Global Energy Storage System Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Electro Chemical, Thermal Storage, Mechanical Energy Storage, and Others), by Application (Grid Storage and Transportation), by End User (Residential, Non-Residential, and Utilities. The non-residential include commercial and industrial) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World).

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3017 | Industry : Energy & Power | Available Format :

|

Page : 177 |

Global Energy Storage System Market – Analysis and Forecast (2025-2030)

Industry Insight by Technology (Electro Chemical, Thermal Storage, Mechanical Energy Storage, and Others), by Application (Grid Storage and Transportation), by End User (Residential, Non-Residential, and Utilities. The non-residential include commercial and industrial) and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World).

Energy Storage System Market Overview

The Global Energy Storage System Market size is expected to grow to USD 440.5 billion by 2030 from USD 205.5 billion in 2023. It will register a CAGR of 9% during the forecast period 2025-2030.

The energy storage system is a device designed to store energy in several forms such as mechanical and electrochemical, enabling its flexible application as needed. These systems find applications in meeting high power demands and unexpected spikes in power requirements. Integrating energy storage systems into innovative power networks is essential.

The global energy storage system market segments include electrochemical, thermal storage, mechanical energy storage, and others. Mechanical energy storage, notably the pumped hydro storage segment, is expected to dominate due to its significant capacity, cost-effectiveness, and efficiency.

The market is also divided into grid storage and transportation, with transportation expected to grow rapidly due to the increasing adoption of battery-powered Electric Vehicles (EVs). End users like residential, non-residential, and utilities also divides the market with the non-residential sectors leading due to higher adoption.

Energy Storage System Market Segmentation

Insight by Technology

The global energy storage system market is categorized into electro chemical, thermal storage, mechanical energy storage, and other segments, based on technology. the electro chemical segment is further subdivided into lithium-ion battery, lead acid battery, sodium sulfur (NAS) battery, flow battery, and other subsections. Mechanical energy storage is further segmented into pumped hydro storage, compressed air and liquid energy storage, and flywheel energy storage.

Out of these segments, the mechanical energy storage segment is expected to dominate the market share in the forecast period. This is mainly attributed to the substantial storage capacity, economic viability, and ability to leverage natural resources efficiently of these systems.

Pumped hydro storage, specifically, holds a prominent position due to the large number of storage systems using water reservoirs, higher demand for power generation, and helpful government initiatives toward renewable energy generation.

Insight by Application

Categorized by application, the global energy storage system market is divided into grid storage and transportation. Out of these two segments, the transportation segment is expected to experience a higher growth rate in the forecast period. This is mainly driven by the growing adoption of battery-powered Electric Vehicles (EVs). This trend not only aids in curbing vehicle emissions but also contributes to the expansion of railway networks.

Insight by End User

The global energy storage system market is divided into residential, non-residential, and utilities segments based on the ned users. Out of these segments, the non-residential category encompasses commercial and industrial sectors.

The non-residential segment is anticipated to lead the market share, driven by the strong growth of industries such as sugar mills, chemical plants, automobile plants, paper mills, etc. Meanwhile, the residential sector is expected to experience substantial growth during the forecast period due to growing adoption of solar panels for lowering cost of electricity and managing power outages.

Industry Dynamics

Energy Storage System Industry Trends

The growing adoption of renewable energy sources such as solar and wind power is driving the need for energy storage systems.

Continual development in battery technology, particularly in lithium-ion batteries, is leading to improved energy density, longer lifetimes, and reduced costs, making energy storage systems more efficient and accessible.

The growth of electric vehicles (EVs) is boosting the demand for energy storage systems to support charging infrastructure development and grid integration.

Governments and utilities worldwide are investing in grid modernization initiatives, including smart grids and microgrids.

Growing frequency and severity of grid disruptions and natural disasters are driving the adoption of energy storage systems for greater resilience.

The integration of multiple energy storage technologies, such as combining lithium-ion batteries with flywheel or pumped hydro storage, is gaining traction to enhance performance, flexibility, and applicability.

