GCC Education Technology (EdTech) Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Platform (Online, Hybrid, Offline), by Education Level (K–12, Higher Education, Vocational / Professional Training), by Language (English, Arabic, Other Languages), by Product Type (Software, Hardware, Services), by Application / End User (Academic Institutions, Corporate Training, Individual Learners)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5211 | Industry : ICT & Media | Available Format :

|

Page : 120 |

GCC Education Technology (EdTech) Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Platform (Online, Hybrid, Offline), by Education Level (K–12, Higher Education, Vocational / Professional Training), by Language (English, Arabic, Other Languages), by Product Type (Software, Hardware, Services), by Application / End User (Academic Institutions, Corporate Training, Individual Learners)

GCC EdTech Market Overview

The GCC education technology (EdTech) market which was valued at approximately USD 2.85 billion in 2025 and is estimated to rise further up to almost USD 3.07 billion by 2026, is projected to reach around USD 6.03 billion by 2035, expanding at a CAGR of about 7.8% during the forecast period from 2026 to 2035.

Market growth is driven by increasing digital adoption in schools and higher education, rising government investments in e-learning infrastructure, and growing demand for skill development and corporate training platforms. Strong uptake in major markets including Saudi Arabia, the UAE, and Qatar is further supporting market expansion.

Adoption is reinforced by regional initiatives such as the UAE National Strategy for Higher Education 2030, Saudi Vision 2030 digital transformation programs, and Qatar’s Education Sector Development Plan, which emphasize online learning, blended classrooms, and lifelong learning platforms. Increasing integration of AI-based learning, adaptive content, and cloud-enabled education management systems is enhancing learning outcomes, operational efficiency, and personalized training solutions. Ongoing investments by public and private institutions are further supporting the long-term prospects of the GCC EdTech landscape.

GCC EdTech Market Dynamics

Market Trends

The market is undergoing a structural transformation driven by the integration of digital learning platforms, AI-powered adaptive learning, and cloud-based educational tools. Initiatives supported by regional governments, such as the UAE Ministry of Education’s digital learning programs and Saudi Arabia’s Vision 2030 education initiatives, emphasize technology adoption, curriculum digitization, and enhanced student engagement. These programs are accelerating the shift from traditional classroom-based teaching to blended and online learning models across schools, universities, and corporate training centers. Increased mobile penetration and internet accessibility are further enabling learners to access educational resources anytime, thereby redefining competitive dynamics within the sector.

Technological advancements, including AI, gamification, and real-time analytics, are influencing product offerings and prompting companies to focus on value-added features, personalized learning experiences, and integrated learning management systems. EdTech providers are increasingly developing platforms with analytics dashboards, interactive content, and adaptive assessments to improve learner outcomes. Government-backed pilot programs and funding for digital curriculum development are reinforcing adoption while creating a conducive environment for innovative solutions across major GCC countries such as UAE, Saudi Arabia, and Bahrain.

Growth Drivers

Market growth is largely supported by the rising demand for digital learning solutions in K-12 education, higher education, and corporate upskilling programs. Investments in smart classrooms, virtual labs, and e-learning content development continue to expand across the GCC, particularly in education hubs such as Dubai, Riyadh, and Abu Dhabi. Reports from regional ministries highlight increasing budgets for digital transformation, reflecting strong government support for modernizing educational infrastructure.

Corporate demand for online training and reskilling initiatives is another key growth driver. Enterprises in technology, healthcare, and finance are adopting Learning Management Systems (LMS) and microlearning solutions to enhance workforce productivity and compliance. Companies offering scalable, cloud-based platforms and mobile-accessible content are expected to benefit from sustained adoption during the forecast period. Incentives, grants, and public-private partnerships promoting digital literacy further strengthen market expansion.

Market Restraints / Challenges

Despite favorable growth prospects, the market faces challenges related to uneven internet penetration and connectivity limitations in remote areas. In some regions, high subscription costs for premium learning platforms limit access among price-sensitive schools and learners. Reports from regional authorities, including the UAE Telecommunications Regulatory Authority, highlight connectivity and infrastructure constraints as a barrier to rapid adoption in emerging zones.

