UAE Cloud Computing Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), by Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), by Organization Size (Large Enterprises, Small and Medium Sized Enterprises), by End User (Government and Public Sector, Banking, Financial Services and Insurance, Healthcare, Retail and E-commerce, Telecommunications, Manufacturing and Industrial, Education, Others)

| Status : Published | Published On : Feb, 2026 | Report Code : VRICT5216 | Industry : ICT & Media | Available Format :

|

Page : 146 |

UAE Cloud Computing Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Model (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), by Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), by Organization Size (Large Enterprises, Small and Medium Sized Enterprises), by End User (Government and Public Sector, Banking, Financial Services and Insurance, Healthcare, Retail and E-commerce, Telecommunications, Manufacturing and Industrial, Education, Others)

UAE Cloud Computing Market Overview

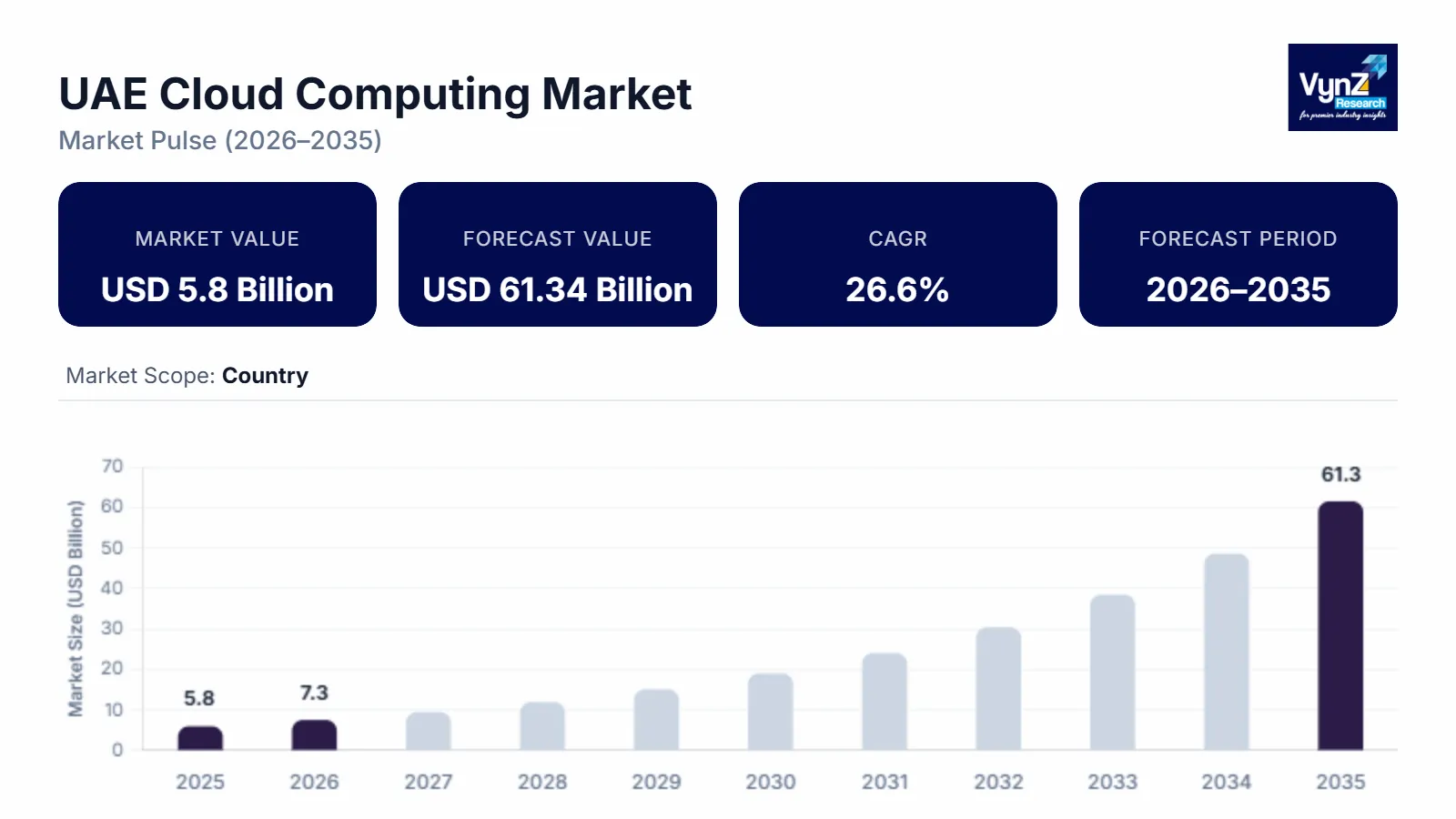

The UAE cloud computing market which was valued at approximately USD 5.8 billion in 2025 and is estimated to rise further up to almost USD 7.34 billion by 2026 is projected to reach around USD 61.34 billion by 2035 expanding at a CAGR of about 26.6 % during the forecast period from 2026 to 2035.

This growth trajectory reflects continued hyperscale capacity expansion accelerated enterprise migration toward cloud native architectures and sustained demand for scalable computing infrastructure across public and private sectors within the UAE digital economy landscape.

Market expansion is driven by large scale digital transformation mandates rising adoption of software platform and infrastructure-based cloud services and increasing deployment of data intensive workloads including artificial intelligence analytics and cybersecurity solutions. Government backed initiatives such as the UAE digital government strategy and the national artificial intelligence strategy supported by the telecommunications and digital government regulatory authority and the ministry of artificial intelligence digital economy and remote work applications continue to promote cloud first policies sovereign data frameworks and secure hyperscale infrastructure development across Abu Dhabi, Dubai and Sharjah. Rising demand from banking government healthcare and smart city programs concentrated in Abu Dhabi, Dubai and the Northern Emirates alongside sustained investments in localized data centers regulatory compliance frameworks and digital resilience capabilities further reinforce long term market expansion across the country.

