Global Hydrogen Fuel Cell Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (molten carbonate fuel cells (MCFC), solid oxide fuel cells (SOFC), alkaline fuel cells, and proton exchange membrane (PEM) fuel cells), by End-Use Application (transportation, stationary (power and energy), hydrogen generation, and other end-use applications), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VREP3032 | Industry : Energy & Power | Available Format :

|

Page : 200 |

Global Hydrogen Fuel Cell Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (molten carbonate fuel cells (MCFC), solid oxide fuel cells (SOFC), alkaline fuel cells, and proton exchange membrane (PEM) fuel cells), by End-Use Application (transportation, stationary (power and energy), hydrogen generation, and other end-use applications), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Hydrogen Fuel Cell Market Overview

The global hydrogen fuel cell market was worth USD 4.20 billion in 2023 and is expected to reach USD 10 billion by 2030 with a CAGR of 26.93% during the forecast period.

A hydrogen fuel cell is an efficient device that converts hydrogen and oxygen into electricity, heat, and water through a chemical reaction. It's clean, emitting only water vapor. Used in vehicles and power generation, it reduces greenhouse gas emissions and fossil fuel dependency for a sustainable future.

The global hydrogen fuel cell market is driven by diverse types, with PEM fuel cells leading due to efficiency, supported by strategic partnerships. The stationary segment, spearheaded by companies like Bloom Energy, dominates end-use applications, ensuring market dominance.

Opportunities abound across sectors like automotive and aerospace, fueled by technological advancements and government incentives. Market growth is evident in small-scale to large-scale systems, catering to portable and stationary power needs, despite challenges posed by limited zinc reserves and technical hurdles.

Hydrogen Fuel Cell Market Segmentation

Insight by Type

The global hydrogen fuel cell market is divided into different types such as molten carbonate fuel cells (MCFC), solid oxide fuel cells (SOFC), alkaline fuel cells, and proton exchange membrane (PEM) fuel cells.

Out of them, the PEM fuel cells segment dominated the market due to their efficiency, compactness, and suitability for various applications, notably transportation. Companies like Toyota and Honda spearheaded PEM technology, seen in vehicles like Toyota's Mirai and Honda's Clarity Fuel Cell. Strategic partnerships, like Ballard Power Systems with Audi, further boosted PEM's prominence. Investments in PEM production, such as Johnson Matthey's plan for a CCM plant in China, reaffirm industry confidence, securing its top position in the global market.

Insight by End-Use Application

The global hydrogen fuel cell market is divided into transportation, stationary (power and energy), hydrogen generation, and other applications.

The stationary (power and energy) segment led the market due to its decentralized power generation capabilities. Companies like Bloom Energy and Plug Power are leaders in this area, with initiatives such as Bloom's Energy Servers and Plug Power's GenSure systems. Collaborations, like Bloom Energy's partnership with SK Engineering and Construction, bolster the stationary segment. Investments, such as Plug Power's Gigafactory in New York, underscore industry dedication to stationary fuel cell technology, ensuring its dominance in the global market.

Insight by Power Rating

Based on the power rating, the global hydrogen fuel cell market is divided into small-scale systems for portable applications, medium-scale, and large-scale installations for grid-connected power generation.

Out of these, the small-scale systems segment has high potential for growth in the forecast period in portable electronics, consumer devices, and off-grid applications due to their compact and lightweight design that supports mobile and remote environments.

On the other hand, medium to large-scale systems segments are also expected to grow during the projected period in stationary power generation, industrial applications, and grid support services due to their scalability, efficiency, and environmentally friendly power generation technologies.

Insight by Fuel Source

Based on fuel source the global hydrogen fuel cell market is divided into renewable sources and fossil fuels segments.

The renewable sources segment is hosing higher growth potential due to increasing shift by the major players and higher investments in electrolysis, renewable hydrogen production, and the integration of hydrogen in decarbonization strategies across industries.

On the other hand, the fossil fuel segment is facing challenges related to carbon emissions and sustainability concerns. However, it is still an important source for short to medium term use as a transitional fuel in hydrogen infrastructure development.

Insight by Industry

The global hydrogen fuel cell market is divided according to different industrial applications into automotive, aerospace, marine, telecommunications, data centers, residential, and commercial sectors.

Out of these, the automotive sector seems to show higher growth potential during the projected period due to the commercialization of fuel cell electric vehicles (FCEVs), supported by advancements in fuel cell technology, hydrogen infrastructure development, and government incentives promoting zero-emission transportation.