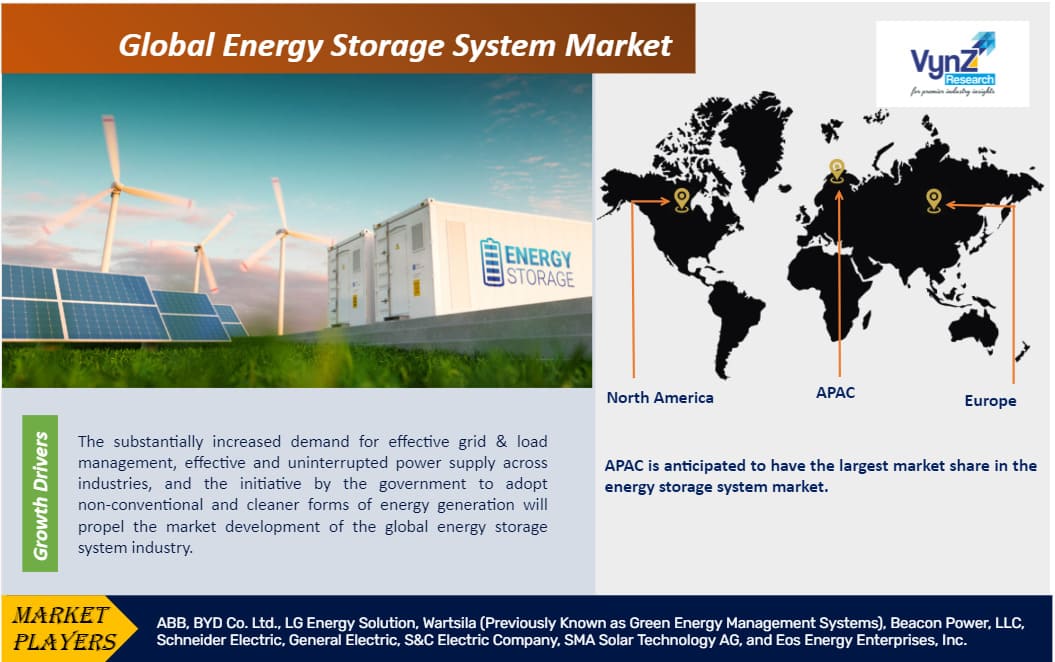

Energy Storage System Market Growth Drivers

The growth in demand for efficient grid and load management, as well as the consistent need for reliable power supply across various industries, along with governmental initiatives promoting cleaner energy generation, will drive the growth of the global energy storage system industry.

Moreover, growing concerns about environmental protection and carbon emissions along with development of sustainable energy sources have further propelled market expansion.

Also, the increasing imperative to reduce vehicular pollution has prompted a shift towards less polluting vehicles like electric cars, buses, and trucks. This has consequently boosted sales of energy storage systems.

All these combined factors have contributed to the expansion of the energy storage system market worldwide.

Energy Storage System Market Challenges

The growth of the energy storage system market is likely to be hindered by the large capital investment required and growing environmental pollution concerns. Furthermore, hindrance to the market expansion is expected due to an imbalance between the supply and demand of raw materials.

Energy Storage System Market Opportunities

Rising investment in power infrastructure networks, modernization, and grid expansion, along with rapid development in the Electric Vehicle sector are creating new opportunities for growth of the global energy storage system market.

Energy Storage System Market Geographic Overview

The Asia Pacific region is poised to grow and lead the energy storage system market, driven by increased engineering projects in countries like India, Japan, and China, alongside growing adoption of smart grids. Additionally, rising electric vehicle sales and stringent pollution regulations further propel market growth. Key drivers include investments in rural electrification, government initiatives promoting sustainable energy, and incentives for corporate adoption of renewables.

North American market is led by the US and Canada and is expected to grow due to renewable energy integration, grid modernization, and government incentives. The European market is led by Germany, the UK, France, and Italy and is expected to grow due to the EU's Clean Energy package to promote renewable integration and grid stability.

Energy Storage System Market Competitive Insight

Recent years have seen a global trend of project contracting, installation, and commissioning in the energy storage business. To stay ahead of their rivals, industry participants have recently started some projects focusing on cutting-edge technology, and product development, and formed collaborations with stakeholders. They are emphasizing enhancing the distribution network, focusing on R&D activities, and handling working capital requirements effectively to flourish in the global energy storage system market.

ABB has a fully digitalized energy storage portfolio that improves grid efficiency at every level. It offers factory-built, pre-tested solutions that can attain extensive quality control and provide a high level of safety. ABB solutions can be deployed directly to the customer site, resulting in faster installation, shorter project execution time, and higher customer savings. Their energy storage offerings include E-mobility, Renewables, Distribution Utility, and Commercial and industrial.

GE is well known throughout the world for creating and providing specialized energy storage solutions for a range of applications. A versatile, portable energy storage option for AC or DC coupled systems is GE's Reservoir. The Reservoir solution integrates GE's cutting-edge technology and expertise in an electrical balance of plant, power electronics, battery management systems, and plant controls, all of which are supported by performance guarantees. By 2030, GE hopes to invest $103 billion in energy storage projects.

Some of the major players operating in the global energy storage system industry include ABB, BYD Co. Ltd., LG Energy Solution, Wartsila (Previously Known as Green Energy Management Systems), Beacon Power, LLC, Schneider Electric, General Electric, S&C Electric Company, SMA Solar Technology AG, and Eos Energy Enterprises, Inc.

Recent Development by Key Players

Schneider Electric (French multinational energy management company) has launched two new battery energy storage systems with enclosures of 2.1 metres and 6.06 metres. Their power ranges from 60 kW to 500 kW. It is available in two enclosure sizes and has different storage and discharge configurations.

Grenergy Renovables SA (Spanish renewables company) has collaborated with China’s BYD Co Ltd. to procure the first batch of batteries for its colossal USD-1.4-billion (USD 1.28bn) Oasis de Atacama solar-plus-storage project in Chile. Oasis de Atacama is hailed by Grenergy as the world’s largest storage project, with a planned total capacity of 4.1 GWh of batteries and 1 GW of solar.

The Energy Storage System Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Technology

- Electro Chemical

- Lithium-Ion Battery

- Lead Acid Battery

- Sodium Sulfur (NAS) Battery

- Flow Battery

- Others

- Thermal Storage

- Mechanical Energy Storage

- Pumped Hydro Storage

- Compressed Air & Liquid Energy Storage

- Flywheel Energy Storage

- Others

- Electro Chemical

- By Application

- Grid Storage

- Transportation Storage

- By End User

- Residential

- Non-Residential

- Commercial and Industrial

- Utilities

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Energy Storage System Market