India Data Center Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Component (IT and Network Equipment, Power and Cooling Infrastructure, General Construction and Physical Infrastructure), by Type of Data Center (Colocation Data Centers, Hyperscale Data Centers, Enterprise Captive Data Centers), by Size of Data Center (Large Data Centers, Medium-Sized Data Centers, Small Data Centers), by Tier Type (Tier I & II Data Centers, Tier III Data Centers, Tier IV Data Centers), by End User (Cloud Service Providers & Colocation Operators, Telecom Operators & Internet Service Providers, Enterprises (BFSI, Healthcare, E-Commerce, Government, etc.))

| Status : Published | Published On : Feb, 2026 | Report Code : VRICT5214 | Industry : ICT & Media | Available Format :

|

Page : 120 |

India Data Center Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Component (IT and Network Equipment, Power and Cooling Infrastructure, General Construction and Physical Infrastructure), by Type of Data Center (Colocation Data Centers, Hyperscale Data Centers, Enterprise Captive Data Centers), by Size of Data Center (Large Data Centers, Medium-Sized Data Centers, Small Data Centers), by Tier Type (Tier I & II Data Centers, Tier III Data Centers, Tier IV Data Centers), by End User (Cloud Service Providers & Colocation Operators, Telecom Operators & Internet Service Providers, Enterprises (BFSI, Healthcare, E-Commerce, Government, etc.))

India Data Center Market Overview

The India data center market which was valued at approximately USD 10.32 billion in 2025 and is estimated to rise further up to almost USD 11.61 billion by 2026, is projected to reach around USD 33.48 billion by 2035, expanding at a CAGR of about 12.4% during the forecast period 2026 to 2035.

Market growth is driven by escalating hyperscale cloud investments aligned with Digital India incentives, mandatory data localization under the Digital Personal Data Protection Act, and surging artificial intelligence workload demands, along with increasing adoption of high-density rack and edge computing architectures.

Rising demand for sovereign data storage across BFSI and government segments and ongoing investments in submarine cable connectivity and renewable power sourcing are further supporting market expansion across major regions including Mumbai, Chennai, and Bengaluru. The Government of India’s emphasis on cloud adoption through initiatives such as the Government Community Cloud and smart cities programs further accelerates infrastructure deployment and digital transformation priorities.

India Data Center Market Dynamics

Market Trends

The market is undergoing a structural transition toward hyperscale-oriented and cloud-native infrastructure architectures aligned with national digitalization priorities and regulatory frameworks supporting sovereign data hosting. Policy-driven localization mandates under the Digital Personal Data Protection Act and infrastructure expansion under the Digital India program are accelerating deployment of large-scale campuses with high-power-density and software-defined networking capabilities. Government-supported connectivity initiatives led by the Department of Telecommunications and the Bharat Net program are further enabling regional data center expansion by improving fiber backhaul and redundancy across tier two and tier three cities.

Operators are increasingly deploying energy-efficient cooling systems, liquid immersion technologies, and artificial-intelligence-based workload management platforms to improve power usage effectiveness and operational reliability. National energy efficiency guidelines issued by the Bureau of Energy Efficiency and renewable integration targets promoted by the Ministry of New and Renewable Energy are reinforcing the shift toward green data centers that utilize solar and wind power through open-access and power-purchase agreements, thereby supporting sustainability-aligned infrastructure strategies across major digital corridors.

Growth Drivers

The growth of the market is strongly supported by sustained cloud adoption across banking, ecommerce, healthcare, and public-sector platforms driven by Government-backed digital service delivery frameworks. Initiatives such as Digital India and India Stack, supported by the Ministry of Electronics and Information Technology, are expanding the volume of digital transactions, identity authentication, and public-cloud workloads, which require domestic hosting under data-localization and security rules. Large-scale investments in hyperscale cloud zones and colocation facilities in Mumbai, Chennai, and Hyderabad are reinforcing demand across enterprise and Government users.

