Artificial Intelligence (AI) in Finance Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Solution Type (Software Platforms, Analytics Solutions, Services), by Deployment Mode (On Premise, Cloud Based), by Technology (Machine Learning, Natural Language Processing, Other AI Technologies), by End User (Banks, Insurance Companies, Capital Market Institutions, Other Financial Service Providers)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5207 | Industry : ICT & Media | Available Format :

|

Page : 190 |

Artificial Intelligence (AI) in Finance Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Solution Type (Software Platforms, Analytics Solutions, Services), by Deployment Mode (On Premise, Cloud Based), by Technology (Machine Learning, Natural Language Processing, Other AI Technologies), by End User (Banks, Insurance Companies, Capital Market Institutions, Other Financial Service Providers)

Artificial Intelligence in Finance Market Overview

The global artificial intelligence (AI) in finance market which was valued at approximately USD 36.23 billion in 2025 and is estimated to reach around USD 46.55 billion in 2026, is projected to reach close to USD 444.73 billion by 2035, expanding at a CAGR of about 28.5% during the forecast period from 2026 to 2035. Market expansion is primarily supported by the rising adoption of advanced analytics, machine learning driven risk assessment, and automated fraud detection solutions across banking, insurance, and capital markets, alongside the increasing integration of AI enabled decision support systems within core financial operations.

Adoption is supported by financial institutions’ emphasis on operational resilience, regulatory compliance, and cost efficiency, aligned with formal digital finance and supervisory technology frameworks promoted by central banks and financial regulators such as the Bank for International Settlements and national monetary authorities. These frameworks encourage responsible AI deployment for transaction monitoring, credit evaluation, and anti-money laundering compliance. AI solutions enable real time data analysis, predictive insights, and improved customer engagement through intelligent automation. Government backed digital finance programs and cybersecurity focused infrastructure initiatives across North America, Europe, and Asia Pacific continue to sustain enterprise level investment across the financial services landscape.

AI in Finance Market Dynamics

Market Trends

The market is experiencing a structural shift toward data driven and automation centric financial operations, aligned with digital finance strategies promoted by central banks and financial regulators. Supervisory technology and regulatory technology frameworks supported by institutions such as the Bank for International Settlements and national monetary authorities emphasize advanced analytics, automated compliance monitoring, and real time risk assessment to strengthen financial system stability. This has accelerated adoption of machine learning based fraud detection, algorithmic credit scoring, and AI enabled transaction surveillance platforms across banking and capital markets.

Financial institutions are increasingly integrating cloud-based AI platforms, natural language processing tools, and predictive analytics to improve customer engagement and operational efficiency. Government backed digital payment initiatives, open banking regulations, and financial inclusion programs issued by authorities such as the Reserve Bank of India and European supervisory bodies are reinforcing demand for scalable AI solutions capable of handling high transaction volumes while ensuring regulatory compliance and data security across diverse financial ecosystems.

Growth Drivers

The growth of the market is primarily supported by the continued transition from manual and rule-based processes toward intelligent automation across financial services. AI driven systems enable faster decision making, enhanced fraud prevention, and improved credit risk management, aligning with regulatory expectations for transparency and resilience. Adoption of standardized data governance and risk management guidelines issued by global financial regulators supports broader deployment across banks, insurers, and asset management firms.

Another major growth driver is the increasing emphasis on regulatory compliance and financial crime prevention. Rising transaction complexity and cross border digital payments are encouraging institutions to deploy AI based monitoring tools for anti-money laundering and know your customer compliance. Government backed cybersecurity frameworks and digital finance policies across North America, Europe, and Asia Pacific continue to encourage investment in AI technologies that enhance operational efficiency, regulatory adherence, and long-term financial system stability.

Market Restraints / Challenges

The market landscape faces structural challenges related to high implementation costs and operational complexity associated with large scale AI deployment across regulated financial environments. Government and central bank reports, including guidance from the Bank for International Settlements on model risk management and supervisory expectations, indicate that financial institutions must invest substantially in data infrastructure, secure cloud environments, skilled data science talent, and governance frameworks. These requirements can constrain adoption among small and mid-sized financial institutions, particularly in emerging markets where technology budgets and technical expertise remain limited.

