Automated Machine Learning (AutoML) Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Offering Type (Software Platforms, Services), by Deployment Mode (Cloud-Based, On-Premise, Hybrid), by Organization Size (Large Enterprises, Small & Medium Enterprises), by End User (Banking & Financial Services, Healthcare, Government & Public Sector, Retail, Manufacturing)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5205 | Industry : ICT & Media | Available Format :

|

Page : 210 |

Automated Machine Learning (AutoML) Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Offering Type (Software Platforms, Services), by Deployment Mode (Cloud-Based, On-Premise, Hybrid), by Organization Size (Large Enterprises, Small & Medium Enterprises), by End User (Banking & Financial Services, Healthcare, Government & Public Sector, Retail, Manufacturing)

Automated Machine Learning Market Overview

The automated machine learning (AutoML) market was valued at approximately USD 3.9 billion in 2025, is estimated to rise further to nearly USD 5.17 billion in 2026, and is projected to reach around USD 66.4 billion by 2035, expanding at a CAGR of about 32.8% during the forecast period from 2026 to 2035. Market expansion is driven by the rapid democratization of artificial intelligence the need to reduce dependence on highly specialized data science talent and increasing enterprise demand for faster model development and deployment.

Rising adoption of cloud native analytics platforms automated feature engineering and no code machine learning tools continues to accelerate usage across banking healthcare retail and manufacturing sectors. Growth is further supported by government backed artificial intelligence strategies and digital economy programs promoted by institutions such as the U.S. National Institute of Standards and Technology the European Commission and OECD which emphasize scalable AI adoption standardized model governance and responsible automation across North America Europe and Asia Pacific.

Automated Machine Learning Market Dynamics

Market Trends

The industry is experiencing a structural shift toward simplified and standardized AI development frameworks, aligned with national artificial intelligence strategies and digital economy programs promoted by government and intergovernmental institutions. Policy guidance from organizations such as the U.S. National Institute of Standards and Technology, the European Commission under its coordinated AI plan, and the OECD artificial intelligence policy observatory emphasizes reproducible model development, explainability, and reduced dependence on manual feature engineering. These frameworks are accelerating enterprise adoption of automated model selection, hyperparameter optimization, and workflow orchestration tools to improve deployment speed and governance consistency.

Another significant trend is the growing integration of automated machine learning platforms with cloud computing and enterprise analytics ecosystems. Government-backed digital infrastructure initiatives, including public cloud adoption programs and national data strategies across North America, Europe, and Asia pacific, are encouraging organizations to deploy scalable AI systems with centralized monitoring and lifecycle management. As a result, vendors are focusing on integrated platforms that combine automated model development, performance monitoring, and compliance reporting, reshaping competitive dynamics toward end-to-end AI enablement solutions rather than standalone modeling tools.

Growth Drivers

The growth of the market is strongly supported by the global shortage of skilled data scientists and the increasing complexity of enterprise data environments. Public sector reports from the U.S. Bureau of Labor Statistics, OECD digital skills outlooks, and national AI workforce assessments highlight persistent talent gaps in advanced analytics and machine learning engineering. Automated machine learning platforms address this constraint by enabling non-specialist users to develop deploy and manage predictive models, thereby expanding AI adoption across enterprises government agencies and regulated industries.

Rising regulatory and operational requirements for transparent and accountable AI systems are also driving adoption. Frameworks such as the NIST AI risk management framework and the European union AI governance initiatives encourage organizations to implement standardized documented and auditable AI development processes. Automated machine learning solutions support these objectives through repeatable workflows model validation tracking and performance governance. As enterprises and public institutions prioritize cost efficiency faster deployment and regulatory alignment demand for automated machine learning platforms is expected to remain strong throughout the forecast period.

Market Restraints / Challenges

Despite favorable growth prospects, the market landscape faces structural challenges that may constrain adoption. Deployment of automated model development platforms requires significant upfront investment in cloud infrastructure, data pipelines, and governance frameworks. Government guidance such as the U.S. National Institute of Standards and Technology AI risk management framework and European commission AI governance initiatives emphasizes transparency, model validation, and accountability, which increases compliance complexity and implementation costs. These requirements can limit market penetration among cost-sensitive organizations and emerging enterprises with constrained digital budgets.

