Chiplet Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Processor Type (CPU, GPU, AI/ML Accelerators, Other Logic Chiplets), by Packaging Technology (D/3D Integrated, System-in-Package (SiP), Fan-out & Wafer-Level CSP, Flip-Chip BGA), by End-User Industry (Data Center & HPC, Telecom & IT, Consumer & Enterprise Electronics, Automotive & Industrial, Aerospace, Defense & Healthcare)

| Status : Published | Published On : Feb, 2026 | Report Code : VRICT5215 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 150 |

Chiplet Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Processor Type (CPU, GPU, AI/ML Accelerators, Other Logic Chiplets), by Packaging Technology (D/3D Integrated, System-in-Package (SiP), Fan-out & Wafer-Level CSP, Flip-Chip BGA), by End-User Industry (Data Center & HPC, Telecom & IT, Consumer & Enterprise Electronics, Automotive & Industrial, Aerospace, Defense & Healthcare)

Chiplet Market Overview

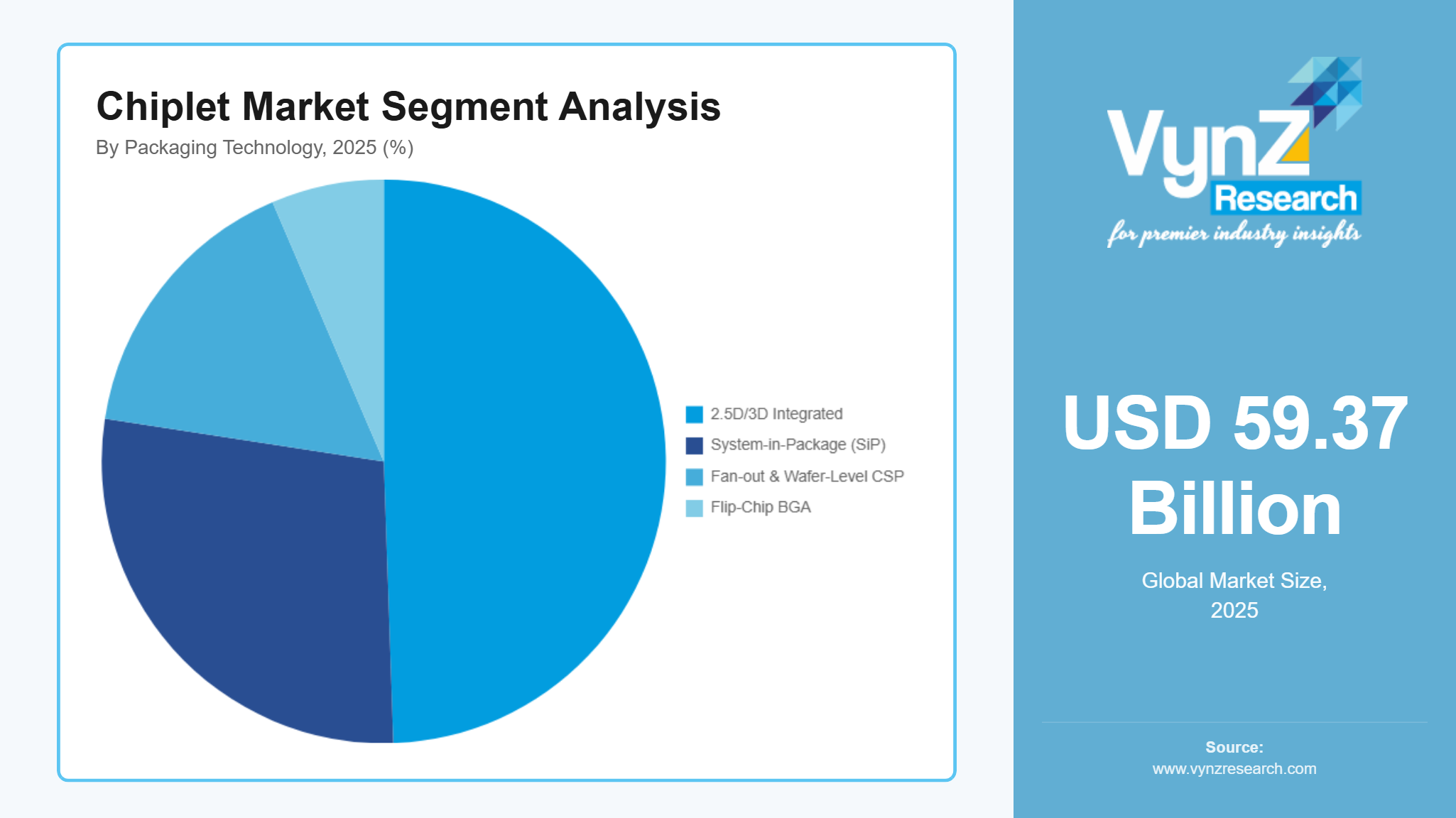

The chiplet market which was valued at approximately USD 59.37 billion in 2025 and is estimated to rise further to nearly USD 73.96 billion in 2026, is projected to reach around USD 534.41 billion by 2035, expanding at a CAGR of about 24.5% during the forecast period from 2026 to 2035.

This expansion reflects a structural shift in semiconductor design toward modular architectures that improve yield efficiency, reduce fabrication complexity, and accelerate time to market across advanced nodes. The market outlook remains materially higher than earlier short-horizon forecasts, as the longer forecast window captures large-scale commercial adoption beyond early deployment phases.

Market growth is driven by increasing demand for high-performance computing, artificial intelligence accelerators, data center processors, and advanced automotive electronics, where monolithic scaling faces physical and economic limits. Chiplet-based architectures enable heterogeneous integration of logic, memory, and specialized accelerators, supporting performance optimization and cost control. Public policy initiatives such as the U.S. CHIPS and Science Act, the European Chips Act, and national semiconductor missions in Asia Pacific are reinforcing domestic manufacturing, advanced packaging investment, and supply chain resilience. These government-backed programs, combined with rising adoption across cloud infrastructure, autonomous systems, and edge computing, are supporting sustained market expansion across North America, Asia Pacific, and Europe.

Chiplet Market Dynamics

Market Trends

The chiplet market is witnessing a structural transformation toward modular, heterogeneous integration and system-level optimization, driven by increasing demand for high-performance, energy-efficient computing. One of the key trends is the adoption of advanced chiplet packaging and interconnect standards, which enable improved performance-per-watt, scalability, and reduced design-to-production timelines. This reflects growing preferences among semiconductor manufacturers for flexible architectures capable of integrating diverse functional blocks such as logic, memory, and I/O components.