UAE Cloud Computing Market Dynamics

Market Trends

The market is undergoing a structural transition toward hyperscale and sovereign cloud architectures aligned with national digital transformation and data governance frameworks. Government programs led by the telecommunications and digital government regulatory authority and the ministry of artificial intelligence digital economy and remote work applications emphasize cloud first adoption secure data residency and interoperability across public sector platforms. These policies are accelerating migration from on premise infrastructure to scalable cloud environments particularly for mission critical government workloads and regulated industries.

Another significant trend is the increasing integration of cloud platforms with artificial intelligence analytics and cybersecurity solutions to support advanced digital services. National strategies such as the UAE artificial intelligence strategy 2031 and smart city initiatives promoted by emirate level authorities are encouraging adoption of cloud-based data processing real time analytics and platform driven service delivery. This shift is influencing service providers to prioritize integrated offerings combining infrastructure security compliance and analytics capabilities thereby reshaping competitive positioning within the UAE cloud ecosystem.

Growth Drivers

Growth of the UAE cloud computing market is strongly supported by sustained government led digitalization initiatives and enterprise modernization programs across federal and emirate level institutions. Policies implemented under the UAE digital government strategy mandate cloud adoption for service delivery data sharing and operational efficiency creating consistent demand across public administration healthcare utilities and education segments. Investments in national data centers sovereign cloud infrastructure and digital identity platforms continue to accelerate cloud adoption across Abu Dhabi, Dubai and Sharjah.

In parallel rising enterprise demand for scalable computing resources is driving adoption across banking financial services retail and logistics sectors. As organizations prioritize operational efficiency regulatory compliance and data security cloud-based infrastructure and platform services are increasingly preferred over legacy systems. Reports from government supported economic development entities highlight that cloud adoption enables cost optimization business continuity and digital resilience which further reinforces long term demand across large enterprises and small and medium sized businesses within the UAE.

