Textile Recycling Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Material Type (Cotton, Polyester & Polyester Fiber, Wool, Nylon & Polyamide, Other), by Source of Textile Waste (Apparel & Clothing Waste, Automotive & Transportation Textiles, Home Furnishing Textiles, Industrial & Technical Textiles, Others), by Waste Lifecycle Type (Post consumer Waste, Pre consumer Waste, Post industrial Waste), by Recycling Method (Mechanical Recycling, Chemical Recycling, Biological / Enzymatic Recycling, Thermal / Energy Recovery), by End User (Apparel & Fashion, Industrial Uses, Home Furnishings, Automotive & Transportation, Building & Construction Materials, Medical & Protective Textiles)

| Status : Published | Published On : Feb, 2026 | Report Code : VRCH2126 | Industry : Chemicals & Materials | Available Format :

|

Page : 180 |

Textile Recycling Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Material Type (Cotton, Polyester & Polyester Fiber, Wool, Nylon & Polyamide, Other), by Source of Textile Waste (Apparel & Clothing Waste, Automotive & Transportation Textiles, Home Furnishing Textiles, Industrial & Technical Textiles, Others), by Waste Lifecycle Type (Post consumer Waste, Pre consumer Waste, Post industrial Waste), by Recycling Method (Mechanical Recycling, Chemical Recycling, Biological / Enzymatic Recycling, Thermal / Energy Recovery), by End User (Apparel & Fashion, Industrial Uses, Home Furnishings, Automotive & Transportation, Building & Construction Materials, Medical & Protective Textiles)

Textile Recycling Market Overview

The textile recycling market which was valued at approximately USD 7.1 billion in 2025 and is estimated to reach around USD 8.0 billion in 2026, is projected to reach close to USD 17.2 billion by 2035, expanding at a CAGR of about 8.9% during the forecast period from 2026 to 2035.

The growing global demand for textile recycling is driven by an increasing focus on the environment among consumers, regulations imposed by governments, and changes in how consumers view products as being "sustainable." Rising amounts of textile waste, combined with the negative environmental effects caused by the rapidly expanding fast-fashion industry, have increased pressure on companies producing these textiles, government agencies, and textile/fashion companies to shift their business models toward a circular economy. The adoption of recycling technology to encourage recycling practices, reduce landfill use, and conserve resources will continue to increase the volume of recycled textiles around the world.

Market Dynamics

Market Trends

The paper and packaging industry is moving toward an advanced technology-based recycling ecosystem, facilitated by the recycling of approximately 46 million tons of paper in the United States in 2024. This technology includes the use of robots, hyperspectral imaging, and artificial intelligence to automate the sorting process of paper products. The use of these technologies provides companies with more accurate fibre identification, better sorting, and increased production output. Brands have developed circularity programs that include "take-back" programs, "closed-loop" partners, and other ways for brands to be transparent about their supply chains. The development of new applications for recycled fibres (beyond apparel) has expanded the market for post-consumer recyclables. These changes indicate a shift from merely diverting materials from landfills to creating efficient methods of converting paper products into new products through up-cycling.

Growth Drivers

The textile recycling market has experienced significant growth due to increasing environmental concern and stricter industry regulations to recycle and reduce waste, with global fibre production reaching 132 million tonnes in 2024, providing an immense feedstock for circular infrastructure. Growing worries about pollution, landfills, and climate change are prompting governments and large corporations to enforce recycling policies, landfill diversion mandates, and extended producer responsibility for manufacturers. At the same time, consumers are placing greater emphasis on sustainability and environmentally friendly products, driving companies to incorporate recycled materials and circular practices into their business models. As a result of these converging factors, government enforcement, consumer pressure, and corporate strategy, the textile recycling market is expected to continue long-term growth.

Market Restraints / Challenges

The market faces significant barriers to entry due to both a lack of scale and limited adoption potential. The primary challenge is the high cost and technical complexity of constructing collection, sorting, and processing systems, which require specialised equipment and substantial capital investment. Textile waste is highly heterogeneous, containing multiple material types (especially blends), contaminants, and non-recyclable items, which makes recycling difficult and reduces the quality of recycled fibres, diminishing their competitive advantage against virgin materials. In addition, inconsistent collection systems and the absence of a standardised regulatory framework for developing a recycling value chain create growth challenges and reduce investor confidence.

