, Hybrid Models)

Remote Patient Monitoring Market Overview

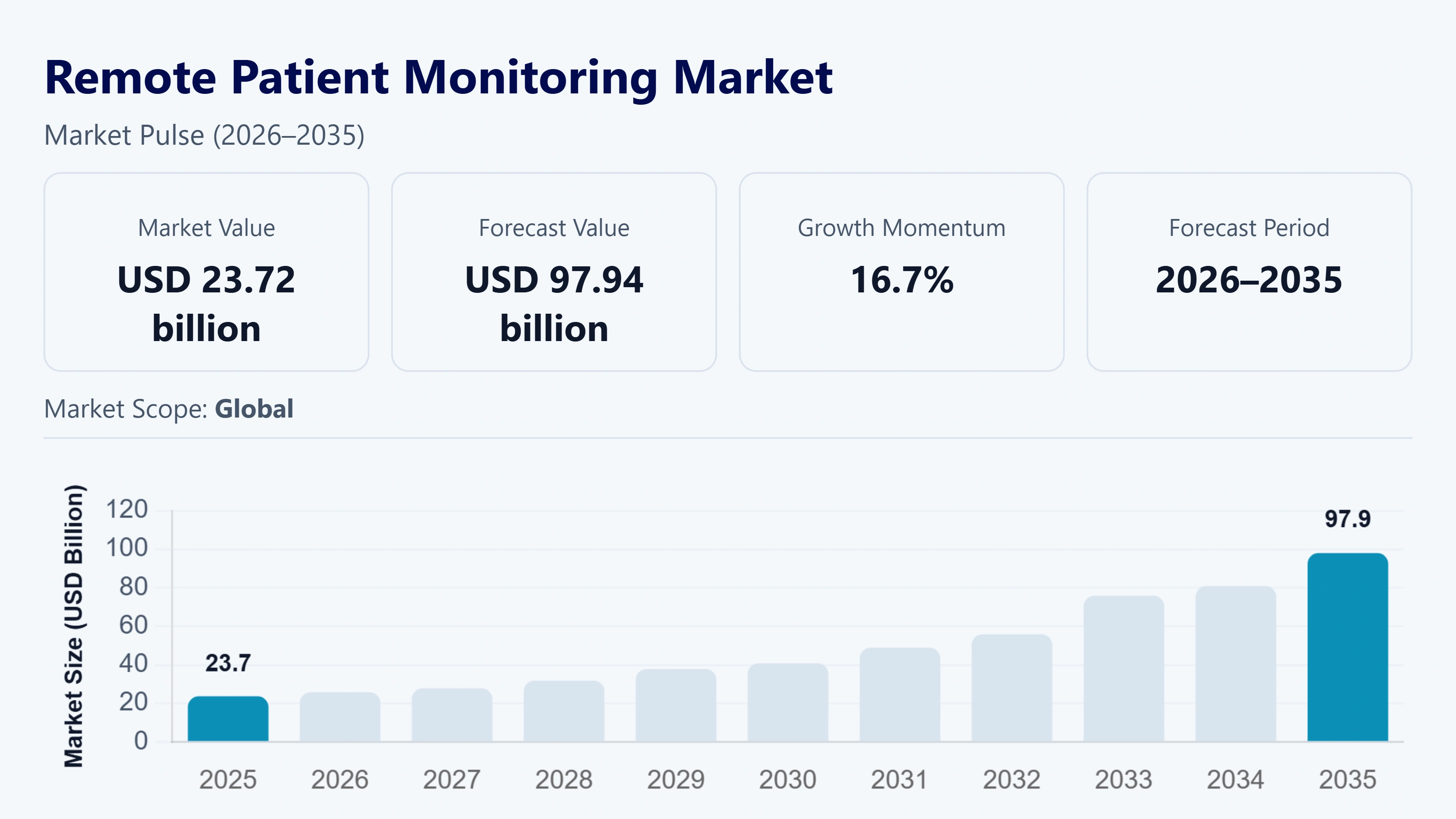

The global remote patient monitoring market was valued roughly at USD 23.72 billion in 2025 and estimated to rise USD 24.86 in 2026, is projected to reach nearly USD 97.94 billion by 2035, registering a compound annual growth rate (CAGR) of about 16.7% within the period 2026 to 2035.

A big reason this market is moving upward is simply the number of people who now live with health issues that don’t really go away. Things like sugar problems, heart trouble or breathing difficulty need someone to keep an eye on them regularly. Since going to a hospital again and again is tiring, many families find it easier when basic checks can happen from home and the doctor still gets the updates.

Another thing pushing the market is how quickly hospitals and small clinics are picking up simple digital tools. Earlier, most things needed a physical visit, but now many places use small devices or apps to collect readings and pass them on to the doctor. It cuts down a lot of unnecessary trips and helps the doctor step in early when something looks off.

