Global Industrial Automation Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Enterprise-Level Controls (Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Manufacturing Execution Systems (MES)), Plant Instrumentation (Motors & Drives, Robots (Articulated Robots, Cartesian Robots, Selective Compliance Assembly Robot Arms (SCARA), Collaborative Robots, and Others), Sensors, Machine Vision Systems (Cameras and Optics and LED Lighting), Relays & Switches, and Others), and Plant-Level Controls(Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Others)), by Automation (Semi-Automatic Systems and Fully-Automatic Systems), by End User (Oil & Gas, Chemicals & Materials, Paper & Pulp, Pharmaceuticals & Biotech, Mining & Metals, Food & Beverages, Power, Consumer Goods, Automotive, Machines & Tools, Semiconductor & Electronics, Aerospace & Defense, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9078 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 300 |

Global Industrial Automation Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Enterprise-Level Controls (Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Manufacturing Execution Systems (MES)), Plant Instrumentation (Motors & Drives, Robots (Articulated Robots, Cartesian Robots, Selective Compliance Assembly Robot Arms (SCARA), Collaborative Robots, and Others), Sensors, Machine Vision Systems (Cameras and Optics and LED Lighting), Relays & Switches, and Others), and Plant-Level Controls(Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Others)), by Automation (Semi-Automatic Systems and Fully-Automatic Systems), by End User (Oil & Gas, Chemicals & Materials, Paper & Pulp, Pharmaceuticals & Biotech, Mining & Metals, Food & Beverages, Power, Consumer Goods, Automotive, Machines & Tools, Semiconductor & Electronics, Aerospace & Defense, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Industrial Automation Market Overview

The 2023 valuation of the Global Industrial Automation Market stood at USD 185 billion. It is projected to reach USD 318 billion by 2030, with a forecasted compound annual growth rate (CAGR) of 9.3% from 2025 to 2030.

Industrial automation signifies the integration of intelligent control systems into manufacturing process in place of humans. These systems can be computers, robots, and anything in between. These are advanced control systems that function on advanced technologies like AI and IoT. The implementation of these systems has facilitated predictive maintenance, real-time monitoring, precise data-driven decision-making, manufacturing of high-quality goods, workplace and worker safety, large-scale production, efficiency, and lowering labor and operations costs. It has also helped in achieving better control over the manufacturing process with higher precision due to the elimination of chances of human errors.

Industrial Automation Market Market Segmentation

Insight by Control Systems

The global industrial automation market is divided by different control systems into enterprise-level, plant instrumentation, and plant-level control segments. The enterprise-level controls segment is further divided into Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Manufacturing Execution Systems (MES). Plant Instrumentation is further divided into motors & drives, robots (articulated robots, Cartesian robots, selective compliance assembly robot arms (SCARA), collaborative robots, and others), sensors, machine vision systems (cameras and optics and LED lighting), relays & switches, and others. Plant-level controls are further divided into supervisory control and data acquisition (SCADA), distributed control systems (DCS), programmable logic controllers (PLC), and others. Out of all these segments and subsegments, the enterprise-level controls segment will dominate the market and grow more due to the benefits offered.

Insight by Automation Type

According to the automation type, the global industrial automation market is split into semi-automatic systems and fully automatic systems segments. Out of these two segmentations, it is the fully automatic systems segment that is anticipated to grow at a higher rate. This is attributed to the rising demand for automation solutions across different industry sectors.

Insight by End User

The global industrial automation market is also divided by end users into oil & gas, chemicals & materials, paper & pulp, pharmaceuticals & biotech, mining & metals, food & beverages, power, consumer goods, automotive, machines & tools, semiconductor & electronics, aerospace & defense, and other segments. Out of all these segments, the oil & gas segment is supposed to contribute the larger share of the market and grow more due to the growing adoption of automation technologies in order to enhance troubleshooting and decision-making along with the rise in efficiency and performance across different processes such as drilling operations, diagnostics, inspections, weather monitoring systems, pipeline monitoring systems, and pressure & flow systems.

Global Industrial Automation Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 185 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 318 Billion |

|

Growth Rate |

9.3% |

|

Segments Covered in the Report |

By Component, By Automation, and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industrial Automation Industry Trends

The businesses are now moving towards more functional automation and control systems. The growing shift to Industry 4.0 solutions is also a notable trend in the industry that offers improved analytics and better connectivity. The growing adoption of intelligent process automation by businesses and rapid tech development will improve the manufacturing process and operations, resulting in the growing trend of industrial automation.

