Artificial Intelligence (AI) Robots Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Robot Type (Industrial robots, Service robots, Collaborative robots), by Application (Manufacturing & assembly, Healthcare & medical support, Logistics & material transport, Inspection & security, Consumer services), by Component (Software platforms, Hardware components, Services), by End Use Industry (Manufacturing & industrial, Logistics & warehousing, Healthcare & medical services, Retail, hospitality & education), by Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5202 | Industry : ICT & Media | Available Format :

|

Page : 210 |

Artificial Intelligence (AI) Robots Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Robot Type (Industrial robots, Service robots, Collaborative robots), by Application (Manufacturing & assembly, Healthcare & medical support, Logistics & material transport, Inspection & security, Consumer services), by Component (Software platforms, Hardware components, Services), by End Use Industry (Manufacturing & industrial, Logistics & warehousing, Healthcare & medical services, Retail, hospitality & education), by Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa)

Artificial Intelligence Robots Market Overview

The artificial intelligence (AI) robots market which was valued at approximately USD 30.0 billion in 2025 and is estimated to rise further up to almost USD 37.0 billion by 2026, is projected to reach around USD 150.91 billion in 2035, expanding at a CAGR of about 16.9% during the forecast period 2026–2035.

Market growth is driven by rapid automation across industrial manufacturing, acceleration of service robotics in healthcare and retail, and advancements in intelligent perception and machine learning integration, along with increasing adoption of collaborative robot solutions. Rising demand for labor augmentation in logistics and ongoing investments in national robotics initiatives supported by OECD digital economy frameworks and public sector modernization programs are further supporting market expansion across North America, Europe, and Asia Pacific. Reports from international robotics agencies and government digitalization plans indicate sustained long-term deployment of AI-powered robotics.

AI Robots Market Dynamics

Market Trends

The AI robots industry is witnessing notable shifts in technology usage enterprise automation frameworks and procurement patterns as organizations increasingly adopt autonomous robotics to enhance operational efficiency and address labor challenges. One of the key trends shaping the market is the accelerated integration of collaborative robots with advanced perception and control capabilities reflecting changing preferences toward efficiency cost optimization and sustainable operation across manufacturing healthcare and logistics sectors. National robotics strategies such as Australia’s national robotics strategy by the Department of Industry Science and Resources highlight structured efforts to drive robotics adoption and responsible technology deployment across the economy.

Another emerging trend is the government led alignment of robotics deployment with ethical and regulatory standards supported by initiatives such as Japan’s revised national robotics strategy focused on AI robotics innovation and public procurement to accelerate industrial uptake. These developments are influencing product offerings and encouraging companies to focus on valueadded features differentiation strategies and integrated robotics solutions thereby redefining competitive dynamics within the market.

Growth Drivers

The growth of the market is largely supported by increasing industrial automation initiatives, which continue to generate consistent demand across manufacturing, logistics, and service sectors. Organizations are adopting autonomous robotics to optimize productivity, improve operational efficiency, and reduce labor costs.

Increasing investments in smart manufacturing infrastructure and robotic deployment programs are further accelerating market expansion. National industrial policies such as the United States National Robotics Initiative and the European Union Strategic Roadmap for Manufacturing Robotics emphasize scalable automation, workforce augmentation, and integration of advanced robotic technologies.

Additionally, government-led emphasis on innovation and digital transformation is playing a crucial role in boosting adoption. Enterprises are prioritizing performance and compliance with safety and quality standards, and demand for autonomous service and industrial robotic solutions is expected to remain strong throughout the forecast period. Public funding and research grants from agencies including Germany’s Federal Ministry of Education and Research and Japan’s Robotics Strategy Council promote advanced robotics integration in key sectors, supporting long-term market growth.

Market Restraints / Challenges

The landscape faces certain challenges that may limit its expansion despite favorable growth prospects. One key restraint is regulatory complexity, as evolving compliance requirements for safety certification, data protection, and autonomous decision-making frameworks continue to affect profitability and market penetration, particularly among emerging enterprise segments that lack dedicated compliance infrastructure. Government policy reports, including the United States National Institute of Standards and Technology (NIST) robotics guidelines and the European Commission Robotics Coordination Action, highlight regulatory fragmentation and standardization gaps that hinder cross-border deployment and slow market growth.

Furthermore, dependence on external technologies and skilled labor poses operational challenges for manufacturers and suppliers. Reliance on specialized hardware, advanced semiconductors, and expert engineering talent can create supply chain constraints, cost pressures, and scalability issues during periods of economic uncertainty. Studies from Japan’s Ministry of Economy, Trade and Industry (METI) and Germany’s Federal Ministry for Economic Affairs and Climate Action emphasize workforce skill shortages and technology dependency as significant restraints impacting large-scale adoption of AI robots.

