TIC Market for Mining Industry Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Mining Type (Surface, Underground, Placer, In-situ methods), by Mineral type (Coal, Metals, Non-metals), by End User (Mining Firms, Explorers, Processors, Government Agencies)

| Status : Published | Published On : Feb, 2026 | Report Code : VRSME9187 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 190 |

TIC Market for Mining Industry Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Mining Type (Surface, Underground, Placer, In-situ methods), by Mineral type (Coal, Metals, Non-metals), by End User (Mining Firms, Explorers, Processors, Government Agencies)

TIC Market for Mining Industry Overview

The global mining industry Testing, Inspection, and Certification (TIC) market was valued at USD 3.41 billion in 2025 and is expected to reach USD 3.60 billion in 2026. The market is projected to grow steadily, reaching USD 5.93 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% during the forecast period from 2026 to 2035.

Testing in TIC means an industry activity that assures manufactured products, individual components, and multi-component systems are suitable for the predetermined purpose. Inspection and testing are the operating parts of quality control, which is the most critical factor for the survival of any manufacturing company. Quality control directly supports other factors such as cost, productivity, on-time delivery, and market share. The testing, inspection, and certification market report is composed of conformity assessment agencies, which provide services from audit and inspection to testing, verification, quality assurance, and certification.

Mining is the world’s highest-risk business that is operated in remote and conflict-afflicted areas. Moreover, rapid urbanization, mandatory safety regulations, upsurge in the illicit trade of counterfeit and pirated products, advancement in networking and communication technology, the inclination of outsourcing testing, inspection, and certification services has propelled the growth of the TIC market in the mining industry. Globalization has led to product standardization norms and has penetrated developed technologies across various industries such as building & construction, mining, electronics, and automotive industries, etc., resulting in the growth of the TIC market during the forecast period. Nevertheless, TIC provides various advantages related to its credibility and image, compliance with legal and regulatory requirements, less turnover of employees, high level of cost control improvement, and fast improvement of different processes. Mining and exploration companies require TIC to know that the project is commercially, technically, and operationally viable. Moreover, companies need to minimize the risk and maintain high industry standards according to IOS 14001, OHSAS 18001, etc.

TIC Market for Mining Industry Dynamics

Market Trends

The Testing, Inspection & Certification (TIC) market in the mining industry is experiencing steady growth driven by increasing regulatory pressure, demand for operational efficiency, and rapid adoption of advanced technologies. Mining operations involve complex processes, stringent safety standards, and significant environmental impacts, making TIC services essential for verifying compliance, ensuring worker safety, improving production quality, and managing risks across the entire mining lifecycle — from exploration and extraction to processing, closure, and reclamation.

Growth Drivers

Fresh rules on mine safety and eco standards are pushing demand for TIC work. Because of stricter laws, officials require regular checks, pollution scans, or system reviews - aimed at cutting crashes and harm to nature. Firms in mining spend about 30–35% of their risk and rule-following funds on outside TIC help just to stay safe and green.

Rising need for vital minerals pushes TIC use faster. Because electric cars, green power, or battery systems expand, mining for lithium, copper, nickel, along with rare earths climbs. Checks on mineral purity, ore levels, plus production speed go up around 8–10% each year.

Older gear in mines creates more need for testing and checks. Harsh conditions wear things down fast, so breakdowns happen more often. Because of this, companies now spend more on inspecting structures - about 7 to 9 percent extra each year. Equipment tests are growing at a similar pace as firms aim to keep operations running smoothly. Safety reviews for tailings dams also rise since failures can cause big problems.

Market Restraints / Challenges

The testing, inspection, and certification market face certain challenges like trade wars and growth fluctuations, huge investment for automation and installation of industrial safety systems, high cost of TIC owing to diverse standards and regulations globally. Mining is a risky business having a complex supply chain and strict environmental regulations. Moreover, a lack of testing facilities and skilled personnel may hamper the growth of the TIC market in the mining industry

Market Opportunities

Testing, inspection, and certification is a massive market that provides lucrative opportunities in technologies such as AI, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity. Moreover, the growing availability of advanced aerial imagery, adoption of innovative business models, shifting of mining activities in developing economies will create opportunities for the growth of TIC in the mining industry.

