Global Driving Simulator Market– Analysis and Forecast (2025-2030)

Industry Insights by Simulator Type (Compact Simulator, Full Scale Simulator, Advanced Driving Simulators), by Application (Research & Testing, Training, Motorsports & Gaming), by End User (Advanced Driving Simulator, Training Driving Simulator, Professional Training Simulator)

| Status : Published | Published On : Mar, 2024 | Report Code : VRAT4192 | Industry : Automotive & Transportation | Available Format :

|

Page : 230 |

Global Driving Simulator Market– Analysis and Forecast (2025-2030)

Industry Insights by Simulator Type (Compact Simulator, Full Scale Simulator, Advanced Driving Simulators), by Application (Research & Testing, Training, Motorsports & Gaming), by End User (Advanced Driving Simulator, Training Driving Simulator, Professional Training Simulator)

Driving Simulator Market Overview

From USD 1.5 billion in 2023 to USD 3.6 billion in 2030, the Global Driving Simulator Market is expected to expand at a CAGR of 7.6 percent during forcast period 2025-2030.

There is a severe shortage of professional and efficient drivers across all sectors, whether it is automobile, railways, marine, aviation, or any other. Moreover, the available drivers are not efficient enough to avert accidents. Several statistics show that more than 90% of accidents and injuries are caused due to human errors. As a result, there is a growing demand for a driving simulator. This is a result of technological advancements. The technology uses a simulated world to teach the driver how to drive efficiently and avert collisions from all possible directions. A motion platform and 360-degree view, with a freedom of up to 9 degrees allow the device to help the driver maintain control of the situation thereby making these simulators more effective in improving safety.

The growing demand for driving simulators is mainly attributed to the significant rise in the demand for professional drivers. This is primarily due to the high rate of road accidents, increasing traffic, future high-speed rail projects, and extensive R&D investments in autonomous vehicles.

This growth is experienced in both developing and developed countries and is expected to grow more during the forecast period.

Today's industries, such as railways, aviation, automobile, marine, and security, are experiencing a driver shortage. Since human error causes more than 90% of all injuries, a driving simulator is a much-needed advancement. The driving simulator is a technology that uses a simulated world to teach the driver how to prevent collisions from all directions.

Driving Simulator Market Segmentation

Based on the Simulator Type

• Compact Simulator

• Full-Scale Simulator

• Advanced Driving Simulators

According to the type of simulation, the global driving simulator market is divided into three segments, namely compact simulator, full-scale simulator, and advanced driving simulator.

Out of these segments, it is the compact simulator segment that dominates the market in terms of sales and is expected to dominate during the analysis period as well. This is mainly because of their smaller size. Moreover, these compact driving simulators can be used across a wide range of applications such as cars, buses, trucks, and bikes.

Furthermore, as opposed to other system types, such as full-scale and advanced simulators, compact simulators are also a very cost-effective solution. As a result, they are generally used for training purposes by driving instructors and several driving schools.

Based on the Application

• Research & Testing

• Training

• Motorsports & Gaming

Based on the different types of applications, the global driving simulator market is divided into three categories, namely training, research & testing, and motorsports & gaming.

Out of these segments, the research and testing segment dominates the market and is expected to grow at an even faster rate during the forecast period. This is primarily due to the introduction and increased use of self-driving cars. Automobile manufacturers all over the globe are now spending a lot of money on research and development activities to bring fully autonomous vehicles to market.

Based on the End User

• Advanced Driving Simulator

• Training Driving Simulator

• Professional Training Simulator

According to the end users, the global driving simulator market is divided into advanced driving simulators, training driving simulators, and professional training simulators.

Out of these segments, the advanced driving simulator segment is expected to hold the larger share of the global driving simulator market during the forecast period. This is due to the advanced technological features it offers, such as the 360-degree viewing angle and motion platform. These features offer a more realistic experience.

These advanced driving simulators help a great deal in the design and development of intelligent highway designs. They also help in understanding human behavior studies an augmented environment is necessary to test the dynamics of the technologically modified vehicles for further study and research.

By Region

• North America

• Asia Pacific

• Europe

• Rest of the World (RoW)

Improving lifestyles, a growing number of metro cities, and a rapidly growing population have all contributed to an increase in passenger car production and sales in Asia Pacific. A few Asia Pacific countries, such as Japan and South Korea, have safety regulations in place, and demand in these countries is expected to increase over the next five years. Due to their rising populations and vehicle demand, China, South Korea, India, and Japan are required to implement strict vehicle and road safety regulations. Factors such as a lack of infrastructure and an increase in the number of injuries are likely to increase the demand for qualified drivers, resulting in a demand for training simulators.

Global Driving Simulator Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1.5 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 3.6 Billion |

|

Growth Rate |

7.6% |

|

Segments Covered in the Report |

By Simulator Type,By Application,End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America,Asia Pacific,Europe,Rest of the World (RoW) |

Driving Simulator Market Trends

Due to the growing demand for autonomous vehicles, manufacturers are investing more in research and development activities to ensure safety on the roads, which needs testing installations. However, some worries need to be addressed, which is where the driving simulators come into play. The large amount of data needed for accurate testing is collected and shared between the IoT-connected automobile and the cloud system to examine and utilize to ensure improved automation.

There is also a significant rise in investments in autonomous car technology by the manufacturers to develop the best vehicle. These activities by the OEMs and the consequent growth of electric vehicles are expected to drive the demand for driving simulators.