Remote Patient Monitoring Industry Dynamics

Market Trends

One trend in the remote patient monitoring market is the rise of wearable devices. People now check their heart rate, oxygen, or sleep at home. Doctors trust these readings more, making remote patient monitoring a regular part of care.

Another trend is home-based care. Families prefer looking after patients at home, and doctors get updates in real-time. This reduces hospital visits and helps patients get quick guidance when needed.

Growth Drivers

A key driver of the remote patient monitoring industry is the growing elderly population. Many cannot travel easily, so remote monitoring helps doctors track their health from home. This makes daily care easier for families.

Another driver is hospital pressure to cut unnecessary visits. Monitoring patients at home allows early detection of problems, lowering complications and treatment costs.

The third driver is faster adoption of digital tools. Clinics now use apps and connected devices to collect data, saving time and making care more efficient.

Market Restraints / Challenges

Starting a remote patient monitoring program isn’t simple for small clinics. Imagine a rural hospital trying to track patients with heart conditions—buying the necessary sensors and software can cost more than they can afford, and that often means some patients don’t get monitored at all.

Rules around patient data make things even harder. One misstep, like storing information the wrong way, could bring fines or legal trouble. Clinics end up spending hours just making sure they don’t break any regulations.

Even when the money and rules are handled, equipment can still be a problem. Shipments of monitors or wearables sometimes arrive late, especially in remote areas. That delay can mean a patient waits days for critical monitoring, which no doctor wants.

Market Opportunities

Collaborating with insurers or tech companies lets them provide care they couldn’t otherwise offer, opening new markets.

Connected devices and apps collect continuous data. Quick intervention becomes possible, driving investment in reliable devices and software.

Government policies supporting telehealth encourage adoption. As more providers implement RPM, opportunities expand for technology providers and service companies.

Home-based monitoring reduces stress for patients and increases engagement. Doctors can watch vital signs without requiring hospital visits, which drives demand for monitoring solutions.

Small clinics gain access to tools through partnerships. This allows them to offer advanced care while creating opportunities for technology suppliers.

Policy support and insurance coverage make remote monitoring more appealing. When providers adopt these solutions, it not only improves patient care but also expands the market for all companies involved in remote patient monitoring.

Global Remote Patient Monitoring Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 23.72 Billion |

|

Revenue Forecast in 2035 |

USD 97.94 Billion |

|

Growth Rate |

16.7% |

|

Segments Covered in the Report |

By Component, By End-User, By Application, By Business Model |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

|

|

Customization |

|

Remote Patient Monitoring Market Segmentation

By Component

Devices currently dominate the RPM market. In 2024, the overall RPM devices‑market size was about USD 50.39 billion.

This reflects widespread demand for wearables, BP monitors, glucometers and other hardware. Even as devices lead now, the software and services piece are growing faster — software/services part of RPM is forecast to grow rapidly through 2030–2034.

Growth in software and services is driven by cloud‑based platforms, patient‑data analytics and remote‑care management — features increasingly needed by hospitals and chronic patients.

Thus, while devices provide the backbone, software/services segment offers higher growth potential — presenting strong opportunity for tech‑firms, SaaS providers, and support‑service vendors.

By Application / Disease Indication

Cardiology (heart‑related care) remains the largest application in RPM. In 2024, cardiac‑monitoring applications led global RPM usage among indications. This is driven by high prevalence of heart disease and growing need for continuous cardiac monitoring.

Alongside cardiology, chronic disease management (like diabetes and respiratory conditions) is rising. Demand for monitoring vitals, glucose levels and chronic care outside hospitals fuels growth in multi‑disease RPM solutions.

Continuous remote tracking helps avoid hospital readmissions and supports long‑term care — making RPM attractive for chronic illnesses and elderly care. That broad patient base increases market demand beyond acute care.

Therefore, RPM providers offering multi‑disease, customizable monitoring platforms stand to benefit, tapping into large segments like cardiac, diabetes and elderly‑care — creating room for diversified product lines in the market.

By End‑User / Deployment Setting

Hospitals and clinical settings remain the largest end‑user segment globally. In 2024, hospital‑based patients accounted for over 61.5 % of RPM system usage worldwide. Use here includes post‑operative monitoring and acute care, where continuous vital‑sign tracking adds value.

At the same time, home‑care and long‑term care settings are growing fast. As patients with chronic diseases seek convenience and safety, home‑based RPM adoption is rising — providing regular monitoring without hospital visits.

This shift expands the market opportunity for at‑home RPM devices and subscription‑based remote‑care services. It opens chances for consumer‑oriented device makers and home‑health platforms.

Hence companies offering affordable, easy‑to‑use home monitoring kits — along with remote‑care support — can capture growing demand as end‑users move away from hospital‑only RPM.

