TIC Market for Logistics & Supply Chain Industry Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Logistics Function (Shipping, Warehousing, Distribution hubs, Last-mile delivery), by Cargo Type (General Cargo, Cold-Chain, Hazardous Stuff, Fancy Shipments), by End User (Freight Movers, E-commerce Firms, Manufacturing firms)

| Status : Published | Published On : Feb, 2026 | Report Code : VRSME9180 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 125 |

TIC Market for Logistics & Supply Chain Industry Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Logistics Function (Shipping, Warehousing, Distribution hubs, Last-mile delivery), by Cargo Type (General Cargo, Cold-Chain, Hazardous Stuff, Fancy Shipments), by End User (Freight Movers, E-commerce Firms, Manufacturing firms)

TIC Market for Logistics & Supply Chain Industry Overview

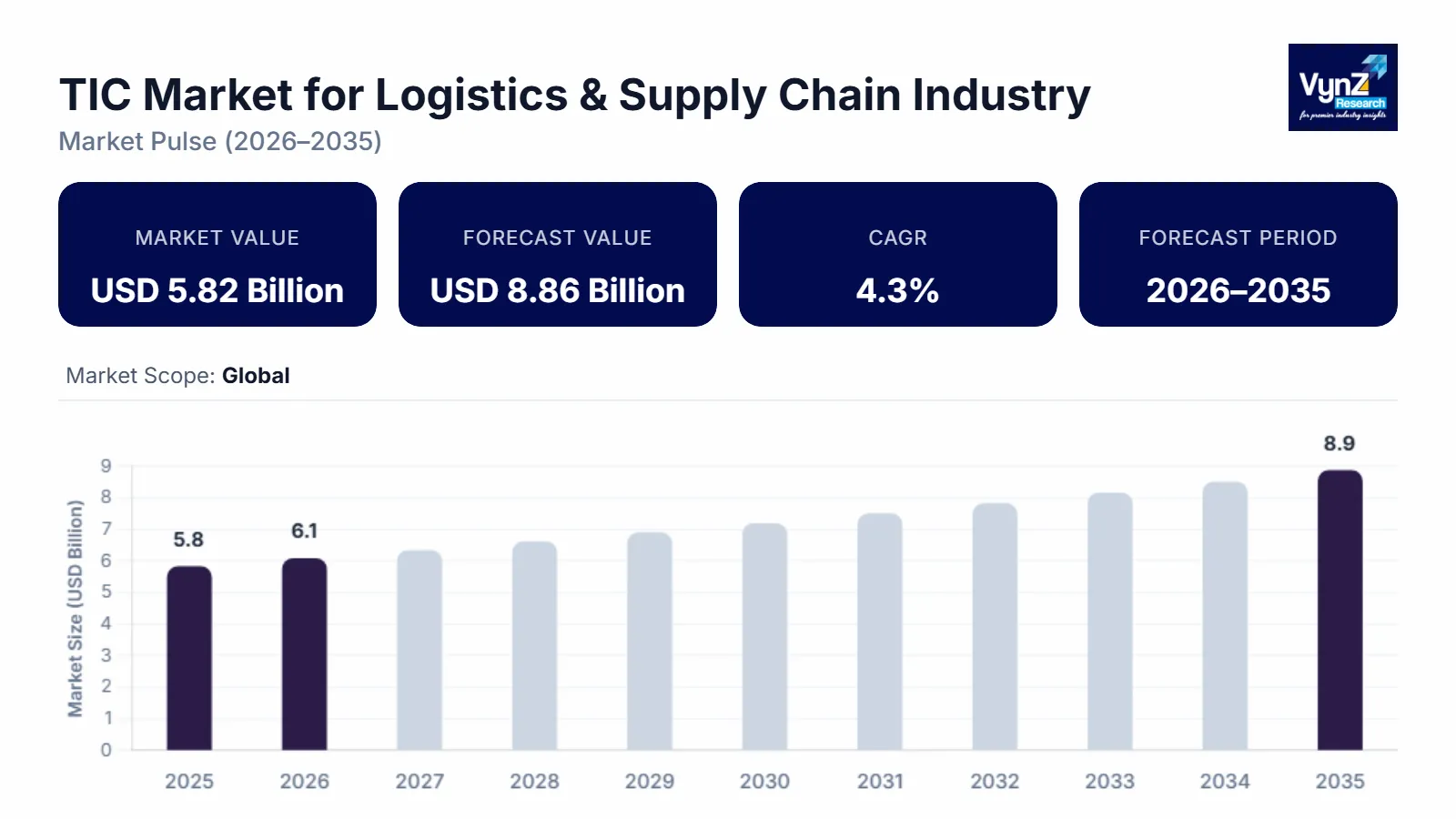

The Logistics and Supply Chain Industry’s Testing, Inspection, and Certification (TIC) market was valued at USD 5.82 billion in 2025 and is estimated to reach USD 6.07 billion in 2026, growing at a CAGR of 4.3% during 2026–2035, to reach USD 8.86 billion by 2035. TIC services ensure the suitability of manufactured products, components, and systems for their intended purpose.

Inspection and testing are the operational parts of quality control and include cost, productivity, on-time delivery, and market share, thus the crucial factor for the survival of any manufacturing company. The TIC market report comprises conformity assessment agencies and includes audit and inspection, testing, verification, quality assurance, and certification.

Logistics and supply chain is one of the fastest-growing sectors owing to the boom in information technology and innovation in sophisticated databases which can track inventor and shipment globally via the internet, resulting in efficiency in transport and logistics. Moreover, growing urbanization, stringent certification requirements, and concerns regarding proper handling, product safety, and quality will propel the growth of the TIC market for the logistics and supply chain industry. The supply chain disruptions shall negatively impact the competitiveness, economic growth, and job creation in the logistics and supply chain industry.

TIC Market for Logistics & Supply Chain Industry Dynamics

Market Trends

The TIC market for logistics and supply chain focuses on ensuring quality, safety, compliance, and traceability across trade networks. Growth is driven by digital inspections, remote audits, sustainability certification, regulatory complexity, and rising demand for transparent, resilient supply chains worldwide. Key drivers include digital transformation, remote audits, IoT-enabled monitoring, sustainability and ESG compliance, and increasing demand for resilient, transparent, and efficient supply chains worldwide.

