Intraoperative Imaging Market Overview

The Global Intraoperative Imaging Market is predicted to grow at 6.4% CAGR during the forecast period with the market size reaching USD 4.8 billion by 2030. Different products such as mobile c-arms, intraoperative computed tomography, intraoperative magnetic resonance imaging, and intraoperative ultrasound are majorly contributing to the intraoperative imaging market size. The market has witnessed significant demand for mobile c-arm over the last few years due to the mounting occurrence of cardiovascular diseases, and expanding number of orthopedic surgeries.

Intraoperative imaging is an imaging technology that helps in surgical procedures. It helps surgeons to capture a real-time view of the organ during the surgery and assists in demanding control and monitoring of the surgical procedures. It is extensively recognized in several fields of medical sciences owing to technological advancements and high precision.

Intraoperative Imaging Market Segmentation

Insight by Product

Based on product, the intraoperative imaging market is categorized into mobile c-arms, intraoperative magnetic resonance imaging, intraoperative computed tomography, and intraoperative ultrasound, of which intraoperative computed tomography holds the largest share in the intraoperative imaging market, globally.

The mounting occurrence of cardiovascular diseases and expanding number of orthopedic surgeries led to the fastest growth of the mobile c-arms segment during the historical period, which is also predicted to continue during the forecast period.

Insight by Application

On the basis of the application, the intraoperative imaging market is segmented into neurosurgery, cardiovascular surgery, orthopedic & trauma surgery, spine surgery, and other applications. Of all, the neurosurgery application is predicted to witness the highest CAGR of 7.4% during the forecast period and accounted for the largest share in the intraoperative imaging market due to an upsurge in the usage of minimally invasive surgeries for the neurological procedure, usage of neurostimulation device for the management of neurological disorder, and mounting occurrence of neurological disorder.

Insight by End User

The different end users in the market are the hospital, and ambulatory surgical centers (ASCs). Of all, the intraoperative imaging market size for ambulatory surgical centers (ASCs) is expected to grow at the fastest rate during the forecast period, globally. In addition, of all end users, hospitals accounted for the largest share of the market, due to the increasing number of patients enduring treatments in hospitals, the execution of government initiatives for fixing intraoperative imaging systems in hospitals, and escalating number of hospitals in developing countries.

Global Intraoperative Imaging Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. x.x Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 4.8 Billion

|

|

Growth Rate

|

6.4%

|

|

Segments Covered in the Report

|

By Product, By Application and By End User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World

|

Industry Dynamics

Intraoperative Imaging Market Growth Drivers

Expanding the geriatric population, the mounting occurrence of chronic diseases and lifestyle-associated diseases, escalating awareness about intraoperative imaging, and escalating inclination towards minimally invasive surgery are the key factors leading to the growth in the intraoperative imaging market, globally.

Rising prevalence of chronic diseases: The increasing incidence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders has led to a higher demand for surgical interventions. Intraoperative imaging plays a crucial role in guiding surgeons during complex procedures, enabling precise tumor removal and reducing the risk of complications.

Growing demand for minimally invasive surgeries: Minimally invasive procedures have gained popularity due to their benefits such as reduced post-operative pain, shorter hospital stays, and faster recovery times. Intraoperative imaging technologies provide real-time visualization and guidance during minimally invasive surgeries, enhancing procedural accuracy and patient safety.

Owing to the benefits of minimally invasive surgery such as less pain, speedy recovery, and shorter hospital stay, various intraoperative devices are used in intraoperative imaging. Some of the other key factors driving the growth of the industry are the expanding application of neurosurgery and orthopedic surgery, favorable reimbursement policies, technological advancement, and escalating demand for intraoperative imaging systems.

Intraoperative Imaging Market Challenges

Key factors hindering the growth of the intraoperative imaging market are the high cost of the intraoperative imaging device, strict regulatory requirements, and lack of skilled professionals. In addition, risks and complications using intraoperative devices are also having a negative impact on the growth of the intraoperative devices market.

Advanced intraoperative imaging technologies may not be readily available in all geographic regions, particularly in low-resource areas and developing countries. Unequal distribution of healthcare resources and infrastructure gaps can hinder the widespread adoption of intraoperative imaging, leading to disparities in patient care.