Market Opportunities

Despite these barriers, the market holds considerable potential. Companies developing circular value chains across brands, recyclers, and technology providers are increasingly aligning with sustainable material demands and net-zero commitments. Extended producer responsibility initiatives are fostering collaborative opportunities. Advances in recycling technologies, particularly for complex and blended textiles, now allow high-quality recycled fibres to re-enter mainstream apparel as well as industrial and technical markets. Expanded reverse logistics capabilities and the integration of digital tracking systems support scalability in collection and sorting processes, enabling more efficient supply chain integration and alignment with sustainable business objectives.

Global Textile Recycling Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 7.1 Billion |

|

Revenue Forecast in 2035 |

USD 17.2 Billion |

|

Growth Rate |

8.9% |

|

Segments Covered in the Report |

Material Type, Source of Textile Waste, Waste Lifecycle Type, Recycling Method, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Rest of the World |

|

Key Companies |

Lenzing AG, Birla Cellulose (Aditya Birla Group), Unifi, Inc. (REPREVE), Renewcell AB, Worn Again Technologies Ltd, Patagonia, Inc., Aquafil S.p.A., American Textile Recycling Service (ATRS), The Woolmark Company, BLS Ecotech, The Boer Group, Textile Recycling International (TRI Group), Evrnu, and H&M Group |

|

Customization |

Available upon request |

Market Segmentation

By Material Type

Cotton is the largest category with a market share of about 40% in 2025, due to being the biggest part of the world's textile production and waste flow, being widely recyclable, and having a well-developed recovery infrastructure. Cotton-based products are everywhere, in clothing, home textiles, and commercial fabrics. This provides an abundant and reliable source of recyclable raw materials to support mechanical recycling processes and streamline collection. Due to mature sorting and reprocessing methods for cotton fibres, there are established and efficient markets for absorbing the recycled materials. Therefore, cotton provides a sustainable, natural fibre content as well as well-established reuse paths for downstream applications that seek these attributes.

Polyester & Polyester Fiber is the fastest-growing category with a CAGR of 9.3% during the forecast period, due to advances in chemical recycling technologies, increased demand for recycled synthetics, and the growing commercial viability of these processes. Polyester is ubiquitous in modern textiles, and innovations are being developed to allow effective depolymerisation and regeneration of high-quality fibres. These factors are driving investment and brand adoption toward circular economy goals. Additionally, the ability to process large volumes of blended polyester streams and growing interest from both fashion and technical textile segments will continue to drive growth in this category.

By Source of Textile Waste

Apparel & Clothing Waste is estimated to account for approximately 45% of total market revenue in 2025. This is due to the enormous number of clothing items manufactured, purchased, and discarded worldwide each year. The uniformity of clothing materials makes them easier to sort, classify, and recycle, creating an environment for highly effective recovery operations. Recycling companies, brands, and retailers have invested in garment take-back and post-consumer collection initiatives primarily targeting clothing waste, further solidifying their top position as a source of recycled textile feedstock and supporting large-scale recycling supply chains.

Automotive & Transportation Textiles is experiencing the fastest growth rate at a CAGR of 9.1% in the coming years. This is due to the increasing number of automotive manufacturers utilising recycled fibres in interior products as part of their sustainability programs and the manufacturers’ increased emphasis on using recycled materials within the product development process. With the growing need for lightweight, eco-friendly products in the auto industry to meet regulatory emissions requirements and through the implementation of circular procurement practices, there have been significant increases in recycling opportunities for carpet, automotive seat fabric, and insulation. Increased cooperation between automotive original equipment manufacturers (OEMs) and textile recyclers has also dramatically increased the strategic relevance and adoption rates of automotive and transportation textiles.

By Waste Lifecycle Type

Post consumer Waste is the largest category, with an expanding body of accumulated end-of-life apparel, household textiles, and disposable items collected at retail establishments and diverted from municipalities. As a result of this widespread use pattern and the existing collection networks directing discarded materials to recycling channels, it is the largest contributor of recoverable materials for recycling. The high volumes and consistent availability of these materials provide opportunities for large-scale economies of scale associated with both sorting and processing, as well as for diverse downstream reuse and upcycling applications.