Another emerging trend is the acceleration of heterogeneous integration and advanced 2.5D/3D packaging, fueled by technological innovation in silicon interposers, advanced substrates, and high-bandwidth interfaces. Government-backed initiatives, such as the U.S. CHIPS and Science Act promoting domestic semiconductor manufacturing and R&D, and China’s National Integrated Circuit Industry Development Guidelines, are reinforcing adoption of chiplet-based architectures. These developments encourage vendors to focus on high-bandwidth, energy-efficient, and modular solutions, redefining competitive dynamics across logic, memory, and AI accelerator markets.

Growth Drivers

Globally, the market is largely driven by the growing demand for high-performance computing and efficient semiconductor solutions. Adoption of advanced heterogeneous integration techniques allows multiple chiplets to be combined on a single package, improving performance, reducing power consumption, and enabling smaller form factors. These capabilities support applications across data centers, AI, and high-end computing, where processing speed and energy efficiency are critical.

The increasing adoption of artificial intelligence, machine learning, and next-generation cloud computing is another major growth driver. Enterprises and technology providers are prioritizing scalable, high-throughput computing solutions, which has reinforced demand for modular chiplet-based architectures.

Furthermore, advancements in manufacturing processes, including 3D packaging and silicon interposers, enable higher yield, flexibility, and cost optimization. This supports broad adoption of chiplets across consumer electronics, automotive semiconductors, and networking devices, driving long-term market growth and operational efficiency.

Market Restraints / Challenges

The industry faces significant challenges despite its rapid growth trajectory. High initial capital investment for advanced packaging technologies, including 3D stacking, interposers, and heterogeneous integration, can constrain adoption among smaller semiconductor manufacturers and emerging players. Reports from the U.S. Department of Commerce and SEMI highlight that capital-intensive fabrication facilities and sophisticated assembly lines remain key barriers, particularly in regions with limited access to cutting-edge semiconductor infrastructure.

Additionally, dependency on specialized skilled labor and advanced lithography tools poses operational challenges for manufacturers. Supply chain constraints for high-purity silicon, interposer materials, and precision testing equipment can lead to delivery delays, cost pressures, and scalability limitations. Geopolitical tensions and export restrictions further exacerbate these risks, requiring continuous investment in process optimization, supply diversification, and technology localization strategies.

