Mobile Wallet and Payment Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Technology (QR-Based Payments, Digital-Only Wallets, Text-Based Payments), by Payment Type (Proximity Payments, Remote Payments), by Transaction Mode (Near Field Communication (NFC), Mobile Web Payments, Short Message Service (SMS), Direct Carrier Billing, Other Transaction Modes), by Payment Nature (Person to Person (P2P), Person to Business (P2B), Business to Person (B2P), Business to Business (B2B)), by End User (Personal, Business)

| Status : Published | Published On : Feb, 2026 | Report Code : VRICT5215 | Industry : ICT & Media | Available Format :

|

Page : 190 |

Mobile Wallet and Payment Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Technology (QR-Based Payments, Digital-Only Wallets, Text-Based Payments), by Payment Type (Proximity Payments, Remote Payments), by Transaction Mode (Near Field Communication (NFC), Mobile Web Payments, Short Message Service (SMS), Direct Carrier Billing, Other Transaction Modes), by Payment Nature (Person to Person (P2P), Person to Business (P2B), Business to Person (B2P), Business to Business (B2B)), by End User (Personal, Business)

Mobile Wallet and Payment Market Overview

The mobile wallet and payment market which was valued at approximately USD 322.00 billion in 2025 and is estimated to rise further up to almost USD 392.20 billion by 2026 is projected to reach around USD 2313.82 billion by 2035, expanding at a CAGR of about 21.8% during the forecast period from 2026 to 2035.

Market growth is driven by rapid smartphone penetration, expansion of digital commerce ecosystems, and increasing preference for cashless transactions, along with rising adoption of contactless and QR code-based payment solutions.

Growing consumer demand for secure, convenient, and real time payment experiences, supported by large scale investments in digital payment infrastructure, regulatory frameworks, and financial inclusion programs led by central banks and government backed financial authorities, is further supporting market expansion across Asia Pacific, North America, and Europe where digital payment adoption is structurally accelerating.

Mobile Wallet and Payment Market Dynamics

Market Trends

The market is witnessing a clear shift toward digital first and contactless transaction ecosystems, driven by changing consumer payment behavior and increasing reliance on mobile based financial services. One of the most prominent trends shaping the market is the rapid adoption of QR code and near field communication enabled payment solutions, reflecting growing preference for transaction speed convenience and reduced physical cash handling. Government backed digital payment frameworks promoted by central banks and financial authorities, including initiatives supporting interoperable payment infrastructure and instant settlement systems, are reinforcing adoption across retail and service ecosystems.

Another emerging trend is the integration of mobile wallets with broader financial services such as bill payments micro lending and digital identity verification, driven by regulatory alignment and rising smartphone penetration. Public sector digital economy programs and national financial inclusion strategies are encouraging providers to focus on integrated platforms value added services and enhanced security features, thereby redefining competitive dynamics within the market.

Growth Drivers

Growth of the mobile wallet and payment market is strongly supported by expanding digital commerce activity and increasing consumer preference for cashless transactions across both urban and semi urban populations. Government investments in national digital payment infrastructure real time payment rails and open banking frameworks led by central banks and monetary authorities continue to generate consistent demand across retail transportation utilities and peer to peer payment applications. These initiatives are aligned with broader policy objectives focused on financial inclusion transaction transparency and reduction of cash dependency.

In addition, rising emphasis on secure and compliant digital transactions is playing a crucial role in accelerating adoption. As consumers and enterprises prioritize transaction security regulatory compliance and seamless user experience demand for mobile wallet-based payment solutions are expected to remain strong throughout the forecast period. Regulatory support for digital know your customer processes consumer protection frameworks and cybersecurity standards further strengthens market expansion.

Market Restraints / Challenges

Despite strong growth potential the market faces challenges related to cybersecurity risks and regulatory complexity. Government reports issued by financial regulators highlight that increasing incidents of digital fraud data breaches and unauthorized transactions continue to affect consumer trust particularly in emerging digital payment markets. Compliance with evolving data protection payment security and consumer safeguarding regulations adds operational complexity for service providers.

Additionally, dependence on digital infrastructure availability and smartphone access poses challenges in certain regions. Limited network coverage digital literacy gaps and uneven access to secure devices can restrict adoption among rural and low-income populations. These structural constraints can lead to scalability challenges and uneven market penetration during periods of economic or technological transition.

