Autonomous AI and Autonomous Agents Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Deployment Mode (Cloud based, On premise), by Component (Software Platforms, Services), by Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), by End Use Industry (Enterprise & Institutional, Public Sector & Smart Governance), by Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America)

| Status : Published | Published On : Jan, 2026 | Report Code : VRICT5201 | Industry : ICT & Media | Available Format :

|

Page : 210 |

Autonomous AI and Autonomous Agents Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Deployment Mode (Cloud based, On premise), by Component (Software Platforms, Services), by Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), by End Use Industry (Enterprise & Institutional, Public Sector & Smart Governance), by Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America)

Autonomous AI and Autonomous Agents Market Overview

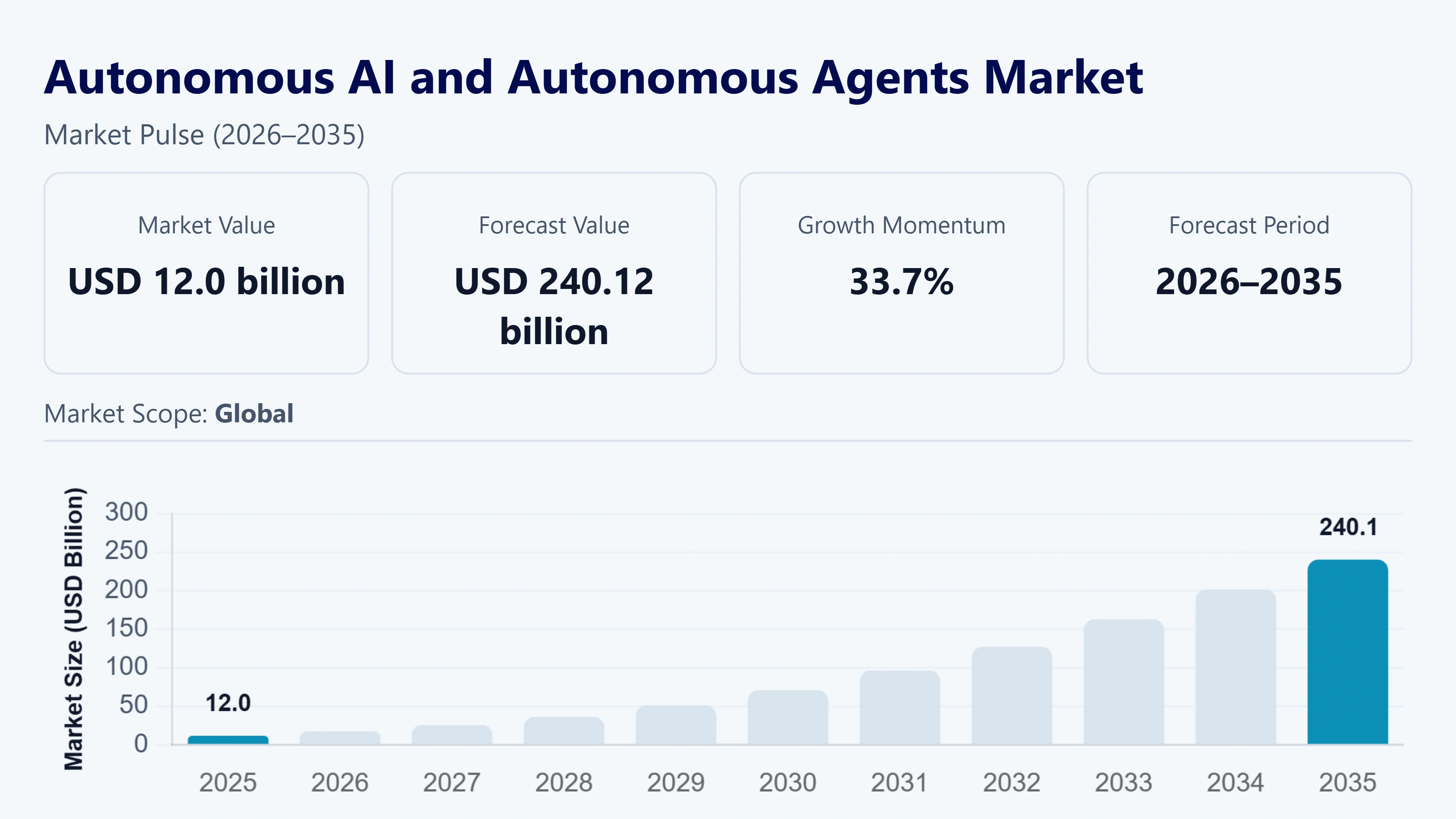

The autonomous AI and autonomous agents market that was valued at approximately USD 12.0 billion in 2025 and is estimated to rise further to nearly USD 17.6 billion by 2026, is projected to reach around USD 240.12 billion in 2035, expanding at a CAGR of about 33.7% during the forecast period 2026–2035. Market growth is supported by rising enterprise demand for autonomous decision-making systems increased deployment of agent-based automation across digital infrastructure and rapid advances in generative AI models.