Market Opportunities

The market offers significant opportunities in advanced heterogeneous integration, particularly driven by rising demand for high-performance, energy-efficient semiconductor solutions in data centers, AI processors, and high-end computing applications. Government initiatives such as the U.S. CHIPS and Science Act (2022) and the European Union’s Digital Compass semiconductor funding programs promote domestic chip manufacturing, advanced packaging, and modular design approaches, creating incentives for adoption. Companies providing modular and scalable chiplet architectures are well-positioned to capture incremental adoption from hyperscalers, cloud service providers, and AI-driven enterprise segments.

Another key opportunity lies in packaging and interconnect innovations, where rising investments in 3D stacking, high-bandwidth interposers, and advanced interconnect technologies are supported by public R&D funding, including programs by Japan’s METI semiconductor strategy and South Korea’s Ministry of Science and ICT. These initiatives enable premium offerings and long-term client relationships. Advancements in automated testing, verification tools, and design-for-chiplet methodologies are expected to improve production efficiency, accelerate time-to-market, and enhance adoption across established and emerging semiconductor markets.

Global Chiplet Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 59.37 Billion |

|

Revenue Forecast in 2035 |

USD 534.41 Billion |

|

Growth Rate |

24.5% |

|

Segments Covered in the Report |

Processor Type, Packaging Technology, End-User Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

|

Key Companies |

Achronix Semiconductor Corporation, Alibaba Group Holding Ltd. (T-Head), Amazon Web Services, Inc. (AWS), Amkor Technology, Inc., Apple Inc., Advanced Micro Devices, Inc.(AMD), Broadcom Inc, IBM Corporation, Intel Corporation, Microsoft Corporation, NVIDIA Corporation, Samsung Electronics Co., Ltd., JCET Group Co. Ltd. |

|

Customization |

Available upon request |

Chiplet Market Segmentation

By Processor Type

CPU chiplets are projected to account for approximately 38% of total market revenue in 2025. This reflects their widespread usage in general-purpose computing, cloud infrastructure, and enterprise servers where modular scaling improves performance and yield efficiency. The growing demand for data center expansion and high-performance computing further supports revenue generation in this segment.

GPU chiplets contribute roughly 27% of market revenue in 2025. These chiplets are increasingly adopted in graphics rendering, AI training workloads, and data-intensive applications due to their high throughput and efficient parallel processing capabilities. The segment’s growth is fueled by the expansion of cloud gaming, deep learning, and high-end workstation deployments.

AI/ML accelerator chiplets are estimated to account for about 21% of revenue in 2025. Adoption is driven by surging demand for machine learning inference, generative AI models, and edge AI devices, which require power-efficient, high-performance chiplet architectures. Heterogeneous integration and specialized compute fabrics are key contributors to this growth.

Other logic chiplets, including FPGA and DSP variants, hold around 14% of revenue. These chiplets are utilized in networking, telecom, and specialized industrial applications requiring programmable and flexible computing solutions, supporting niche but growing demand.

By Packaging Technology

2.5D/3D integrated chiplets are projected to represent approximately 46% of total market revenue in 2025. This segment is supported by superior interconnect bandwidth, dense component integration, and thermal management, which are critical for HPC, AI accelerators, and modular GPU solutions.

System-in-Package (SiP) solutions contribute roughly 26% of revenue. Adoption is increasing in consumer electronics and edge devices, where compact, power-efficient integration of heterogeneous chiplets is highly valued. SiP designs allow manufacturers to optimize performance while reducing footprint.

Fan-out and wafer-level chip-scale packaging account for around 18% of market revenue. These packaging types are preferred for low-power, mobile, and IoT applications due to their high integration density and reliability.

Flip-chip ball grid array (FCBGA) contributes about 10% of revenue, mainly for premium servers and enterprise networking hardware, where signal integrity, thermal efficiency, and high-performance interconnects are essential.

By End-User Industry

Data center & HPC segment is estimated to account for approximately 44% of total market revenue in 2025. Rising demand for cloud computing, AI model training, and hyperscale infrastructure drives the deployment of modular chiplets in servers and storage solutions, offering high performance and scalability.

Telecom & IT applications contribute roughly 22% of revenue. The deployment of chiplet-based network processors in 5G infrastructure, edge computing, and networking equipment supports low-latency, high-bandwidth processing, reinforcing segment growth.

Consumer & enterprise electronics account for around 18% of revenue. Chiplets are increasingly integrated into high-end laptops, gaming devices, and compact edge devices requiring high compute density in small form factors.

