Philippines Electric Two-Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-scooters, E-bikes, E-motorcycles, Others), by Battery Type (Sealed Lead Acid, Li-ion, Ni-MH), by Battery Technology (Removable Battery, Non-removable Battery), by Voltage (24V, 36V, 48V, 60V, 72V) and by Geography (Philippines)

| Status : Published | Published On : Nov, 2024 | Report Code : VRAT4050 | Industry : Automotive & Transportation | Available Format :

|

Page : 95 |

Philippines Electric Two-Wheeler Market Size & Share | Growth Forecast Report 2030

Industry Insights by Product (E-scooters, E-bikes, E-motorcycles, Others), by Battery Type (Sealed Lead Acid, Li-ion, Ni-MH), by Battery Technology (Removable Battery, Non-removable Battery), by Voltage (24V, 36V, 48V, 60V, 72V) and by Geography (Philippines)

Philippines Electric Two-Wheeler Market Overview

The Philippines Electric Two-Wheeler Market is predicted to grow at 7.1% CAGR during the forecast period in terms of revenue size.

The Philippines two-wheeler market is primarily driven by the rapidly growing due to the efforts of the non-government and government organizations. Different products including e-scooters and e-bikes are majorly contributing to the electric two-wheeler market size in the Philippines.

Philippines Electric Two-Wheeler Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. XX Billion |

|

Revenue Forecast in 2035 |

U.S.D. XX Billion |

|

Growth Rate |

7.1% |

|

Segments Covered in the Report |

By Product, By Battery Type, By Battery Technology, By Voltage |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Philippines |

Philippines Electric Two-Wheeler Market Industry Dynamics

Philippines Electric Two-Wheeler Market Trends / Growth Drivers

The Philippine's Electric Two-Wheeler Market is rapidly growing due to the efforts of non-government and government organizations. The Electric Vehicle Association of the Philippines (EVAP) plans for a national development program for electric vehicles that is anchored on the existing Motor Vehicle Development Program for the automotive industry. As per the association, this is to be implemented in four (4) phases within ten years.

The Philippines government provide tax incentives and support to encourage the adoption of electric vehicles (EVs), along with electric two-wheelers. The Electric Vehicle Industry Development Act (EVIDA) is implemented that aims to promote electric vehicle adoption, is the vital growth driver of this market. Green road infrastructure, environmental awareness through reduction of carbon footprints, clean air initiatives with the growing urban population, lower operating costs particularly for last-mile transportation, advancement in battery technology, improved vehicle design, urbanization and traffic congestion are the other aspects contributing to boost the market growth

Philippines Electric Two-Wheeler Market Challenges

High initial cost, affordability of the vehicle, limited charging infrastructure are the primary factors constraining the market growth. Battery disposal, and lack of awareness about the EV industry hinder the market growth.

Recent Developments by Key Players

Cirtek Holdings Philippines Corp. has started manufacturing and assembling electric motorcycles and lithium-ion battery packs. This initiative, led by Cirtek's business unit, Cirtek Advanced Technologies and Solutions Inc. (CATSI), is set to take place at their Laguna Technopark facility in Biñan City, Laguna. This venture marks a notable development in the Philippines' electric vehicle sector, especially since Cirtek aims to produce up to a million units within the next three to four years. These units are intended solely for domestic sales, underscoring a significant push towards adopting eco-friendly transportation solutions in the Philippines.

Ayala Corporation (Philippines) has teamed up with Taiwan's Gogoro in a strategic move to enter the electric scooter market in the Philippines. This collaboration aims to boost Ayala's presence in sustainable transportation by importing, selling, and maintaining Gogoro's e-scooters. They also plan to develop battery-swapping stations to support this venture, enhancing the infrastructure needed for e-scooters in urban areas.

Philippines Electric Two-Wheeler Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the Philippines Electric Two-Wheeler Market report, along with forecasts at the regional and country levels from 2025-2030. Our report has categorized the market based on product, battery type, battery technology and voltage.

Insight by Product

- E-scooters

- E-bikes

- E-motorcycles

- Others

Based on product, the market is categorized into e-scooters, e-bikes, e-motorcycles, and others. E-scooters hold the largest share in the Thailand market, in terms of revenue as well as fleet size. E-motorcycles are anticipated to witness the fastest growth at a CAGR of 37.9%, in terms of fleet size, during the forecast period.

Insight by Battery Type

- Sealed Lead Acid

- Li-ion

- Ni-MH

Based on battery type, the market is segmented into sealed lead acid, Li-ion, and NiMH. Sealed lead acid is the most common type of battery used in electric two-wheelers in Malaysia. Lower prices are the primary reason behind the highest share of sealed lead acid batteries in the Malaysian electric two-wheelers market.

Insight by Battery Technology

- Removable Battery

- Non-removable Battery

Based on battery technology, the market is categorized into removable and non-removable batteries. Of both categories, non-removable batteries are majorly used in the market as it is convenient for electric two-wheelers to plug in and charge batteries instead of removing and charging indoors.

Insight by Voltage

- 24V

- 36V

- 48V

- 60V

- 72V

Based on voltage, the market is segmented into 24V, 36V, 48V, 60V, 72V. Of all, 48V electric two-wheelers hold the largest share in the Malaysian electric two-wheeler market, followed by 36V two-wheelers.

Philippines Electric Two-Wheeler Market: Geographic Overview

Metro region of Philippines dominates the market due to its economic prominence and transportation challenges.

Philippines Electric Two-Wheeler Market Competitive Insight

- Xiaomi Inc.

- Gxsun Corp.

- Terra Motors Corporation

- Tinker Motors Inc.

- Dongguan Tailing Electric Vehicle Co. Ltd.

Terra Motors designs and manufactures electric two wheelers and three wheelers with well experienced Japanese engineers. Company's core technology is power train system including charger, motor, battery and controller. Their production plant is in Bangladesh,Vietnam, India and Japan.

The Philippines Electric Two-Wheeler Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

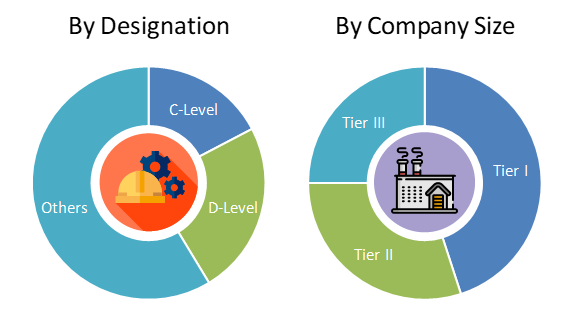

PRIMARY RESEARCH INTERVIEWS - BREAKDOWN

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Philippines Electric Two-Wheeler Market