Dependence on skilled technical staff for platform integration, content development, and system maintenance poses operational challenges for providers. Limited availability of local digital content aligned with regional curricula can delay deployment and reduce scalability. Additionally, data privacy regulations and compliance requirements necessitate investments in secure infrastructure and cybersecurity measures, which can increase operational costs and affect smaller EdTech startups.

Market Opportunities

The market presents significant opportunities in AI-driven personalized learning and gamified educational content, particularly fueled by rising digital literacy and remote learning adoption. Companies providing adaptive, cloud-enabled, and mobile-accessible solutions are well-positioned to capture incremental demand from K-12 institutions, higher education universities, and corporate clients across the GCC.

Another key opportunity lies in government-backed initiatives for STEM education, coding programs, and virtual learning laboratories, where growing investments in digital-enabled solutions are creating avenues for higher margins and long-term institutional partnerships. Integration of AI analytics, learning dashboards, and interactive content is expected to enhance learner engagement, improve retention, and strengthen adoption of scalable educational solutions across schools, universities, and vocational training centers. Reports from regional ministries and public education authorities continue to reinforce the potential for long-term market growth.

GCC EdTech Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 2.85 Billion |

|

Revenue Forecast in 2035 |

USD 6.03 Billion |

|

Growth Rate |

7.8% |

|

Segments Covered in the Report |

By Platform, By Education Level, By Language, By Product Type, By Application / End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Saudi Arabia, Abu Dhabi, Qatar, Others |

|

Key Companies |

Al‑Gooru, SMART Technologies ULC, Abwaab, Al‑Mentor, Al‑Academia, Coursera Inc, Alphabet Inc, Microsoft Corp, UpGrad Education Private Limited, Udacity |

|

Customization |

Available upon request |

GCC EdTech Market Segmentation

By Platform

Online learning platforms accounted for approximately 54% of the market in 2025, driven by widespread adoption of cloud-based learning management systems (LMS), mobile-accessible apps, and virtual classrooms. Government-backed initiatives in the UAE, Saudi Arabia, and Bahrain to digitize classrooms and integrate AI-driven learning tools reinforce adoption across schools, universities, and corporate training centers.

Hybrid learning solutions are expected to register the fastest growth at an estimated CAGR of 8.9% from 2026 to 2035. This growth is driven by increasing demand for blended models combining classroom and digital learning, supported by smart classroom infrastructure, interactive whiteboards, and virtual labs.

Offline learning remains relevant, contributing roughly 15% of market revenue in 2025. Traditional instructor-led training and workshops are still used in regions with limited internet access. Gradual digital adoption under government programs is expected to integrate these into hybrid models over time.

By Education Level

Higher education platforms accounted for the largest share in 2025, approximately 48%, supported by universities and professional institutes adopting digital tools for student engagement, assessment, and administration. Funding and incentives from regional education ministries strengthen adoption of adaptive learning and AI-enabled platforms.

K-12 EdTech solutions are expected to grow at the fastest pace with a CAGR of 9.3% over the forecast period. Growth is fueled by government initiatives to implement smart classrooms, e-learning curriculum integration, and STEM-based interactive learning, particularly in Abu Dhabi, Dubai, and Riyadh.

Vocational and professional training platforms contributed roughly 18% of the market in 2025, driven by workforce upskilling programs in IT, healthcare, and engineering. Digital solutions provide scalable learning for corporate learners and job seekers, increasing adoption in key GCC economies.

By Language

English-language EdTech solutions accounted for approximately 62% of the market in 2025, reflecting the prevalence of English-medium institutions, corporate training programs, and international curricula. Regional governments support bilingual and English-based learning, ensuring curriculum alignment and quality standards.

Arabic-language platforms are expected to grow at the fastest rate, with an estimated CAGR of 9.5% from 2026 to 2035. Growth is driven by demand from public schools, governmental education programs, and local content development to promote digital literacy and inclusivity in native language education.

Other language platforms contributed around 12% of the market in 2025, primarily catering to expatriate communities and niche vocational programs. Multilingual offerings are gradually expanding as government programs encourage inclusive digital learning access.