In parallel, rising investments in broadband networks under the National Broadband Mission and submarine cable landing stations promoted by the Department of Telecommunications are improving connectivity resilience and latency performance. As enterprises prioritize data security, compliance, and high-availability infrastructure, demand for carrier-neutral and Tier III and above data centers continues to rise, which further supports long-term expansion of domestic digital infrastructure capacity.

Market Restraints / Challenges

Despite strong growth fundamentals, the market landscape faces constraints related to power availability, land acquisition, and regulatory approvals, which affect project timelines and cost structures. Reports from the Ministry of Power and the Central Electricity Authority indicate that high-capacity data centers require reliable grid connectivity and dedicated substations, which remain constrained in certain urban clusters, leading to elevated capital expenditure and longer commissioning cycles. In addition, zoning regulations and environmental clearances can delay campus development, particularly in coastal and metropolitan areas.

The sector also faces dependence on imported servers, cooling equipment, and network hardware, which exposes operators to foreign-exchange volatility and global supply-chain disruptions. According to the Ministry of Commerce and Industry, a significant share of advanced data center equipment is sourced from overseas, which can lead to procurement delays and cost escalation during periods of global trade instability, thereby impacting deployment schedules and profitability.

Market Opportunities

The market presents substantial opportunities in edge data centers and regional colocation hubs driven by the rapid expansion of digital services in tier two and tier three cities. Government initiatives such as Bharat Net and the National Smart Cities Mission are extending fiber connectivity and digital public services beyond major metropolitan areas, which increases demand for localized computing and low-latency infrastructure. Operators offering modular and scalable facilities are well positioned to capture incremental demand from fintech, health tech, and Government service platforms.

Another major opportunity lies in green and energy-efficient data center development as renewable energy adoption expands across the country. The Ministry of New and Renewable Energy continues to promote open-access solar and wind procurement, which allows data center operators to secure long-term clean power at stable costs. Advances in artificial-intelligence-driven energy management and liquid-cooling technologies further enable operators to improve power efficiency and offer high-density computing solutions that attract global cloud and enterprise customers.

India Data Center Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 10.32 Billion |

|

Revenue Forecast in 2035 |

USD 33.48 Billion |

|

Growth Rate |

12.4% |

|

Segments Covered in the Report |

By Component, By Type of Data Center, By Size of Data Center, By Tier Type, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Western India, Southern India, Northern India, Eastern India |

|

Key Companies |

AdaniConneX Private Limited, Alphabet Inc Class A, Amazon Web Services Inc, AT&T, Bridge Data Centers India Private Limited, Equinix Inc, Microsoft Corp, NTT Data Group Corp, Oracle Corp, Reliance Communications Limited, SAP SE |

|

Customization |

Available upon request |

India Data Center Market Segmentation

By Component

IT and network equipment accounts for approximately 52% of total market revenue in 2025, reflecting the capital-intensive deployment of servers, storage arrays, networking switches, and high-speed interconnects across hyperscale and colocation facilities. The expansion of cloud platforms, artificial intelligence workloads, and digital payment systems continues to drive higher rack densities and shorter refresh cycles, which directly supports this segment’s leading position. This segment is projected to grow at about 17.8% during the forecast period, supported by increasing adoption of graphics processing units, high-performance computing clusters, and software-defined networking.

Power and cooling infrastructure contributes around 31% of total revenue, driven by investments in electrical distribution systems, uninterruptible power supplies, backup generators, and advanced cooling technologies required to maintain uptime standards. This segment is expected to expand at approximately 16.2% as operators prioritize energy efficiency, liquid cooling deployment, and redundancy to meet Tier III and Tier IV reliability requirements.

General construction and physical infrastructure represent roughly 17% of the market, supported by spending on buildings, raised flooring, and physical security, with a growth rate of about 14.5% as new campuses are developed across major data center hubs.

By Type of Data Center

Colocation data centers hold the largest share at an estimated 47% of the market in 2025, supported by strong demand from enterprises seeking scalable, carrier-neutral, and cost-efficient hosting solutions. The role of colocation in enabling digital service providers, banks, and telecom firms to avoid heavy capital investment while ensuring regulatory compliance, and this segment is projected to grow at approximately 17.6% as outsourcing of IT infrastructure continues to rise.