Market Restraints / Challenges

Despite favorable growth conditions the market faces challenges related to regulatory complexity and data sovereignty requirements. Government issued data protection frameworks and sector specific compliance mandates require cloud providers and enterprises to implement localized data hosting security certifications and continuous compliance monitoring. These requirements can increase deployment costs and extend implementation timelines particularly for multinational enterprises and smaller organizations with limited regulatory expertise.

Additionally, dependence on advanced digital skills and specialized cloud architecture expertise presents operational challenges. Government labor market assessments indicate a persistent shortage of highly skilled cloud security and data engineering professionals within the region. This reliance on specialized talent can create cost pressures delay project execution and limit scalability for certain cloud deployments particularly during periods of rapid digital expansion or heightened cybersecurity risk environments.

Market Opportunities

The market presents significant opportunities through expanding adoption of sovereign cloud and industry specific cloud platforms supported by government digital sovereignty initiatives. Programs promoting local data residency and national cloud infrastructure development are creating opportunities for providers offering compliant secure and high-performance cloud solutions tailored to government financial services and healthcare applications. These initiatives are expected to generate incremental demand from public sector agencies and regulated industries across the UAE.

Another key opportunity lies in the growing integration of cloud platforms with artificial intelligence smart city applications and advanced analytics. Government backed investments in digital twins’ urban mobility platforms and predictive analytics under national smart city and sustainability agendas are driving demand for cloud enabled data processing and automation capabilities. Advancements in cloud native tools automation and platform integration are expected to strengthen long term client engagement and support higher value service models within the market landscape.

UAE Cloud Computing Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 5.8 Billion |

|

Revenue Forecast in 2035 |

USD 61.34 Billion |

|

Growth Rate |

26.6% |

|

Segments Covered in the Report |

By Service Model, By Deployment Mode, By Organization Size, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Abu Dhabi, Dubai, Northern Emirates, Others |

|

Key Companies |

Amazon Web Services, Microsoft, Snowflake, Google, Oracle, Alibaba, IBM, Tencent, DigitalOcean, Rackspace, Equinix, Khazna Data Centers, G42, Huawei, SAP SE, Salesforce |

|

Customization |

Available upon request |

UAE Cloud Computing Market Segmentation Analysis

By Service Model

Infrastructure oriented cloud services accounted for the largest revenue share at approximately 44% in 2025, supported by sustained demand for scalable compute storage and networking resources across government enterprises and regulated industries. This segment benefits from high workload intensity long usage cycles and extensive adoption in data intensive applications including enterprise resource planning cybersecurity and disaster recovery.

Platform level cloud services are witnessing faster growth with an estimated CAGR of about 21.8%, driven by increasing adoption of artificial intelligence analytics application development and integration platforms. Enterprises are shifting toward managed development environments to reduce deployment time improve interoperability and enhance operational flexibility.

Software based cloud services continue to expand steadily with growth of approximately 18.6%, supported by demand for standardized enterprise applications collaboration tools and compliance driven digital solutions across public and private organizations.

By Deployment Mode

Public cloud deployment accounted for approximately 48% of total market revenue in 2025, supported by cost efficiency elastic scalability and strong adoption among small and medium sized enterprises and digital native organizations. Centralized public cloud infrastructure aligns with government supported digital enablement programs and cloud first procurement policies which continue to support this segment.

Hybrid cloud deployment is expected to register the fastest growth at nearly 22.4%, driven by regulatory requirements related to data residency security and workload segmentation. Large enterprises and government institutions increasingly adopt hybrid architectures to balance sensitive data control with scalable public cloud capabilities. Private cloud environments continue to maintain stable growth of around 17.9%, supported by mission critical applications in banking healthcare and defense related operations requiring high control compliance and customization.

