Artificial Intelligence (AI) as a Service Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Deployment Model (Public Cloud, Hybrid Cloud, Private Cloud), by Service Type (Machine Learning Platform Services, AI Infrastructure Services, Cognitive Services, Managed & Professional Services), by Organization Size (Large Enterprises, Small and Medium Enterprises), by End-User Industry (Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, IT & Telecommunications, Manufacturing, Energy & Utilities, Others)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5204 | Industry : ICT & Media | Available Format :

|

Page : 220 |

Artificial Intelligence (AI) as a Service Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Deployment Model (Public Cloud, Hybrid Cloud, Private Cloud), by Service Type (Machine Learning Platform Services, AI Infrastructure Services, Cognitive Services, Managed & Professional Services), by Organization Size (Large Enterprises, Small and Medium Enterprises), by End-User Industry (Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, IT & Telecommunications, Manufacturing, Energy & Utilities, Others)

Artificial Intelligence as a Service Market Overview

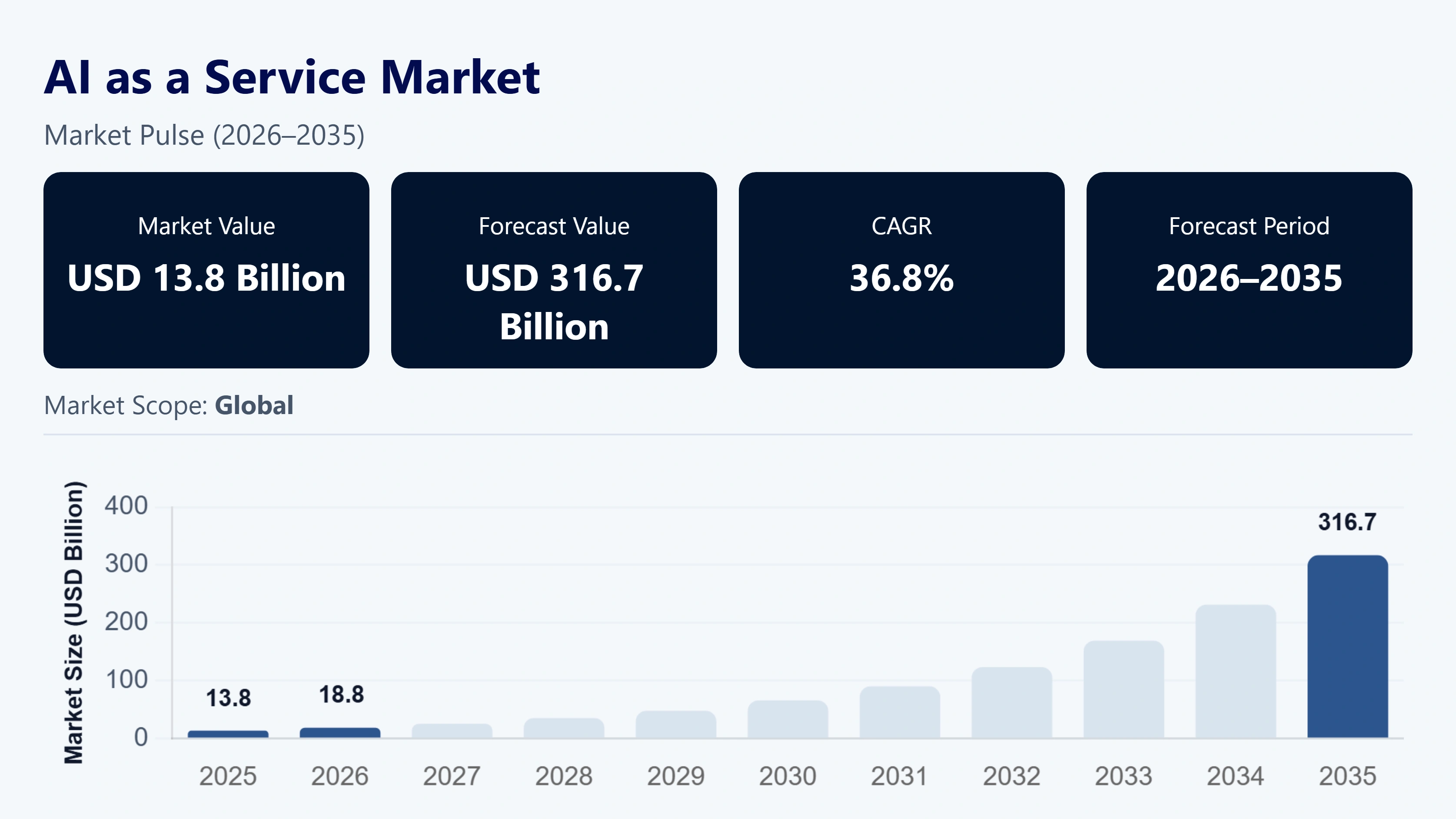

The artificial intelligence (AI) as a service market which was valued at approximately USD 13.8 billion in 2025 and is estimated to rise further up to nearly USD 18.8 billion in 2026 is projected to reach around USD 316.7 billion by 2035 expanding at a CAGR of about 36.8% during the forecast period from 2026 to 2035. The AI as a Service Market is benefiting from accelerated enterprise level cloud adoption expanding use of scalable artificial intelligence platforms and rising demand for cost efficient deployment of advanced analytics machine learning and natural language processing capabilities across multiple industries.

Market expansion is supported by growing reliance on data driven decision making automation of business processes and rapid integration of artificial intelligence across banking healthcare retail manufacturing and public sector operations. Government backed digital transformation initiatives including national artificial intelligence strategies published by organizations such as the OECD the European Commission and the U.S. National Institute of Standards and Technology continue to encourage responsible AI deployment cloud interoperability and secure data governance. Public investments in digital infrastructure skills development and cloud readiness programs across North America Europe and Asia Pacific are further reinforcing long term demand for AI enabled service platforms among enterprises and public institutions.

AI as a Service Market Dynamics

Market Trends