Growth Drivers

Rising intricacy in worldwide shipping pushes more firms to use inspection services. Because goods come from various nations, move across borders, often by several transport types, checking shipments becomes essential. Testing freight and confirming rules are followed helps avoid problems down the line. These days, logistics teams spend about one-fifth of their safety and risk funds on such checks - cuts downtime, fewer damaged goods reports, keeps fines away.

Growth in online shopping plus faster shipping needs is pushing up demand for testing checks. More packages moving quickly means higher chances of damage during handling or labels getting mixed up. Firms also face tougher rules they must follow, which adds pressure on operations. Checking goods before shipment along with reviewing how things run behind the scenes - those kinds of services are rising by roughly 8 to 10 percent every year. That’s because delivery companies want to keep promises made to clients while holding onto their reputation.

Tougher rules on safety, eco-friendliness, or import-export checks push the market up. Across nations, there's a rising push for checks on dangerous substances, refrigerated shipping conditions, or emissions tracking. Because of these requirements, testing and inspection needs in transport rose about 6 to 7% each year - seen most with food hauls, medicine shipments, or pricey items moving around.

Market Restraints / Challenges

The TIC market for logistics and supply chain face the challenge of the use of sub-contractors and agents who do not know the compliance level and the risk involved. Moreover, the threat of natural disasters may interfere in the operations resulting in delay or damage of goods. Furthermore, lack of testing facilities and skilled personnel may hinder the growth of the TIC market.

Market Opportunities

Testing, inspection, and certification is a huge market that provides opportunities in technologies and has revolutionized the concept of supply chain 4.0 i.e. integrated use of robotics and automation, sensors and IoT, AR and VR, cloud computing, AI, big data analytics, etc. where digital technologies are used on the global value chains, resulting in physical and virtual manufacturing and transportation systems work together to streamline the production. This will result in providing mass customization and develop new business models in a more transparent way.