Automotive and industrial applications represent approximately 10% of revenue. Advanced driver-assistance systems, infotainment platforms, and industrial automation applications leverage chiplets for modular performance, energy efficiency, and scalability.

Aerospace, defense, and healthcare segments contribute roughly 6% of revenue. These specialized applications require rugged, high-reliability chiplets for mission-c

Regional Insights

North America

North America accounted for approximately 30% of the global chiplet industry in 2025. The region is witnessing strong growth due to advanced semiconductor R&D, high adoption of heterogeneous integration, and substantial investments in AI and high-performance computing (HPC) applications. Government initiatives, including support from the U.S. Department of Energy (DOE) and the National Institute of Standards and Technology (NIST), promote semiconductor innovation, fabrication infrastructure, and next-generation packaging technologies. High demand from technology hubs in California, Texas, and Massachusetts continues to support the deployment of chiplets across computing, automotive, and defense sectors.

Asia Pacific

Asia Pacific is projected to hold roughly 34% of the market in 2025. China, Taiwan, South Korea, and Japan are leading the adoption of chiplet technologies due to large-scale semiconductor manufacturing, increasing AI and HPC deployments, and government-backed initiatives for advanced packaging and R&D. Policies promoting domestic semiconductor capabilities, along with incentives for foundries and integrated device manufacturers, encourage investments in chiplet-enabled processors. Rapid industrial digitization and growing cloud infrastructure in metropolitan centers such as Shanghai, Seoul, and Tokyo further boost regional demand.

Europe

Europe represents approximately 14% of the market in 2025. Growth is driven by government-backed programs supporting semiconductor innovation, such as the European Chips Act, along with rising investment in automotive electronics, AI, and HPC segments. Key industrial hubs in Germany, France, and the Netherlands are adopting chiplet architectures to enhance energy-efficient computing and accelerate time-to-market. The integration of chiplets in defense, industrial automation, and aerospace electronics contributes to sustained regional market performance.

Other Regions

The remaining regions collectively contribute around 22% of the global chiplet industry. Growth is supported by emerging semiconductor ecosystems in Latin America, the Middle East, and Africa, along with government programs promoting industrial digitization and advanced manufacturing. These regions, while currently smaller in market share, represent strategic long-term opportunities for chiplet adoption and technological expansion.

Competitive Landscape / Company Insights

The chiplet landscape is moderately competitive, with global and regional players emphasizing product innovation, advanced packaging technologies, and geographic expansion. Companies are heavily investing in R&D, strategic partnerships, and digital design capabilities to strengthen their market position. Adoption is supported by government-backed semiconductor initiatives such as the U.S. CHIPS and Science Act, the European Union’s Important Projects of Common European Interest (IPCEI) on microelectronics, and India’s Semiconductor Mission, which encourage advanced manufacturing, heterogeneous integration, and AI-driven chiplet solutions across North America, Europe, and Asia Pacific.

Mini Profiles

Intel Corporation focuses on high-performance chiplets, supported by global manufacturing and strong R&D capabilities enabling advanced heterogeneous integration.

AMD operates in premium and HPC segments, emphasizing performance, energy efficiency, and scalable multi-die solutions for computing and graphics applications.

Taiwan Semiconductor Manufacturing Company Limited leverages foundry leadership and advanced packaging technologies to expand chiplet production and market presence globally.

NVIDIA is advancing chiplet adoption through multi-die GPU architectures, NVLink interconnects, and UCIe support, enabling scalable AI accelerators, higher yields, modular design, and next-generation data-center computing platforms.

Qualcomm specializes in mobile and AI-enabled chiplets, emphasizing power efficiency, customization, and seamless integration with 5G and IoT ecosystems.

Key Players

- Achronix Semiconductor Corporation

- Alibaba Group Holding Ltd. (T-Head)

- Amazon Web Services, Inc. (AWS)

- Amkor Technology, Inc.

- Apple Inc.

- Advanced Micro Devices, Inc. (AMD)

- Broadcom Inc.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Samsung Electronics Co., Ltd.

- JCET Group Co. Ltd.

Recent Developments

January 2026 - NVIDIA Corporation partnered with CoreWeave, Inc. to accelerate the buildout of more than 5 gigawatts of AI factories by 2030. The expanded collaboration aims to scale high-performance AI infrastructure globally, strengthening NVIDIA’s leadership in accelerated computing and reinforcing CoreWeave’s role as a key cloud infrastructure provider for large-scale AI workloads.