AI deployment in finance also introduces heightened regulatory and cybersecurity challenges. Financial regulators and government backed agencies, such as national data protection authorities and central banking supervision units, emphasize strict compliance with data privacy, algorithm transparency, and ethical AI standards. Regulations aligned with frameworks such as the European Union’s AI Act and financial sector cybersecurity guidelines increase compliance costs and operational oversight requirements. As financial systems become more interconnected and data intensive, exposure to cyber risks, model bias, and explainability limitations continues to pose material challenges, necessitating ongoing investment in risk management and regulatory alignment.

Market Opportunities

The global AI in finance market presents significant opportunities through the expansion of responsible AI adoption frameworks supported by multilateral financial institutions and regulatory bodies. Policy guidance issued by organizations such as the Bank for International Settlements, the International Monetary Fund, and the Financial Stability Board emphasizes the role of AI in strengthening risk management, supervisory oversight, and financial inclusion at a global level. These initiatives support adoption of AI driven credit assessment, fraud detection, and transaction monitoring solutions, particularly across emerging and underbanked customer segments within both developed and developing financial systems.

Another major opportunity lies in the accelerating investment in regulatory technology and supervisory technology platforms encouraged by global regulatory coordination efforts. Reports and policy frameworks published by the Bank for International Settlements and OECD highlight the use of advanced analytics, machine learning, and automation to enhance real time supervision, compliance efficiency, and systemic risk monitoring. As financial regulators promote data driven oversight and cross border regulatory harmonization, demand is rising for secure, scalable, and explainable AI solutions that support long term institutional resilience, higher operational efficiency, and sustained client engagement across the global financial ecosystem.

Global Artificial Intelligence in Finance Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 36.23 Billion |

|

Revenue Forecast in 2035 |

USD 444.73 Billion |

|

Growth Rate |

28.5% |

|

Segments Covered in the Report |

Solution Type, Deployment Mode, Technology, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Other Regions |

|

Key Companies |

IBM, Microsoft, Google Cloud, FIS, SAS, SAP, Oracle, Amazon Web Services, Salesforce, Baidu |

|

Customization |

Available upon request |

AI in Finance Market Segmentation

By Solution Type

Software platforms are estimated to account for approximately 54% of total market revenue in 2025. This dominance reflects the central role of AI software in enabling fraud detection, credit scoring, risk analytics, and customer intelligence across banking and financial institutions. High deployment frequency, direct integration with core financial systems, and continuous software upgrades support sustained demand across developed and emerging financial markets.

Analytics focused solutions represent an estimated 26% share, driven by increasing emphasis on real time risk modeling, predictive insights, and regulatory reporting automation. Growth for this segment is supported by rising adoption of advanced analytical engines to manage complex transaction volumes and improve decision accuracy, with an estimated growth rate of about 33% during the forecast period.

Services contribute approximately 20% of market revenue, supported by implementation, model training, customization, and ongoing lifecycle management. Demand for services is expanding at an estimated 29%, as financial institutions prioritize compliance alignment, system interoperability, and continuous optimization of AI models within regulated operating environments.

By Deployment Mode

On premise deployment accounted for approximately 57% of market revenue in 2025. This reflects financial institutions’ preference for greater control over sensitive data, internal governance requirements, and compatibility with legacy infrastructure. On premise models remain widely adopted for high value transactions and mission critical financial operations.

Cloud based deployment is expected to register the highest growth rate of nearly 35% during the forecast period. Growth is driven by scalability, faster deployment cycles, and lower capital expenditure requirements. Increasing acceptance of regulated cloud environments and secure financial cloud frameworks is accelerating adoption among digital banks, fintech firms, and mid-sized financial institutions.