Global TIC Market for Mining Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 3.41 Billion |

|

Revenue Forecast in 2035 |

USD 5.93 Billion |

|

Growth Rate |

5.7% |

|

Segments Covered in the Report |

Service Type, Mining Type, Mineral Type and End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific |

|

Key Companies |

Intertek Group Plc, Bureau Veritas, MISTRAS Group, SGS SA, Eurofins Scientific, TUV Rheinland, TUV SUD, DEKRA SE, Applus+, DNV GL, Element Materials Technology |

|

Customization |

25% available |

TIC Market for Mining Industry Segmentation

By Service Type

Inspection, testing, certification, audits, or advisory work make up the mining TIC field. The inspection part’s growing quickest - close to 8.7% each year - as mines need more safety checks, gear reviews, plus evaluations of waste areas, whether above or below ground.

Inspection work brings in about 43–45% of all market earnings. Since rules demand frequent checks, companies have to schedule them often - not just for legal reasons, but also to keep workers safe and buildings standing strong.

Testing helps check minerals, judge ore value, or track environmental impact. Need grows when mining firms boost recovery rates while sticking to pollution and clean-water rules.

Certification work’s picking up because miners want proof they’re sustainable, while advisors help them pass checks that investors and regulators demand.

By Mining Type

Depending on how it’s done, mining splits into surface, underground, placer, or in-situ methods. Surface digging grows quickest - about 9.1% each year - thanks to big projects pulling up coal, iron ore, along with vital minerals.

Surface mining needs close checks on big machines, transport routes, also ground angles - this pushes up TIC use.

Miners need regular checks because hidden dangers pop up often. Since air flow must stay reliable, tests happen nonstop - this keeps everyone safer underground. On top of that, crews examine walls and supports frequently so collapses don’t occur. When drills or gear get checked ahead of time, surprises drop during urgent moments.

In-situ or placer mining takes up less space yet needs unique tests along with eco-related approvals, creating limited openings for specific TIC work.