Intraoperative imaging technologies need to comply with regulatory standards and obtain necessary approvals before they can be commercially available. The regulatory processes can be time-consuming and expensive, delaying the introduction of new imaging systems to the market. Additionally, reimbursement policies may not adequately cover the costs associated with intraoperative imaging procedures, affecting their affordability for healthcare providers and patients.

Recent Developments By the Key Players

Ziehm Imaging partnered with Body Vision Medical to integrate AI-driven bronchoscopy solutions. This collaboration aims to enhance diagnostic and therapeutic procedures in pulmonary medicine.

Brainlab entered into a development and distributorship agreement with Nexstim Plc, a Finnish medical technology company specializing in navigated transcranial magnetic stimulation (nTMS). The agreement aim to enhance navigated neuromodulation therapies.

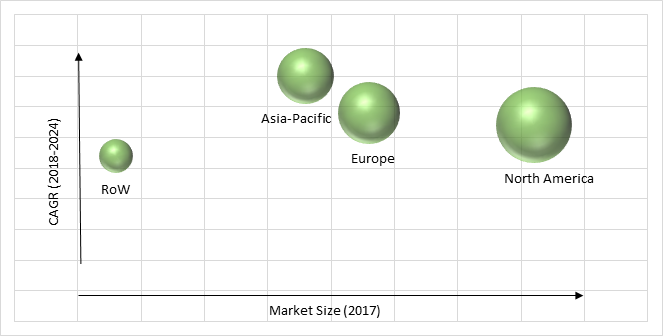

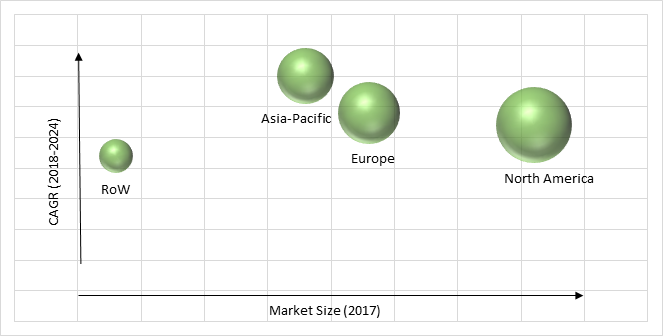

Intraoperative Imaging Market Geographic Overview

Geographically, North America is the largest intraoperative imaging market as the region the demand for minimally invasive procedures is increasing and well-developed healthcare infrastructure. In addition, the mounting occurrence of chronic diseases and lifestyle-associated diseases, and expanding geriatric population are also fueling the growth of the North American intraoperative imaging market.

GLOBAL INTRAOPERATIVE MARKET SHARE, BY REGION

Asia-Pacific is observed to witness significant growth in the intraoperative imaging market during the forecast period, as the region comprises a large population and government initiatives in establishing innovative technologies and refining healthcare infrastructure. Moreover, intensifying healthcare expenditure, expanding the geriatric population, growing occurrence of orthopedic disorders, demand for refined medical services, and mounting occurrence of chronic diseases and lifestyle-associated diseases are also facilitating the significant growth of Asia-Pacific intraoperative imaging industry.

Intraoperative Imaging Market Competitive Insight

Market players in the intraoperative imaging industry are investing capital to develop technologically advanced systems.

Some of the key players offering solutions for intraoperative imaging are:

- Ziehm Imaging GmbH

- Medtronic Plc

- General Electric Company

- Koninklijke Philips NV

- Toshiba Corporation

- Siemens AG

- Brainlab AG

- Shimadzu Corporation

The Intraoperative Imaging Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

- By Product

- Mobile C-Arms

- Intraoperative Magnetic Resonance Imaging

- Intraoperative Computed Tomography

- Intraoperative Ultrasound

- By Application

- Neurosurgery

- Cardiovascular Surgery

- Orthopedic & Trauma Surgery

- Spine Surgery

- Others

- By End User

- Hospital

- Ambulatory Surgical Centers (ASCs)

Intraoperative Imaging Market by Region

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Brazil

- South Africa

- Saudi Arabia

- U.A.E

- Other Countries

PRIMARY RESEARCH INTERVIEW - BREAKDOWN