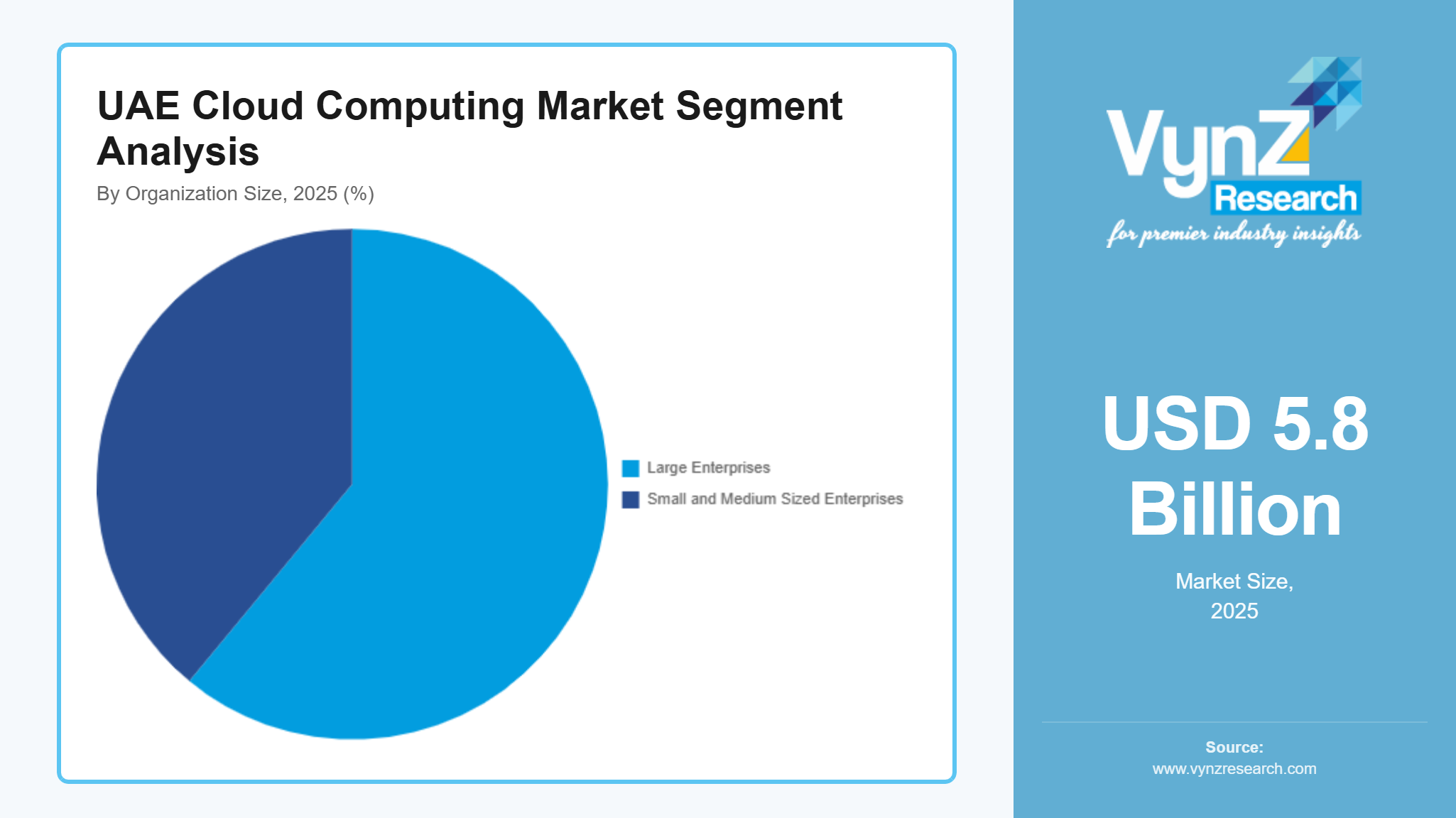

By Organization Size

Large enterprises represented approximately 61% of market revenue in 2025, supported by higher digital maturity extensive data workloads and long-term cloud modernization strategies. This segment benefits from multi cloud deployments advanced security frameworks and integrated analytics platforms aligned with regulatory and operational requirements.

