Global 48 Volt Battery System Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (AC/DC Inverter, 48-Volt Lithium-Ion Battery, Battery Controller, Power Distribution Box, and Others), by Architecture (Crankshaft Mounted, Belt Driven, Transmission Output Shaft, and Dual-Clutch Transmission-Mounted), by Vehicle Type (Passenger Vehicle and Commercial Vehicle), by Vehicle Class (Premium, Mid, Entry, and Luxury), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VRAT9625 | Industry : Automotive & Transportation | Available Format :

|

Page : 225 |

Global 48 Volt Battery System Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (AC/DC Inverter, 48-Volt Lithium-Ion Battery, Battery Controller, Power Distribution Box, and Others), by Architecture (Crankshaft Mounted, Belt Driven, Transmission Output Shaft, and Dual-Clutch Transmission-Mounted), by Vehicle Type (Passenger Vehicle and Commercial Vehicle), by Vehicle Class (Premium, Mid, Entry, and Luxury), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

48 Volt Battery System Market Overview

The Global 48 Volt Battery System Market size is expected to grow from USD 3.1 billion in 2023 to USD 25.5 billion by 2030. It will register a CAGR of 27.2% during the forecast period. The Automotive 48-volt battery system is an electrical system that increases engine efficiency by reducing the weight of engine parts and increasing mileage. Manufacturers are unveiling new models with 48V battery systems because of their low cost and high efficiency when compared to 12V systems used in vehicles, which reduces carbon emissions and fuel consumption.

The automobile industry is boosting the electrification of the powertrain for vehicles to comply with global fuel economy regulations. 48-volt battery systems enable internal combustion engines to function more effectively, resulting in increased fuel economy and reduced carbon emissions at a minimal cost. During the forecast period, this will augment the global 48-volt battery system market.

Automotive 48-volt battery systems are more cost-effective hybrid solutions for decreasing discharge than conventional battery electric vehicles. This 48-volt automotive battery system provides four times the power of a 12-volt battery. In mild hybrid vehicles, the 48-volt battery system is widely used.

48 Volt Battery System Market Segmentation

Insight by Component

Based on Components, the Global 48 Volt Battery System Market is segmented into AC/DC Inverter, 48-volt Lithium-Ion Battery, Battery Controller, Power Distribution Box, and Others. AC/DC Inverter contributes the largest share in the market and is important in 48 Volt Battery Systems as batteries provide DC power which is converted into AC for use in most electrical devices. The inverter is also responsible for securing the vehicle's electrical system against surges and spikes, as well as isolating the 48-volt system from the high-voltage battery.

Insight by Architecture

Based on Architecture, the Global 48 Volt Battery System Market is segmented into crankshaft-mounted, belt-driven, Transmission Output Shaft, and Dual-Clutch Transmission-Mounted. Belt-driven dominates the 48 Volt Battery System Market since belt-driven (P0) is the initial configuration of the powertrain being used in mild hybrid vehicles. Thus, contributing significantly to their global adoption. Also, pure hybrid vehicles are very expensive due to their battery system, so mild hybrid vehicles fill the gap between technologies and meet the condition of low carbon emission at an affordable price.

Insight by Vehicle Type

Based on Vehicle Type, the Global 48 Volt Battery System Market is bifurcated into Passenger Vehicle and Commercial Vehicle. The passenger vehicle contributes the largest share in the market owing to a high combination of the 48-volt battery systems in passenger cars like Renault Scenic and Buick LaCrosse.

Insight by Vehicle Class

Based on Vehicle Class, the Global 48 Volt Battery System Market is categorized into Premium, Mid, Entry, and Luxury. The mid-sized vehicle class dominates the market owing to increased prominence for vehicles to enhance fuel efficiency and rising awareness among people about battery-driven vehicles. Furthermore, strict regulations by the government regarding emission norms and safety will propel the market growth of the 48 Volt Battery System Industry.

Global 48 Volt Battery System Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 3.1 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 25.5 Billion |

|

Growth Rate |

27.2% |

|

Segments Covered in the Report |

By Component,By Architecture,By Vehicle Type,By Vehicle Class, |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America,Europe,Asia-Pacific (APAC),Rest of the World (RoW) |

Industry Dynamics

48 Volt Battery System Market Growth Drivers

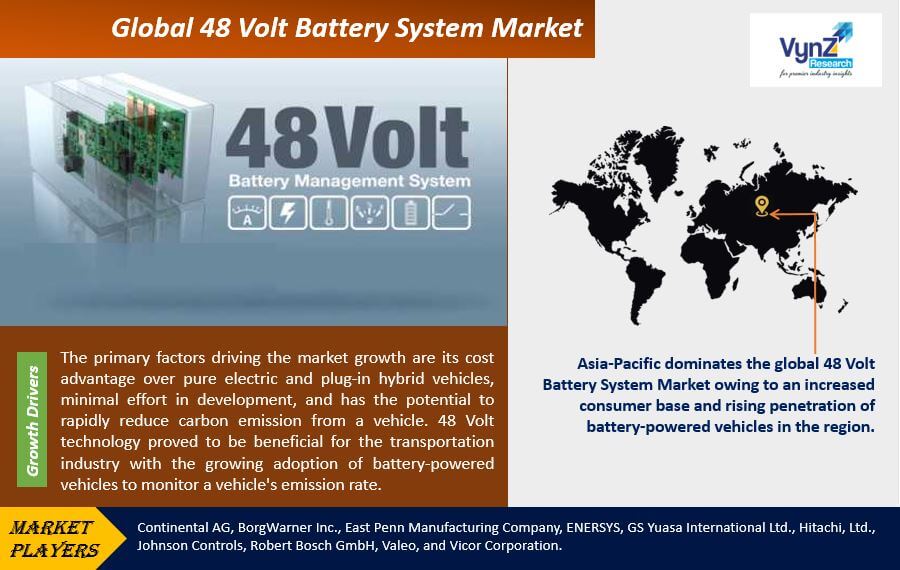

The primary factors driving the market growth are its cost advantage over pure electric and plug-in hybrid vehicles, minimal effort in development, and the potential to rapidly reduce carbon emissions from a vehicle. 48 Volt technology proved to be beneficial for the transportation industry with the growing adoption of battery-powered vehicles to monitor a vehicle's emission rate. Also, strict regulations by the government about the CO2 emission norms in the environment and the increasing trend towards the implementation of fast-charging batteries will increase the adoption of 48V technology during the forecast period.