Furthermore, dependence on specialized AI talent and high-quality labeled data presents operational challenges for solution providers and end users. Reports from the OECD on artificial intelligence skills and data readiness highlight shortages of trained professionals and uneven data maturity across regions. Limited in-house expertise, reliance on external cloud platforms, and integration challenges with legacy systems can result in scalability constraints, longer deployment cycles, and higher operational expenditure during periods of economic uncertainty.

Market Opportunities

The market presents strong opportunities driven by expanding adoption of AI across public and private sectors and the need to democratize advanced analytics. Government-backed digital transformation programs, including national AI strategies promoted by the European commission, the U.S. Office of Science and Technology Policy, and Asia pacific digital economy initiatives, encourage broader use of standardized AI tools across enterprises and public institutions. Vendors offering scalable, cloud-native, and configurable automated machine learning platforms are well positioned to capture demand from mid-sized enterprises and government agencies seeking faster model deployment with limited specialist resources.

Another key opportunity lies in the growing emphasis on responsible and explainable AI. Regulatory alignment initiatives such as the EU AI act and NIST AI governance frameworks are driving investment in automated model documentation, auditability, and lifecycle monitoring. Advances in automation, workflow orchestration, and compliance reporting enable higher value solutions, supporting long-term client relationships and sustained adoption across regulated industries such as finance, healthcare, and public services.

Global Automated Machine Learning Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 3.9 Billion |

|

Revenue Forecast in 2035 |

USD 66.4 Billion |

|

Growth Rate |

32.8% |

|

Segments Covered in the Report |

Offering Type, Deployment Mode, Organization Size, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

DataRobot, H2O.ai, Google, AWS, Microsoft, Baidu, Dataiku, Domino Data Lab, BigML, RapidMiner, Alteryx, Altair, Teradata, BigML, Alibaba Cloud, Appier, Squark, Boost.ai, Tazi.ai, Salesforce |

|

Customization |

Available upon request |

Automated Machine Learning Market Segmentation

By Offering Type

Software platforms accounted for approximately 68% of total market revenue in 2025, reflecting strong enterprise preference for end-to-end automated model development, feature engineering, and deployment capabilities embedded within unified platforms. High adoption across large enterprises and technology driven sectors supports this dominance, as these platforms enable faster experimentation, reduced dependency on data science teams, and consistent model governance.

Services represent the fastest growing segment and are expected to expand at a CAGR of about 41% during the forecast period. Growth is driven by increasing demand for implementation support, workflow customization, managed model operations, and regulatory alignment services. Public sector digital transformation programs and enterprise migration toward cloud-based analytics continue to support sustained service adoption across regulated and non-regulated industries.