By Business Model / Pricing Type

In many RPM deployments the subscription model is gaining strong traction. Providers often charge monthly platform fees (for software, data analytics, remote monitoring services), typically ranging from US $10–50 per patient per month, which ensures predictable recurring revenue. As chronic‑disease burden grows globally, recurring‑revenue models encourage retention and long‑term monitoring, boosting market stability.

Hybrid pricing models combining one‑time device sales with ongoing subscription for software and support have emerged as popular. Clinics or hospitals buy the hardware upfront (monitors, wearables), then pay monthly or yearly for data services — this lowers the initial entry barrier while enabling lifetime value via recurring fees. This model appeals especially to mid‑size clinics and emerging‑market providers seeking cost‑effective RPM adoption.

Pure device‑sale (one‑time purchase) models remain relevant, especially for small clinics or regions with limited insurance/ reimbursement coverage. In such contexts, providers or patients purchase hardware outright, avoiding recurring expenses. This model ensures immediate revenue for vendors and supports market penetration in lower‑income segments or areas with less developed telehealth infrastructure.

Revenue streams based on value‑based care or insurance reimbursement contracts are becoming an important model. As payers — insurance companies or governments — reimburse RPM services, providers gain incentive to enroll chronic patients under RPM, reducing hospital readmissions and long‑term costs. This helps drive broader adoption, creating opportunity both for RPM service providers and supporting technology firms over long‑term contracts.

Regional Insights

North America

North America remains the largest RPM market globally, holding around 40–42% of global RPM revenue share in 2024.

The region’s advanced healthcare infrastructure, widespread telehealth adoption, and strong insurance/reimbursement support drive high uptake of RPM systems. RPM device shipments are substantial — recent data point to over 120 million units shipped in 2024 across the region, indicating a deep penetration of monitoring tools in hospitals and home‑care alike.

The U.S., in particular, leads with a majority of these shipments, boosting scale and vendor confidence in expanding RPM offerings. Chronic diseases (cardiac, diabetes, hypertension) are widespread in North America; that chronic‑care burden creates continuous demand for remote monitoring beyond hospital stays.

As patients increasingly prefer home‑based follow-up, RPM is becoming a standard part of long‑term disease management here. Strong regulatory and reimbursement frameworks reinforce RPM adoption. Government and private payers in the U.S. cover remote‑monitoring services more broadly now, which reduces cost barriers for patients and encourages providers to integrate RPM into care pathways — sustaining growth momentum.

Asia Pacific

Asia Pacific stands out as the fastest‑growing RPM region, projected to grow at a high CAGR owing to rising digital‑health investments, expanding chronic‑disease patient base, and increasing healthcare access initiatives. In 2024, the region held roughly around 20–25% global share in RPM revenues.

Large and densely populated countries like China, India, and others are expanding adoption of wearable devices and connected monitoring platforms to manage rising cases of chronic illnesses. Home‑care RPM and remote clinics are gradually replacing only hospital‑based care — especially in rural or semi‑urban areas — which widens the customer base significantly.

Governments in these countries are increasingly promoting digital health infrastructure and telemedicine frameworks. National programs, healthcare reform, and improved internet/mobile penetration make RPM more viable and affordable across socioeconomic segments.

Manufacturers and vendors are responding with cost‑effective devices and scalable RPM platforms tailored to local needs (multi‑lingual apps, low-cost wearables, cloud-based systems). This localization helps accelerate adoption in markets that previously lacked access to advanced monitoring — fueling strong growth in the RPM business in Asia Pacific.

Europe

Europe holds the second‑largest RPM market share after North America, with estimates around 25–30% of global RPM revenues in 2024.

The region benefits from robust public‑healthcare systems, regulatory support for telehealth, and increasing emphasis on preventive care, all of which support RPM adoption. An aging population and high prevalence of chronic diseases such as cardiovascular, respiratory, and diabetes are pushing demand for long‑term health monitoring — something RPM is well‑placed to deliver.

As hospitals and clinics integrate RPM tools to manage outpatient care and reduce readmissions, market adoption grows steadily. Cross‑country collaborations and EU‑level digital health strategies are encouraging standardization of remote‑care platforms, creating interoperability and boosting vendor confidence. This regulatory and structural support reduces barriers for RPM solution providers and speeds up rollouts across multiple European markets.

Insurance and reimbursement frameworks across many European countries support RPM services for chronic and elderly care, making it financially viable for patients and healthcare systems alike. As a result, demand is sustained not just for devices but also for software and continuous remote‑care services — broadening the RPM market beyond one‑time purchases.