Market Opportunities

The market presents significant opportunities through expanding financial inclusion initiatives and growing adoption of digital payments among previously underserved populations. Government backed programs promoting cashless economies direct benefit transfers and digital identity linked payment systems are creating demand for affordable and interoperable mobile wallet solutions. Providers offering simplified user interfaces multilingual support and low-cost transaction models are well positioned to capture incremental demand from first time digital payment users.

Another key opportunity lies in the integration of mobile wallets with advanced digital services such as biometric authentication embedded finance and cross border payment capabilities. Rising public investment in digital public infrastructure and smart governance platforms is opening avenues for premium and technology enabled offerings. Advancements in artificial intelligence driven fraud detection and real time analytics are expected to enhance transaction security strengthen user confidence and support long term market growth.

Global Mobile Wallet and Payment Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 322.00 Billion |

|

Revenue Forecast in 2035 |

USD 2313.82 Billion |

|

Growth Rate |

21.8% |

|

Segments Covered in the Report |

By Technology, By Channel of Payment, By Transaction Mode, By Payment Nature, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, LAMEA, Other Regions |

|

Key Companies |

Amazon Web Services Inc., American Express, Apple Inc., Google LLC, Mastercard Inc, Tencent Holdings Ltd., Visa, PayPal Payments Private Limited, Samsung Electronics Co Ltd |

|

Customization |

Available upon request |

Mobile Wallet and Payment Market Segmentation

By Technology

QR based payment technology accounted for approximately 36% of total market revenue in 2025, making it the largest technology segment. This dominance is supported by minimal infrastructure requirements, rapid merchant onboarding, and widespread adoption across small retailers and peer to peer payment ecosystems. Government backed digital payment frameworks promoting interoperable QR standards and low-cost acceptance infrastructure have reinforced adoption across emerging and developed markets.

Digital only wallet platforms represented nearly 33% of the market and are expected to register the fastest growth at approximately 23.1% during the forecast period. Growth is driven by increasing smartphone penetration, app based financial services, and integration of wallets with digital identity and instant payment systems.

Text based payment technologies accounted for the remaining 31%, supported by continued usage in basic mobile services and regions with limited access to advanced payment infrastructure.

By Channel of Payment

Proximity payments accounted for around 55% of total market revenue in 2025, supported by high transaction frequency in retail, transportation, and hospitality environments. The segment benefits from fast authentication, secure transaction protocols, and strong acceptance across point-of-sale terminals. Public sector initiatives promoting contactless payments in urban transit systems and retail digitization programs continue to reinforce demand.

Remote payments represented approximately 45% of the market and are expected to grow at a faster pace of nearly 21.4% through the forecast period. Expansion is driven by rising digital commerce activity, bill payments, subscription services, and remote service consumption supported by mobile web platforms and carrier billing systems.

By Transaction Mode

Near field communication-based transactions held the largest share at approximately 36% in 2025, reflecting strong adoption across contactless retail payments and transit ticketing systems.

Mobile web payments accounted for nearly 29%, driven by growth in e commerce and app-based service usage.

Short message service and direct carrier billing together contributed around 21%, supported by digital content purchases and telecom linked payment models.

Other transaction modes represented the remaining 14% and are projected to grow steadily at approximately 18.9%, supported by innovation in embedded payments and alternative transaction mechanisms aligned with national digital payment infrastructure development.

By Payment Nature

Person to business transactions dominated the market with approximately 41% share in 2025, supported by high frequency retail purchases and service payments. Government backed merchant digitization initiatives and transparent transaction frameworks have reinforced this segment.

Person to person transactions accounted for nearly 27%, driven by peer transfers and remittance use cases enabled by instant settlement systems.

Business to person and business to business transactions together represented approximately 32%, with this segment expected to grow at around 20.8% due to increasing adoption of digital disbursements, payroll processing, and enterprise payment platforms.