Growing adoption of intelligent agents in healthcare finance and smart manufacturing along with sustained public sector investment in AI research supported by government backed institutions such as national digital strategies and responsible AI frameworks promoted by global agencies is further strengthening market expansion across North America, Europe and Asia Pacific. Increasing deployment across healthcare finance and smart infrastructure is reinforced by government backed initiatives including national AI strategies published by OECD member countries public digital transformation missions and global guidance on ethical and safe AI adoption issued by who UNESCO and other multilateral institutions supporting responsible large scale implementation across major regions.

Autonomous AI and Autonomous Agents Market Dynamics

Market Trends

The industry is witnessing notable shifts in technology usage enterprise procurement patterns and operational decision frameworks as organizations move toward higher levels of automation. One of the key trends shaping the market is the transition toward agentic AI systems capable of independent reasoning planning and execution which reflects growing preferences for efficiency scalability and cost optimization across digital operations. Another emerging trend is the integration of autonomous agents with responsible AI governance models driven by regulatory alignment and public sector guidance. Reports and policy frameworks issued by WHO, UNESCO and OECD emphasize ethical AI deployment transparency and safety which are influencing solution design and encouraging companies to focus on integrated compliant and value-added autonomous AI platforms thereby reshaping competitive dynamics within the industry landscape.

Growth Drivers

The growth of the market is largely supported by accelerating enterprise demand for intelligent automation, which continues to generate consistent adoption across sectors such as healthcare administration, financial operations, logistics management, and public service delivery. Increasing investments in digital infrastructure, cloud computing ecosystems, and national AI research programs are further accelerating market expansion, particularly in economies prioritizing large scale digital transformation. Government backed initiatives such as national AI strategies issued by OECD member states and public digital innovation missions have created a supportive environment for autonomous system deployment while emphasizing safety and accountability.

Additionally, regulatory and operational efficiency requirements are playing a crucial role in boosting adoption. As enterprises and public institutions prioritize cost efficiency operational accuracy and compliance, demand for autonomous AI platforms capable of continuous decision making and task execution is expected to remain strong throughout the forecast period. Guidance frameworks released by WHO and UNESCO on ethical and responsible AI use further reinforce structured adoption across regulated industries.

Market Restraints / Challenges

Despite favorable growth prospects, the marketplace faces several challenges that may limit expansion across certain sectors. One key restraint is regulatory and governance complexity, as evolving compliance requirements related to data protection algorithm transparency and ethical AI use continue to affect deployment speed and profitability, particularly among cost sensitive enterprises and emerging digital ecosystems. Government backed assessments from OECD and UNESCO highlight gaps in regulatory harmonization and readiness, which create uncertainty for large scale autonomous system adoption across borders.

Furthermore, dependence on advanced digital infrastructure skilled AI talent and external cloud and semiconductor technologies poses operational challenges for solution providers. Reliance on limited pools of specialized expertise and imported high performance computing resources can lead to cost pressures scalability constraints and implementation delays. Reports from WHO and other multilateral institutions also note that uneven digital capacity across regions impacts consistent AI integration, influencing overall market performance during periods of economic and policy uncertainty.

Market Opportunities

The market landscape presents significant opportunities in enterprise process automation and public sector digital transformation, primarily driven by rapid technological advancements and unmet demand for scalable intelligent decision systems. Organizations offering modular secure and high-performance autonomous AI platforms are well positioned to capture incremental demand from regulated industries such as healthcare finance and government services where efficiency accuracy and compliance remain critical priorities. Government backed digital economy programs and national AI roadmaps published by OECD member states further highlight expanding scope for autonomous agent deployment across mission critical applications.

Another key opportunity lies in responsible and sector specific autonomous AI solutions, where rising investments in compliant digital enabled offerings are creating avenues for higher margins and durable institutional partnerships. Frameworks and technical guidance issued by WHO and UNESCO emphasize ethical safe and inclusive AI adoption, encouraging solution providers to align innovation with governance requirements. Advancements in automation orchestration tools intelligent monitoring systems and adaptive learning models are also expected to strengthen customer engagement and support sustained long term adoption across global markets.