Competitive Landscape / Company Insights

Mini Profiles

Philips Healthcare is a global leader in RPM thanks to its strong Connected Care division. The company builds systems that link hospitals, clinics, and patients at home — offering wearable sensors, monitoring platforms and analytics dashboards that help clinicians track vital signs, manage chronic diseases, and reduce hospital readmissions.

Medtronic brings a broad medicaldevice portfolio to RPM, covering cardiac care, diabetes, postoperative monitoring and more. It leverages its implantable and wearable technologies alongside remote monitoring software — giving it a strong foothold in both criticalcare and chroniccare RPM segments worldwide.

Abbott Laboratories focuses on chronic disease management with RPM tools — especially for diabetes and metabolic disorders. Its diagnostic devices and remotecare products help patients track health metrics at home, enabling continuous monitoring and preventive care outside hospital walls.

GE HealthCare integrates RPM into its broader patientcare solutions, including remote monitoring, respiratory, cardiac, and general vitalsign tracking. GE HealthCare’s strength lies in combining traditional hospitalgrade monitoring with cloudenabled remote care, bridging inhospital and athome patient management.

ResMed primarily addresses sleep, respiratory and chroniccare RPM needs. With a history in homecare respiratory devices, ResMed adapts its product range to include connected CPAP devices and remote monitoring platforms — making it a notable name in respiratory and sleeprelated RPM use cases.

Recent Developments

In May 2025, Masimo received FDA 510(k) clearance for its “Masimo W1” watch, expanding its indications for continuous and spotcheck measurements of heart rate and oxygen saturation (SpO2), making it a viable option for remote monitoring in clinical and homecare settings.

In April 2025, Dexcom released its “G8 Continuous Glucose Monitoring (CGM) System,” boasting lower latency and expanded compatibility with smartphones and wearables. This helps improve remote glucose monitoring for diabetic patients and supports increased adoption of RPM-enabled diabetes care.

In 2025, Teladoc Health added a workplacesafety monitoring capability to its AIenabled “Clarity™” platform for hospitals and healthsystems. While not strictly a patientvitalsign use case, this expansion shows how RPM / healthmonitoring firms are broadening their services to include environmental and patientsafety monitoring.

In October 2024, Omron Healthcare announced its “Home Health Connect” platform, a remotepatientmonitoring solution featuring connected BP monitors, pulse oximeters, and a cloudbased clinician portal — indicating it is actively expanding its RPM footprint beyond just devices.

In early 2025, the RPM market saw several strategic partnerships and expansions; while direct BioTelemetry news was limited in recent public summaries, the broader market trends (like rise in cloudbased multiparameter monitoring and AI analytics) indicate growing opportunity for firms in its segment.

Global Remote Patient Monitoring Market Coverage

Component Insight and Forecast 2026 - 2035

- Hardware

- Software

- Services

End-User Insight and Forecast 2026 - 2035

- Hospitals & Clinics

- Home Care Settings

- Ambulatory Care

- Long-Term Care Facilities

Application Insight and Forecast 2026 - 2035

- Cardiology

- Diabetes Management

- Respiratory Care

- Others (Post-Operative Care

- General Wellness)

Business Model Insight and Forecast 2026 - 2035

- Subscription-Based

- Pay-Per-Device / One-Time Purchase

- Bundled Solutions

- Hybrid Models

Global Remote Patient Monitoring Market by Region

- North America

- By Component

- By End-User

- By Application

- By Business Model

- By Country - U.S., Canada, Mexico

- Europe

- By Component

- By End-User

- By Application

- By Business Model

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Component

- By End-User

- By Application

- By Business Model

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Component

- By End-User

- By Application

- By Business Model

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Remote Patient Monitoring Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component

1.2.2. By

End-User

1.2.3. By

Application

1.2.4. By

Business Model

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. Hardware

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Software

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Services

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By End-User

5.2.1. Hospitals & Clinics

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Home Care Settings

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Ambulatory Care

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Long-Term Care Facilities

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Application

5.3.1. Cardiology

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Diabetes Management

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Respiratory Care

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Others (Post-Operative Care

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. General Wellness)

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.4. By Business Model

5.4.1. Subscription-Based

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Pay-Per-Device / One-Time Purchase

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Bundled Solutions

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Hybrid Models

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Component

6.2. By

End-User

6.3. By

Application

6.4. By

Business Model

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Component

7.2. By

End-User

7.3. By

Application

7.4. By

Business Model

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Component

8.2. By

End-User

8.3. By

Application

8.4. By

Business Model

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Component

9.2. By

End-User

9.3. By

Application

9.4. By

Business Model

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

Philips Healthcare

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

Medtronic

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

Abbott Laboratories

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

GE HealthCare

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

ResMed

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

Masimo Corporation

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Omron Healthcare

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

Dexcom, Inc.

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

BioTelemetry (Philips)

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

10.10.

Teladoc Health

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Remote Patient Monitoring Market