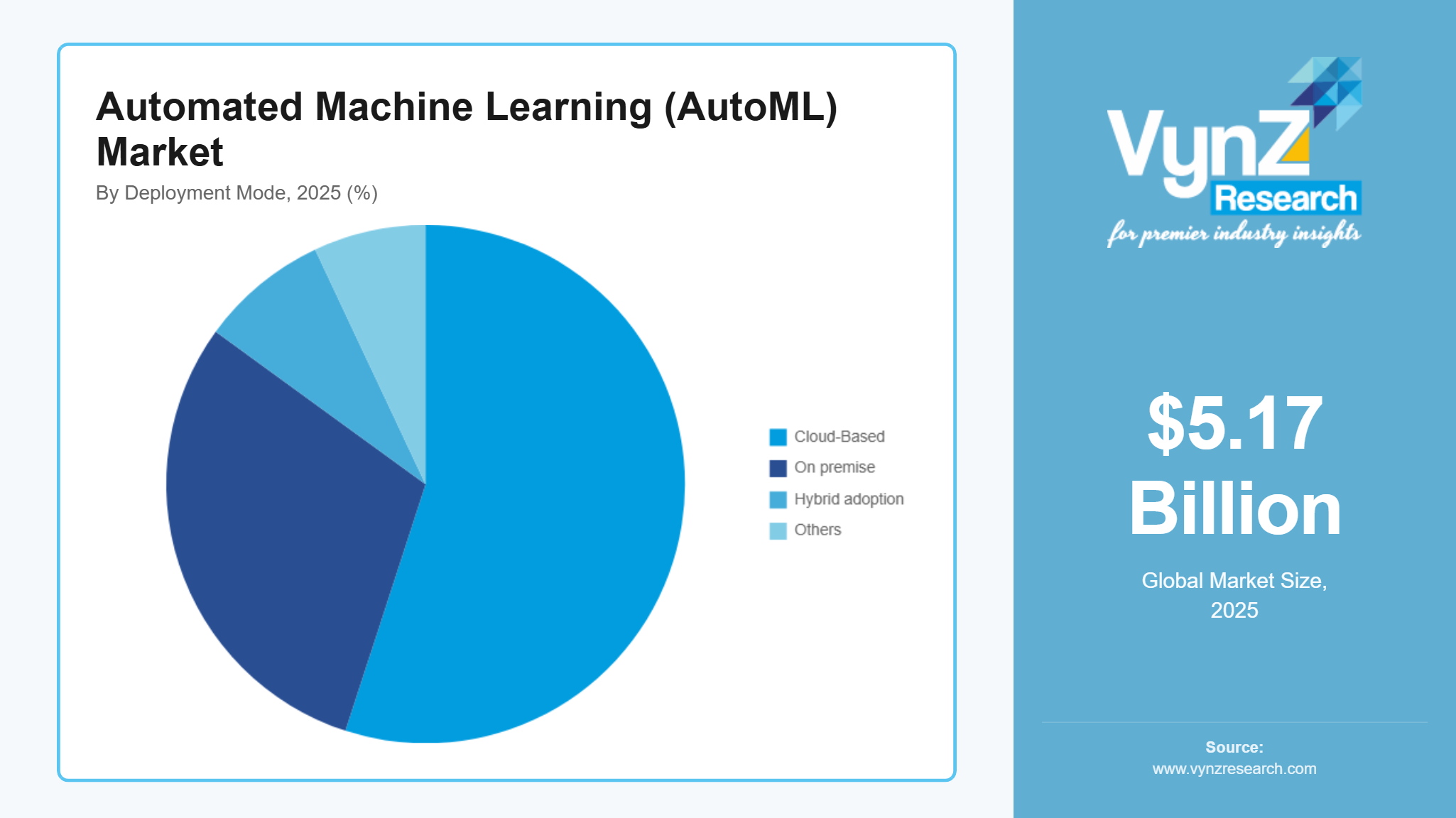

By Deployment Mode

Cloud based deployment held approximately 61% of market share in 2025, supported by scalability, centralized data access, and rapid integration with enterprise analytics ecosystems. Organizations favor cloud platforms to accelerate model training cycles, enable real time updates, and reduce infrastructure overhead, particularly in data intensive use cases.

On premise deployment remains relevant for sectors with strict data sovereignty and security requirements and is projected to grow at an estimated CAGR of around 37%. Growth is supported by government institutions, financial organizations, and critical infrastructure operators prioritizing control over sensitive datasets.

Hybrid adoption is also increasing as enterprises seek balanced performance, compliance alignment, and flexible data orchestration across distributed environments.

By Organization Size

Large enterprises accounted for approximately 64% of total revenue in 2025, driven by complex data environments, higher analytics budgets, and enterprise-wide AI integration strategies. These organizations deploy automated machine learning to standardize model development across multiple business units, improve productivity, and reduce time to value at scale.

Small and medium enterprises represent the fastest growing segment, with an estimated CAGR of about 42% during the forecast period. Growth is supported by cloud native pricing models, simplified user interfaces, and reduced technical barriers that enable broader adoption. Government backed digitalization initiatives and increased availability of preconfigured solutions further encourage uptake among resource constrained enterprises seeking advanced analytics capabilities.