Global TIC Market for Logistics & Supply Chain Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 5.82 Billion |

|

Revenue Forecast in 2035 |

USD 8.86 Billion |

|

Growth Rate |

4.3% |

|

Segments Covered in the Report |

Service Type, Logistics Function, Cargo Type and End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific |

|

Key Companies |

Intertek Group Plc, Bureau Veritas, MISTRAS Group, SGS SA, Eurofins Scientific SE, TUV Rheinland, TUV SUD, DEKRA SE, Applus+, DNV GL, UL LLC, ALS Limited, Element Materials Technology, BSI Group (British Standards Institution), Lloyd’s Register Group, Kiwa N.V. |

|

Customization |

25% available |

TIC Market for Logistics & Supply Chain Industry Segmentation

By Service Type

The logistics and supply chain TIC sector covers inspection, testing, certification, audits, along with advisory work. Inspection grows quickest - close to 8.4% per year - as demand rises for checking shipments, assessing cargo conditions, also reviewing warehouses worldwide.

Cargo checks take up most of the income - about 42 to 45 percent. Since these inspections happen at docks, storage spots, or transfer zones, they help skip arguments plus lower insurance requests by confirming how much stuff there is, if boxes are intact, along with how well items were moved.

Testing checks help verify cold chains, test package durability - also ensuring safe handling of dangerous cargo. More companies need these tests since sensitive products face trickier shipping routes these days.

Certification’s picking up speed because logistics firms want to meet global rules on trade, safety, or eco practices - helping them move goods across borders smoothly.

By Logistics Function

Thanks to how things move, TIC helps with shipping, storage, moving goods around, also getting them to the final stop. Shipping-focused TIC is expanding quicker - about 9.1% each year - because more cargo’s on the road, ports might get backed up, besides tougher rules for safe transit.

Warehousing TIC checks include site reviews, rack safety scans, or workflow verification. With more automated systems popping up, testing and safety confirmations grow - keeping things running without hiccups.

Distribution hubs need regular checks so things stay accurate. Because they handle lots of orders, mistakes happen more - so inspections must keep up. Tasks pile up fast, meaning reviews can't lag behind.

Last-mile delivery sees more tech use as companies check operations and performance - keeping trust where rivals fight hard.

By Cargo Type

General cargo, items needing cool or warm storage, dangerous stuff, also pricey deliveries make up the market by kind. Cool-storage freight’s growing fastest - almost 9.5% per year - as drug shipping, fresh food routes, alongside biotech transport pick up speed.

Cold-chain checks keep goods at the right temp during shipping and storage. Small changes might ruin items, so more people want real-time tracking or outside verification.

Hazardous stuff moving around needs regular checks or else it won’t pass safety rules. This area keeps TIC work flowing, no matter the economy.

Fancy shipments - like gadgets or high-end gear - use TIC checks to cut losses from stealing, harm during transit, or claim fights, which boosts demand for top-tier inspections.