The industry is experiencing a structural transition toward cloud native artificial intelligence delivery models driven by enterprise demand for scalable computing resources and rapid deployment of advanced analytics capabilities. One of the most significant trends shaping the market is the growing preference for subscription-based AI platforms that enable flexible access to machine learning natural language processing and computer vision tools without extensive upfront infrastructure investment. This trend aligns with digital government frameworks promoted by organizations such as the OECD and the World Economic Forum which emphasize cloud interoperability responsible AI adoption and data driven public service delivery across developed and emerging economies.

Another notable trend is the increasing integration of AI as a Service platforms with regulatory aligned data governance and cybersecurity frameworks. Government backed initiatives such as the U.S. National Institute of Standards and Technology AI Risk Management Framework and the European Commission artificial intelligence policy guidelines are encouraging vendors to embed transparency security and compliance features into AI service offerings. These developments are influencing solution design and encouraging providers to focus on integrated platforms lifecycle management and enterprise grade governance capabilities thereby reshaping competitive dynamics within the market.

Growth Drivers

The growth of the market is strongly supported by rising enterprise demand for cost efficient artificial intelligence deployment across diverse application areas including customer analytics fraud detection predictive maintenance and digital health. Increasing investments in cloud infrastructure data centers and national digital transformation programs are accelerating adoption across both private enterprises and public sector organizations. Government supported cloud first and AI adoption strategies published by authorities such as the European Commission and national digital ministries in Asia Pacific continue to promote scalable AI access models that reduce capital expenditure and implementation complexity.

Additionally, the growing emphasis on automation operational efficiency and data driven decision making is playing a critical role in boosting AI as a Service adoption. As enterprises prioritize performance optimization regulatory compliance and faster innovation cycles demand for managed AI platforms remains strong. Public investments in AI research workforce upskilling and digital infrastructure supported by institutions such as the OECD and national science agencies are further reinforcing long term market expansion by creating a supportive ecosystem for enterprise level artificial intelligence adoption.