Hyperscale data centers represent around 38% of the market and are the fastest-growing category with an estimated CAGR of 18.9%, driven by global cloud service providers expanding their India footprint to support artificial intelligence, software-as-a-service, and digital media workloads.

Enterprise captive data centers account for roughly 15% of total capacity and are expected to grow at about 13.4% as regulated industries and large corporations continue to retain on-premise facilities for sensitive and mission-critical operations.

By Size of Data Center

Large data centers dominate the market with an estimated 55% share in 2025, reflecting the prevalence of hyperscale and wholesale colocation facilities designed to support cloud platforms, streaming services, and national digital infrastructure. These facilities benefit from high utilization and economies of scale, and they are projected to grow at approximately 18.1% as new mega campuses are commissioned in Mumbai, Chennai, and Hyderabad.

Medium-sized data centers account for about 28% of the market, supported by enterprise and regional colocation demand, and are expected to expand at around 15.7% as digital adoption spreads across mid-sized businesses and service providers.

Small data centers contribute roughly 17%, mainly serving localized and edge computing needs, with a growth rate of about 14.2% as content delivery and latency-sensitive applications increase across tier two and tier three cities.

By Tier Type

Tier III data centers represent the largest segment with approximately 56% of total operational capacity in 2025, reflecting strong demand for concurrently maintainable infrastructure that offers high availability at optimized cost levels. Tier III is the preferred standard for hyperscale and colocation developments across India’s primary data center hubs, and this segment is projected to grow at around 17.7% as new facilities continue to adopt this certification to attract international and domestic enterprise clients.

Tier IV facilities account for about 24% of the market and are the fastest growing tier with an estimated CAGR of 18.8%, driven by mission-critical workloads in banking, digital payments, government platforms, and high-availability cloud services that require fault-tolerant infrastructure.

Tier I and Tier II data centers together contribute roughly 20% of total capacity, serving small and mid-sized enterprises and regional IT providers, and are expected to grow at about 13.5% as edge and regional deployments continue to expand.