Small and medium sized enterprises are emerging as the fastest growing segment with a CAGR of about 23.1%, driven by increasing digital penetration government supported entrepreneurship initiatives and access to subscription-based cloud solutions. SMEs increasingly adopt cloud platforms to reduce upfront capital expenditure improve business agility and enable remote operations. Growth is further supported by simplified onboarding localized data centers and packaged cloud offerings designed for cost sensitive business environments.

By End User

Government and public sector entities accounted for the largest share at approximately 34% in 2025, supported by mandated digital government initiatives centralized service platforms and national data infrastructure programs. Cloud adoption within this segment is driven by service delivery optimization data sharing frameworks and cybersecurity compliance requirements.

Banking financial services and insurance represents the fastest growing end user segment with growth estimated at around 22.6%, driven by digital payments fintech integration regulatory reporting and advanced risk analytics. Healthcare and retail sectors are also experiencing sustained growth supported by electronic health records omnichannel commerce and real time data analytics adoption. Collectively other institutional users continue to contribute steady demand supported by smart infrastructure logistics digitization and enterprise modernization programs.

Regional Insights

Abu Dhabi

Abu Dhabi accounted for approximately 31% of the market in 2025, supported by large scale government digitalization programs sovereign cloud adoption and advanced data center infrastructure development. The emirate hosts a high concentration of federal ministries national enterprises and regulated institutions which continue to drive demand for secure and compliant cloud platforms. Government initiatives led by entities such as the Abu Dhabi digital authority and national investment bodies emphasize cloud first procurement data sovereignty and hyperscale infrastructure expansion to support artificial intelligence defense healthcare and financial services workloads.

Continued investment in smart government platform’s digital identity frameworks and advanced analytics under national digital economy strategies is strengthening cloud adoption across Abu Dhabi. Expansion of local hyperscale data centers and government supported innovation zones further reinforces regional demand while enabling long term scalability resilience and regulatory compliance for public and enterprise cloud deployments.

Dubai

Dubai represented approximately 28% of the market in 2025, driven by strong enterprise demand digital commerce platforms and extensive adoption across financial services retail logistics and tourism sectors. The emirate’s role as a regional business and technology hub continues to attract multinational enterprises and cloud service providers seeking scalable infrastructure and regional connectivity. Government initiatives under smart Dubai and digital Dubai authority promote cloud enabled service delivery open data platforms and integrated digital ecosystems across public and private sectors.

Growth in Dubai is further supported by high adoption of software and platform-based cloud services among enterprises prioritizing agility customer engagement and data driven decision making. Expansion of fintech e-commerce and media platforms alongside continued investments in cybersecurity frameworks and compliance aligned cloud services is sustaining steady market expansion within the emirate.

Northern Emirates

The northern emirates including Sharjah, Ajman Ras-al-Khaimah, Fujairah and Umm-al-Quwain collectively accounted for approximately 17% of the market in 2025. Growth in this region is supported by increasing digital adoption among small and medium sized enterprises industrial zones and public sector institutions. Government backed digital transformation initiatives led by emirate level authorities emphasize cloud-based service delivery business digitization and support for manufacturing logistics and education sectors.

Investments in digital infrastructure smart industrial parks and localized data services are creating long term opportunities for cloud service providers within the northern emirates. While adoption levels remain lower compared to Abu Dhabi and Dubai increasing connectivity government incentives and SME focused cloud offerings are expected to gradually enhance regional contribution over the forecast period.

The remaining share of the market is collectively accounted for by other smaller deployments and emerging use cases across the UAE.

Competitive Landscape / Company Insights

The market is moderately to highly competitive with the presence of global hyperscaler and regional service providers focusing on infrastructure expansion security compliance and service differentiation. Key participants including AWS, Microsoft, Oracle, Google Cloud and regional operators are strengthening local data center capacity and sovereign cloud offerings. Adoption is supported by government frameworks led by the telecommunications and digital government regulatory authority and national digital government strategies which emphasize data residency cybersecurity and cloud first procurement policies thereby reinforcing long term enterprise and public sector contracts.