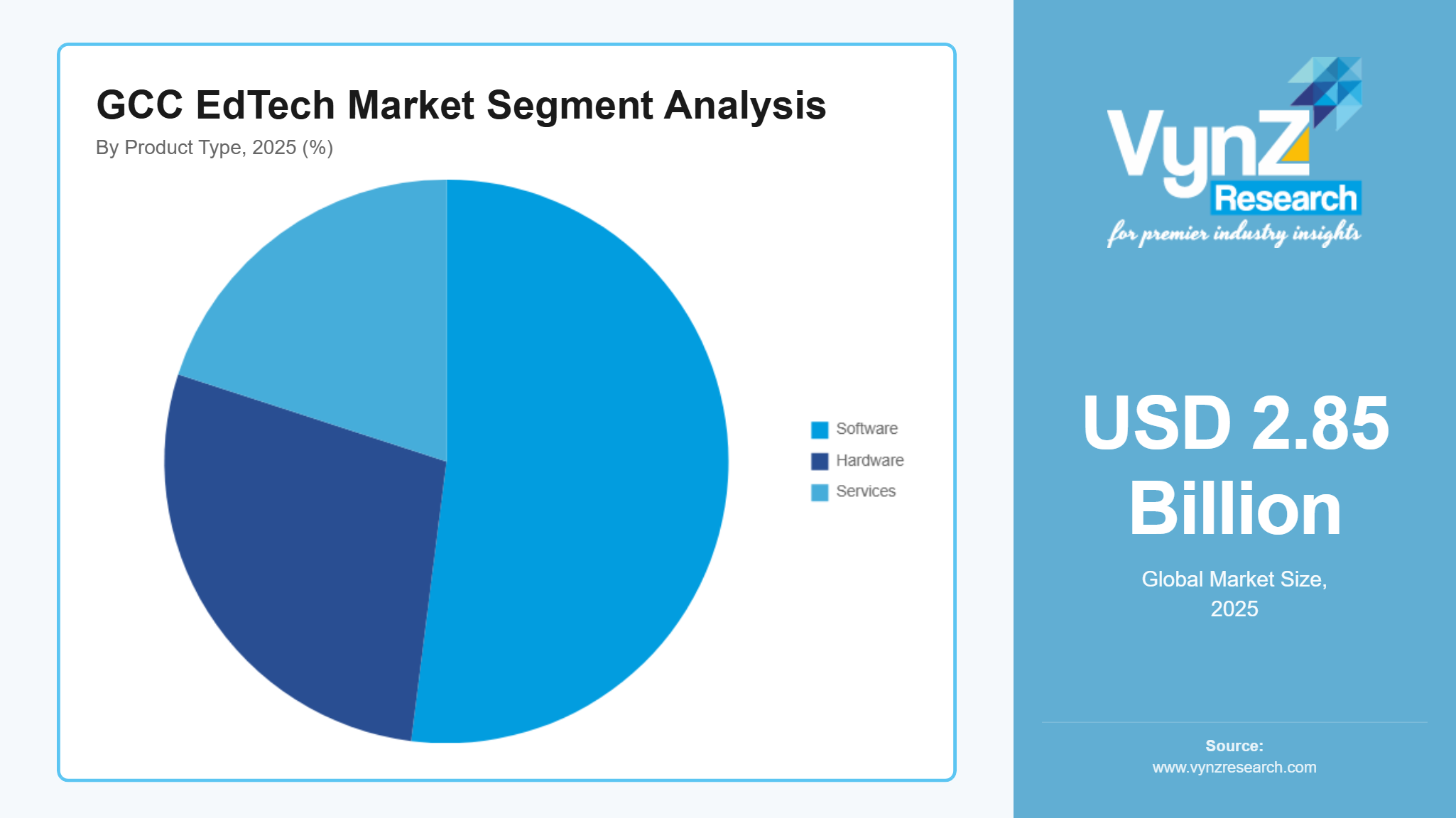

By Product Type

Software solutions dominated the market in 2025, accounting for approximately 52% of revenue, driven by widespread adoption of LMS, digital content platforms, and analytics-enabled tools for student performance tracking and curriculum delivery. Governments in the UAE and Saudi Arabia are incentivizing software adoption in schools and higher education institutions to meet digital transformation goals.

Hardware solutions, including smart classroom devices and interactive boards, contributed around 28% of the market in 2025 and are expected to grow at a CAGR of 7.6%. Investments in digital classrooms, VR/AR labs, and IoT-enabled educational devices support operational efficiency and immersive learning experiences.