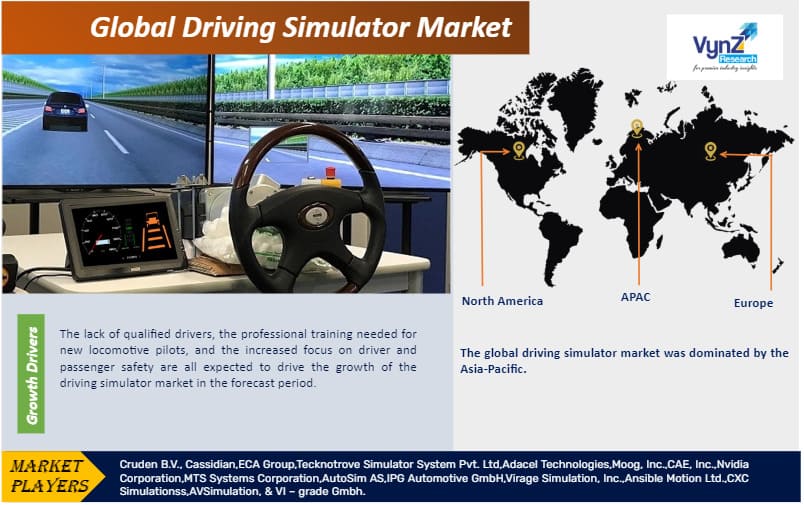

Driving Simulator Market Growth Drivers

The notable shortage of efficient and qualified drivers is the most significant growth driver of the global driving simulator market. Moreover, the need for additional professional training for the new pilots of locomotives also drives the growth of this market.

Most importantly, all across the globe there is an increased focus on the safety of the drivers and the passengers. This and the rise in the number of accidents and injuries are also other significant growth factors of the market during the forecast period.

In addition to all these factors, the fact that the accident rate has risen significantly over the years has also promoted the growth of the global driving simulator market. This is also considered as the result of the greater emphasis on research and development.

Furthermore, there is a significant rise in the number of airport and air traffic projects all over the globe and in the need for emergency and police vehicle simulators. This will also propel the growth of the global driving simulator market during the forecast period just as the advances in autonomous and semi-autonomous vehicles will.

Driving Simulator Market Opportunity

The driving simulators come with advanced and customized technology such as 3D visualization and 360-degree view. These developments create better opportunities for specific categories of simulators, especially those that are used for training purposes.

The professional simulators also help in training police, firefighters, military forces, and ambulance drivers thereby creating more growth opportunities for the global driving simulator market.

Driving Simulator Market Challenges

The lack of benchmarks and requirements for developing and employing a simulation-based virtual environment is a key challenge for the driving simulator industry. Typically, these simulators are designed to solve issues found during implementation. So, it allows the users to create a design that will validate the fundamental research and development processes in most cases.

The criteria to validate and verify established prototypes vary from one vendor to the other. This is mainly due to the lack of specifications, assumptions, and metrics necessary to understand how simulation can be combined with an application to address the issues related to the devices and processes.

However, the pressing need to establish specifications for driving simulators is changing the scenario and creating more opportunities for the global driving simulator market.

Driving Simulator Market Geographic Overview

Though Europe contributes the largest share of the global driving simulator market, it is expected to grow more in the Asia Pacific region during the forecast period. This is mainly due to the improving lifestyles, higher disposable income, growing number of metro cities, and a rapidly growing population. All these have resulted in a significant rise in the production and sales of passenger cars. This, in turn, results in the growth in demand for driving simulators.

Moreover, the global driving simulator market in the Asia Pacific region is expected to grow during the forecast period even more than the other regions such as North America, Europe, and the Rest of the World due to stricter safety regulations imposed by the governments in countries like India, China, South Korea, and Japan. These safety regulations are needed due to the rising demand for passenger vehicles by the growing population.

The lack of proper infrastructure in most countries in this region along with the rising number of accidents and injuries will result in the growing need for qualified drivers, which, in turn, results in the growing demand for training simulators.

Key Players:

• Cruden B.V.

• Cassidian

• ECA Group

• Tecknotrove Simulator System Pvt. Ltd

• Adacel Technologies

• Moog, Inc.

• CAE, Inc.

• Nvidia Corporation

• MTS Systems Corporation

• AutoSim AS

• IPG Automotive GmbH

• Virage Simulation, Inc.

• Ansible Motion Ltd.

• CXC Simulationss

• AVSimulation

• VI-grade Gmbh

Recent Development by Key Players

CAE signs deal to sell health care business to Madison Industries for $311 million. CAE Inc. This is to position the company to secure growth opportunities in its much larger core simulation and training markets. While CAE is best known for its flight simulators, the health care business focuses on training for medical professionals, including patient simulators.

Ansys AVxcelerate Sensorsshall be accessible within NVIDIA DRIVE Sim, a scenario-based AV simulator powered by NVIDIA Omniverse, a platform for developing Universal Scene Description (OpenUSD) applications for industrial digitalization. The integration shall provide users the access to high-fidelity sensor simulation outputs for the training and validation of perception ADAS/AV systems.

The Driving Simulator Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Simulator Type

- Compact Simulator

- Full-Scale Simulator

- Advanced Driving Simulators

- Application Type

- Research & Testing

- Training

- Motorsports & Gaming

- End-User

- Advanced Driving Simulator

- Training Driving Simulator

- Professional Training Simulator

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Driving Simulator Market