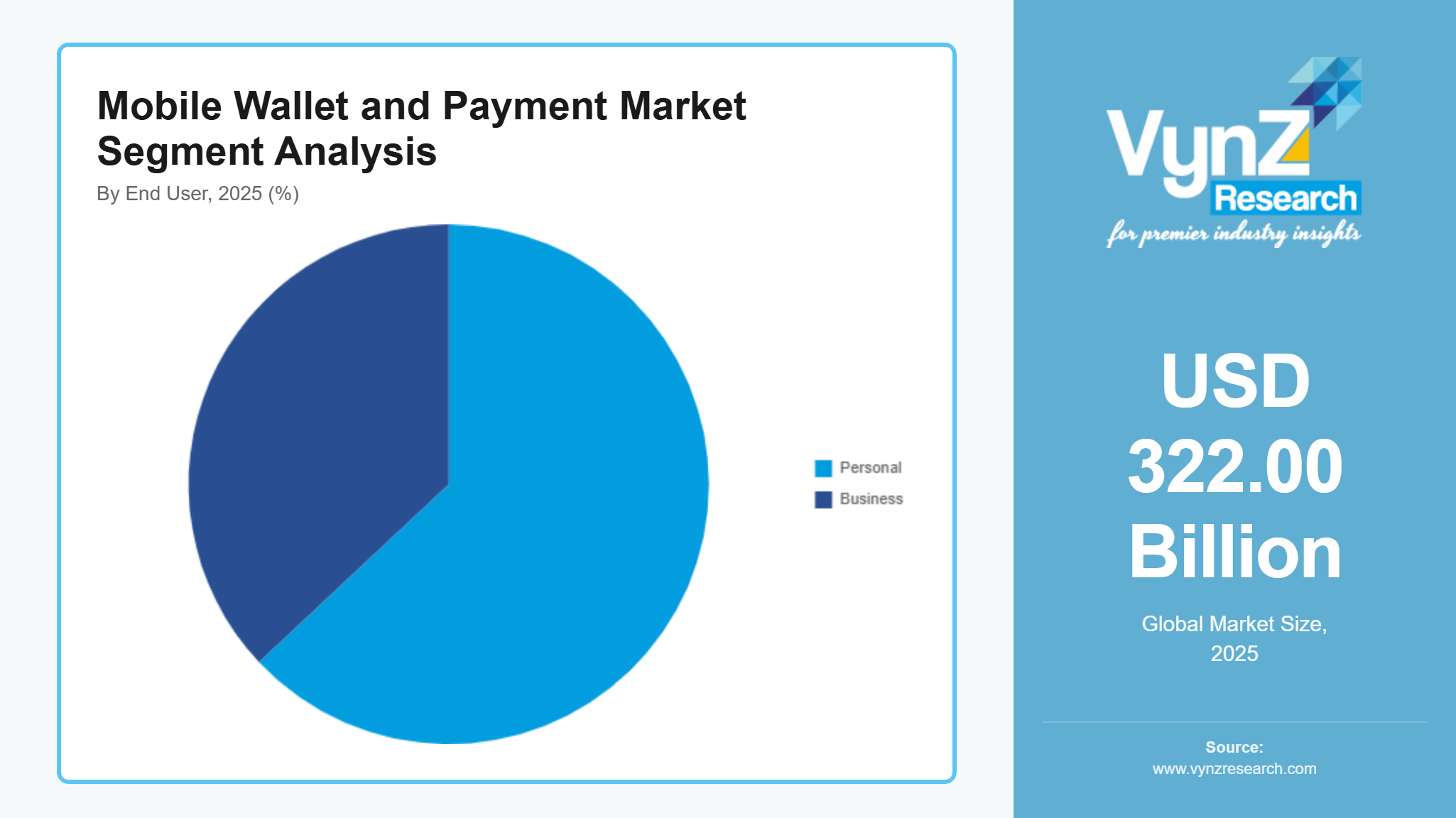

By End User

Personal users accounted for approximately 63% of total market revenue in 2025, making them the largest end user segment. Strong smartphone adoption, preference for cashless payments, and extensive use of wallets for daily transactions continue to support dominance. Government led financial inclusion and consumer digital payment initiatives further reinforce adoption.

Business users represented around 37% and are expected to register faster growth at approximately 21.9% during the forecast period, driven by rising merchant digitalization, wallet integration with enterprise systems, and demand for traceable and efficient payment solutions.

Regional Insights

North America

North America accounted for approximately 22% of the market in 2025, driven by high smartphone penetration, strong internet infrastructure, and consumer preference for cashless transactions. The United States leads adoption through Federal Reserve initiatives promoting faster payment systems, the Real-Time Payments (RTP) network, and regulatory frameworks supporting secure contactless and near-field communication payments. Canada is witnessing growing digital wallet penetration in retail, transit, and financial services, supported by the Canadian Payments Association’s modernization programs. Expansion of online retail platforms, government-backed fintech sandbox programs, and consumer awareness campaigns continue to strengthen regional market growth.

