U.S. Freight and Logistics Market Size & Share - Growth Forecast Report 2035

Industry Insights By Service (Transportation, Warehousing and Distribution, Freight Forwarding and Value-Added Logistics Services), By Mode Of Transportation (Road, Rail, Air and Maritime), By Industry (Retail & E-commerce, Healthcare, Industrial & Manufacturing and Food & Beverage) and By Geography (U.S)

| Status : Published | Published On : Jan, 2026 | Report Code : VRAT9653 | Industry : Automotive & Transportation | Available Format :

|

Page : 91 |

U.S. Freight and Logistics Market Size & Share - Growth Forecast Report 2035

Industry Insights By Service (Transportation, Warehousing and Distribution, Freight Forwarding and Value-Added Logistics Services), By Mode Of Transportation (Road, Rail, Air and Maritime), By Industry (Retail & E-commerce, Healthcare, Industrial & Manufacturing and Food & Beverage) and By Geography (U.S)

U.S. Freight and Logistics Market Overview

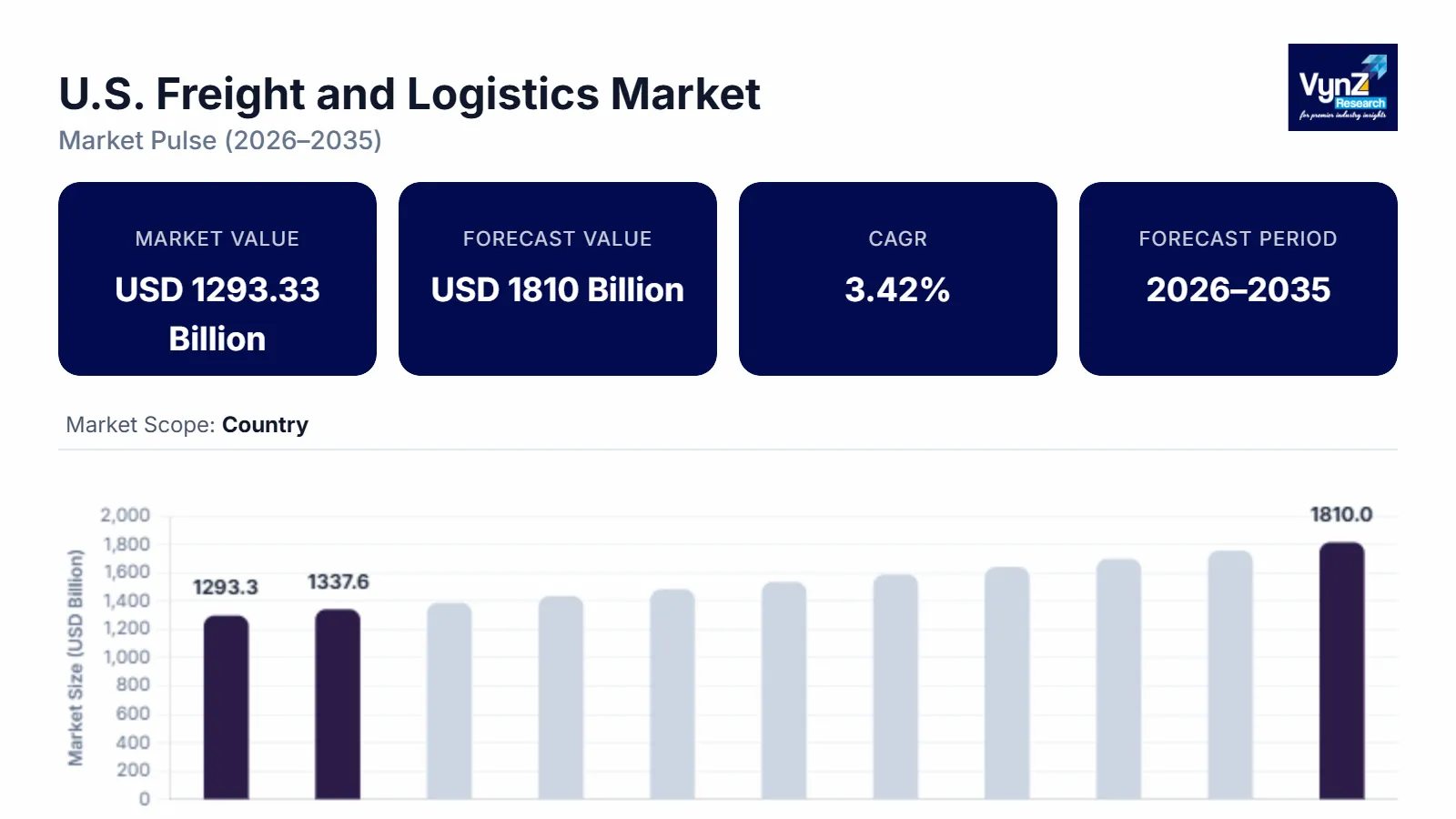

The U.S. Freight and Logistics Market size was valued at USD 1293.3 billion in 2025 and is estimated to reach around USD 1337.5 billion in 2026. It is projected to reach around USD 1810 billion by 2035, expanding at a CAGR of about 3.42% from 2026 to 2035.