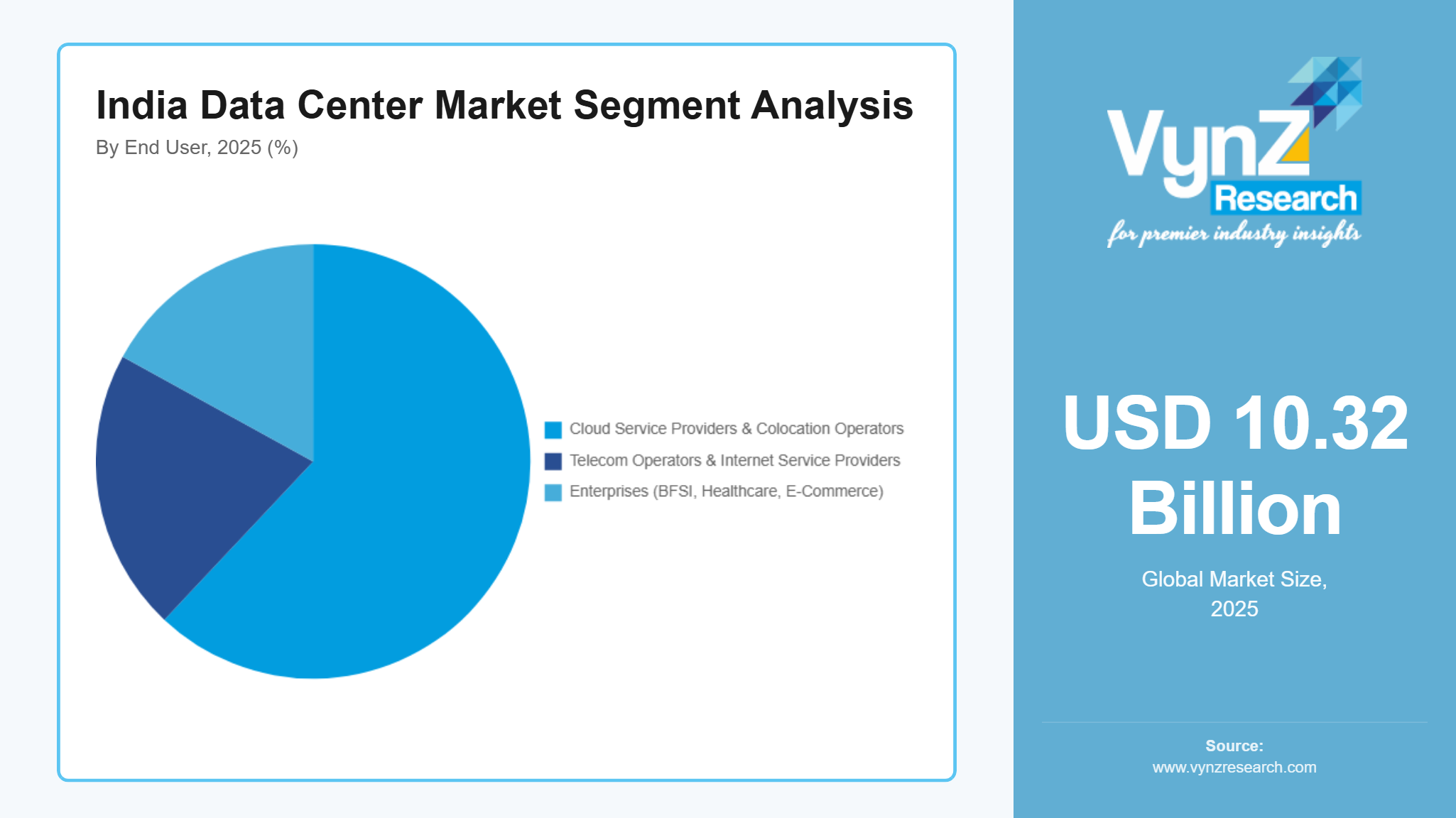

By End User

Cloud service providers and colocation operators together account for approximately 62% of total market revenue in 2025, reflecting sustained growth in public cloud adoption, managed hosting, and digital content delivery platforms. This segment is projected to expand at around 18.3% as enterprises accelerate cloud migration and data localization requirements continue to strengthen domestic hosting demand.

Telecom operators and internet service providers contribute about 21% of the market, supported by rising data traffic, 5G network deployment, and content distribution needs, with a growth rate of approximately 16.1%.

Enterprises across banking, financial services, ecommerce, healthcare, and government account for the remaining 17% and are expected to grow at around 14.6% as organizations continue to invest in secure, compliant, and high-availability domestic data center infrastructure.

Regional Insights

Western India

Western India is estimated to account for approximately 38% of the market in 2025, supported by the strong presence of major hubs in Mumbai and Pune which benefit from subsea cable connectivity, robust financial sector demand, and advanced telecommunications networks that attract hyperscale and colocation investments. The region’s leadership position is reinforced by Mumbai’s role as the primary gateway for international connectivity and dense internet exchange points which contribute to dominant capacity shares. Government support under national digital infrastructure initiatives and state energy policies further enhances investment appeal and operational readiness for large-scale data center campuses.

Southern India

Southern India holds an estimated 32% share of the market in 2025, driven by rapid data center expansion across Chennai, Hyderabad, and Bengaluru. Strategic coastal connectivity, supported by undersea cable landings near Chennai and emerging hyperscale deployments in Hyderabad and Bengaluru’s strong IT ecosystem, underpins regional growth. The presence of multinational technology firms and startup activity fosters a continuous demand for secure and scalable digital infrastructure. Additionally, state incentives and government digital adoption programs contribute to heightened enterprise and cloud workload hosting requirements.

Northern India

Northern India accounts for approximately 20% of the market, led by the Delhi-NCR corridor, which serves as a key region for enterprise, government, and sovereign cloud hosting due to its proximity to national institutions and large enterprise demand. Improved connectivity and power infrastructure supported by central and state policies are strengthening the region’s competitiveness as an important data center destination. Emerging investments in Uttar Pradesh and adjoining satellite cities reflect spillover growth beyond traditional urban centers driven by lower land costs and supportive state digital infrastructure frameworks.