Pre consumer Waste is the fastest-growing category, due to increasing adoption by manufacturers and companies of "zero-waste" policies. As a result, a significant amount of cuttings, overruns, and rejected materials are being directed back into in-house recycling programs or third-party recycling programs, with the objective of minimising waste and maximising recovery of value. As commitment from companies to both circular designs and lean manufacturing increases, the pre-consumer waste stream will be further systematised and quickly incorporated into existing recycling frameworks.

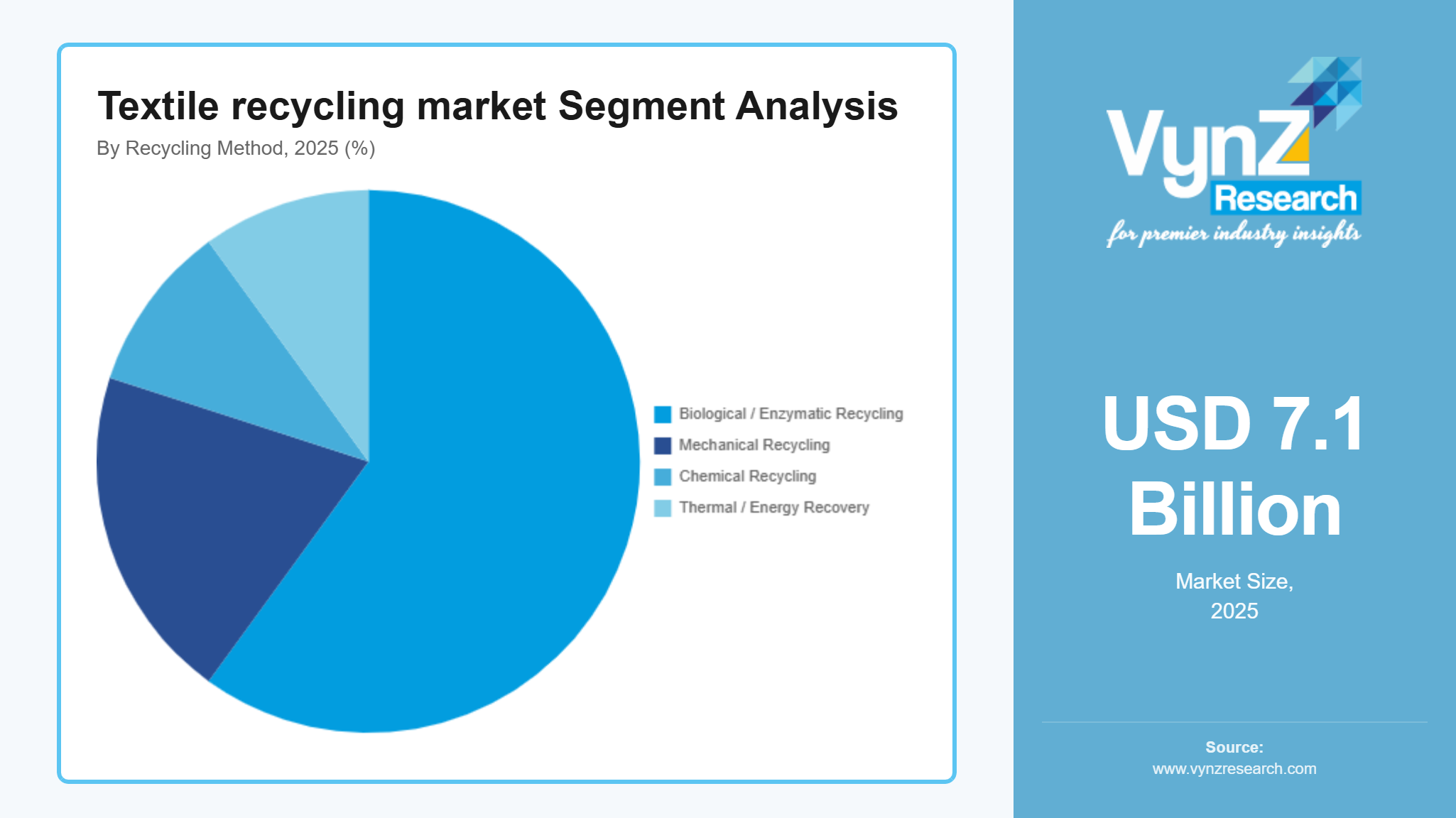

By Recycling Method

Mechanical Recycling is the largest category with a market share of approx. 60% in 2025, due to its long-standing use, relative cost-effectiveness, and ability to handle large volumes of homogeneous natural fibres. Established mechanical processes like shredding and re-spinning support a broad range of recycled outputs for secondary markets, particularly in apparel, interior textiles, and industrial yarns. Lower technical barriers and compatibility with existing infrastructure have sustained mechanical methods as the dominant recycling pathway.