Market Restraints / Challenges

Despite strong long-term growth potential, the market faces several structural and operational challenges that may moderate adoption across certain user segments. One of the primary restraints is data governance and regulatory complexity particularly related to cross border data movement privacy protection and algorithm accountability. Government backed frameworks such as the European Union General Data Protection Regulation and emerging artificial intelligence governance guidelines published by the OECD and national digital authorities impose strict compliance requirements. These regulations increase implementation costs and operational complexity especially for small and mid-sized enterprises and public sector organizations with limited technical and legal resources.

Another significant challenge is the high dependency on advanced cloud infrastructure skilled talent and external technology ecosystems. Reports from government agencies such as the U.S. Government Accountability Office and national digital transformation bodies in Asia Pacific highlight persistent shortages of AI skilled professionals and uneven cloud readiness across regions. This dependence can result in cost pressures scalability constraints and slower deployment timelines particularly in emerging economies where digital infrastructure maturity remains uneven thereby affecting overall market penetration during periods of economic and policy uncertainty.

Market Opportunities

The industry presents substantial opportunities through expanding adoption among small and medium enterprises and public sector institutions seeking cost efficient access to advanced artificial intelligence capabilities. Government backed digital inclusion and cloud first initiatives promoted by organizations such as the OECD national IT ministries and public innovation agencies are accelerating demand for modular and subscription-based AI platforms. These solutions enable organizations to deploy analytics automation and decision support tools without heavy upfront investment creating incremental demand across sectors such as healthcare education urban administration and financial services.

Another key opportunity lies in the growing integration of AI as a Service platforms with industry specific and compliance aligned solutions. Rising public and private investments in digital health smart cities fintech and industrial automation supported by national artificial intelligence strategies and innovation funding programs are creating opportunities for higher value long term engagements. Advancements in automation model lifecycle management and secure cloud architectures are expected to improve adoption confidence enhance service differentiation and support sustained revenue growth across enterprise and government user segments.

Global Artificial Intelligence as a Service Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 13.8 Billion |

|

Revenue Forecast in 2035 |

USD 316.7 Billion |

|

Growth Rate |

36.8% |

|

Segments Covered in the Report |

Deployment Model, Service Type, Organization Size, End-User Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, GCC & Middle East, Other Regions |

|

Key Companies |

Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, Alibaba Cloud, Salesforce, Oracle Corporation, SAP SE, NVIDIA Corporation, ServiceNow |

|

Customization |

Available upon request |

AI as a Service Market Segmentation

By Deployment Model

Public cloud is projected to account for approximately 77% of total market revenue in 2025. This reflects the extensive enterprise reliance on hyperscale infrastructure, broad applicability for multi-industry analytics workloads, and cost efficiency in cloud-based AI deployment.

Hybrid cloud represents around 15% of the market share in 2025, supported by growing adoption among large organizations seeking regulatory compliance, data residency, and scalable AI operations.

Private cloud contributes roughly 8%, mainly adopted by enterprises with sensitive data handling requirements or industry-specific compliance obligations.

By Service Type

Machine learning platform services are estimated to hold approximately 40% of total revenue in 2025. This is driven by widespread use for predictive analytics, pattern recognition, and automated decision-making across enterprises.

AI infrastructure services account for around 30%, reflecting increasing demand for compute-optimized architectures, networking solutions, and reduced latency in model training and inference.

Cognitive services contribute approximately 20%, enabled by rising deployment of natural language processing, image recognition, and speech processing applications.

Managed and professional services represent roughly 10%, supporting installation, consulting, integration, and lifecycle management for enterprise-level AI adoption.

By Organization Size

Large enterprises are projected to contribute approximately 58% of total market revenue in 2025, supported by higher IT budgets, early AI adoption, and subscription-based platform usage across multiple business functions.

Small and medium enterprises account for about 42% of the market in 2025, witnessing strong growth driven by modular, low-code AI platforms and flexible subscription pricing that lowers entry barriers and expands market penetration.

By End-User Industry

Banking, financial services, and insurance (BFSI) accounted for approximately 23% of market revenue in 2025, reflecting extensive use of AI for fraud detection, risk management, and automated advisory services.