Services such as professional training, consulting, and technical support contributed roughly 20% of market revenue, offering integration, onboarding, and content development assistance. Growth is driven by government-funded EdTech adoption programs and private sector support for skill development initiatives.

By Application / End User

Academic institutions accounted for the largest share in 2025, approximately 52%, supported by digital adoption in schools, universities, and private colleges. Investments in LMS, cloud libraries, and AI-based assessment tools enhance operational efficiency and student outcomes.

Corporate training platforms are projected to grow at a CAGR of 9.1% during the forecast period, driven by workforce upskilling initiatives, regulatory compliance, and certification programs across IT, healthcare, and engineering sectors. Microlearning, gamification, and analytics dashboards increase engagement and retention.

Individual learners contributed around 16% of market revenue in 2025, primarily through online courses, digital certifications, and skill development programs. Growth is supported by rising awareness of lifelong learning and government initiatives promoting accessible digital education.

Regional Insights

Saudi Arabia

Saudi Arabia accounted for approximately 34% of the GCC EdTech market in 2025, driven by government-led digital education initiatives, increasing ICT infrastructure, and high internet penetration. Strong demand from major cities including Riyadh, Jeddah, and Dammam continues to support market growth. Programs such as the Ministry of Education’s digital transformation strategy and Vision 2030 reforms are encouraging investments in e-learning platforms, educational software, and digital classrooms, while the expansion of online education channels is further strengthening regional market performance.

Abu Dhabi

Abu Dhabi is estimated to represent roughly 28% of the GCC EdTech landscape in 2025. Rapid urbanization, high adoption of smart learning technologies, and government-backed digital education initiatives are driving growth. Policies supporting smart schools, digital learning content, and AI-driven education tools are enhancing adoption in key public and private institutions. Investments in blended learning platforms, virtual classrooms, and interactive e-learning solutions continue to improve student engagement and operational efficiency across the emirate.

Qatar

Qatar accounted for approximately 14% of the GCC EdTech market in 2025. Growth is supported by the expansion of higher education institutions, vocational training centers, and government programs promoting digital skills development. National initiatives such as the Qatar National Vision 2030 and Ministry of Education’s digital learning strategies are boosting adoption of virtual classrooms, online assessments, and cloud-based learning solutions. Rising awareness among students and educators regarding personalized and technology-enabled learning is further contributing to market expansion.

Others

The remaining GCC member states, including Kuwait, Oman, and Bahrain, collectively contributed around 24% of the market in 2025. Growth in these regions is driven by digital school adoption, private sector initiatives, and increasing investments in blended and online learning solutions. Although adoption is slower compared with Saudi Arabia, Abu Dhabi, and Qatar, these countries represent strategic long-term opportunities for EdTech vendors targeting both K–12 and higher education segments across the GCC.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players emphasizing technology innovation, content localization, and platform scalability. Key vendors including Blackboard, Coursera, Byju’s, Udemy, and Noon Academy focus on digital learning solutions, curriculum alignment, and AI-enabled learning tools. Adoption is reinforced by government initiatives such as Saudi Arabia’s Vision 2030 digital education reforms and UAE’s Smart Learning Strategy, which promote e-learning integration, digital classrooms, and online skill development, encouraging companies to expand offerings and strengthen regional market presence.

Mini Profiles

Abwaab focuses on digital learning and exam preparation platforms supported by strong regional reach, localized Arabic content, curriculum alignment, and robust mobile access to enhance student engagement across schools and higher education in the GCC.

Noon Academy operates in the mass EdTech segment emphasizing collaborative live classes, peer learning, and adaptive assessments, supported by wide app distribution, community engagement, and localized tutoring that drives high user retention across K‑12 learners.

Al‑Mentor leverages premium online training and professional development offerings supported by strategic content partnerships, recognized instructors, and corporate training collaborations to expand presence among vocational learners, professionals, and lifelong learners in the Gulf region.

Orcas focuses on personalized learning solutions for schools and institutions supported by digital curriculum delivery, analytics dashboards, and tailored student support tools that enhance academic performance and institutional adoption across key GCC education sectors.

Ostaz operates in niche educational service delivery with emphasis on tutor‑based learning, localized content quality, and scalable digital infrastructure, enabling improved learning outcomes and high engagement among students preparing for standardized and regional examinations.

