India Electric Three Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-rickshaw, E-auto, Others) by Type (Passenger Vehicle, Load Carrier), by Motor Power (<1000 W, 1000-1500 W, >1500 W), by Driving Range (Less than 50 miles, 50-100 miles and Above 100 miles) and by Geography (North India, East India, West and Central India, South India)

| Status : Published | Published On : Nov, 2024 | Report Code : VRAT4055 | Industry : Automotive & Transportation | Available Format :

|

Page : 109 |

India Electric Three Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-rickshaw, E-auto, Others) by Type (Passenger Vehicle, Load Carrier), by Motor Power (<1000 W, 1000-1500 W, >1500 W), by Driving Range (Less than 50 miles, 50-100 miles and Above 100 miles) and by Geography (North India, East India, West and Central India, South India)

India Electric Three Wheeler Market Overview

The India Electric Three Wheeler Market is anticipated to grow from USD 1.2 billion in 2023 to USD 1.7 billion in 2030 at a CAGR of 2.1% during the forecast period from 2025 to 2030.

Electric three-wheelers which are commonly known as e-rickshaws have emerged as an eco-friendly mode of public transportation in India. These vehicles operate with the help of battery-based electric motors that are cost effective in fuel consumption. The electric three wheelers are adopted due to their features like compact design, cost-effectiveness, zero carbon emissions, and noise-free travel experience.

India Electric Three Wheeler Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1.2 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 1.7 Billion |

|

Growth Rate |

2.1% |

|

Segments Covered in the Report |

By Product, By Type, By Motor Power and By Driving Range |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North India, East India, West and Central India, South India |

India Electric Three Wheeler Industry Dynamics

India Electric Three Wheeler Market Trends / Growth Drivers

Government support and subsidies, the entrance of new entrants in the market, and the need for an alternative transport system to curb vehicular emissions are the key factors fueling the demand for the electric three-wheelers market in India. The government of India has committed to lower the vehicular emission, that shall lead to immediate measures to replace the conventional modes of transport with electric vehicles. The high prices of several transportation fuels, such as petrol, LPG, diesel, CNG, etc. have led to a growing inclination towards electric three-wheelers in India. The government of India has introduced various subsidies on the purchase of electric three-wheeler vehicles which is ultimately boosting the market. Furthermore, the growing investments in the upgradation of public charging infrastructures for electric three-wheelers are also driving the product demand in the country. Many courier companies have adopted electric three-wheelers for providing last-mile postal services. Also technological advancements of three-wheelers with remote sensors, anti-theft locking systems, GPS navigation, etc. are too expected to drive the market growth during the forecast period.

India Electric Three Wheeler Market Restraints

The major restraints of India Electric Three Wheeler Market are lack of sufficient charging stations particularly in remote areas, the low range of distance covered and heavy battery pack. Also higher initial costs hinders the market.

Recent Developments by Key Players

Clean Mobility Solution India, is a subsidiary of Swedish electric vehicle (EV) company Clean Motion. The company has set up a manufacturing facility in Pune to localise and indigenously produce its flagship product, the Zbee electric passenger three-wheeler.

KETO Motors and Saera Electric collaborated in the electric vehicle industry, giving rise to Saera Keto EV Private Limited. This partnership shall be a key player in India’s Electric 3-Wheeler (E3W) sector.

India Electric Three Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the India Electric Three Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, type, motor power and driving range.

Insight by Product

- E-rickshaw

- E-auto

- Others

Based on product, the electric three-wheelers market is segmented into e-rickshaws, e-auto, and others. E-rickshaws are the most preferred three-wheeler category. E-rickshaws are the typical three-wheelers with a top speed of around 25km/hr. These are alternatives to conventional pull rickshaws with pedals and auto rickshaws. A typical e-rickshaw carries 4+1 or 3 passengers at a time.

Insight by Type

- Passenger Vehicle

- Load Carrier

Based on type, the market is categorized into passenger vehicles and load carriers. Passenger vehicles hold a larger share of the market due to the high preference for these vehicles in intracity transport within metropolitan cities.

Insight by Motor Power

- <1000 W

- 1000-1500 W

- >1500 W

Based on motor power, the market is segmented into 1,500 W. Of all, 1,000-1,500 W powered three-wheelers hold the largest share in the Indian market. The highest share of the 1,000-1,500 W powered three-wheelers in the market is due to the optimum performance and cost of the vehicle at this power.

Insight by Driving Range

- Less than 50 miles

- 50-100 miles

- Above 100 miles

The market is segmented based on driving range, as less than 50 miles, 50-100 miles and above 100 miles. The 50-100 miles segment dominated the market during the forecast period. Developments in electric vehicles with dynamic investments by automakers and increasing concerns about environmental pollution are the major factors for the growth of the market.

India Electric Three Wheeler Market: Geographic Overview

Geographically, India Electric Three Wheeler Market is segmented into North India, East India, West and Central India, South India. Eastern and Northern regions dominate the electric three wheeler registrations as these regions are the fastest-growing markets as various automotive industries are setting up their manufacturing units in this region.

India Electric Three Wheeler Market Competitive Insight

- Clean Motion India

- Kinetic Green Energy and Power Solutions Ltd.

- Terra Motors Corporation

- Hero Electric Vehicles Pvt. Ltd.

- Lohia Auto Industries

Saera Electric Auto Limited (formerly known as Saera Electric Auto Private limited) is a company based in Delhi, India, that manufactures clean and greener electric vehicles. The company introduced Mayuri, the first E-Rickshaw in India, in 2011.

Kinetic Green Energy and Power Solutions Ltd is a part of the USD 600MN Firodia Group of companies. The company is headquartered in Pune and with its commitment to environment friendly technology it has developed ergonomically designed Battery Operated Vehicles (BOVs) using world class technology, ranging from 2 seater to 14 seater capacity.

The India Electric Three-Wheeler Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

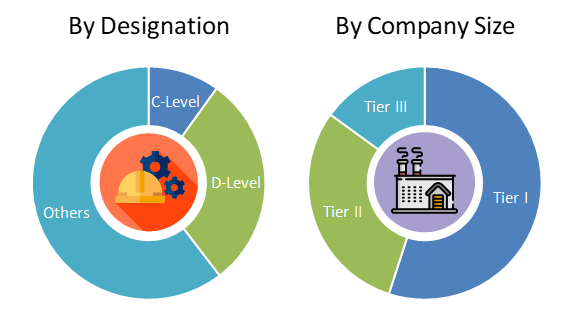

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Also, Have a look at our eDiscovery Market Report

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India Electric Three Wheeler Market