Market Opportunities

The market presents significant opportunities in industrial automation and service delivery solutions, particularly driven by technological advancements and unmet demand for adaptable and intelligent robotic systems across manufacturing, healthcare, and logistics sectors. Companies offering modular and high‑performance AI robotic solutions are well‑positioned to capture incremental demand from enterprises seeking cost‑efficient automation and enhanced operational resilience. Government technology development programs such as the United States national robotics initiative and the European Union’s strategic research agenda for robotics emphasize innovation in robotics systems that can operate safely alongside human workers, creating a favorable innovation environment for solution providers.

Another key opportunity lies in specialized service robotics and digital‑enabled offerings, where rising investments in premium automation technologies are creating avenues for higher margins and long‑term client relationships. Advancements in smart sensors, edge computing, and autonomous control algorithms are expected to enhance customer engagement and improve deployment success across mission‑critical applications. Policy reports from Japan’s ministry of economy trade and industry and South Korea’s robotics promotion roadmap highlight national efforts to accelerate adoption of intelligent robotic technologies, supporting broader market opportunities for vendors aligned with strategic industrial automation goals.

Global Artificial Intelligence Robots Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 30 Billion |

|

Revenue Forecast in 2035 |

USD 150.91 Billion |

|

Growth Rate |

16.9% |

|

Segments Covered in the Report |

Robot Type, Application, Component, End Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

|

Key Companies |

ABB, FANUC, KUKA, Yaskawa Electric, Universal Robots (UR), Mitsubishi Electric, Omron, Hanson Robotics, SoftBank Robotics, Boston Dynamics |

|

Customization |

Available upon request |

AI Robots Market Segmentation

By Robot Type

Industrial robots are projected to account for approximately 47% of total market revenue in 2025, supported by their extensive deployment in automotive, electronics, and heavy manufacturing where precision and repeatability are critical. This reflects the role of automated assembly, welding, and material handling systems in driving operational productivity.

Service robots, including healthcare assistance, logistics support, and customer interaction robots, are estimated at around 35% of market revenue in 2025, as enterprises increasingly leverage AI robots to augment labor‑scarce environments and improve service quality across hospitals, warehouses, and retail outlets.

Collaborative robots designed for safe human interaction contribute roughly 18% of revenue, primarily in industries where flexibility and seamless human‑machine collaboration are essential. Research initiatives highlighted in national industrial strategies emphasize the integration of advanced perception and adaptive control technologies, creating opportunities for all robot types to evolve. Growth in this segment is expected to be supported by ongoing innovation in robot sensing capabilities and by policies promoting technology‑driven manufacturing transformation in key economies.

By Application

In manufacturing and assembly applications, AI robots are expected to hold approximately 42% of total market revenue in 2025, reflecting strong demand for automation in high‑volume production environments. This dominance is supported by the need for consistent product quality, higher throughput, and reduced operational risks.

In healthcare and medical support applications, AI robotics are estimated at around 28% of revenue, driven by demand for patient care assistance, sanitization robots, and logistical support within hospitals and clinics.

Autonomous logistics and material transport applications account for approximately 20% of market revenue, as warehouses and distribution centers adopt AI robots to optimize order fulfillment and reduce lead times.

Other applications, including inspection, security, and consumer services, contribute roughly 10% of revenue, reflecting adoption in niche segments. Strategic national digitalization programs and robotics innovation plans emphasize the use of robotics in critical sectors like healthcare and supply chain, bolstering adoption across diverse application areas and supporting projected growth throughout the forecast period.

By Component

Software platforms are anticipated to represent approximately 55% of total market revenue in 2025, reflecting the importance of intelligent perception, decision algorithms, and integration frameworks that enable autonomous navigation, task planning, and adaptive learning capabilities in AI robots. This substantial share underscores the value placed on advanced control systems and analytics that enhance robot performance and reliability across sectors.

Hardware components, including sensors, actuators, and computing modules, are estimated at around 30% of market revenue, driven by investments in high‑precision and durable systems that support real‑time operations.

Services, such as installation, integration, maintenance, and customization, contribute approximately 15% of revenue, supporting organizations in deploying AI robotics solutions while ensuring long‑term performance optimization. Industry technology white papers and strategy reports in major economies highlight the critical role of software innovation and skilled services in realizing the full potential of robotics deployments, encouraging companies to expand their software and service portfolios to address evolving automation needs across global markets.