Key Players

- Al‑Gooru

- SMART Technologies ULC

- Abwaab

- Al‑Mentor

- Al‑Academia

- Coursera Inc

- Alphabet Inc

- Microsoft Corp

- UpGrad

- Education Private Limited

- Udacity

Recent Developments

January 2026 - As part of its plan to assist students across the whole educational path, from early learning to international university placement, MENA-focused education technology platform Abwaab has purchased Apex Education, a business that specializes in elite college admissions. The acquisition enhances Abwaab's positioning throughout the student lifecycle by supplementing its current tutoring and test-prep services with upscale admissions counseling for prestigious international colleges.

October 2025 - edX, a global online education provider from 2U, announced a strategic partnership with Skillsoft (NYSE: SKIL), the leading AI-native skills management platform designed for the human + AI era. edX's catalog of courses from top universities and businesses, including instructor-led executive education programs, will integrate directly into the Skillsoft Percipio Platform. Through this collaboration, the level of professional and academic learning offered by the Skillsoft platform is increased, and it is linked to how businesses develop, implement, and monitor skills.

October 2025 - A fully certified Master of Science in Artificial Intelligence degree program has been introduced by Udacity, a division of Accenture and the top supplier of tech skills for the AI industry. Its goal is to eliminate barriers to higher education and open doors to professions in technology. This collaboration is a significant step toward providing formal academic accreditation to a worldwide student body. Woolf's certified degree infrastructure and Udacity's proficiency in high-impact, project-based learning go hand in hand. A top-notch master's program that meets students wherever they are is the end result.

GCC EdTech Market Coverage

Platform Insight and Forecast 2026 - 2035

- Online

- Hybrid

- Offline

Education Level Insight and Forecast 2026 - 2035

- K–12

- Higher Education

- Vocational / Professional Training

Language Insight and Forecast 2026 - 2035

- English

- Arabic

- Other Languages

Product Type Insight and Forecast 2026 - 2035

- Software

- Hardware

- Services

Application / End User Insight and Forecast 2026 - 2035

- Academic Institutions

- Corporate Training

- Individual Learners

GCC EdTech Market by Region

- Brazil

- By Platform

- By Education Level

- By Language

- By Product Type

- By Application / End User

- Saudi Arabia

- By Platform

- By Education Level

- By Language

- By Product Type

- By Application / End User

- South Africa

- By Platform

- By Education Level

- By Language

- By Product Type

- By Application / End User

- U.A.E.

- By Platform

- By Education Level

- By Language

- By Product Type

- By Application / End User

- Other Countries

- By Platform

- By Education Level

- By Language

- By Product Type

- By Application / End User

Table of Contents for GCC EdTech Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Platform

1.2.2. By

Education Level

1.2.3. By

Language

1.2.4. By

Product Type

1.2.5. By

Application / End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Platform

5.1.1. Online

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Hybrid

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Offline

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Education Level

5.2.1. K–12

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Higher Education

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Vocational / Professional Training

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Language

5.3.1. English

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Arabic

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Other Languages

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Product Type

5.4.1. Software

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Hardware

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Services

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By Application / End User

5.5.1. Academic Institutions

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Corporate Training

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Individual Learners

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

6. Brazil Market Estimate and Forecast

6.1. By

Platform

6.2. By

Education Level

6.3. By

Language

6.4. By

Product Type

6.5. By

Application / End User

7. Saudi Arabia Market Estimate and Forecast

7.1. By

Platform

7.2. By

Education Level

7.3. By

Language

7.4. By

Product Type

7.5. By

Application / End User

8. South Africa Market Estimate and Forecast

8.1. By

Platform

8.2. By

Education Level

8.3. By

Language

8.4. By

Product Type

8.5. By

Application / End User

9. U.A.E. Market Estimate and Forecast

9.1. By

Platform

9.2. By

Education Level

9.3. By

Language

9.4. By

Product Type

9.5. By

Application / End User

10. Other Countries Market Estimate and Forecast

10.1. By

Platform

10.2. By

Education Level

10.3. By

Language

10.4. By

Product Type

10.5. By

Application / End User

10. Company Profiles

10.1. Al-Gooru

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. SMART Technologies ULC

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Abwaab

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Al-Mentor

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Al-Academia

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Coursera Inc.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Alphabet Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Microsoft Corp

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. UpGrad Education Private Limited

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Udacity

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

GCC EdTech Market