Healthcare and life sciences contributed around 18%, with strong growth supported by diagnostic automation, clinical workflow optimization, and drug discovery solutions.

Retail and e-commerce represent roughly 15%, leveraging AI for personalization, customer behavior analysis, and inventory optimization.

Information technology and telecommunications hold about 14%, driven by AI-powered network management, cybersecurity, and operational automation.

Manufacturing contributes approximately 12%, with adoption centered on predictive maintenance, production optimization, and quality assurance.

Energy and utilities account for around 10%, supported by smart energy management, automation, and analytics for operational efficiency.

Others make up the remaining 8%, covering sectors such as government, education, and logistics that are increasingly integrating AI services for analytics and decision support.

Regional Insights

North America

North America is estimated to hold approximately 28% of the AI as a Service market in 2025. Strong adoption is driven by enterprise reliance on cloud-based AI platforms, early digital transformation, and high IT infrastructure maturity. Major hubs such as New York, San Francisco, and Chicago continue to lead deployment across banking, healthcare, and retail sectors. Government initiatives including the U.S. National Artificial Intelligence Initiative Act and NIST AI Risk Management Framework promote responsible AI adoption, standardized cloud practices, and data governance, further supporting market expansion. Investments in AI-enabled analytics, automation platforms, and cloud interoperability are strengthening regional market performance.

Europe

Europe accounted for roughly 22% of the AI as a Service market in 2025. Growth is underpinned by strong regulatory frameworks including the EU Artificial Intelligence Act and GDPR, which encourage secure and ethical AI deployment. Countries such as Germany, France, and the UK are integrating AI solutions across finance, manufacturing, and public services. Government-backed digital transformation programs, combined with enterprise demand for predictive analytics, automation, and smart customer engagement, are driving investments in cloud-based AI services and professional support platforms, supporting steady regional adoption.

Asia Pacific

Asia Pacific is projected to represent around 25% of the market in 2025. Rapid digitalization, expanding cloud infrastructure, and government AI strategies in China, India, Japan, and South Korea are key growth drivers. National AI development plans, such as China’s Next Generation AI Development Plan and India’s National AI Strategy, incentivize adoption in healthcare, finance, smart cities, and industrial automation. Increasing enterprise cloud migration and rising awareness of AI-enabled business intelligence further accelerate market penetration.

GCC and Middle East

The GCC region is expected to account for approximately 8% of total market revenue in 2025. Adoption is supported by smart government initiatives such as Saudi Arabia’s National AI Strategy and UAE AI Strategy 2031, targeting AI integration across healthcare, finance, and public administration. Investment in digital infrastructure, cloud platforms, and AI-enabled solutions in major cities such as Riyadh, Dubai, and Abu Dhabi is driving moderate but steady growth.

Other Regions

The remaining regions collectively represent about 17% of the global market in 2025. While adoption is comparatively slower due to limited cloud readiness and regulatory maturity, these areas offer long-term potential driven by digital transformation initiatives, infrastructure modernization, and growing enterprise interest in AI services.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on product innovation, pricing strategies, and geographic expansion. Companies such as Microsoft, IBM, Google, Amazon Web Services, and Oracle are investing heavily in R&D, cloud infrastructure, and AI model optimization. Government-backed initiatives, including NIST AI guidelines, the EU AI Act, and national AI strategies in APAC, support technology adoption and reinforce vendor positioning across enterprise and public sector clients.

Mini Profiles

Amazon Web Services (AWS) is a leading provider of AI-as-a-Service, offering cloud infrastructure plus AI and ML tools that let companies launch AI models without building hardware themselves. Its services include managed ML frameworks and APIs, helping businesses scale quickly with minimal overhead.

Microsoft Corporation (Azure & Azure AI) integrates AI services into its widely used cloud and enterprise software stack. Many firms already using Microsoft environments adopt these AI tools for analytics, automation and intelligent workflows — making AI adoption smoother and more consistent.