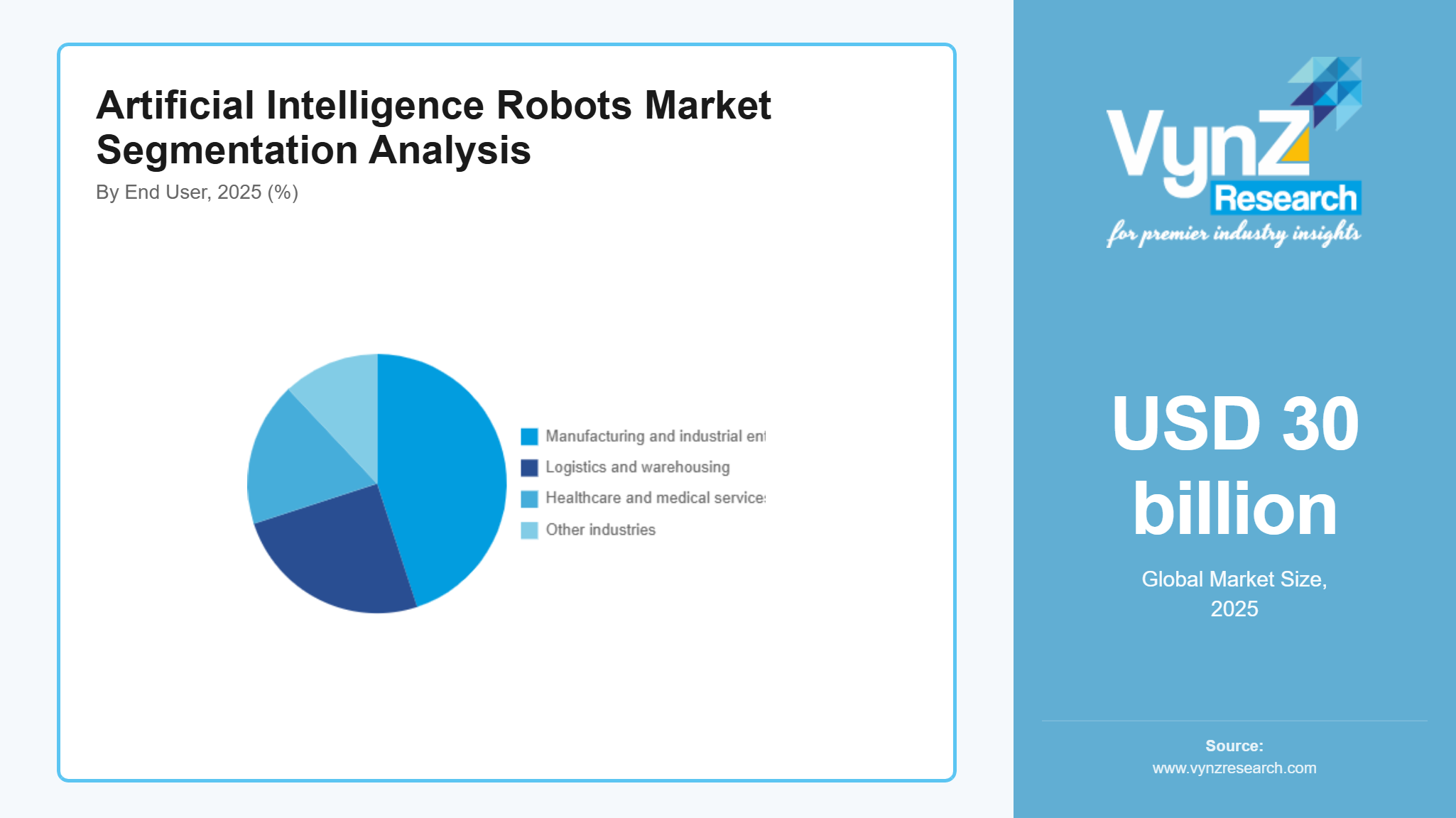

By End Use Industry

Manufacturing and industrial enterprises are projected to account for approximately 45% of total market revenue in 2025, driven by adoption of AI robots for assembly, welding, machining, and quality inspection tasks that improve output and safety. This segment benefits from ongoing investments in industrial modernization programs and technology transformation strategies that prioritize automation.

Logistics and warehousing end‑use industries contribute an estimated 25% of market revenue as organizations implement AI robots to optimize material transport, inventory handling, and order processing.

Healthcare and medical services represent around 18% of revenue, supported by demand for patient care assistance, sanitization, and diagnostic robotics in hospital ecosystems.