Mini Profiles

Amazon Web Services focuses on scalable infrastructure platform and software cloud services supported by strong regional data centers broad service portfolio and established enterprise and government adoption across the UAE.

Microsoft operates across enterprise and government cloud segments emphasizing hybrid cloud integration security compliance and productivity ecosystems supported by deep enterprise relationships and strong alignment with UAE digital government initiatives.

Google emphasizes data analytics artificial intelligence and cloud native application platforms leveraging advanced digital capabilities open architecture and strategic enterprise partnerships to expand adoption across regulated and commercial UAE sectors.

Oracle focuses on high performance enterprise workloads database services and mission critical applications supported by localized cloud regions strong compliance positioning and deep penetration in finance telecom and government segments.

Alibaba operates in mass and enterprise cloud segments emphasizing cost efficient infrastructure digital commerce integration and regional data centers supporting growing adoption among enterprises and technology driven businesses in the UAE.

Key Players

- Amazon Web Services

- Microsoft

- Snowflake Inc.

- Oracle

- Alibaba

- International Business Machines Corp.

- Tencent Holdings Ltd.

- DigitalOcean Holdings Inc.

- Rackspace Technology Inc.

- Equinix Inc.

- Khazna Data Centers LLC

- G42

- Huawei Technologies Co. Ltd.

- SAP SE

- Salesforce Inc.

Recent Developments

In January 2026, The AI Data Cloud provider Snowflake has declared that its AI Data Cloud is now generally available on the Amazon Web Services (AWS) Middle East (UAE) Region, allowing users to access deeper data insights driven by AI to promote business innovation. With Snowflake doubling its transaction growth in AWS Marketplace YoY to surpass $2 billion in worldwide sales in a single calendar year, the regional cloud expansion builds on the solid momentum of the cooperation between Snowflake and AWS.

In November 2025, The global technology group e& and Amazon Web Services, Inc. (AWS), an Amazon.com, Inc. company, unveiled the UAE Sovereign Launchpad, a cloud offering that speeds up the adoption of cloud and AI services for UAE government agencies as well as regulated customers in the healthcare, financial services, education, space, oil & gas, and non-profit sectors. This announcement is in line with the UAE National Cyber Security Strategy.

In October 2025, In order to strengthen IT sovereignty and national digital priorities, IBM and Amazon Web Services (AWS) have announced an expanded partnership centered on hosting IBM solutions and digital products on AWS servers in the United Arab Emirates and Saudi Arabia. Clients will be able to access IBM software solutions offered as Software-as-a-Service (SaaS) on the AWS cloud regions in Saudi Arabia and the United Arab Emirates thanks to the agreement. Organizations will be able to meet local regulatory and data-hosting requirements while speeding up their digital transformation thanks to the solutions.

UAE Cloud Computing Market Coverage

Service Model Insight and Forecast 2026 - 2035

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Deployment Mode Insight and Forecast 2026 - 2035

- Public Cloud

- Private Cloud

- Hybrid Cloud

Organization Size Insight and Forecast 2026 - 2035

- Large Enterprises

- Small and Medium Sized Enterprises

End User Insight and Forecast 2026 - 2035

- Government and Public Sector

- Banking

- Financial Services and Insurance

- Healthcare

- Retail and E-commerce

- Telecommunications

- Manufacturing and Industrial

- Education

- Others

UAE Cloud Computing Market by Region

Table of Contents for UAE Cloud Computing Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Model

1.2.2. By

Deployment Mode

1.2.3. By

Organization Size

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. UAE Market Estimate and Forecast

4.1. UAE Market Overview

4.2. UAE Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Model

5.1.1. Infrastructure as a Service (IaaS)

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Platform as a Service (PaaS)

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Software as a Service (SaaS)