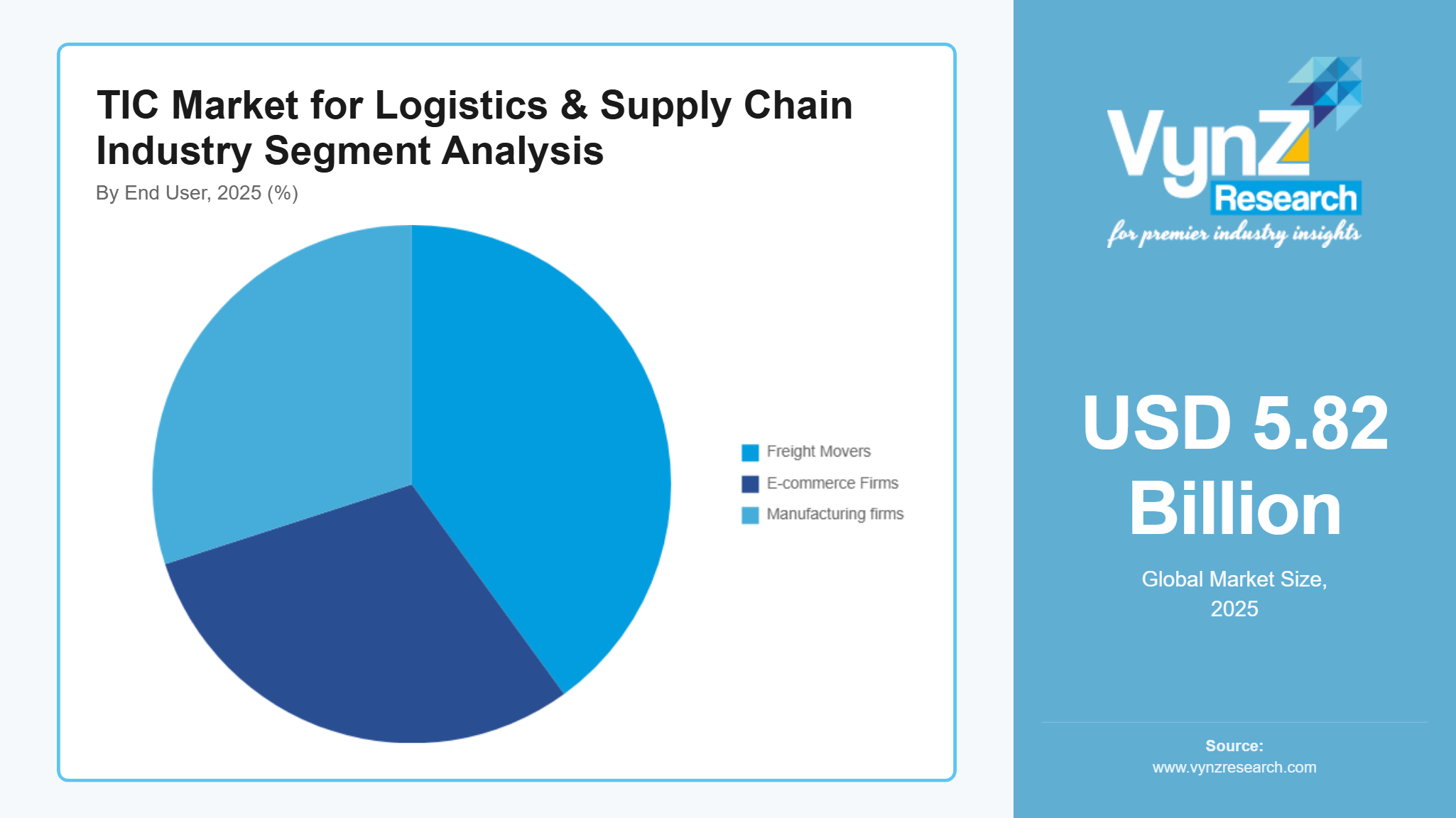

By End-User Industry

For those who use it, this market works with firms moving goods, shipping helpers, online sellers, or factories sending products. Firms handling shipments take up most of the space - more than 40% of overall TIC earnings - because they check things often and on a big scale.

Freight movers use TIC checks to confirm shipments while handling paperwork for trade rules. Separate inspections cut risks, also boosting trust from buyers.

E-commerce firms are growing fast because more packages are being shipped. So that items arrive safely, TIC checks cover how well boxes hold up, whether labels match contents, also if deliveries meet standards.

Manufacturing firms now hand off TIC tasks more often, using outside help to handle supply chain dangers while keeping rules consistent among various transport teams.

Regional Insights

North America

North America’s TIC market for logistics is well-established, yet still climbing by around 5.8–6.3% each year. Trade activity stays strong there, which - alongside solid transport systems - keeps pushing the need for checks and certifications forward. Tough safety rules also play a big role in keeping that demand steady.

Cold-chain logistics is expanding fast in pharma and food delivery, boosting demand for niche testing services. Contracts for checking temperature controls rise by about 10% each year across the area - tighter rules are pushing this trend.

Digital tools in logistics push companies to check how things run, so firms that test performance see more interest - especially those using tech-based checks instead of old methods.

Europe

Europe sees consistent yearly gains near 5.5–6%, thanks to strict rules and active trading between member nations. Because guidelines are aligned, companies need more checks and proof they meet requirements.

Sustainability rules plus tighter carbon reporting push more checks in shipping workflows. Because of this, eco-audits along with emission monitoring outpace older types of inspections.

European shipping firms focus on cutting risks while being clear about operations, which helps boost high-value testing deals even if overall shipments grow slowly.

Asia Pacific

Asia Pacific's growing quicker than anywhere else - about 9 to 10% each year - thanks to booming trade and export-heavy production. Instead of slowing down, countries like China, India, along with Southeast Asian nations are pushing up needs for checking and certifying large shipments.

Port upgrades along with online shopping across borders keep boosting demand for testing firms. As import laws get stricter, officials depend more on outside inspectors.

Folks who check goods nearby or far are adding more truck labs plus test spots at docks - shipment numbers keep climbing, after all.

Competitive Landscape / Company Insights

The Testing, Inspection, and Certification (TIC) market in logistics and supply chain is moderately to highly competitive, characterized by the presence of well‑established global players alongside specialized regional firms. Competition centers on service breadth, technological capabilities, regional presence, regulatory compliance expertise, and digital innovation.