Europe

Europe is estimated to contribute approximately 18% to the market in 2025. Growth is supported by regulatory frameworks such as the European Union Payment Services Directive (PSD2), which encourages open banking, secure digital payments, and innovation in proximity and remote payment solutions. The UK, Germany, France, Spain, and Italy are witnessing strong adoption in retail, banking, and public transport systems, reinforced by government digital payment initiatives and subsidies for fintech development. Increasing acceptance of QR codes, NFC-based transactions, and mobile-only platforms in urban centers is further driving market expansion.

Asia Pacific

Asia Pacific is projected to account for roughly 28% of the market in 2025, reflecting strong smartphone adoption, rising e-commerce penetration, and government-led financial inclusion programs. China leads with central bank-backed mobile wallet initiatives, including digital yuan pilots and QR-based payment platforms integrated with banking infrastructure. India’s Unified Payments Interface (UPI) and Digital India program have accelerated adoption across urban and rural areas, while Japan, South Korea, and Australia continue to expand contactless and digital-only wallet usage. Rapid urbanization, growing consumer digital literacy, and integration with retail and transportation sectors are key drivers of regional market growth.

LAMEA (Latin America, Middle East, Africa)

LAMEA contributed around 9% to the global market in 2025. In Latin America, Brazil and Mexico are witnessing rising mobile wallet adoption supported by government-backed instant payment systems and fintech collaboration for retail and P2P payments. Middle Eastern countries, including the UAE and Saudi Arabia, are promoting cashless transactions through central bank regulations, smart city programs, and fintech sandbox initiatives. In Africa, mobile money platforms and regulatory support from institutions such as the Central Bank of Kenya are enabling financial inclusion in underserved regions. Expansion of online commerce, peer-to-peer transfers, and mobile banking infrastructure continues to reinforce adoption. The remaining 23% of the market is represented by other emerging regions not explicitly covered, which offer long-term strategic growth potential.

Competitive Landscape / Company Insights

The mobile wallet and payment market is moderately competitive, with global and regional players focusing on technology innovation, transaction security, and geographic expansion. Key vendors offer NFC-enabled solutions, QR-based platforms, and integrated digital payment ecosystems. Adoption is supported by government initiatives such as India’s Unified Payments Interface (UPI), China’s digital yuan pilot programs, the European Union Payment Services Directive (PSD2), and U.S. Federal Reserve faster payment frameworks, which promote secure, efficient, and interoperable digital transactions. These regulatory and policy measures encourage vendors to enhance their market position and capture long-term consumer and business contracts across North America, Europe, and Asia Pacific.

Mini Profiles

Alipay focuses on digital wallet services, mobile payments, and financial technology solutions, supported by extensive user base, strong brand recognition, and robust security protocols across Asia-Pacific.

American Express operates in premium and business-focused segments, emphasizing secure, high-performance payment solutions, customer loyalty programs, and integrated financial services for personal and corporate users.

Apple Inc. leverages device integration and digital ecosystem reach to expand its mobile wallet offerings globally, including Apple Pay, contactless payments, and seamless cross-platform transaction experiences.

Amazon Web Services Inc. provides cloud-based payment and transaction infrastructure, enabling mobile wallet operators, fintech firms, and enterprises to implement scalable, secure, and efficient digital payment platforms.

Visa Inc. offers global payment processing, digital wallets, and contactless solutions, supported by strategic partnerships, high reliability, and extensive network infrastructure connecting consumers, merchants, and financial institutions.

Key Players

- Amazon Web Services Inc.

- American Express

- Apple Inc.

- Google LLC

- Mastercard Inc

- Tencent Holdings Ltd.

- Visa

- PayPal Payments Private Limited

- Samsung Electronics Co Ltd

Recent Developments

In January 2026, Samsung Electronics Co., Ltd. has announced a significant enhancement to Samsung Care+, its official device protection service, available across 17 European markets, including the United Kingdom. From January, customers choosing Samsung Care+ can enjoy new features and services, providing peace of mind for Galaxy mobile phone, tablet, wearable and PC owners.

In January 2026, Thales which is a global technology leader in the Defense, Aerospace, Cybersecurity, and Digital sectors, and Samsung Electronics, announce today the signing of a Memorandum of Understanding (MoU) aimed at expanding the availability of the Cryptosmart solution in selected Latin American markets, with an initial focus on Brazil, redefining data protection for the corporate and government sectors.

In November 2025, ACI Worldwide, an original innovator in global payments technology has acquired Payment Components, a provider of AI-powered financial messaging and Open Banking solutions. ACI will integrate Payment Components technology into ACI Connetic, accelerating the roadmap of the industry's only cloud-native unified payments platform that seamlessly integrates account-to-account (A2A) payments, card processing, and AI-powered fraud prevention within a single, modular cloud-native architecture.