Chemical Recycling is the fastest-growing category with a CAGR of 9.5% during the forecast period, due to technological advancements allowing for the efficient breakdown and reuse of complex, blended textile fibres as feedstocks at the quality level needed by manufacturers. Innovations in depolymerisation, solvents, and catalysts allow for expanded application of chemical recycling methods beyond traditional mechanical limitations, opening up recycling opportunities for synthetic and composite materials that were previously considered unrecyclable. Increasingly, commercial focus on producing high-value recycled products and greater commitment to circular economy practices across all industry sectors will accelerate the adoption of chemical recycling methods.

By End User

Apparel & Fashion is the largest category with a market share of around 40% in 2025, as a result of the widespread use of recycled fibres in the majority of garments produced by fashion brands and retailers, with the vast number of consumers demanding sustainable clothing. Brands and retailers are now incorporating recycled materials into products and establishing their own targets and product lines for the absorption of the large majority of recycled outputs. The presence of the apparel and fashion industry at the forefront of the consumer interface also creates an opportunity for increased investment in and adoption of recycling technologies and infrastructure.

Industrial Uses is the fastest-growing category, due to increasing applications in various industries utilising recycled materials to provide performance, economic benefits, and environmental sustainability. Regulations requiring businesses to reduce waste and minimise raw material use are also driving the adoption of recycled materials in construction insulation, wipes, and automotive components. The wide variety of industrial applications for recycled textiles has created an environment where new products are being developed rapidly, creating high potential for future growth.

Regional Insights

Asia Pacific

Asia Pacific's textile recycling market has been heavily influenced by its position as the world's largest producer and consumer of textiles. Countries including China, India, and Bangladesh generate large amounts of both post-consumer and pre-consumer waste, with India generating approximately 7.8 million tonnes of textile waste in 2025, where roughly 59% of this volume was successfully diverted back into the industry, which can be converted into fibre feedstocks. Waste management frameworks are being strengthened and formalised recycling facilities expanded in response to mounting environmental concerns and regulatory demands, as according to the national government, China aims to recycle 25% of its waste textiles and produce 2 million tonnes of recycled fibre annually by 2025 to transition toward a circular textile economy. Manufacturers are increasingly incorporating recycled materials into their products through partnerships with international recyclers and investments in new sorting and processing technology. Growing environmental awareness among consumers and decision-makers continues to reinforce Asia Pacific's role as a leader in textile recovery and reuse.

Europe

Europe's textile recycling market is among the most heavily regulated, with comprehensive circular economy strategies in place, driven by the generation of 6.94 million tonnes of textile waste in 2022, according to the European Environment Agency (EEA). EPR laws and sustainability mandates require brands to fund collection, sorting, and recycling systems at both the EU and member-state levels. Organised collection networks, quality recycling facilities, and industry collaboration to incorporate recycled fibres into mainstream fashion and technical applications are modelled after systems developed in Germany, the Netherlands, and Nordic countries. Strong public awareness campaigns and institutional support establish Europe as a model for regulatory-driven transformation of supply chains, transparency, and closed-loop utilisation of textiles.

North America

Textile recycling efforts in North America are gaining momentum due to corporate sustainability commitments and rising consumer demand for sustainable products. The U.S. leads in this effort, having recycled approximately 46 million tons of paper in 2024, while global cotton production reached 120.5 million bales in 2024, according to the United States Department of Agriculture (USDA), to provide the necessary feedstock for recycling ecosystems. Many retailers are implementing formal textile collection and take-back programs and increasing the use of recycled materials in their products. In Canada, government-backed circular economy initiatives provide better traceability and recovery of materials from clothing. Companies in the textile sector and related technologies are scaling up chemical recycling and forming strategic partnerships with apparel manufacturers to develop closed-loop systems that minimise landfill waste.

