Asia Electric Two-Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-scooters, E-bikes, E-motorcycles, Others), by Battery Type (Sealed Lead Acid, Li-ion, Ni-MH), by Battery Technology (Removable Battery, Non-removable Battery), by Voltage (24V, 36V, 48V, 60V, 72V), by Geography (China, India, Indonesia,Thailand, Malaysia, Philippines, Vietnam)

| Status : Published | Published On : Nov, 2024 | Report Code : VRAT4052 | Industry : Automotive & Transportation | Available Format :

|

Page : 99 |

Asia Electric Two-Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-scooters, E-bikes, E-motorcycles, Others), by Battery Type (Sealed Lead Acid, Li-ion, Ni-MH), by Battery Technology (Removable Battery, Non-removable Battery), by Voltage (24V, 36V, 48V, 60V, 72V), by Geography (China, India, Indonesia,Thailand, Malaysia, Philippines, Vietnam)

Asia Electric Two-Wheeler Market Overview

The Asian electric two-wheeler market fleet size is predicted to reach 114.6 billion units by 2030, growing at a CAGR 14.2% during 2025-2030.

The Asia electric two-wheeler market is expanding rapidly due to the demand for eco-friendly transportation solutions that includes motorcycles, electric scooters, and mopeds. The market has witnessed significant demand for these products over the last few years with the increasing disposable income and rapid urbanization.

The market is anticipated to grow with the supportive government policies, technological advancements, and rising fuel prices that push consumers toward electric options.

Asia Electric Two-Wheeler Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 95.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 114.6 Billion |

|

Growth Rate |

14.2% |

|

Segments Covered in the Report |

By Product, By Battery Type, By Battery Technology,By Voltage |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

China, India, Indonesia,Thailand, Malaysia, Philippines, Vietnam |

Asia Electric Two Wheeler Industry Dynamics

Asia Electric Two Wheeler Market Trends/ Growth Drivers:

Various Asian countries offer tax incentives, subsidies, and rebates for manufacturers and consumers to promote EV adoption. Electric two-wheelers are cheaper to operate due to lower fuel costs and few maintenance requirements. Carbon emissions are reduced as the government is aware of environmental degradation, and urbanization.

The technological advancements in battery technology, government support and initiatives for electric vehicles, and increasing awareness for curbing vehicular emissions, have made electric two-wheelers more practical for daily use. OEMs are investing capital in research and development to further increase the efficiency of the electric battery along with reducing their cost. Most of the light electric vehicles run on lithium-ion batteries, for which manufacturers are researching to increase its charging capacity.

Asia Electric Two Wheeler Market Challenges

However, the cost of battery, lack of adequate charging infrastructure and competition from gasoline-driven two-wheelers are the key factors hindering the growth of the Asian electric two-wheelers market. Proper disposal or recycling of used batteries poses environmental challenges as battery degradation is a concern for consumers. Consumer awareness and high initial costs also contribute to the restraints for the market growth.

Recent Developments by Key Players

Yadea (the world's leading brand of electric two-wheelers) inuagurated its new factory in Karawang, Indonesia, which will be Yadea's eighth factory globally and will be its largest factory in Southeast Asia. This event marks an important milestone in aYadea's commitment to innovation and excellence in electric vehicles.

Hero Electric has launched its new range of electric scooters of Optima CX5.0, Optima CX2.0 and NYX in the Indian market. The newly updated Comfort and City speed scooters are now available for purchase at a price range of 85,000-95,000 and 105,000-130,000, respectively. These new range of electric scooters are available in various colours like dark matt blue, matt maroon colors and charcoal black. These electric scooters boasts advanced Japanese motor technology that promises a seamless riding experience and also feature German ECU technology for accurate performance.

Asia Electric Two-Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the Asian Electric Two Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, battery type, battery technology and voltage.

Insight by Product

- e-scooters

- e-bikes

- e-motorcycles

- Others

E-scooters held the largest share of more than 55% in the Asian electric two-wheeler market

Based on product, the market is categorized into e-scooters, e-bikes, e-motorcycles, and others. E-scooters held the largest share of more than 55% in the Asian electric two-wheeler market in terms of fleet size. The increasing popularity of electric scooters among the younger generation especially working professionals and students leads to the largest share of the category.

Insight by Battery Type

- Sealed Lead Acid

- Li-ion

- NiMH

Sealed lead acid batteries dominate the market

On the basis of battery type, the market is segmented into sealed lead acid, Li-ion, and NiMH. Of all, sealed lead acid is the most common type of battery used in electric two-wheelers in Asia. The highest share of sealed lead acid batteries in the market is due to the lower prices and high output of these batteries.

Insight by Battery Technology

- Removable batteries

- Non-removable batteries

Non-removable batteries dominate the market share

On the basis of battery technology, the market is categorized into removable batteries and non-removable batteries. Of both categories, non-removable batteries are majorly used in the market as it is convenient for electric two-wheelers to plug in and charge batteries instead of removing and charging indoors.

Insight by Voltage

- 24V

- 36V

- 48V

- 60V

- 72V

48V electric two-wheeler holds the largest share in the Asian electric two-wheeler market

Based on voltage, the market is segmented into 24V, 36V, 48V, 60V, 72V. Of all, 48V electric two-wheeler holds the largest share in the Asian electric two-wheeler market, followed by 36V two-wheelers. Most of the e-rickshaws and e-scooters are being developed with a battery of 48V thus leading to the largest share of the category.

Asia Electric Two-Wheeler Market: Geographic Overview

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

Competitive Insights of Asia Electric Two-Wheeler Market:

RD_COMPANY_COVERED

Market players in the Asian electric two-wheeler industry are investing huge capital in battery technology, motor technology, and capacity expansion in order to cater to rising demand.

HERO ELECTRIC is a pioneer and market leader in the Indian electric two-wheeler industry. Company have been the front runner for electric mobility in India for over a decade and offers an ecological 2-wheeler solution to their consumers that gives value for money.

Hero Electric’s mission of “No Emission” supports to make the country greener with ‘Zero Pollution’ transportation through its wide range of electric vehicles. Every product manufactured by them is closely inspected, rigorously tested by quality engineers and put through 46 stringent quality checks before it reaches the customers that makes them quality seekers and a quality conscious entity. It is a SA 8000 certified organization that is socially responsible, environmentally conscious and professionally ethical in its business operations.

Yadea, the world's leading electric two-wheeler brand, has ranked global No.1 in annual sales for last 6 consecutive years, with the product ranges mainly covering high-performance electric mopeds, electric bicycles, electric motorcycles and electric kick scooters.

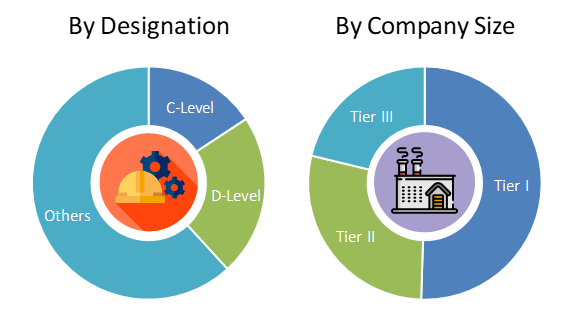

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Asia Electric Two-Wheeler Market