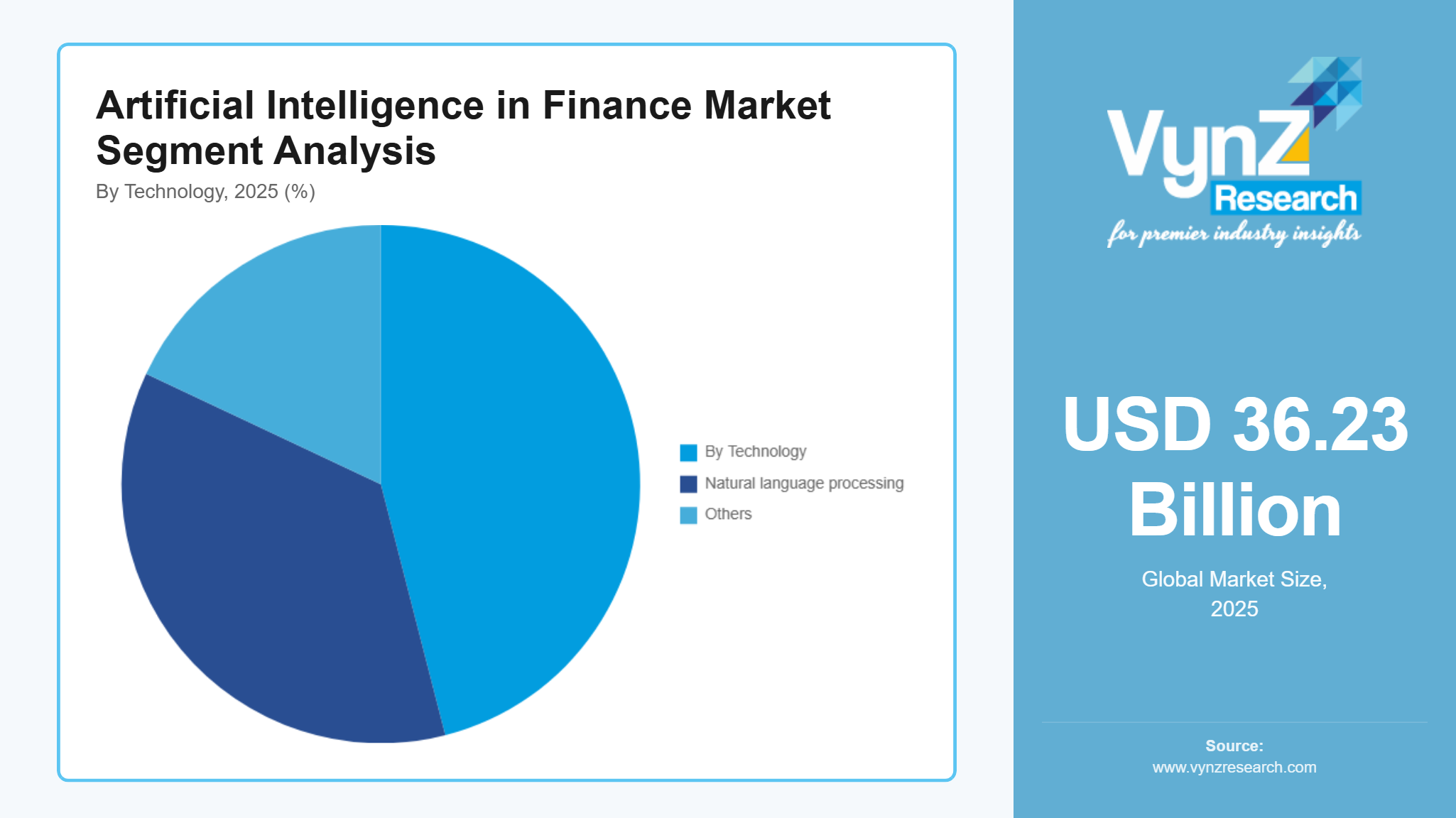

By Technology

Machine learning held the largest share at approximately 46% in 2025, supported by its extensive use in credit risk assessment, fraud detection, transaction monitoring, and predictive analytics. Continuous improvements in model accuracy and explainability are strengthening adoption across core financial applications.