Rest of the World

The rest of the world, including Latin America, the Middle East, and Africa, is seeing textile recycling evolve from informal, inefficient systems to more formalised, organised operations supported by policy changes and capital investment. Brazil and Mexico are developing pilot projects around recycling and waste-to-value initiatives to leverage textile consumption and automotive uses. Middle Eastern countries are establishing national circular programs and recycling facilities to reduce landfill waste and grow sustainable industry. In parts of Africa and South America, environmentally focused regulations and international partnerships are creating opportunities for formalised collection systems and cross-border recycling collaborations, which are expected to accelerate implementation in the near future.

Competitive Landscape / Company Insights

The global textile recycling industry is highly concentrated among a number of large, well-established firms that dominate the development of all the primary factors that affect the industry's behaviour. Dominant companies are able to develop a dominant position as they continue to invest in emerging recycled textile technologies and integrate their production processes vertically, and create long-term relationships with branded apparel suppliers and other industry participants. Each company continues to differentiate itself from others based on its capacity to recycle textiles mechanically or chemically; its ability to produce high-quality fibres; and its global reach into important production and consumption markets.

In addition to these factors that are critical to the development of the industry, while smaller regional recyclers and specialized recyclers add depth to the competitive environment created within this industry, the size and technological capabilities of the larger and more innovative recycling companies create very substantial barriers to the entry of new recyclers, which reinforces the highly consolidated nature of the global textile recycling industry due to the presence of the larger recyclers' technological superiority, their alliance relationships, and their commitment to implementing sustainable business practices.

Mini Profiles

Lenzing AG is a global fibre producer specialising in sustainable cellulose fibres, serving textile, nonwoven, and technical industries with eco-friendly materials derived from renewable wood sources.

Birla Cellulose (Aditya Birla Group) manufactures viscose, lyocell, and filament fibres, providing sustainable textile solutions for apparel, home textiles, and industrial applications worldwide.

Unifi, Inc. (REPREVE) produces recycled polyester fibres from post-consumer plastics, supplying apparel, automotive, and industrial markets with sustainable synthetic yarns and fabrics.

Renewcell AB Innovates in chemical textile recycling, converting post-consumer cotton and blended fabrics into high-quality textile raw materials for apparel and industrial use.

Worn Again Technologies Ltd develops advanced polymer and cellulose recycling solutions, creating circular raw materials from textile and PET waste for global fashion and textile brands.

Key Players

- Lenzing AG

- Birla Cellulose (Aditya Birla Group)

- Unifi, Inc. (REPREVE)

- Renewcell AB

- Worn Again Technologies Ltd

- Patagonia, Inc.

- Aquafil S.p.A.

- American Textile Recycling Service (ATRS)

- The Woolmark Company

- BLS Ecotech

- The Boer Group

- Textile Recycling International (TRI Group)

- Evrnu

- H&M Group

Recent Developments

January 2026 – Recycling Europe Textiles Association urged the EU Commission to propose mandatory recycled-content rules for textile products by 2028, aiming to strengthen recycling systems and support circular supply chains.

December 2025 – Circulose announced new multi-year supply agreements with several major fashion brands to enable commercial use of its recycled viscose material, supporting the restart of its manufacturing facility and expansion of recycled fibre availability.

October 2025 – Techtextil India launched the ‘ReCycle Zone’ at its 2025 event, bringing together recyclers, machinery manufacturers, and solution providers to showcase technologies for transforming textile waste.

June 2025 – Syre, a Swedish recycling firm, partnered with U.S. retailers Gap and Target to supply recycled polyester material, advancing commercial adoption of recycled feedstock.