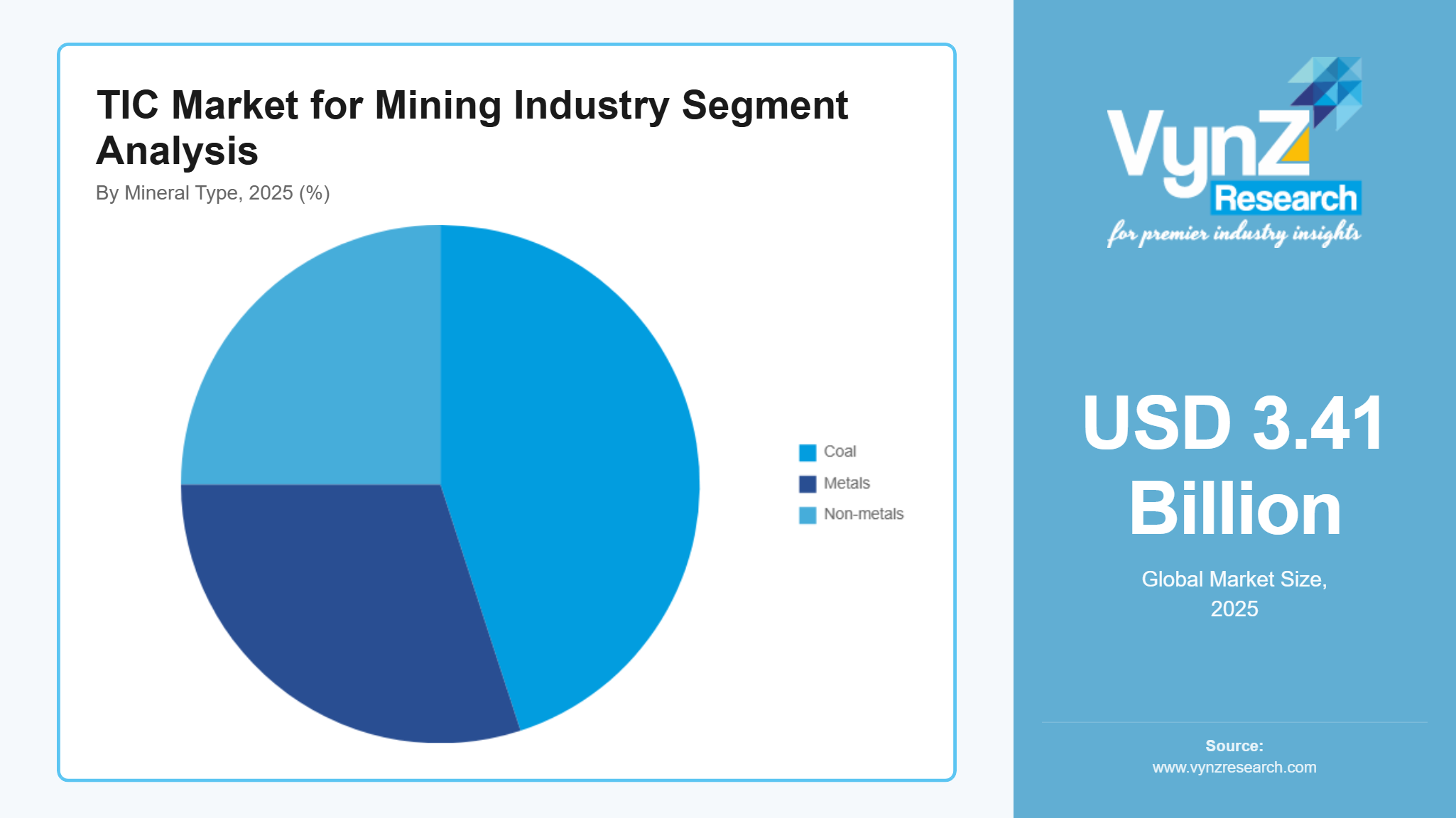

By Mineral Type

Coal, metals, and non-metals make up part of the market - critical ones stand out. These are growing fast, around 10.3% each year, because electric cars need them more now. Demand from green tech pushes their rise steadily.

Lithium, nickel - also rare earths - need tough checks before hitting battery specs. Testing locks in purity so materials perform right under strict rules.

Metallic ores like iron, copper - also gold - bring in big earnings because output stays high while checks on their quality never stop.

Cool demand stays steady thanks to check-ups from regulators plus ongoing watch on pollution levels.

By End-User Industry

Depending on who uses it, this market supports mining firms, explorers, processors, or government agencies. Mining outfits drive most of the need - over half the income comes from them because they constantly require checks and tests.

Mineral prospecting firms use inspection, verification, and analysis help to check rock data or confirm material quality - this backs up project planning plus funding choices.

Processing plants need regular checks on quality plus safety so things run smoothly while meeting rules.

Government watchdogs use TIC firms to run checks or take action, helping keep mining operations open and safe. These outside reviews boost trust while making sure rules are followed underground and on site.

Regional Insights

North America

North America keeps growing at about 5.9–6.4% each year, thanks to strict rules and more output of vital minerals. While the U.S. focuses on safer mines, Canada pushes cleaner practices - both keeping testing and inspection needs stable.

Lithium and copper digging spreads, pushing up checks and verifications. Demand for mineral testing climbs close to 9% yearly - government backing local supplies fuels this jump.

Digital tracking in mines plus distant checks boost testing chances here - yet growth comes through real-time tools that cut delays while improving safety without extra crews showing up.

Europe

Europe sees steady yearly gains near 5.5–6%, thanks to tight eco-rules alongside tough mining safety rules. Because firms must follow these laws, testing and inspection tasks keep coming up regularly.

Rising interest in clean power along with storage tech pushes more checks on key raw materials. Because of this, reviews focused on ecological effects spread quicker compared to standard evaluation methods.

European TIC firms stick to premium advice and rule-checking work, so deals bring in more cash even if numbers grow slow.