Global Autonomous AI and Autonomous Agents Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 12 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 240.12 Billion |

|

Growth Rate |

33.7% |

|

Segments Covered in the Report |

Deployment Mode, Component, Organization Size, End Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Key Companies |

IBM Corporation, Google LLC, Microsoft Corporation, AWS, NVIDIA Corporation, OpenAI, Salesforce Inc., Oracle Corporation, SAP SE, Meta Platforms Inc. |

|

Customization |

Available upon request |

Available upon request

Autonomous AI and Autonomous Agents Market Segmentation

By Deployment Mode

Cloud based deployment is projected to account for approximately 61% of total market revenue in 2025, reflecting strong enterprise preference for scalable infrastructure rapid deployment cycles and lower capital expenditure. This segment benefits from widespread availability of high-performance computing resources and government supported cloud adoption frameworks that enable secure and compliant AI workloads across industries.

On premise deployment contributes an estimated 39% of market revenue, supported by adoption in regulated sectors such as healthcare finance and public administration where data sovereignty security and compliance requirements remain critical. Organizations in these segments continue to rely on controlled environments to manage sensitive data and ensure alignment with national AI governance policies.

By Component

Software platforms are estimated to represent approximately 58% of total market revenue in 2025, driven by demand for autonomous reasoning engines orchestration layers learning models and decision management frameworks. Continuous upgrades and integration with enterprise applications support sustained growth as organizations seek advanced functionality and adaptability.

Services account for nearly 42% of revenue, supported by rising demand for deployment consulting system integration monitoring and governance support. Government backed responsible AI guidelines issued by OECD and UNESCO emphasize lifecycle management and accountability, increasing reliance on specialized services for compliant autonomous AI implementation.

By Organization Size

Large enterprises are expected to hold around 64% of total market revenue in 2025, supported by higher technology budgets complex operational requirements and early adoption of autonomous AI for large scale automation. These organizations benefit from internal data availability and established governance structures enabling faster and broader deployment.

Small and medium enterprises contribute approximately 36% of revenue, reflecting growing access to cloud based autonomous AI solutions and digital inclusion initiatives. This segment is witnessing faster growth as government supported innovation programs and shared digital infrastructure reduce cost and technical barriers for smaller organizations.

By End Use Industry

Enterprise and institutional users are projected to account for approximately 55% of total market revenue in 2025, driven by adoption across healthcare administration financial services logistics and large-scale operational management. Demand is reinforced by efficiency requirements compliance automation and public sector digital transformation programs supported by WHO and national AI strategies.

Public sector and smart governance applications represent nearly 45% of market revenue, supported by increasing investments in digital public infrastructure autonomous service delivery and policy driven AI integration. This segment continues to expand as governments prioritize scalable and responsible autonomous AI systems to enhance service efficiency and transparency.

Regional Insights

North America

North America is estimated to hold approximately 32% of the market in 2025. Growth is supported by mature digital infrastructure strong enterprise spending and early adoption of agentic AI across healthcare finance logistics and public administration. Federal level AI strategies research funding programs and public sector modernization initiatives encourage deployment of autonomous decision systems. Guidance issued by WHO and OECD aligned institutions on ethical and safe AI deployment further supports adoption in regulated environments. High concentration of AI development hubs and cloud infrastructure continues to reinforce regional market leadership.

Asia Pacific

Asia pacific is projected to account for roughly 21% of the market in 2025, driven by rapid digital transformation expanding enterprise automation and large-scale government led AI missions. Countries across the region are investing in autonomous AI to support smart governance financial digitization healthcare operations and logistics optimization. National AI strategies digital public infrastructure programs and innovation funding aligned with responsible AI principles promoted by UNESCO and WHO are accelerating adoption. High enterprise volume and increasing cloud penetration position the region as a key long term growth engine.

Europe

Europe represents approximately 24% of the market in 2025, supported by policy driven adoption and strong focus on compliant and transparent AI systems. The region benefits from coordinated national AI plans and regulatory frameworks emphasizing accountability safety and data protection. Enterprises and public institutions across healthcare manufacturing and public services are adopting autonomous agents to improve efficiency while maintaining regulatory alignment. Guidance from UNESCO OECD and regional public bodies reinforces responsible AI deployment and supports steady market expansion.

Other Regions

The remaining regions collectively contribute approximately 23% of the market. Growth in these regions is supported by gradual digital infrastructure development increasing enterprise awareness and government initiatives promoting digital transformation and AI readiness. Although adoption remains slower compared with North America, Asia Pacific and Europe, public sector modernization programs and alignment with global AI governance frameworks issued by WHO and other multilateral institutions position these regions as strategic long-term opportunities for autonomous AI deployment.

Competitive Landscape / Company Insights

The industry is moderately competitive, with leading global and regional players focusing on product innovation, strategic partnerships, and geographic expansion. Companies are investing in R&D, cloud integration, and ethical AI compliance to enhance technological capabilities and market presence. Government and multilateral guidelines from OECD, UNESCO, and WHO are influencing solution design, prompting vendors to align autonomous AI platforms with responsible use frameworks. Key players include Microsoft, IBM, Google, and NVIDIA, leveraging advanced AI models for enterprise and public sector adoption.