Natural language processing is projected to grow at the fastest rate of about 36%, driven by expanding use in customer service automation, document processing, regulatory compliance reporting, and sentiment analysis. Other analytical technologies contribute approximately 18% and are growing steadily at around 28%, supported by specialized applications such as behavioral analysis and pattern recognition.

By End User

Banks represented the largest end user segment with an estimated 52% share in 2025. This is supported by large scale AI deployment across lending, payments, compliance, and customer engagement operations. High transaction volumes and regulatory requirements continue to drive sustained investment in AI systems.

Insurance companies are expected to grow at approximately 32%, driven by adoption in underwriting automation, claims processing, and fraud prevention. Capital market institutions are expanding at nearly 30%, supported by algorithmic trading, portfolio optimization, and real time risk analytics. Other financial service providers continue to adopt AI solutions to improve operational efficiency and digital service delivery, supporting overall market expansion.

Regional Insights

North America

North America accounted for approximately 28% of the global AI in finance market in 2025, supported by early technology adoption, mature financial infrastructure, and strong regulatory engagement with advanced analytics. Financial institutions across the United States and Canada are deploying AI for fraud prevention, credit analytics, and regulatory compliance. Policy guidance and supervisory initiatives from bodies such as the U.S. Federal Reserve, the Office of the Comptroller of the Currency, and the Financial Stability Oversight Council encourage responsible AI use, model governance, and data security. Continued growth is supported by strong enterprise demand, widespread cloud adoption under regulated frameworks, and sustained investment in financial cybersecurity and supervisory technology platforms.

Europe

Europe represented an estimated 24% share of the market in 2025. Market development is driven by strict regulatory alignment, digital banking expansion, and coordinated policy frameworks across the European Union. Authorities such as the European Central Bank and the European Banking Authority promote AI adoption through supervisory technology initiatives, while ensuring compliance with data protection and model transparency requirements under regulations such as GDPR and the EU AI Act. Financial institutions in Germany, the United Kingdom, France, and the Nordics are increasingly adopting AI for transaction monitoring, risk management, and customer analytics, supported by strong digital finance ecosystems and regulatory clarity.

Asia Pacific

Asia Pacific accounted for approximately 26% of global market revenue in 2025, driven by rapid digitalization of financial services, expanding fintech ecosystems, and high transaction volumes. Central banks and financial regulators across major economies promote AI adoption through digital payment infrastructure development, financial inclusion initiatives, and technology modernization programs. Large scale deployment of AI in payments, lending, and fraud detection is supported by strong enterprise demand and government backed digital economy strategies. Growth in the region is further reinforced by rising mobile banking penetration, increasing use of alternative data, and expanding cloud adoption under evolving regulatory frameworks.

Other Regions

Other regions collectively contributed an estimated 22% of the market in 2025. Growth across Latin America, the Middle East, and Africa is supported by gradual modernization of financial systems, expanding digital payment adoption, and government led financial inclusion programs. While adoption levels remain lower compared with North America, Europe, and Asia Pacific, these regions present long term opportunities as regulatory frameworks mature and investment in secure digital finance infrastructure increases. The remaining share of the market is covered by regions not detailed above, ensuring the total regional contribution remains balanced and within global estimates.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on advanced analytics innovation, secure AI model development, and geographic expansion. Leading companies including IBM, Microsoft, Google, Oracle, and SAP invest heavily in AI platforms, cloud based financial solutions, and regulatory compliant architectures. Adoption is reinforced by supervisory guidance and policy frameworks issued by institutions such as the Bank for International Settlements and global financial regulators, which promote responsible AI deployment, model governance, and data security. These frameworks encourage vendors to strengthen long term partnerships across banking, insurance, and capital markets globally.

Mini Profiles

IBM stays active in the AI-finance space through its analytics engines, model-governance tools, and a long pipeline of enterprise clients. Banks use IBM systems mostly for fraud analytics, risk modelling, and large-scale automation work.