Global Textile Recycling Market Coverage

Material Type Insight and Forecast 2026 - 2035

- Cotton

- Polyester & Polyester Fiber

- Wool

- Nylon & Polyamide

- Other

Source of Textile Waste Insight and Forecast 2026 - 2035

- Apparel & Clothing Waste

- Automotive & Transportation Textiles

- Home Furnishing Textiles

- Industrial & Technical Textiles

- Others

Waste Lifecycle Type Insight and Forecast 2026 - 2035

- Post consumer Waste

- Pre consumer Waste

- Post industrial Waste

Recycling Method Insight and Forecast 2026 - 2035

- Mechanical Recycling

- Chemical Recycling

- Biological / Enzymatic Recycling

- Thermal / Energy Recovery

End User Insight and Forecast 2026 - 2035

- Apparel & Fashion

- Industrial Uses

- Home Furnishings

- Automotive & Transportation

- Building & Construction Materials

- Medical & Protective Textiles

Global Textile Recycling Market by Region

- North America

- By Material Type

- By Source of Textile Waste

- By Waste Lifecycle Type

- By Recycling Method

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Material Type

- By Source of Textile Waste

- By Waste Lifecycle Type

- By Recycling Method

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Material Type

- By Source of Textile Waste

- By Waste Lifecycle Type

- By Recycling Method

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Material Type

- By Source of Textile Waste

- By Waste Lifecycle Type

- By Recycling Method

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Textile Recycling Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Material Type

1.2.2. By

Source of Textile Waste

1.2.3. By

Waste Lifecycle Type

1.2.4. By

Recycling Method

1.2.5. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Material Type

5.1.1. Cotton

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Polyester & Polyester Fiber

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Wool

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Nylon & Polyamide

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.1.5. Other

5.1.5.1. Market Definition

5.1.5.2. Market Estimation and Forecast to 2035

5.2. By Source of Textile Waste

5.2.1. Apparel & Clothing Waste

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Automotive & Transportation Textiles

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Home Furnishing Textiles

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Industrial & Technical Textiles

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Others

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.3. By Waste Lifecycle Type

5.3.1. Post consumer Waste

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Pre consumer Waste

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Post industrial Waste

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Recycling Method

5.4.1. Mechanical Recycling

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Chemical Recycling

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Biological / Enzymatic Recycling

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Thermal / Energy Recovery

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.5. By End User

5.5.1. Apparel & Fashion

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Industrial Uses

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Home Furnishings

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Automotive & Transportation

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. Building & Construction Materials

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

5.5.6. Medical & Protective Textiles

5.5.6.1. Market Definition

5.5.6.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Material Type

6.2. By

Source of Textile Waste

6.3. By

Waste Lifecycle Type

6.4. By

Recycling Method

6.5. By

End User

6.5.1.

U.S. Market Estimate and Forecast

6.5.2.

Canada Market Estimate and Forecast

6.5.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Material Type

7.2. By

Source of Textile Waste

7.3. By

Waste Lifecycle Type

7.4. By

Recycling Method

7.5. By

End User

7.5.1.

Germany Market Estimate and Forecast

7.5.2.

U.K. Market Estimate and Forecast

7.5.3.

France Market Estimate and Forecast

7.5.4.

Italy Market Estimate and Forecast

7.5.5.

Spain Market Estimate and Forecast

7.5.6.

Russia Market Estimate and Forecast

7.5.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Material Type

8.2. By

Source of Textile Waste

8.3. By

Waste Lifecycle Type

8.4. By

Recycling Method

8.5. By

End User

8.5.1.

China Market Estimate and Forecast

8.5.2.

Japan Market Estimate and Forecast

8.5.3.

India Market Estimate and Forecast

8.5.4.

South Korea Market Estimate and Forecast

8.5.5.

Vietnam Market Estimate and Forecast

8.5.6.

Thailand Market Estimate and Forecast

8.5.7.

Malaysia Market Estimate and Forecast

8.5.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Material Type

9.2. By

Source of Textile Waste

9.3. By

Waste Lifecycle Type

9.4. By

Recycling Method

9.5. By

End User

9.5.1.

Brazil Market Estimate and Forecast

9.5.2.

Saudi Arabia Market Estimate and Forecast

9.5.3.

South Africa Market Estimate and Forecast

9.5.4.

U.A.E. Market Estimate and Forecast

9.5.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

Lenzing AG

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

Birla Cellulose (Aditya Birla Group)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

Unifi, Inc. (REPREVE)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

Renewcell AB

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

Worn Again Technologies Ltd

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

Patagonia, Inc.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Aquafil S.p.A.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

American Textile Recycling Service (ATRS)

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

The Woolmark Company

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

10.10.

BLS Ecotech

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5.

Recent

Developments

10.11.

The Boer Group

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5.

Recent

Developments

10.12.

Textile Recycling International (TRI Group)

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5.

Recent

Developments

10.13.

Evrnu

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5.

Recent

Developments

10.14.

H&M Group

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Textile Recycling Market