Agricultural Micronutrients Market Overview

The global Agricultural Micronutrients Market is expected to be worth USD 4.2 billion in 2025, rising to USD 7.6 billion by 2035, with a CAGR of 9.4% over the forecast period. The agricultural micronutrient market is expected to expand due to factors such as rising soil micronutrient deficiencies and rising knowledge about food security.

Micronutrients are required by plants for healthy growth. Certain biochemical functions associated with plant metabolism and plant growth are associated with micronutrients. Conventionally, farmers focussed on phosphate, nitrogen, and potash, but lately, due to increased pest infestation and plant diseases, farmers are now focussing on increased adoption of various micronutrients.

Agricultural Micronutrients Market Segmentation:

Based on Type

• Zinc

• Boron

• Iron

• Manganese

• Molybdenum

• Others (Chlorine and Nickel)

Because of the growing number of benefits offered and the increase in zinc deficiency in soil across various regions and countries, zinc as an agriculture micronutrient is expected to gain popularity in the coming years. Zinc application rates, on the other hand, vary depending on the amount of zinc required in the soil for agricultural purposes.

Based on Crop Type

• Cereals & grains

• Oilseeds & pulses

• Fruits & vegetables

• Others (Turfs, ornamentals, plantation crops, forages, and fiber crops)

Fruit consumption has increased dramatically over the last two decades, and this trend is expected to continue in the coming years. Increased fruit and vegetable exports have resulted in an increase in crop plantation area, which has resulted in increased production levels. As a result, the demand for crop-sustaining and preserving chemicals for fruits and vegetables is expected to rise significantly.

Based on Form

• Chelated

• Non-Chelated

Chelated micronutrients are organic molecules that form a ring-like structure when they combine with a metal cation. Chelated micronutrients are present in a variety of soil pH ranges. Ethylene diamine-tetra-acetic acid (EDTA), diethylene-triamine Penta-acetic acid (DTPA), and ethylenediamine-N, Nä-bis (2-hydroxyphenyl acetic acid) are some of the most widely used chelating agents in the manufacture of synthetic micronutrient chelates (EDDHA). Furthermore, the adoption of chelated micronutrients is expected to increase at a faster rate due to the stable existence of chelated compounds.

Global Agricultural Micronutrients Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 4.2 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 7.6 Billion

|

|

Growth Rate

|

9.4%

|

|

Segments Covered in the Report

|

By Type, By Crop, and Type By Form

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Based on Geographies

• North America

• Europe

• Asia Pacific (APAC)

• Latin America

• Middle East and Africa

During the historical era, APAC was the largest agricultural micronutrient sector, and this trend is expected to continue during the forecast period when it will also experience the fastest growth. Because of the constant sowing and reaping cycles, there is a strong micronutrient deficit in the soil and poor biofortification of crops.

Agricultural Micronutrients Market Trends:

In the forecast period of 2025-2030, technological advances in the production of agricultural micronutrients, as well as rapid growth, are expected to generate new opportunities for the agricultural micronutrients market.

Since cereals are the most commonly consumed crop on the planet, the cereals & grains segment is expected to rise at the fastest rate. Food consumption is increasing in developing countries due to rising population and economic growth. Soil texture, pH impact, climatic variability, and organic matter are all factors that influence micronutrient availability in soil. The availability of micronutrients in the soil decreases as the pH rises. Crop growth is limited by a lack of micronutrients in the soil. If left unchecked, this will have a direct impact on crop production as well as decrease the efficiency with which macronutrient fertilizers are applied.