Industry-wide supply chains are becoming more efficient and optimized due to technological developments like automation, artificial intelligence, and data analytics. The market is expanding as a result of the infrastructure developments. The major factors propelling the U.S. freight and logistics business include the expansion of e-commerce, modernization initiatives, and significant infrastructure investments. Sustainability initiatives also have a favorable effect on this sector's growth.

U.S. Freight and Logistics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1293.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 1810 Billion |

|

Growth Rate |

3.42% |

|

Segments Covered in the Report |

By Service, By Mode of Transportation and By Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

U.S |

U.S. Freight and Logistics Industry Dynamics

U.S. Freight and Logistics Market Trends/ Growth Drivers:

Companies are concentrating on using technology and insights from data to streamline their supply chains.E-commerce and last-mile delivery are key growth drivers in the U.S. freight and logistics market, as the popularity of online shopping is increasing demand for effective last-mile delivery options. Additionally, there is growing need for real-time tracking and visibility of commodities across the supply chain. Furthermore, due to increasing international trade necessitates robust logistics networks for the movement of goods across borders. Companies are focusing on green logistics solutions and zero-emission truck adoption, that are driven by environmental concerns and regulations

U.S. Freight and Logistics Market Challenges

The U.S. Freight and Logistics Market faces numerous challenges like the shortage of qualified truck drivers and other essential personnel. Supply chain disruptions is also a challenge for the growth of this market. Rising costs of labour wages, fuel prices and regulatory compliance expenses are too contributing to increased operational costs for freight and logistics companies. Infrastructure limitations, capacity constraints results in higher freight rates and operational inefficiencies.

U.S. Freight and Logistics Market Opportunities

The US freight and logistics market is expected to continue growing, driven by ongoing investments in infrastructure, technological advancements, and the continued expansion of e-commerce. The industry is expected to become more efficient, automated, and sustainable in the coming years

Recent development by the key players

Federal Express Corporation (FedEx), has partnered with Singapore-based QuikBot Technologies, to introduce autonomous delivery robots at selected commercial buildings in Singapore. This move marks FedEx’s first deployment of delivery robots in the country, that shall leverage autonomous tech floor-to-floor, last-mile commercial deliveries.

Pepsi and XPO Logistics has collaborated for transportation across England and Wales. The partnership with XPO Logistics will operate across PepsiCo’s four main distribution sites in Leicester, Lutterworth, Coventry, and Warrington, supporting the distribution of its popular snacks brands, such as Walkers and Doritos, to customers throughout the United Kingdom (UK).

U.S. Freight and Logistics Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the U.S. Freight and Logistics Market report, along with forecasts at the regional and country levels from 2026-2035. Our report has categorized the market based on service, mode of transportation and industry.

Insight by Service

- Transportation

- Warehousing and Distribution

- Freight Forwarding

- Value-Added Logistics Services

On the basis of service the U.S. Freight and Logistics Market is segregated into Transportation, Warehousing and Distribution, Freight Forwarding and Value-Added Logistics Services. Transportation dominate the market share as it includes all modes of transport (road, rail, air, and maritime) and is the largest segment by revenue. Also warehousing and distribution segment is experiencing rapid growth due to the increasing demands of e-commerce and inventory management.

Insight by Mode of Transportation

- Road

- Rail

- Air

- Maritime

Based on the mode of the transportation, the U.S. Freight and Logistics Market is segmented into Road, Rail, Air and Maritime. Road dominates the transportation segment, especially in domestic transportation. Rail transportation is important for long-distance, heavy-haul freight. Air transportation is used for time-sensitive shipments and maritime mode is crucial for international trade and large volume shipments.

Insight by Industry

- Retail & E-commerce

- Healthcare

- Industrial & Manufacturing

- Food & Beverage

According to the Industry the U.S. Freight and Logistics Market is segmented into Retail & E commerce, Healthcare, Industrial & Manufacturing and Food & Beverage. Retail & E-commerce is a major driver of growth due to the continued expansion of online shopping. The healthcare industry also relies heavily on logistics for the movement of pharmaceuticals, medical equipment, and other supplies.

U.S. Freight and Logistics Market : Geographic Overview

- U.S.

- Canada

- Mexico

The Coastal States (California, Texas, Florida, and New York) dominate the U.S. Freight and Logistics Market as these regions are major points of entry and distribution for international and domestic freight. Midwestern states are also crucial for manufacturing and agricultural goods. And Inland hubs are important inland distribution centers.

U.S. Freight and Logistics Market : Competitive Insights

- UPS

- FedEx

- C.H. Robinson

- XPO Logistics

- J.B. Hunt

U.S. Freight and Logistics Market report offer a comprehensive market segmentation analysis along with estimation for the forecast period 2026-2035.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

U.S. Freight and Logistics Market