Mini Profiles

Intertek provides a diverse range of both military and civil Aerospace and Defence Services of all aspects of production and performance.

Bureau Veritas provides electrical safety testing and certification services that help gain access to global markets. This certification program test products against recognized safety standards relating to criteria such as electric shock, excessive temperature, radiation, implosion, and mechanical hazards and fire.

Element Materials Technology is an UK-headquartered provider specializing in material and product testing and certification.

Key Players

- Intertek Group Plc

- Bureau Veritas

- MISTRAS Group

- SGS SA

- Eurofins Scientific SE

- TUV

- Rheinland

- TUV SUD

- DEKRA SE

- Applus +

- DNV GL

- UL LLC

- ALS Limited

- Element Materials Technology

- BSI Group (British Standards Institution)

- Lloyd’s Register Group

- Kiwa N.V.

Recent Developments

December 2025 - Bureau Veritas Marine & Offshore (BV) has classed its first methanol-fueled containership, CMA CGM ANTIGONE. The 15,000 TEU methanol dual-fuel vessel was built by CSSC Jiangnan Shipyard for the CMA CGM Group

December 2025 - UL Solutions, a global leader in applied safety science, has signed a memorandum of understanding (MOU) with Saudi Electricity Company to collaborate on advancing fire protection and life safety standards, reflecting a shared commitment to reducing fire risk and strengthening public safety.

April 2025 - The UAE Ministry of Economy collaborated with SGS S.A. for improving consumer protection and product quality compliance all over the nation. SGS shall provide technical support, inspection services, and cooperative efforts to ensure that products entering the UAE market adhere with national and international safety and quality standards. This partnership shall strengthen regulatory enforcement, reduce hazardous and motivate domestic and international suppliers to adhere to best practices. The initiative supports public awareness campaigns, faster certification procedures, and capacity building for UAE inspectors by utilizing SGS's worldwide TIC experience. Also, this helps firms comply with statutory standards while safeguarding consumers.

Global TIC Market for Logistics & Supply Chain Industry Coverage

Service Type Insight and Forecast 2026 - 2035

- Testing

- Inspection

- Certification

Logistics Function Insight and Forecast 2026 - 2035

- Shipping

- Warehousing

- Distribution hubs

- Last-mile delivery

Cargo Type Insight and Forecast 2026 - 2035

- General Cargo

- Cold-Chain

- Hazardous Stuff

- Fancy Shipments

End User Insight and Forecast 2026 - 2035

- Freight Movers

- E-commerce Firms

- Manufacturing firms

Global TIC Market for Logistics & Supply Chain Industry by Region

- North America

- By Service Type

- By Logistics Function

- By Cargo Type

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Service Type

- By Logistics Function

- By Cargo Type

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Service Type

- By Logistics Function

- By Cargo Type

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Service Type

- By Logistics Function

- By Cargo Type

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for TIC Market for Logistics & Supply Chain Industry Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Type

1.2.2. By

Logistics Function

1.2.3. By

Cargo Type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Type

5.1.1. Testing

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Inspection

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Certification

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Logistics Function

5.2.1. Shipping

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Warehousing

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Distribution hubs

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Last-mile delivery

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Cargo Type

5.3.1. General Cargo

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Cold-Chain

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Hazardous Stuff

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Fancy Shipments

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Freight Movers

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. E-commerce Firms

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Manufacturing firms

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Service Type

6.2. By

Logistics Function

6.3. By

Cargo Type

6.4. By

End User

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Service Type

7.2. By

Logistics Function

7.3. By

Cargo Type

7.4. By

End User

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Service Type

8.2. By

Logistics Function

8.3. By

Cargo Type

8.4. By

End User

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Service Type

9.2. By

Logistics Function

9.3. By

Cargo Type

9.4. By

End User

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Intertek Group Plc

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Bureau Veritas

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. MISTRAS Group

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. SGS SA

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Eurofins Scientific SE

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. TUV Rheinland

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. TUV SUD

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. DEKRA SE

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Applus+

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. DNV GL

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. UL LLC

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. ALS Limited

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. Element Materials Technology

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. BSI Group (British Standards Institution)

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Lloyd’s Register Group

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Kiwa N.V.

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Logistics & Supply Chain Industry