Global Hydrogen Fuel Cell Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 4.20 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 10 Billion |

|

Growth Rate |

26.93%% |

|

Segments Covered in the Report |

By Type and By End-Use Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Hydrogen Fuel Cell Industry Trends

These following trends collectively display the growing momentum and evolving landscape of the global hydrogen fuel cell market, indicating a promising future for clean energy solutions.

There is a rise in demand for clean energy solutions due to the increasing concerns over climate change. Hydrogen fuel cells, with their minimal environmental footprint, are gaining traction as a feasible solution for several industries.

Advancements in Proton Exchange Membrane (PEM) technology, enhancing efficiency and versatility, along with performance. It is reducing costs and expanding applications, especially in transportation.

Governments across the world are implementing new policies to encourage the adoption of hydrogen fuel cells and extending their support and promote rapid market expansion via incentives, subsidies, and investment in infrastructure.

Major players of the industry are increasingly entering into strategic partnerships. This is driving innovations, expanding market reach, and accelerating commercialization. Typically, collaborations between fuel cell manufacturers, automotive companies, and energy providers are becoming commonplace, leading to new opportunities.

Higher investments in infrastructure and production capacity are being made which includes refueling stations, research facilities, and large-scale production plants, helping in addressing challenges related to scalability and cost-effectiveness.

The hydrogen fuel cells are also finding applications beyond transportation, including stationary power generation, backup power systems, material handling equipment, and even residential and commercial power supply. This diversification of applications is expanding the market potential and growth prospects driving innovation in fuel cell technology.

Hydrogen Fuel Cell Market Growth Drivers

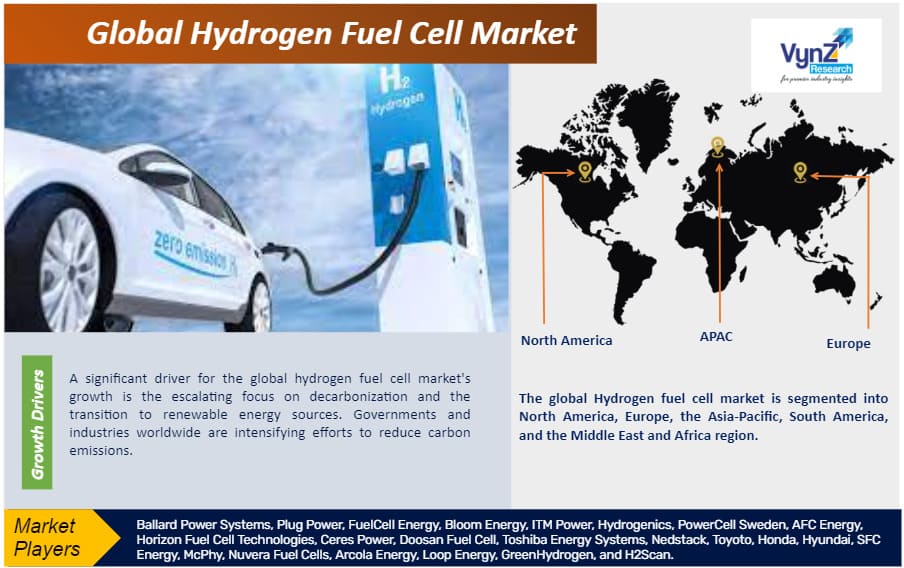

One of the main growth drivers of the hydrogen fuel cells market is the rising focus on decarbonization and the transition to renewable energy sources.

The rising adoption in heavy-duty transportation is another significant driver for market growth which is also revolutionizing the heavy-duty transportation market.

Increasing government support and incentives worldwide for hydrogen fuel cell technology, including funding programs, tax incentives, and regulatory mandates, are driving market growth by promoting investment in research, development, and deployment.

Advancements in fuel cell technology, such as improvements in efficiency, durability, and cost-effectiveness, are enhancing the attractiveness of hydrogen fuel cells as a viable alternative to traditional power sources, promoting market expansion across several industries.

The expansion of hydrogen infrastructure, including refueling stations, production facilities, and distribution networks, is helping the adoption of hydrogen fuel cell technology in transportation, stationary power generation, and other applications, driving market growth globally.

Hydrogen Fuel Cell Market Challenges

Limited zinc reserves, high investment and coordination, technical and logistical hurdles offer significant challenges to the widespread adoption as a sustainable energy solution and growth of the global hydrogen fuel cells market.