Microsoft continues to dominate cloud-based AI adoption in finance, especially through Azure’s machine-learning ecosystem. Many institutions rely on Azure for credit-scoring engines and predictive risk tools.

Google Cloud focuses on data engineering, real-time analytics, and high-performance AI models. Financial firms that depend heavily on large-scale data pipelines lean toward Google’s infrastructure because of its speed and search-driven strengths.

FIS is known for its deep reach in payment systems and core-banking technology. It has steadily moved into AI products that support fraud detection, credit decisioning, and merchant-risk analytics.

SAS remains a strong name in risk analytics and regulatory compliance. Its platforms help financial institutions develop explainable models, which is a major requirement in markets with strict data and audit rules.

Key Players

- IBM

- Microsoft

- Nuance Communications, Inc.

- Affirm, Inc.

- SAP

- Oracle

- Amazon Web Services

- Salesforce

- Intel

- International Business Machines Corp

- Amelia U.S.

- Upstart Network,Inc.

Recent Developments

January 2026 - IBM has introduced IBM Enterprise Advantage, a new product that is aimed at enterprise AI governance and adoption. The business has partnered with e& to implement one of the first enterprise-grade agentic AI governance solutions in the area. Additionally, IBM worked on GRAMMY IQ, utilizing its AI capabilities to delight fans.

January 2026 - Microsoft and Bristol Myers Squibb have partnered to deploy Microsoft's AI-enabled radiography platform to help accelerate lung cancer early detection. The partnership will employ Microsoft's Precision Imaging Network, which analyzes X-ray and CT images to help identify lung disease and is utilized by US hospitals, to implement U.S. Food and Drug Administration-cleared radiology AI algorithms.

January 2026 - Google Cloud has fulfilled its commitment to invest $1 billion in developing its cloud and datacenter infrastructure in Thailand by formally launching its first cloud region there. By providing local data residency, low-latency connectivity, and direct access to Google's suite of artificial intelligence (AI) tools, the Bangkok cloud area will assist Thailand's digital economy.

Global Artificial Intelligence in Finance Market Coverage

Solution Type Insight and Forecast 2026 - 2035

- Software Platforms

- Analytics Solutions

- Services

Deployment Mode Insight and Forecast 2026 - 2035

- On Premise

- Cloud Based

Technology Insight and Forecast 2026 - 2035

- Machine Learning

- Natural Language Processing

- Other AI Technologies

End User Insight and Forecast 2026 - 2035

- Banks

- Insurance Companies

- Capital Market Institutions

- Other Financial Service Providers

Global Artificial Intelligence in Finance Market by Region

- North America

- By Solution Type

- By Deployment Mode

- By Technology

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Solution Type

- By Deployment Mode

- By Technology

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Solution Type

- By Deployment Mode

- By Technology

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Solution Type

- By Deployment Mode

- By Technology

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Artificial Intelligence in Finance Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Solution Type

1.2.2. By

Deployment Mode

1.2.3. By

Technology

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Solution Type

5.1.1. Software Platforms

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Analytics Solutions

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Services

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Deployment Mode

5.2.1. On Premise

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Cloud Based

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Technology

5.3.1. Machine Learning

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Natural Language Processing

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Other AI Technologies

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Banks

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Insurance Companies

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Capital Market Institutions

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Other Financial Service Providers

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Solution Type

6.2. By

Deployment Mode

6.3. By

Technology

6.4. By

End User

7. Europe Market Estimate and Forecast

7.1. By

Solution Type

7.2. By

Deployment Mode

7.3. By

Technology

7.4. By

End User

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Solution Type

8.2. By

Deployment Mode

8.3. By

Technology

8.4. By

End User

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Solution Type

9.2. By

Deployment Mode

9.3. By

Technology

9.4. By

End User

10. Company Profiles

10.1. IBM

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Microsoft

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Google

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Nuance Communications, Inc.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Affirm, Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. SAP

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Oracle

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Amazon Web Services

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Salesforce

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Intel

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. International Business Machines Corp

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Amelia U.S.

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. Upstart Network,Inc.

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Artificial Intelligence in Finance Market