Automotive 48-volt battery systems can power a wide range of electrical devices, such as lights, radios, and climate control systems. The main benefit of using an automotive 48-volt battery system is that standard electrical connections and components can be used. This means one can easily tailor the system according to specific requirements.

The increased adoption in several applications like electric vehicles, small power tools, and golf carts will drive 48 Volt Battery System Market Demand. Lead-acid batteries are used in the systems to generate the 48-volt supply required by many electrical devices. Lead-acid batteries are the most commonly used type of battery in automobiles and other vehicles, and they have a long track record of reliability and performance.

Because advanced battery systems are equipped for the vehicles, electric vehicles are very expensive these days, resulting in a lower rate of adoption among the middle-class public. Aside from that, 48V technology reduces vehicle operating costs while improving vehicle efficiency and speed. As a result, automotive 48V technology is regarded as a bridging technology between a pure electric vehicle and a conventional vehicle.

48 Volt Battery System Market Challenges

The increased cost of implementation will hamper market expansion. The demand for 48-volt hybrid systems is expected to decline owing to an increased focus by the governments to produce zero-emission vehicles. Furthermore, the integration of a 48-volt battery system raises the cost of a 48-volt system integrated battery electric vehicle, which is a major impediment to the 48-volt battery system market.

48 Volt Battery System Market Opportunities

The market participants are undertaking research and development initiatives to improve the performance of battery systems. These 48V battery systems can reduce CO2 emissions in the coming years while remaining affordable to a broader range of customers. Major automakers are incorporating 48-volt battery systems into vehicles to improve performance and efficiency, thereby accelerating market opportunities in the global 48 Volt Battery System Industry. Also, the increased adoption of fuel-efficient technology in the automotive industry and the increased prominence of electric vehicles in the automotive sector will further offer lucrative opportunities in the 48 Volt Battery System Market.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Asia-Pacific dominates the global 48 Volt Battery System Market owing to an increased consumer base and rising penetration of battery-powered vehicles in the region. China is recognized as the world's largest auto market. At the same time, due to government subsidies, China hopes to achieve unprecedented growth in the sale of electric vehicles, thereby accelerating the market development of the 48 Volt Battery System Industry in the region.

48 Volt Battery System Market Competitive Insight

The global automotive 48V system market is fiercely competitive. The key players are massively investing in research and development (R&D) to improve their product lines and offerings. Furthermore, new product development enables them to meet the rapidly changing consumer demand in the automotive industry. In addition, advancements in convenience features and safety systems are pushing manufacturers to design compatible battery systems without increasing vehicle costs.

With the conviction that 48V systems are a crucial requirement for advanced vehicles, Borg Warner, Inc. has developed one of the industry's most comprehensive 48V portfolios. Their extensive knowledge of electric motors, power electronics, and mechanical components, as well as their comprehensive system knowledge of propulsion solutions, place them in a unique position. Borg Warner, Inc. is now the world's leading manufacturer of propulsion technologies for vehicles powered by combustion engines, as well as hybrid and electric vehicles. BorgWarner's portfolio includes a large number of 48-volt technologies, each of which offers significant efficiency gains. Other advantages include easy integration, lower weight, and reduced space requirements, allowing for more flexible use of the installation area. Fuel savings of up to 20% can be achieved with corresponding improvements in exhaust emission values in real-world driving conditions, as highlighted during both the preliminary development and series development phases. Thus, their solutions can also improve passenger comfort by improving response or power transmission.

Bosch's 48 V hybrid solutions make it easier for passenger cars to transform to electrified powertrains. The solutions allow electric driving modes for coasting, traffic jam assistance, and highly automated parking. This significantly reduces fuel consumption and local emissions. Electrical energy obtained through recuperation is used to power the 48 V power net as well as charge the 48 V battery.

Recent Development by Key Players

Vicor Corp. (Electric power module supplier) is pointing out that automakers can enjoy the benefits of 48-volt electric systems in the vehicles without immediately replacing the many familiar 12-volt devices employed in their cars.

Engineers have consistently predicted that cars would shift from 12-volt electrical systems to 48-volt systems for two decades. But cost and inertia have kept 12-volt electrics in place, with the occasional targeted application of 48-volt power in high-current applications.

Key Players Covered in the Report

Some of the key players operating in the global 48 Volt Battery System Market include Continental AG, BorgWarner Inc., East Penn Manufacturing Company, EnerSys, GS Yuasa International Ltd., Hitachi, Ltd., Johnson Controls, Robert Bosch GmbH, Valeo and Vicor Corporation.

The 48 Volt Battery System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Component

- AC and DC Inverter

- 48 Volt Lithium-Ion Battery

- Battery Controller

- Power Distribution Box

- Others

- By Architecture

- Crankshaft Mounted

- Belt Driven

- Transmission Output Shaft

- Dual Clutch Transmission Mounted

- By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- By Vehicle Class

- Premium

- Mid

- Entry

- Luxury

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

48 Volt Battery System Market