Other industries, including retail, hospitality, and education, account for approximately 12% of revenue, reflecting adoption in service roles that enhance customer engagement and operational efficiency. National technology adoption frameworks and industrial automation roadmaps underscore the strategic importance of robotics across key sectors, reinforcing sustained demand from diversified end‑use industries throughout the forecast period.

Regional Insights

North America

North America is estimated to hold approximately 26% of the market in 2025, supported by robust automation investments and high technology adoption in manufacturing, aerospace, and logistics. Strong demand from major industrial hubs such as the Midwest manufacturing belt and California technology corridor continues to underpin regional growth. National robotics initiatives such as the United States National Robotics Initiative encourage public and private collaboration to accelerate robotics research and deployment across key sectors, while smart manufacturing funding programs drive enterprise digitization and productivity improvement. Increasing integration of AI capabilities into autonomous robotic platforms to improve operational agility reinforces adoption across North America.

Asia Pacific

Asia Pacific is projected to account for roughly 38% of the market in 2025, driven by rapid industrial automation and large‑scale robotics integration across manufacturing ecosystems. China, Japan and South Korea lead regional adoption with extensive installation of industrial and service robots as enterprises automate production lines and logistics operations to remain competitive. Government industrial policies, including China’s “Made in China 2025” strategy and public‑private research funding in Japan and South Korea, are accelerating the deployment of AI robots across key sectors. Enhanced AI robotics research and vocational training programs are further promoting regional market expansion.

Europe

Europe represents approximately 21% of the market in 2025, supported by strong engineering capabilities and strategic investments in collaborative robotics across automotive, machinery and healthcare sectors. Major economies such as Germany, France and Italy are advancing research and deployment of AI robots as part of industry modernization efforts, with the European Union’s digital innovation programs funding cross‑border robotics research and ethical automation frameworks. These government‑backed initiatives strengthen robotics adoption while ensuring alignment with sustainability and safety requirements.

Other Regions

The remaining regions collectively contribute approximately 15% of the market, supported by expanding enterprise automation and logistics modernization in Latin America, the Middle East and Africa. Although adoption remains slower compared with North America, Asia Pacific and Europe, government incentives promoting technology adoption and digital transformation in emerging economies are creating long‑term opportunities for AI robotics deployment.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with leading global and regional players focusing on technological innovation, strategic partnerships, and geographic expansion. Companies are investing heavily in R&D, cloud integration, and AI software capabilities to enhance performance, compliance, and operational efficiency. Government initiatives such as the United States National Robotics Initiative, the European Union’s Horizon Europe robotics programs, and Asia Pacific industrial automation policies support innovation and standardization, encouraging vendors to align offerings with national robotics strategies and responsible AI frameworks, thereby strengthening their market position.

Mini Profiles

ABB has been active in robotics for decades, and much of its current momentum comes from blending its older industrial platforms with lighter, AI-assisted units. The company’s robots are common in car plants and electronics workshops, mainly because they hold up well under long production hours.

FANUC tends to focus on high-precision work. Its robots are a familiar sight in welding bays and machining lines, and many factories choose them for their stability rather than just raw speed. FANUC’s software updates also help machines adjust to small process shifts without constant manual tuning.

KUKA continues to broaden its footprint across automated factories and large logistics centers. A lot of its recent attention has gone into improving the way its robots “think” during task changes, making it easier for operators to switch between jobs without stopping entire lines.

Yaskawa Electric has been pushing its motion-control capabilities forward, which is noticeable in applications that need smoother, more predictable robot movement. This has helped the company stay relevant in fields like packaging, metalwork and electronics assembly.

Universal Robots (UR) remains a go-to option for collaborative robots. Its cobots are lightweight and relatively simple to adopt, so many smaller workshops prefer them when they need automation without rebuilding their whole setup.

Key Players

- ABB

- FANUC

- KUKA

- Yaskawa Electric

- Universal Robots (UR)

- Mitsubishi Electric

- Omron

- Hanson Robotics

- SoftBank Robotics

- Boston Dynamics

Recent Developments

January 2026 - OMRON Electronic Components has been selected as the "Smart Agriculture Solution of the Year" winner of the 10th annual IoT Breakthrough Awards program. The sensor's multi-parameter sensing capabilities and excellent sensitivity enable advanced environmental variable monitoring. The gadget has been employed in a variety of applications, including smart farming, smart lighting, and spot weather collection, and its sturdy, small form makes it perfect for field deployment in challenging settings. The Omron Weather Sensor is being developed to incorporate basic LTE and collaborates closely with integrators to transfer the gathered data to the majority of common LoRa communication protocols. The innovative solution may readily connect to IoT networks in smart cities and provide data to people in the vicinity for evaluation and safety.