Google LLC (Google Cloud / Vertex AI) brings its strong machine-learning and data-processing background to the AI-as-a-Service space. Clients benefit from scalable AI workloads, advanced ML capabilities and cloud-native integration — valuable especially for data-intensive applications.

IBM Corporation (Watsonx / IBM Cloud) caters to enterprises needing compliance, security and flexibility. Its AI-service offerings suit regulated sectors and large organisations migrating from legacy systems, making it a go-to for firms requiring robust, governance-friendly AI.

SAP SE stands out by embedding AI services within enterprise applications, offering business-process oriented AI solutions. For companies using ERP, operations, finance or supply-chain systems, SAP’s AI-as-a-Service offerings help integrate intelligence directly into everyday workflows.

Key Players

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Alibaba Cloud

- Salesforce

- Oracle Corporation

- SAP SE

- NVIDIA Corporation

- ServiceNow

Recent Developments

Jan 2026 - In order to help businesses, governments, and service providers create, execute, and oversee AI-ready sovereign environments, IBM introduced IBM Sovereign Core, the first AI-ready sovereign-enabled software. Businesses and governments are looking for self-managed environments where they retain full operational power due to changing regulatory constraints and the need for auditable governance. This is especially true as they implement AI workloads that increase sovereignty issues.

January 2026 - To increase AI-assisted innovation throughout Syngenta's global operations, SAP SE (SAP) and Syngenta formed a multi-year strategic technological partnership. Through the partnership, artificial intelligence will be integrated into Syngenta's operations, modernizing operations and facilitating faster innovation through sophisticated data analytics. SAP Cloud ERP Private solutions will be the first step in Syngenta's transformation, updating essential operations throughout the value chain. Syngenta will establish a consolidated, more secure, and scalable data foundation using SAP Business Data Cloud, which is necessary for AI integration and real-time decision-making.

January 2026 - Data centers are given priority as Nvidia and Intel collaborate to dominate AI servers via x86. Due to component shortages and price increases brought on by AI HBM demand, a 2026 PC market downturn is imminent. As inexpensive, high-performance technology continues to be out of reach, experts advise removing Steam backlogs.

Global Artificial Intelligence as a Service Market Coverage

Deployment Model Insight and Forecast 2026 - 2035

- Public Cloud

- Hybrid Cloud

- Private Cloud

Service Type Insight and Forecast 2026 - 2035

- Machine Learning Platform Services

- AI Infrastructure Services

- Cognitive Services

- Managed & Professional Services

Organization Size Insight and Forecast 2026 - 2035

- Large Enterprises

- Small and Medium Enterprises

End-User Industry Insight and Forecast 2026 - 2035

- Banking

- Financial Services & Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & E-commerce

- IT & Telecommunications

- Manufacturing

- Energy & Utilities

- Others

Global Artificial Intelligence as a Service Market by Region

Table of Contents for Artificial Intelligence as a Service Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Deployment Model

1.2.2. By

Service Type

1.2.3. By

Organization Size

1.2.4. By

End-User Industry

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Deployment Model

5.1.1. Public Cloud

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Hybrid Cloud

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Private Cloud

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Service Type

5.2.1. Machine Learning Platform Services

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. AI Infrastructure Services

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Cognitive Services

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Managed & Professional Services

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Organization Size

5.3.1. Large Enterprises

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small and Medium Enterprises

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End-User Industry

5.4.1. Banking

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Financial Services & Insurance (BFSI)

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Healthcare & Life Sciences

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Retail & E-commerce

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. IT & Telecommunications

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

5.4.6. Manufacturing

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2035

5.4.7. Energy & Utilities

5.4.7.1. Market Definition

5.4.7.2. Market Estimation and Forecast to 2035

5.4.8. Others

5.4.8.1. Market Definition

5.4.8.2. Market Estimation and Forecast to 2035

10. Company Profiles

10.1. Amazon Web Services (AWS)

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Microsoft Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Google LLC

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. IBM Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Alibaba Cloud

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Salesforce

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Oracle Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. SAP SE

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. NVIDIA Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. ServiceNow

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Artificial Intelligence as a Service Market