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Deployment Mode

5.2.1. Public Cloud

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Private Cloud

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Hybrid Cloud

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Organization Size

5.3.1. Large Enterprises

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small and Medium Sized Enterprises

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Government and Public Sector

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Banking

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Financial Services and Insurance

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Healthcare

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Retail and E-commerce

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

5.4.6. Telecommunications

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2035

5.4.7. Manufacturing and Industrial

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2035

5.4.8. Education

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2035

5.4.9. Others

5.4.9.1. Market Definition

5.4.9.2. Market Estimation and Forecast to 2035

5. Company Profiles

5.1.

Amazon Web Services

5.1.1.

Snapshot

5.1.2.

Overview

5.1.3.

Offerings

5.1.4.

Financial

Insight

5.1.5.

Recent

Developments

5.2.

Microsoft

5.2.1.

Snapshot

5.2.2.

Overview

5.2.3.

Offerings

5.2.4.

Financial

Insight

5.2.5.

Recent

Developments

5.3.

Snowflake Inc.

5.3.1.

Snapshot

5.3.2.

Overview

5.3.3.

Offerings

5.3.4.

Financial

Insight

5.3.5.

Recent

Developments

5.4.

Google

5.4.1.

Snapshot

5.4.2.

Overview

5.4.3.

Offerings

5.4.4.

Financial

Insight

5.4.5.

Recent

Developments

5.5.

Oracle

5.5.1.

Snapshot

5.5.2.

Overview

5.5.3.

Offerings

5.5.4.

Financial

Insight

5.5.5.

Recent

Developments

5.6.

Alibaba

5.6.1.

Snapshot

5.6.2.

Overview

5.6.3.

Offerings

5.6.4.

Financial

Insight

5.6.5.

Recent

Developments

5.7.

International Business Machines Corp.

5.7.1.

Snapshot

5.7.2.

Overview

5.7.3.

Offerings

5.7.4.

Financial

Insight

5.7.5.

Recent

Developments

5.8.

Tencent Holdings Ltd.

5.8.1.

Snapshot

5.8.2.

Overview

5.8.3.

Offerings

5.8.4.

Financial

Insight

5.8.5.

Recent

Developments

5.9.

DigitalOcean Holdings Inc.

5.9.1.

Snapshot

5.9.2.

Overview

5.9.3.

Offerings

5.9.4.

Financial

Insight

5.9.5.

Recent

Developments

5.10.

Rackspace Technology Inc.

5.10.1.

Snapshot

5.10.2.

Overview

5.10.3.

Offerings

5.10.4.

Financial

Insight

5.10.5.

Recent

Developments

5.11.

Equinix Inc.

5.11.1.

Snapshot

5.11.2.

Overview

5.11.3.

Offerings

5.11.4.

Financial

Insight

5.11.5.

Recent

Developments

5.12.

Khazna Data Centers LLC

5.12.1.

Snapshot

5.12.2.

Overview

5.12.3.

Offerings

5.12.4.

Financial

Insight

5.12.5.

Recent

Developments

5.13.

G42

5.13.1.

Snapshot

5.13.2.

Overview

5.13.3.

Offerings

5.13.4.

Financial

Insight

5.13.5.

Recent

Developments

5.14.

Huawei Technologies Co. Ltd.

5.14.1.

Snapshot

5.14.2.

Overview

5.14.3.

Offerings

5.14.4.

Financial

Insight

5.14.5.

Recent

Developments

5.15.

SAP SE

5.15.1.

Snapshot

5.15.2.

Overview

5.15.3.

Offerings

5.15.4.

Financial

Insight

5.15.5.

Recent

Developments

5.16.

Salesforce Inc.

5.16.1.

Snapshot

5.16.2.

Overview

5.16.3.

Offerings

5.16.4.

Financial

Insight

5.16.5.

Recent

Developments

6. Appendix

6.1. Exchange Rates

6.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

UAE Cloud Computing Market