Global Mobile Wallet and Payment Market Coverage

Technology Insight and Forecast 2026 - 2035

- QR-Based Payments

- Digital-Only Wallets

- Text-Based Payments

Payment Type Insight and Forecast 2026 - 2035

- Proximity Payments

- Remote Payments

Transaction Mode Insight and Forecast 2026 - 2035

- Near Field Communication (NFC)

- Mobile Web Payments

- Short Message Service (SMS)

- Direct Carrier Billing

- Other Transaction Modes

Payment Nature Insight and Forecast 2026 - 2035

- Person to Person (P2P)

- Person to Business (P2B)

- Business to Person (B2P)

- Business to Business (B2B)

End User Insight and Forecast 2026 - 2035

- Personal

- Business

Global Mobile Wallet and Payment Market by Region

- North America

- By Technology

- By Payment Type

- By Transaction Mode

- By Payment Nature

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Technology

- By Payment Type

- By Transaction Mode

- By Payment Nature

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Technology

- By Payment Type

- By Transaction Mode

- By Payment Nature

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Technology

- By Payment Type

- By Transaction Mode

- By Payment Nature

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Mobile Wallet and Payment Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Technology

1.2.2. By

Payment Type

1.2.3. By

Transaction Mode

1.2.4. By

Payment Nature

1.2.5. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Technology

5.1.1. QR-Based Payments

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Digital-Only Wallets

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Text-Based Payments

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Payment Type

5.2.1. Proximity Payments

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Remote Payments

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Transaction Mode

5.3.1. Near Field Communication (NFC)

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Mobile Web Payments

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Short Message Service (SMS)

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Direct Carrier Billing

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Other Transaction Modes

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.4. By Payment Nature

5.4.1. Person to Person (P2P)

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Person to Business (P2B)

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Business to Person (B2P)

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Business to Business (B2B)

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.5. By End User

5.5.1. Personal

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Business

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Technology

6.2. By

Payment Type

6.3. By

Transaction Mode

6.4. By

Payment Nature

6.5. By

End User

6.5.1.

U.S. Market Estimate and Forecast

6.5.2.

Canada Market Estimate and Forecast

6.5.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Technology

7.2. By

Payment Type

7.3. By

Transaction Mode

7.4. By

Payment Nature

7.5. By

End User

7.5.1.

Germany Market Estimate and Forecast

7.5.2.

U.K. Market Estimate and Forecast

7.5.3.

France Market Estimate and Forecast

7.5.4.

Italy Market Estimate and Forecast

7.5.5.

Spain Market Estimate and Forecast

7.5.6.

Russia Market Estimate and Forecast

7.5.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Technology

8.2. By

Payment Type

8.3. By

Transaction Mode

8.4. By

Payment Nature

8.5. By

End User

8.5.1.

China Market Estimate and Forecast

8.5.2.

Japan Market Estimate and Forecast

8.5.3.

India Market Estimate and Forecast

8.5.4.

South Korea Market Estimate and Forecast

8.5.5.

Vietnam Market Estimate and Forecast

8.5.6.

Thailand Market Estimate and Forecast

8.5.7.

Malaysia Market Estimate and Forecast

8.5.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Technology

9.2. By

Payment Type

9.3. By

Transaction Mode

9.4. By

Payment Nature

9.5. By

End User

9.5.1.

Brazil Market Estimate and Forecast

9.5.2.

Saudi Arabia Market Estimate and Forecast

9.5.3.

South Africa Market Estimate and Forecast

9.5.4.

U.A.E. Market Estimate and Forecast

9.5.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

Amazon Web Services Inc.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

American Express

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

Apple Inc.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

Google LLC

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

Mastercard Inc

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

Tencent Holdings Ltd.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Visa

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

PayPal Payments Private Limited

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

Samsung Electronics Co Ltd

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

10.10.

Amazon Web Services Inc.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5.

Recent

Developments

10.11.

American Express

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5.

Recent

Developments

10.12.

Apple Inc.

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5.

Recent

Developments

10.13.

Google LLC

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5.

Recent

Developments

10.14.

Mastercard Inc

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5.

Recent

Developments

10.15.

Tencent Holdings Ltd.

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5.

Recent

Developments

10.16.

Visa

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5.

Recent

Developments

10.17.

PayPal Payments Private Limited

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5.

Recent

Developments

10.18.

Samsung Electronics Co Ltd

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Mobile Wallet and Payment Market