Eastern India

Eastern India, including West Bengal and Odisha, accounts for approximately 10% of the market in 2025, with Kolkata increasingly positioned as the primary hub due to governmental focus on technology parks such as the Bengal Silicon Valley Tech Hub and growing interest from both domestic and international data center operators. Although still nascent compared with Western and Southern regions, investments and emerging facilities in Eastern India illustrate long-term opportunities as connectivity and policy support improve.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and domestic operators focusing on capacity expansion, energy efficiency, and geographic reach. Key participants including NTT Global Data Centers, STT GDC India, Yotta Infrastructure, CtrlS, and AdaniConneX are investing in hyperscale campuses and advanced cooling and power systems. Government initiatives such as Digital India, the National Broadband Mission, and data localization frameworks issued by the Ministry of Electronics and Information Technology are reinforcing demand for secure and compliant domestic data center infrastructure, encouraging operators to expand capacity and strengthen long-term enterprise and cloud partnerships.

Mini Profiles

AdaniConneX Private Limited provides hyperscale and colocation data center solutions, supported by strategic greenfield campuses, renewable energy integration, and strong regional connectivity, enabling enterprises and cloud providers to scale digital infrastructure efficiently.

Bridge Data Centers India Private Limited operates premium data center facilities, emphasizing high availability, energy-efficient cooling, and Tier III/IV standards, leveraging advanced design, robust service networks, and strong enterprise client partnerships across India.

CtrlS Datacenters Ltd delivers secure, managed, and colocation services, supported by strategic partnerships, disaster recovery solutions, and digital infrastructure capabilities, focusing on high reliability, compliance, and enterprise adoption across multiple metropolitan regions.

Digital Realty Trust Inc specializes in global colocation and hyperscale facilities, leveraging strategic real estate, connectivity networks, and operational efficiency, providing enterprises and cloud operators with scalable, resilient, and secure data center solutions.

Equinix Inc offers interconnected colocation and cloud data centers, supported by a strong global presence, digital interconnection platforms, and predictive maintenance services, enabling high-performance, scalable, and secure infrastructure for enterprise and hyperscale clients.

Key Players

- AdaniConneX Private Limited

- Alphabet Inc Class A

- Amazon Web Services Inc

- AT&T

- Bridge Data Centers India Private Limited

- Equinix Inc

- Microsoft Corp

- NTT Data Group Corp

- Oracle Corp

- Reliance Communications Limited

- SAP SE

Recent Developments

In November 2025, AdaniConneX Private Limited announced a planned investment of up to USD 5 billion in Google’s AI data center project in Andhra Pradesh, expanding hyperscale infrastructure and AI computing capacity.

In September 2025, Equinix Inc inaugurated a new AI‑ready data center in Chennai equipped with advanced liquid cooling and global interconnection capabilities to support high‑density and AI workloads.

In June 2025, CtrlS Datacenters Ltd formed a strategic partnership with the Bombay Stock Exchange to power its critical digital infrastructure with highly secure and reliable data center solutions.

In May 2025, Sify Technologies Limited launched South India’s largest AI‑ready data center in Chennai with scalable capacity and high-performance features tailored for hyperscale and enterprise clients.

In 2025, Bridge Data Centers India Private Limited commenced construction of its Nava Raipur data center campus’s first phase, expected to deliver significant power capacity to support future demand.

India Data Center Market Coverage

Component Insight and Forecast 2026 - 2035

- IT and Network Equipment

- Power and Cooling Infrastructure

- General Construction and Physical Infrastructure

Type of Data Center Insight and Forecast 2026 - 2035

- Colocation Data Centers

- Hyperscale Data Centers

- Enterprise Captive Data Centers

Size of Data Center Insight and Forecast 2026 - 2035

- Large Data Centers

- Medium-Sized Data Centers

- Small Data Centers

Tier Type Insight and Forecast 2026 - 2035

- Tier I & II Data Centers

- Tier III Data Centers

- Tier IV Data Centers

End User Insight and Forecast 2026 - 2035

- Cloud Service Providers & Colocation Operators

- Telecom Operators & Internet Service Providers

- Enterprises (BFSI

- Healthcare

- E-Commerce

- Government

- etc.)

