Global Automotive Differential Market – Analysis and Forecast (2025-2030)

Industry Insights by Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), by Drive Type (Open Differential, Locking Differential, Limited Slip Differential, Electronic Limited Slip Differential, Torque Vectoring Differential), by Off-Highway Vehicle (Construction & Mining Equipment, Agriculture Tractors, Forklift) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Apr, 2024 | Report Code : VRAT4090 | Industry : Automotive & Transportation | Available Format :

|

Page : 220 |

Global Automotive Differential Market – Analysis and Forecast (2025-2030)

Industry Insights by Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), by Drive Type (Open Differential, Locking Differential, Limited Slip Differential, Electronic Limited Slip Differential, Torque Vectoring Differential), by Off-Highway Vehicle (Construction & Mining Equipment, Agriculture Tractors, Forklift) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Automotive Differential Market Overview

The Global Automotive Differential Market is expected to expand at a CAGR of 5.9 percent from 2025 to 2030. It is expected to grow from a market size of USD 18.8 billion in 2023 to USD 26.2 billion by 2030. The demand for improved road traction and fuel efficiency are two major factors driving the growth of the automotive differential industry. With vehicle demand, the automotive differential market has a lot of room for development. A major driver for the differential market is the increasing demand for all-wheel-drive vehicles.

Since the outer wheels must occupy a greater diameter, the automotive differential assists in smooth operations by assisting the wheels to revolve at different speeds. It is a component of the rear axle assembly of rear-wheel drives, consisting of rear drive axles and rear axle housing, which splits or allows the power produced to move the wheels independently.

Automotive Differential Market Segmentation

By Vehicle Type

• Passenger Car

• Light Commercial Vehicle

• Heavy Commercial Vehicle

In terms of volume and value, the passenger car market is the highest. The main factors influencing passenger car sales in various countries are rising per capita income and improved living standards.

By Drive Type

• Open Differential

• Locking Differential

• Limited Slip Differential

• Electronic Limited Slip Differential

• Torque Vectoring Differential

The open differential market is expected to dominate the automotive differential market in terms of differential form. Due to its low cost and the fact that it offers better traction on good roads, most vehicles are fitted with an open differential.

By Off-Highway Vehicle

• Construction & Mining Equipment

• Agriculture Tractors

• Forklift

With a market value of over USD 10.1 billion, agriculture tractors are the market leader. Agriculture tractors are the fastest-growing segment in the automotive differential, owing to the rising global population, declining soil fertility, and unpredictable climatic changes.

By Region

• Asia Pacific

• Europe

• North America

• RoW

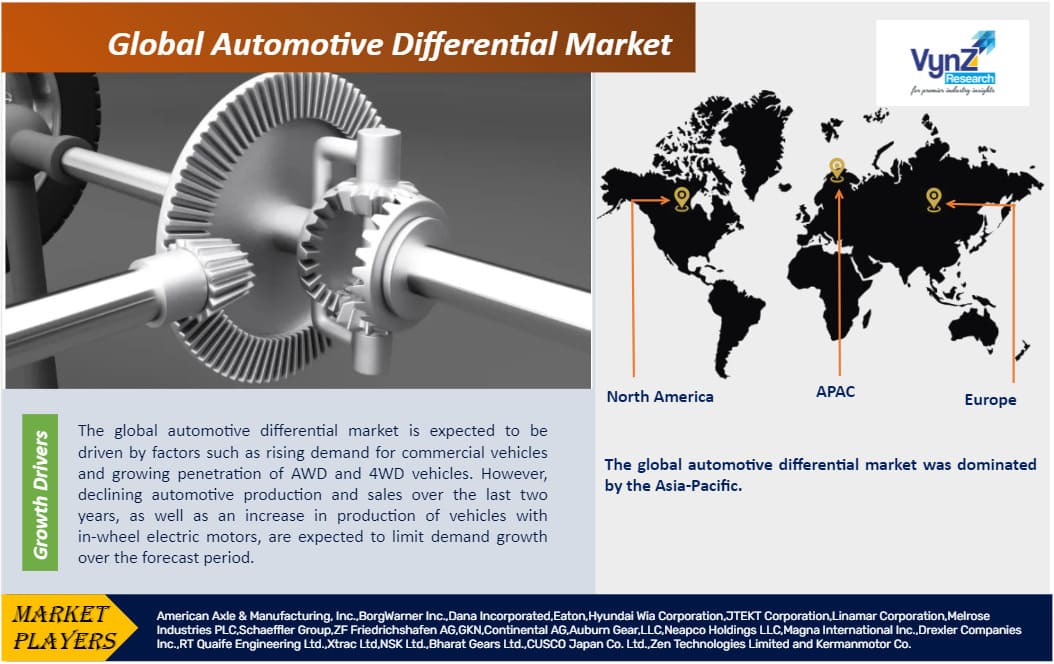

During the forecast period, Asia Pacific is projected to account for the largest market share. China and Japan, for example, are major vehicle manufacturing centres in the area. The demand for automotive differential is expected to rise significantly as vehicle output increases. Off-road vehicles and sports cars have also grown in popularity in Asian countries, thanks to an increasing preference for all-wheel and four-wheel drive integrated vehicles. During the forecast period, these factors are likely to contribute to overall market growth. However, due to the high volume of vehicles produced in the area, the overall demand for differential is the highest.