Industrial Automation Market Growth Drivers

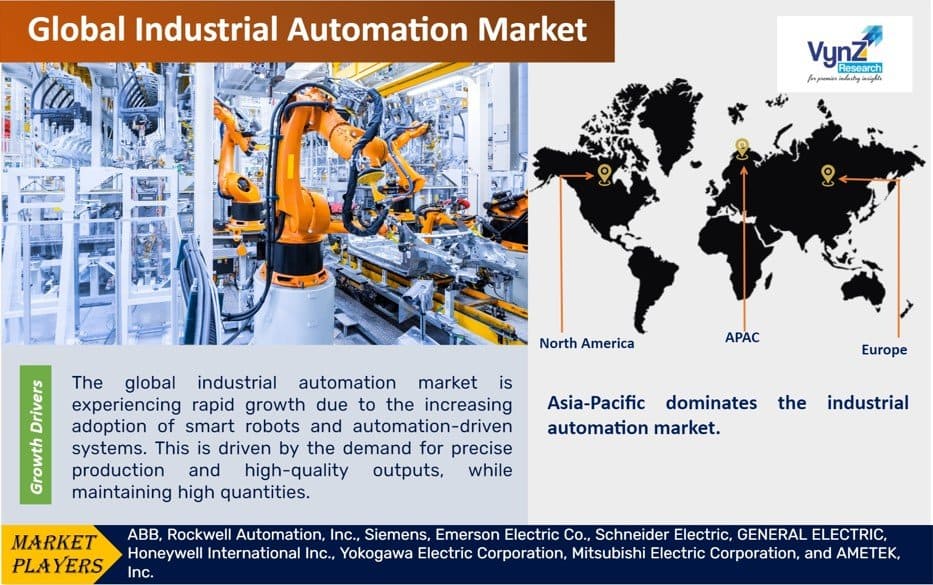

The major factors influencing the growth of the global industrial automation market include higher adoption of smart production control systems such as robots and other advanced automation-driven systems. There is also a growing demand for high-quality goods and accurate production outputs, which is pushing the market forward. Supportive government policies and initiatives to promote digitization and industrial development in the manufacturing sector are also driving the market forward. The notable economic diversification in developing economies and the increasing need for digital transformation across different industry verticals is also resulting in market expansion. The higher investments further accelerate the market growth to transform traditional production processes, the desire to minimize human errors, and the high labor costs in North American and European regions.

Industrial Automation Market Challenges

The significant challenges to the global industrial automation market growth include the high cost of setup, compatibility problems, lack of awareness of the benefits of automation, shortage of technical expertise, growing cyber risks, and insufficient training.

Industrial Automation Market Opportunities

Growth opportunities for the global industrial automation market lie in higher employment of enterprise management and process control solutions, growing number of SMEs, increasing demand for smart systems, growing adoption of IoT in the manufacturing sector, and advancements in engineering technologies.

Industrial Automation Market Geographic Overview

The Asia-Pacific region dominates the global industrial automation market due to a large number of manufacturers producing these advanced systems, higher manufacturing industries, favorable government policies to promote the digitalization of manufacturing plants, and higher investment in IoT.

North America is experiencing growth due to tech developments, growing demand for higher efficiency and lower cost, higher adoption, a large skilled workforce and strong industrial base, and favorable government initiatives.

Europe also shows growth possibilities during the forecast period due to the higher adoption of automation control systems and the rise of automotive and power generation industries.

Industrial Automation Market Competitive Insight

The global industrial automation market is highly competitive and industry players are maintaining their position by adopting strategies like collaboration, mergers & acquisitions, partnerships, product/ technology launches, and geographical expansion.

Rockwell Automation, Inc. is an American provider of industrial automation and digital transformation technologies. Brands include Allen-Bradley, FactoryTalk software and LifecycleIQ Services.

Siemens AG is a German multinational technology conglomerate. It is focused on industrial automation, distributed energy resources, rail transport and health technology.

Some of the key players operating in the industrial automation market: are ABB, Rockwell Automation, Inc., Siemens, Emerson Electric Co., Schneider Electric, GENERAL ELECTRIC, Honeywell International Inc., Yokogawa Electric Corporation, Mitsubishi Electric Corporation, and AMETEK, Inc.

Recent Developments by Key Players

U.S. industrial conglomerate Emerson Electric Co. has acquired NI for USD 8.2 bn to deepen automation push.

Yokogawa Electric Corporation (a leading provider of industrial automation and test and measurement solutions) and FPT Software Company Limited (a global technology and IT services provider) collaborated for the development and deployment of digital transformation (DX) services to strengthen operational technology (OT) – information technology (IT) convergence in the industrial sector. This partnership shall help accelerate the growth of Yokogawa's DX portfolio of applications and services while helping FPT Software expand its market reach.

The Industrial Automation Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Component

- Enterprise-Level Controls

- Product Lifecycle Management (PLM)

- Enterprise Resource Planning (ERP)

- Manufacturing Execution Systems (MES)

- Plant Instrumentation

- Motors & Drives

- Robots

- Articulated Robots

- Cartesian Robots

- Selective Compliance Assembly Robot Arms (SCARA)

- Collaborative Robots

- Others

- Sensors, Machine Vision Systems

- Cameras and Optics

- LED Lighting

- Relays & Switches

- Others

- Plant-Level Controls

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Others

- Enterprise-Level Controls

- By Automation

- Semi-Automatic Systems

- Fully-Automatic Systems

- By End-User

- Oil & Gas

- Chemicals & Materials

- Paper & Pulp

- Pharmaceuticals & Biotech

- Mining & Metals

- Food & Beverages

- Power

- Consumer Goods

- Automotive

- Machines & Tools

- Semiconductor & Electronics

- Aerospace & Defense

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Industrial Automation Market