November 2025 - Qualcomm Incorporated strengthened its presence in industrial and edge AI markets through a collaboration with Advantech, which unveiled new edge AI solutions powered by Qualcomm’s Dragonwing™ IQ-9075 processor. The solutions target robotics, industrial automation, and generative AI applications, highlighting Qualcomm’s expanding role in high-performance, energy-efficient edge computing and its strategic push beyond traditional mobile-centric semiconductor offerings.

May 2025 - The industry-leading Speedster 7t1500 FPGA powers the VectorPath 815 (VP815) PCIe accelerator card, which was introduced by Achronix Semiconductor Corporation, a pioneer in data acceleration FPGAs. The VP815 offers scalable acceleration, high throughput, and affordable alternatives to conventional GPU-based systems in order to meet the increasing performance and efficiency demands of AI workloads and high-performance computing (HPC) applications. The launch improves Achronix's standing in the markets for advanced computing and data center acceleration, especially in the areas of AI inference and heterogeneous computing architectures.

Global Chiplet Market Coverage

Processor Type Insight and Forecast 2026 - 2035

- CPU

- GPU

- AI/ML Accelerators

- Other Logic Chiplets

Packaging Technology Insight and Forecast 2026 - 2035

- D/3D Integrated

- System-in-Package (SiP)

- Fan-out & Wafer-Level CSP

- Flip-Chip BGA

End-User Industry Insight and Forecast 2026 - 2035

- Data Center & HPC

- Telecom & IT

- Consumer & Enterprise Electronics

- Automotive & Industrial

- Aerospace

- Defense & Healthcare

Global Chiplet Market by Region

- North America

- By Processor Type

- By Packaging Technology

- By End-User Industry

- By Country - U.S., Canada, Mexico

- Europe

- By Processor Type

- By Packaging Technology

- By End-User Industry

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Processor Type

- By Packaging Technology

- By End-User Industry

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Processor Type

- By Packaging Technology

- By End-User Industry

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Chiplet Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Processor Type

1.2.2. By

Packaging Technology

1.2.3. By

End-User Industry

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Processor Type

5.1.1. CPU

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. GPU

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. AI/ML Accelerators

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Other Logic Chiplets

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.2. By Packaging Technology

5.2.1. D/3D Integrated

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. System-in-Package (SiP)

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Fan-out & Wafer-Level CSP

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Flip-Chip BGA

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By End-User Industry

5.3.1. Data Center & HPC

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Telecom & IT

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Consumer & Enterprise Electronics

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Automotive & Industrial

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Aerospace

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.3.6. Defense & Healthcare

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Processor Type

6.2. By

Packaging Technology

6.3. By

End-User Industry

6.3.1.

U.S. Market Estimate and Forecast

6.3.2.

Canada Market Estimate and Forecast

6.3.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Processor Type

7.2. By

Packaging Technology

7.3. By

End-User Industry

7.3.1.

Germany Market Estimate and Forecast

7.3.2.

U.K. Market Estimate and Forecast

7.3.3.

France Market Estimate and Forecast

7.3.4.

Italy Market Estimate and Forecast

7.3.5.

Spain Market Estimate and Forecast

7.3.6.

Russia Market Estimate and Forecast

7.3.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Processor Type

8.2. By

Packaging Technology

8.3. By

End-User Industry

8.3.1.

China Market Estimate and Forecast

8.3.2.

Japan Market Estimate and Forecast

8.3.3.

India Market Estimate and Forecast

8.3.4.

South Korea Market Estimate and Forecast

8.3.5.

Vietnam Market Estimate and Forecast

8.3.6.

Thailand Market Estimate and Forecast

8.3.7.

Malaysia Market Estimate and Forecast

8.3.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Processor Type

9.2. By

Packaging Technology

9.3. By

End-User Industry

9.3.1.

Brazil Market Estimate and Forecast

9.3.2.

Saudi Arabia Market Estimate and Forecast

9.3.3.

South Africa Market Estimate and Forecast

9.3.4.

U.A.E. Market Estimate and Forecast

9.3.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Achronix Semiconductor Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Alibaba Group Holding Ltd. (T-Head)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Amazon Web Services, Inc. (AWS)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Amkor Technology, Inc.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Apple Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Advanced Micro Devices, Inc. (AMD)

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Broadcom Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. IBM Corporation

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Intel Corporation

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Microsoft Corporation

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. NVIDIA Corporation

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Samsung Electronics Co., Ltd.

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. JCET Group Co. Ltd.

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Chiplet Market