Asia Pacific

Asia Pacific’s growing quicker than anywhere else - around 9 to 10 percent every year - thanks to massive mines and stronger need for raw materials. In this area, countries like China, Australia, or India use the most testing, inspection, and certification services when it comes to coal, metals, plus rare minerals.

Firm mineral exports plus refining push demand for solid checks and approval tags. State-required risk reviews also boost use of inspection services.

Worldwide testing firms boost lab setups here, while also stepping up on-site checks to handle large-scale workloads.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on product innovation, pricing strategies, and geographic expansion. Companies such as Microsoft, IBM, Google, Amazon Web Services, and Oracle are investing heavily in R&D, cloud infrastructure, and AI model optimization. Government-backed initiatives, including NIST AI guidelines, the EU AI Act, and national AI strategies in APAC, support technology adoption and reinforce vendor positioning across enterprise and public sector clients.

Mini Profiles

MISTRAS can perform inspections on single components, or centralize testing and machining aerospace production milestones in a purpose-built facility.

Bureau Veritas provides electrical safety testing and certification services that help gain access to global markets. This certification program test products against recognized safety standards relating to criteria such as electric shock, excessive temperature, radiation, implosion, and mechanical hazards and fire.

Intertek provides a diverse range of both military and civil Aerospace and Defence Services of all aspects of production and performance.

Key Players

- Intertek Group Plc

- Bureau Veritas

- MISTRAS Group

- SGS SA

- Eurofins Scientific

- TUV Rheinland

- TUV SUD

- DEKRA SE

- Applus+

- DNV GL

- Element Materials Technology

Recent Developments

In December 2025, Bureau Veritas Marine & Offshore (BV) has classed its first methanol-fueled containership, CMA CGM ANTIGONE. The 15,000 TEU methanol dual-fuel vessel was built by CSSC Jiangnan Shipyard for the CMA CGM Group

In November 2025, Intertek Group plc, a leading Total Quality Assurance provider to industries worldwide, has acquired Suplilab, a market-leading provider of food safety and medical devices testing services, based in San José, Costa Rica.

In November 2025, DEKRA inaugurated a cybersecurity evaluation laboratory in Málaga, Spain, dedicated to testing and certifying digital products and semiconductors. This strengthens its global Digital Trust Services offering a response to growing demand for security and resilience in digital and connected technologies.

Global TIC Market for Mining Industry Coverage

Service Type Insight and Forecast 2026 - 2035

- Testing

- Inspection

- Certification

Mining Type Insight and Forecast 2026 - 2035

- Surface

- Underground

- Placer

- In-situ methods

Mineral type Insight and Forecast 2026 - 2035

- Coal

- Metals

- Non-metals

End User Insight and Forecast 2026 - 2035

- Mining Firms

- Explorers

- Processors

- Government Agencies

Global TIC Market for Mining Industry by Region

- North America

- By Service Type

- By Mining Type

- By Mineral type

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Service Type

- By Mining Type

- By Mineral type

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Service Type

- By Mining Type

- By Mineral type

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Service Type

- By Mining Type

- By Mineral type

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for TIC Market for Mining Industry Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Type

1.2.2. By

Mining Type

1.2.3. By

Mineral type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Type

5.1.1. Testing

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Inspection

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Certification

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Mining Type

5.2.1. Surface

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Underground

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Placer

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. In-situ methods

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Mineral type

5.3.1. Coal

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Metals

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Non-metals

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Mining Firms

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Explorers

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Processors

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Government Agencies

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Service Type

6.2. By

Mining Type

6.3. By

Mineral type

6.4. By

End User

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Service Type

7.2. By

Mining Type

7.3. By

Mineral type

7.4. By

End User

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Service Type

8.2. By

Mining Type

8.3. By

Mineral type

8.4. By

End User

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Service Type

9.2. By

Mining Type

9.3. By

Mineral type

9.4. By

End User

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Intertek Group Plc

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Bureau Veritas

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. MISTRAS Group

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. SGS SA

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Eurofins Scientific

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. TUV Rheinland

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. TUV SUD

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. DEKRA SE

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Applus+

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. DNV GL

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Element Materials Technology

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Mining Industry