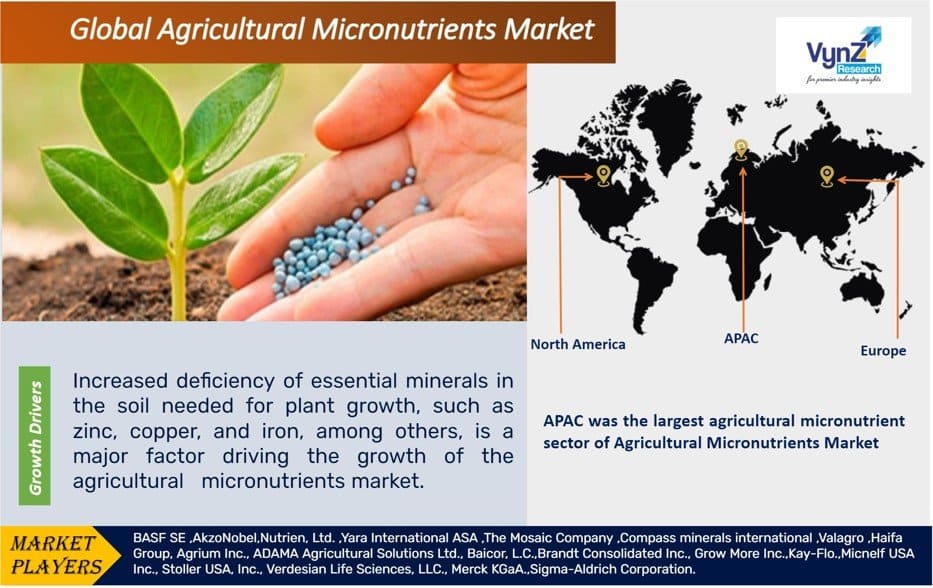

Market Drivers

Increased deficiency of essential minerals in the soil needed for plant growth, such as zinc, copper, and iron, among others, is a major factor driving the growth of the agricultural micronutrients market. Other major factors driving the growth of the agricultural micronutrients market include increasing soil pollution around the world and research activities on the production and introduction of low-cost agricultural micronutrients.

A bad diet can be blamed for an increase in the incidence of micronutrient deficiency in people. Micronutrient deficiencies in agricultural soil reduce crop yield and nutritional quality, as well as have an adverse effect on human health. Micronutrient deficiencies can cause a variety of health problems in people. It's also possible that it'll boost the mortality rate.

Agricultural Micronutrients Market Opportunities

The global population is increasing tremendously. According to the Population Reference Bureau (PRB), the global human population is projected to increase by 75 million people each year, or 1.1 percent. As a result, the world's population is projected to hit 9.9 billion in 2050, up from an estimated 7.4 billion in 2017. As the world's population rises, so does the demand for food. An increasing population means a growing appetite and a growing appetite means agriculture can play a larger role in the world's future. Since the number of arable acres is only projected to increase modestly, agricultural farmers would need to become more effective and profitable in order to feed an increasing world of hungry people. At the same time, crop production will continue to be hampered by unpredictably harsh weather, such as drought, flooding, and extreme heat, among other factors.

Agricultural Micronutrients Market Challenges

The lack of knowledge among farmers about the benefits of using agricultural micronutrients will be a restraining factor for the agricultural micronutrients market during the forecast period, posing a further challenge to the market's development. Apart from this, the lack of an agriculture budget, the booming organic fertilizer industry, and the bio-accumulation of non-biodegradable chelates can hinder the agriculture micronutrient market rise.

COVID-19 Impact on the Global Agricultural Micronutrients Market

The COVID-19 pandemic has devastated agricultural micronutrient supply chains, as many countries were under lockdown and closed their borders to prevent the virus from spreading. Strict containment regulations implemented by various governments, as well as protective measures to monitor the outbreak's effects, had resulted in substantial transportation restrictions of agricultural micronutrients

Key Players

• BASF SE

• AkzoNobel

• Nutrien, Ltd.

• Yara International ASA

• The Mosaic Company

• Compass Minerals international

• Valagro

• Haifa Group

• Agrium Inc.

• ADAMA Agricultural Solutions Ltd.

• Baicor, L.C.

• Brandt Consolidated Inc.

• Grow More Inc.

• Kay-Flo.

• Micnelf USA Inc.

• Stoller USA, Inc.

• Verdesian Life Sciences, LLC

• Merck KGaA.

• Sigma-Aldrich Corporation

Recent Developments

• The Mosaic Company and the Technology Research Centre (FTRC) at the University of Adelaide in Australia signed an agreement in to concentrate on improved fertilizer production.

• Rocket Seeds Moly Shine seed finisher, which has the advantage of micronutrient, was launched by Compass Minerals . The company's Plant Nutrition business unit has a new addition with this launch.

• Valagro renewed its distribution agreement with Just Agrotech (China), a leading agricultural technology company in China. This agreement would assist the organization in expanding its market share.

• Nutrien completed the purchase of Ruralco Holdings Limited (Ruralco) in Australia which will help the company improve the supply of goods and services to Australian farmers.

The Agricultural Micronutrients Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- Type

- Zinc

- Boron

- Iron

- Manganese

- Molybdenum

- Others (Chlorine and Nickel)

- Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & Vegetables

- Others (Turfs, ornamentals, plantation crops, forages, and fibre crops)

- Form

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)