India Data Center Market by Region

- Western India

- By Component

- By Type of Data Center

- By Size of Data Center

- By Tier Type

- By End User

- Southern India

- By Component

- By Type of Data Center

- By Size of Data Center

- By Tier Type

- By End User

- Northern India

- By Component

- By Type of Data Center

- By Size of Data Center

- By Tier Type

- By End User

- Eastern India

- By Component

- By Type of Data Center

- By Size of Data Center

- By Tier Type

- By End User

Table of Contents for India Data Center Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component

1.2.2. By

Type of Data Center

1.2.3. By

Size of Data Center

1.2.4. By

Tier Type

1.2.5. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. India Market Estimate and Forecast

4.1. India Market Overview

4.2. India Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. IT and Network Equipment

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Power and Cooling Infrastructure

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. General Construction and Physical Infrastructure

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Type of Data Center

5.2.1. Colocation Data Centers

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Hyperscale Data Centers

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Enterprise Captive Data Centers

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Size of Data Center

5.3.1. Large Data Centers

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Medium-Sized Data Centers

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Small Data Centers

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Tier Type

5.4.1. Tier I & II Data Centers

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Tier III Data Centers

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Tier IV Data Centers

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By End User

5.5.1. Cloud Service Providers & Colocation Operators

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Telecom Operators & Internet Service Providers

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Enterprises (BFSI

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Healthcare

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. E-Commerce

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

5.5.6. Government

5.5.6.1. Market Definition

5.5.6.2. Market Estimation and Forecast to 2035

5.5.7. etc.)

5.5.7.1. Market Definition

5.5.7.2. Market Estimation and Forecast to 2035

6. Western India Market Estimate and Forecast

6.1. By

Component

6.2. By

Type of Data Center

6.3. By

Size of Data Center

6.4. By

Tier Type

6.5. By

End User

6.5.1.

Western India Market Estimate and Forecast

6.5.2.

Southern India Market Estimate and Forecast

6.5.3.

Northern India Market Estimate and Forecast

6.5.4.

Eastern India Market Estimate and Forecast

7. Southern India Market Estimate and Forecast

7.1. By

Component

7.2. By

Type of Data Center

7.3. By

Size of Data Center

7.4. By

Tier Type

7.5. By

End User

7.5.1.

Western India Market Estimate and Forecast

7.5.2.

Southern India Market Estimate and Forecast

7.5.3.

Northern India Market Estimate and Forecast

7.5.4.

Eastern India Market Estimate and Forecast

8. Northern India Market Estimate and Forecast

8.1. By

Component

8.2. By

Type of Data Center

8.3. By

Size of Data Center

8.4. By

Tier Type

8.5. By

End User

8.5.1.

Western India Market Estimate and Forecast

8.5.2.

Southern India Market Estimate and Forecast

8.5.3.

Northern India Market Estimate and Forecast

8.5.4.

Eastern India Market Estimate and Forecast

9. Eastern India Market Estimate and Forecast

9.1. By

Component

9.2. By

Type of Data Center

9.3. By

Size of Data Center

9.4. By

Tier Type

9.5. By

End User

9.5.1.

Western India Market Estimate and Forecast

9.5.2.

Southern India Market Estimate and Forecast

9.5.3.

Northern India Market Estimate and Forecast

9.5.4.

Eastern India Market Estimate and Forecast

10. Company Profiles

10.1. AdaniConneX Private Limited

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Alphabet Inc Class A

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Amazon Web Services Inc

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. AT&T

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Bridge Data Centers India Private Limited

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Equinix Inc

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Microsoft Corp

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. NTT Data Group Corp

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Oracle Corp

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Reliance Communications Limited

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. SAP SE

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India Data Center Market