Hydrogen Fuel Cell Market Opportunities

The hydrogen fuel cell market presents abundant opportunities for growth and innovation, driven by decarbonization efforts, technological advancements, and diverse applications. Leveraging government support and strategic partnerships can accelerate market expansion, establishing these devices as a vital component of the sustainable energy transition.

Hydrogen Fuel Cell Market Geographic Overview

North America leads the market for hydrogen fuel cells, driven by government support, technological innovation, and strong demand from automotive and stationary power sectors. It is also attributed to the increasing investment in hydrogen infrastructure, fuel cell manufacturing, and adoption in transportation and energy markets.

Europe is the key region for fuel cell deployment due to ambitious hydrogen strategies, renewable energy targets, and stringent emissions regulations and promises growth due to expanding hydrogen infrastructure, investments in electrolyzer capacity, and integration of fuel cells in energy transition initiatives.

The Asia Pacific market is emerging as a significant market for hydrogen fuel cells, fueled by government initiatives, industrial partnerships, and growing demand for clean energy solutions as well as higher investments in fuel cell manufacturing, hydrogen production, and adoption in transportation and industrial sectors.

Hydrogen Fuel Cell Market Competitive Insight

Ballard Power Systems is one of the leading companies in the global hydrogen fuel cell market and is recognized for its advanced fuel cell technology. The company's strategic partnerships and high focus on R&D of fuel cells have bolstered its standing. For instance, in August 2023, Ballard announced a strategic partnership with Ford Trucks to supply a fuel cell system as part of the development of a hydrogen fuel cell-powered vehicle prototype. Furthermore, Ballard announced its global manufacturing strategy in September 2022 which included a plan to invest $130 million in an MEA manufacturing facility and R&D center in Shanghai, China, showing its commitment to large-scale production, reinforcing its influence in the market. With a strong foothold in both transportation and stationary applications, Ballard Power Systems plays a pivotal role in advancing the adoption of hydrogen fuel cell technology.

Toyota is a prominent force in the global hydrogen fuel cell market and is renowned for its pioneering work in fuel cell vehicles. The Toyota Mirai stands as a flagship example, showcasing the company's commitment to sustainable transportation. Toyota's partnerships further solidify its leading position in the market; in October 2023, Toyota announced that it will supply hydrogen fuel cell coaches for Parish 2024 Olympics and Paralympics games and also announced the development of a new 50kW-class fuel cell module. Additionally, Toyota has been actively involved in initiatives like the "Basic Hydrogen Strategy" in Japan, outlining ambitious goals for hydrogen adoption. With dedicated plants for fuel cell production, Toyota's investments and technological advancements underscore its leadership in advancing hydrogen fuel cell technology on a global scale.

Recent Development by Key Players

Hyzon Motors agreed a deal with TR Group for up to 20 fuel cell vehicles. TR Group is New Zealand's largest heavy-duty truck fleet owner and the fuel cell vehicles will use Hyzon's single-stack 200kW fuel cell system. The first two trucks are scheduled to be ready for commercial trial beginning in March 2024 and will be deployed for up to three months for a commercial trial.

BMW, Sasol, and Anglo American Platinum Ltd. Announced a strategic partnership focused on the development of a South African hydrogen car infrastructure that will help drive the manufacture and use of the vehicles. BMW will provide its X5 H2 fuel cell sport utility vehicle, while Sasol will supply green hydrogen, and Anglo American Platinum will supply platinum-group metals used in fuel cell manufacturing.

Key Players Covered in the Report

Ballard Power Systems, Plug Power, FuelCell Energy, Bloom Energy, ITM Power, Hydrogenics, PowerCell Sweden, AFC Energy, Horizon Fuel Cell Technologies, Ceres Power, Doosan Fuel Cell, Toshiba Energy Systems, Nedstack, Toyota, Honda, Hyundai, SFC Energy, McPhy, Nuvera Fuel Cells, Arcola Energy, Loop Energy, GreenHydrogen, and H2Scan.

The hydrogen fuel cell market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

Type

-

Molten carbonate fuel cells (MCFC)

-

Solid oxide fuel cells (SOFC)

-

Alkaline fuel cells

-

Proton exchange membrane (PEM) fuel cells

-

End-Use Application

-

Transportation

-

Stationary (Power and Energy)

-

Hydrogen Generation

-

Others process

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Hydrogen Fuel Cell Market