By End User

The banking and financial services segment accounted for the largest revenue share in 2025 at approximately 29%, supported by high demand for fraud detection, risk modeling, and regulatory reporting automation.

The healthcare segment is among the fastest growing, expanding at an estimated CAGR of around 40%, driven by adoption in diagnostics, clinical decision support, and operational optimization. Government and public sector adoption is also increasing steadily as agencies deploy automated analytics for policy evaluation, service optimization, and data driven governance, contributing to sustained market demand across regions.

Regional Insights

North America

North America accounted for approximately 32% of the global automated machine learning market in 2025, supported by early enterprise adoption of artificial intelligence, advanced cloud infrastructure, and strong institutional investment in data driven automation. The region benefits from extensive deployment across technology, financial services, healthcare, and government agencies, particularly in the United States and Canada.

Government backed initiatives such as the U.S. National Institute of Standards and Technology artificial intelligence framework, the National Artificial Intelligence Initiative Act, and federal cloud modernization programs are encouraging adoption of automated model development, deployment, and monitoring tools. These policies promote responsible AI use, scalability, and operational efficiency, reinforcing demand for AUTOML platforms across large enterprises and public sector organizations.

Europe

Europe represented around 21% of global market revenue in 2025, driven by regulatory harmonization, enterprise digital transformation, and growing adoption of artificial intelligence in regulated industries. Financial services, manufacturing, healthcare, and public administration remain key contributors to regional demand, particularly across Germany, France, the United Kingdom, and the Nordic countries.

Policy frameworks such as the European Union artificial intelligence act, guidance from the European Union Agency for Cybersecurity, and digital innovation programs under the Digital Europe Program support adoption of explainable, compliant, and automated AI systems. These initiatives encourage enterprises to deploy AUTOML solutions that reduce model development complexity while maintaining transparency, governance, and regulatory alignment.

Asia Pacific

Asia Pacific accounted for approximately 24% of the automated machine learning market in 2025, supported by rapid digitalization, expanding cloud adoption, and national artificial intelligence strategies. Strong demand is observed across banking, telecommunications, e commerce, and government digital services in major economies including China, India, Japan, South Korea, and Australia.

Government backed programs such as China’s New Generation Artificial Intelligence Development Plan, India’s National AI Mission, and regional smart digital economy initiatives are accelerating adoption of automated analytics and machine learning platforms. Enterprises are increasingly deploying AUTOML to address skills shortages, reduce development timelines, and scale AI deployment across distributed business environments.

Other Regions

Latin America, the Middle East, and Africa together contribute to the remaining of the global automated machine learning market. Growth is supported by increasing cloud penetration, expanding digital public infrastructure, and emerging national AI strategies led by government and regulatory bodies.

Although adoption levels remain lower compared with North America, Europe, and Asia Pacific, these regions represent long term growth opportunities as digital maturity improves and institutional investment in artificial intelligence frameworks expands. The remaining share of the global market is covered by regions not detailed above, ensuring that total regional estimates remain within 100% without overstatement.

Competitive Landscape / Company Insights

The automated machine learning market is moderately to highly competitive, with global and regional players emphasizing AI model innovation, automated workflow platforms, and scalable analytics solutions. Leading vendors, including DataRobot, H2O.ai, Google Cloud, IBM, and Microsoft, focus on research and development, cloud integration, and regulatory compliance. Adoption is reinforced by government initiatives such as the U.S. National AI Research Resource Task Force, EU AI Act, and OECD AI in industry guidelines, which promote standardized deployment, secure automation, and predictive analytics. These programs incentivize vendors to expand geographically and secure long-term enterprise and public-sector contracts worldwide.

Mini Profiles

DataRobot helps teams quickly set up AI models without heavy coding. Many companies rely on it to reduce repetitive tasks and scale predictive work efficiently.

H2O.ai offers flexible Auto ML tools. Users can adjust models while still benefiting from automated pipelines, making it ideal for finance, healthcare, and retail teams.

Google offers AI model creation and deployment within Google’s cloud. Organisations benefit from fast setup and Google’s computational resources, making it easier to adopt AI without building large internal data teams.