December 2025 - Mitsubishi Electric Corporation has partnered with Tulip Interfaces, Inc., a Massachusetts-based supplier of no-code platforms for system operations that facilitate manufacturing digitalization, to form a strategic alliance. Through this collaboration, Mitsubishi Electric hopes to improve its digital transformation solutions for manufacturing and other industries by creating a no-code system development platform.

June 2025 - Hanson Robotics unveiled its latest humanoid AI robot platform focused on natural interaction and customer service applications, aimed at supporting advanced service robotics adoption in retail and hospitality environments.

Oct 2025 - As part of the Japanese group's aggressive drive into a sector it believes will be linked to the emergence of artificial intelligence, SoftBank has agreed to purchase ABB's robotics division in a deal valued at $5.4 billion. The acquisition shall construct a comprehensive AI infrastructure encompassing robotics, data centers, energy, and chip manufacturing.

Global Artificial Intelligence Robots Market Coverage

Robot Type Insight and Forecast 2026 - 2035

- Industrial robots

- Service robots

- Collaborative robots

Application Insight and Forecast 2026 - 2035

- Manufacturing & assembly

- Healthcare & medical support

- Logistics & material transport

- Inspection & security

- Consumer services

Component Insight and Forecast 2026 - 2035

- Software platforms

- Hardware components

- Services

End Use Industry Insight and Forecast 2026 - 2035

- Manufacturing & industrial

- Logistics & warehousing

- Healthcare & medical services

- Retail

- hospitality & education

Region Insight and Forecast 2026 - 2035

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Global Artificial Intelligence Robots Market by Region

- North America

- By Robot Type

- By Application

- By Component

- By End Use Industry

- By Region

- By Country - U.S., Canada, Mexico

- Europe

- By Robot Type

- By Application

- By Component

- By End Use Industry

- By Region

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Robot Type

- By Application

- By Component

- By End Use Industry

- By Region

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Robot Type

- By Application

- By Component

- By End Use Industry

- By Region

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Artificial Intelligence Robots Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Robot Type

1.2.2. By

Application

1.2.3. By

Component

1.2.4. By

End Use Industry

1.2.5. By

Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Robot Type

5.1.1. Industrial robots

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Service robots

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Collaborative robots

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Application

5.2.1. Manufacturing & assembly

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Healthcare & medical support

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Logistics & material transport

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Inspection & security

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Consumer services

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.3. By Component

5.3.1. Software platforms

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Hardware components

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Services

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End Use Industry

5.4.1. Manufacturing & industrial

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Logistics & warehousing

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Healthcare & medical services

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Retail

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. hospitality & education

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

5.5. By Region

5.5.1. North America

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Asia Pacific

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Europe

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Latin America

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. Middle East & Africa

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Robot Type

6.2. By

Application

6.3. By

Component

6.4. By

End Use Industry

6.5. By

Region

6.5.1.

U.S. Market Estimate and Forecast

6.5.2.

Canada Market Estimate and Forecast

6.5.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Robot Type

7.2. By

Application

7.3. By

Component

7.4. By

End Use Industry

7.5. By

Region

7.5.1.

Germany Market Estimate and Forecast

7.5.2.

U.K. Market Estimate and Forecast

7.5.3.

France Market Estimate and Forecast

7.5.4.

Italy Market Estimate and Forecast

7.5.5.

Spain Market Estimate and Forecast

7.5.6.

Russia Market Estimate and Forecast

7.5.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Robot Type

8.2. By

Application

8.3. By

Component

8.4. By

End Use Industry

8.5. By

Region

8.5.1.

China Market Estimate and Forecast

8.5.2.

Japan Market Estimate and Forecast

8.5.3.

India Market Estimate and Forecast

8.5.4.

South Korea Market Estimate and Forecast

8.5.5.

Vietnam Market Estimate and Forecast

8.5.6.

Thailand Market Estimate and Forecast

8.5.7.

Malaysia Market Estimate and Forecast

8.5.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Robot Type

9.2. By

Application

9.3. By

Component

9.4. By

End Use Industry

9.5. By

Region

9.5.1.

Brazil Market Estimate and Forecast

9.5.2.

Saudi Arabia Market Estimate and Forecast

9.5.3.

South Africa Market Estimate and Forecast

9.5.4.

U.A.E. Market Estimate and Forecast

9.5.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

ABB

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

FANUC

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

KUKA

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

Yaskawa Electric

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

Universal Robots (UR)

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

Mitsubishi Electric

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Omron

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

Hanson Robotics

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

SoftBank Robotics

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

10.10.

Boston Dynamics

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Artificial Intelligence Robots Market