Global Automotive Differential Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 400.6 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 1000.43 Billion |

|

Growth Rate |

CAGR 20.1% |

|

Segments Covered in the Report |

By Product, By Delivery Mode, By Component and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Automotive Differential Market Trends

COVID-19 has caused a drop in vehicle demand, which has a negative impact on the overall automotive differential market. However, the automotive differential market is expected to expand in the coming years due to a projected steady recovery in vehicle production by Q1-Q2 of 2021. China and Japan, for example, are major vehicle manufacturing centres in the area. The demand for automotive differential is expected to rise significantly as vehicle output increases. Off-road vehicles and sports cars have also grown in popularity in Asian countries, thanks to an increasing preference for all-wheel and four-wheel drive integrated vehicles. During the forecast period, these factors are likely to contribute to overall market growth. However, due to the high volume of vehicles produced in the area, the overall demand for differential is the highest.

Automotive Differential Market Drivers

The global automotive differential market is expected to be driven by rising demand for commercial vehicles and the growing penetration of AWD and 4WD vehicles. However, declining automotive production and sales over the last two years, as well as an increase in the production of vehicles with in-wheel electric motors, are expected to limit demand growth over the forecast period. Furthermore, winning contracts/agreements is a key strategy for gaining a competitive edge, and electronically limited-slip differential output is expected to complement the global automotive differential market development. As a result, these trends are projected to improve the market's growth prospects shortly.

Automotive Differential Market Opportunities

OEMs use vehicle differential assemblies extensively and often in their manufacturing processes. Open contracts and agreements between OEMs and manufacturers of automotive differential assemblies are seen in this product procurement. These contracts detail the collection of conditions that must be met within the specified timeline. To achieve a competitive edge and maintain long-term market prospects, manufacturers must concentrate on winning contracts and deals with new installations.

Automotive Differential Market Challenges

The growing demand for electric buses and trucks, as well as increased knowledge about electric vehicles, may stymie the automotive differential market in the forecast period. The automotive differential market faces a challenge in developing and delivering electronics that ensure safety.

COVID-19 Impact on the Global Automotive Differential Market

The COVID-19 crisis is causing instability in the automotive differential industry by slowing supply chains, stifling business growth, generating unpredictable demand scenarios, and growing consumer fear. The selling of automotive differentials is inextricably linked to the manufacture and sale of automobiles all over the world. If the country-by-country blockade is prolonged, production loss is expected to rise. In the third quarter of 2020, global automotive production fell by 22.3 percent compared to the third quarter of 2019. Furthermore, global light vehicle sales fell by nearly 20% year over year, from 6,335 thousand in February 2019 to 5,077 thousand in February 2020.

Automotive Differential Market Competitive Insights

American Axle & Manufacturing, Inc. is an American manufacturer of automobile driveline and drivetrain components and systems that is headquartered in Detroit, Michigan.

BorgWarner Inc. is an American automotive and e-mobility supplier headquartered in Auburn Hills, Michigan.

Market Key Players

Some of the key players in the global automotive differential market are American Axle & Manufacturing, Inc. (AAM)

• BorgWarner Inc.

• Dana Incorporated

• Eaton

• Hyundai Wia Corporation

• JTEKT Corporation

• Linamar Corporation

• Melrose Industries PLC

• Schaeffler Group

• ZF Friedrichshafen AG

• GKN

• Continental AG

• Auburn Gear

• LLC

• Neapco Holdings LLC

• Magna International Inc.

• Drexler Companies Inc.

• RT Quaife Engineering Ltd.

• Xtrac Ltd

• NSK Ltd.

• Bharat Gears Ltd.

• CUSCO Japan Co. Ltd.

• Zen Technologies Limited

• Kermanmotor Co.

Recent Developments by Key Players

BorgWarner (a global product leader in delivering innovative and sustainable mobility solutions) has secured a contract to deliver its high-voltage eFan system for use on a major global OEM’s series of heavy- and medium-duty battery electric vehicles (BEVs) in North America.

Koyo Machinery USA (Grinding machine supplier) shall be integrated with the JTEKT Machinery Americas portfolio of operations, including product and services, as well as customer support. .

The global automotive differential market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

-

By Drive Type

- Open Differential

- Locking Differential

- Limited Slip Differential

- Electronic Limited Slip Differential

- Torque Vectoring Differential

-

By Off-Highway Vehicle

- Construction & Mining Equipment

- Agriculture Tractors

- Forklift

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automotive Differential Market