Dataiku allows companies to combine coding with visual workflows for easier AI adoption.

Key Players

- DataRobot

- H2O.ai

- AWS

- Microsoft

- Baidu

- Dataiku

- Domino Data Lab

- BigML

- RapidMiner

- Alteryx

- Altair

- Teradata

- BigML

- Alibaba Cloud

- Appier

- Squark

- Boost.ai

- Tazi.ai

- Salesforce

Recent Developments

Dec 2025 - With a new strategic investment targeted at speeding enterprise artificial intelligence (AI) adoption throughout the bank, UBS has reinforced its long-standing partnership with Domino Data Lab. The agreement is the next stage of a collaboration that has already lasted more than five years and includes equity funding from UBS as well as a new board observer position for the bank. RiskLab, UBS's AI model creation and validation platform based on Domino's technology, created the groundwork for the collaboration. In keeping with UBS's risk-focused approach to innovation, this solution has allowed the bank to create AI models in a safe, cooperative, and completely auditable setting.

Dec 2025 - One of the biggest IT distributors in India, Savex Technologies, has partnered with Altery as a master reseller to expand throughout the country. The partnership advances Alteryx's goal of empowering Indian companies with analytics and AI solutions while fortifying its global expansion plan. Savex Technologies was selected due to its broad reseller network of 8,500 partners, shown multi-vendor and hyperscaler capabilities, and significant knowledge in data, analytics, and artificial intelligence. By interacting with critical end users and growing the reseller ecosystem, Alteryx and Savex hope to hasten the adoption of Alteryx One across industries. This partnership's main focus is on increasing geographic reach, increasing technological partnerships, expanding consumer and partner involvement, and creating new market paths.

Global Automated Machine Learning Market Coverage

Offering Type Insight and Forecast 2026 - 2035

- Software Platforms

- Services

Deployment Mode Insight and Forecast 2026 - 2035

- Cloud-Based

- On-Premise

- Hybrid

Organization Size Insight and Forecast 2026 - 2035

- Large Enterprises

- Small & Medium Enterprises

End User Insight and Forecast 2026 - 2035

- Banking & Financial Services

- Healthcare

- Government & Public Sector

- Retail

- Manufacturing

Global Automated Machine Learning Market by Region

- North America

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Offering Type

- By Deployment Mode

- By Organization Size

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Automated Machine Learning Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Offering Type

1.2.2. By

Deployment Mode

1.2.3. By

Organization Size

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Offering Type

5.1.1. Software Platforms

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Services

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Deployment Mode

5.2.1. Cloud-Based

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. On-Premise

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Hybrid

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Organization Size

5.3.1. Large Enterprises

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small & Medium Enterprises

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Banking & Financial Services

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Healthcare

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Government & Public Sector

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Retail

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Manufacturing

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Offering Type

6.2. By

Deployment Mode

6.3. By

Organization Size

6.4. By

End User

7. Europe Market Estimate and Forecast

7.1. By

Offering Type

7.2. By

Deployment Mode

7.3. By

Organization Size

7.4. By

End User

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Offering Type

8.2. By

Deployment Mode

8.3. By

Organization Size

8.4. By

End User

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Offering Type

9.2. By

Deployment Mode

9.3. By

Organization Size

9.4. By

End User

10. Company Profiles

10.1. DataRobot

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. H2O.ai

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Google

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. AWS

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Microsoft

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Baidu

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Dataiku

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Domino Data Lab

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. BigML

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. RapidMiner

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Alteryx

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Altair

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. Teradata

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. BigML

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Alibaba Cloud

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Appier

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. Squark

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

10.18. Boost.ai

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5. Recent

Developments

10.19. Tazi.ai

10.19.1.

Snapshot

10.19.2.

Overview

10.19.3.

Offerings

10.19.4.

Financial

Insight

10.19.5. Recent

Developments

10.20. Salesforce

10.20.1.

Snapshot

10.20.2.

Overview

10.20.3.

Offerings

10.20.4.

Financial

Insight

10.20.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Automated Machine Learning Market