Mini Profiles

IBM positions its autonomous AI around governance, orchestration and decision control, mainly to meet the needs of regulated industries that demand security and explainability.

Google builds its agent systems into its large cloud ecosystem, letting businesses run multi-agent workloads at scale without handling data or infrastructure complexity themselves.

Microsoft integrates autonomous AI directly into Azure so enterprises can automate routine tasks and speed up responses with minimal setup.

AWS takes a modular approach, offering building blocks for retail, logistics and customer service automation.

NVIDIA serves the compute-heavy side with specialized hardware and simulation spaces built for real-time training, making it a starting point for robotics and industrial players exploring complex autonomous behavior.

Key Players

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services (AWS)

- NVIDIA Corporation

- OpenAI

- Salesforce Inc.

- Oracle Corporation

- SAP SE

- Meta Platforms Inc.

Recent Developments

In October 2025, Salesforce Inc. expanded its strategic partnership with OpenAI to integrate Salesforce’s Agentforce 360 platform with OpenAI’s frontier models, enabling enterprises to create and deploy AI agents directly within ChatGPT and Slack environments, supporting enhanced CRM workflows and commerce experiences.

In September 2025, SAP SE and OpenAI launched “OpenAI for Germany,” a sovereign AI initiative aimed at enabling secure AI agent use in the German public sector with strict data sovereignty and compliance standards. This partnership marks a major step in adopting sovereign AI in Europe, combining major tech players to build a localized, secure AI ecosystem for critical public sector functions.

In October 2025, Oracle Corporation introduced new AI agents embedded across its Fusion Cloud Applications to enhance decision‑making in finance HR supply chain sales and service operations. The new marketplace shall help customers boost productivity and address complex business challenges by enabling them to accelerate AI adoption at scale through secure AI agents built and ready for enterprise use.

In December 2025, Meta Platforms Inc. acquired Manus, a Singapore-based autonomous AI agent startup with Chinese origins, for over USD 2 billion in late 2025, aiming to integrate its advanced AI agent technology to enhance Meta AI, automate complex tasks, and compete in the AI race, bringing sophisticated AI automation to both consumers and businesses. Manus's technology allows agents to perform multi-step tasks like coding and data analysis, and the acquisition strengthens Meta's push into agentic AI beyond simple chatbots.

Global Autonomous AI and Autonomous Agents Market Coverage

Deployment Mode Insight and Forecast 2026 - 2035

- Cloud based

- On premise

Component Insight and Forecast 2026 - 2035

- Software Platforms

- Services

Organization Size Insight and Forecast 2026 - 2035

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End Use Industry Insight and Forecast 2026 - 2035

- Enterprise & Institutional

- Public Sector & Smart Governance

Region Insight and Forecast 2026 - 2035

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Global Autonomous AI and Autonomous Agents Market by Region

- North America

- By Deployment Mode

- By Component

- By Organization Size

- By End Use Industry

- By Region

- By Country - U.S., Canada, Mexico

- Europe

- By Deployment Mode

- By Component

- By Organization Size

- By End Use Industry

- By Region

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Deployment Mode

- By Component

- By Organization Size

- By End Use Industry

- By Region

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Deployment Mode

- By Component

- By Organization Size

- By End Use Industry

- By Region

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Autonomous AI and Autonomous Agents Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Deployment Mode

1.2.2. By

Component

1.2.3. By

Organization Size

1.2.4. By

End Use Industry

1.2.5. By

Region

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Deployment Mode

5.1.1. Cloud based

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. On premise

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Component

5.2.1. Software Platforms

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Services

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Organization Size

5.3.1. Large Enterprises

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Small & Medium Enterprises (SMEs)

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End Use Industry

5.4.1. Enterprise & Institutional

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Public Sector & Smart Governance

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.5. By Region

5.5.1. North America

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Europe

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Asia Pacific

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Middle East & Africa

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. Latin America

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Deployment Mode

6.2. By

Component

6.3. By

Organization Size

6.4. By

End Use Industry

6.5. By

Region

7. Europe Market Estimate and Forecast

7.1. By

Deployment Mode

7.2. By

Component

7.3. By

Organization Size

7.4. By

End Use Industry

7.5. By

Region

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Deployment Mode

8.2. By

Component

8.3. By

Organization Size

8.4. By

End Use Industry

8.5. By

Region

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Deployment Mode

9.2. By

Component

9.3. By

Organization Size

9.4. By

End Use Industry

9.5. By

Region

10. Company Profiles

10.1. IBM Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Google LLC

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Microsoft Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Amazon Web Services (AWS)

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. NVIDIA Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. OpenAI

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Salesforce Inc.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Oracle Corporation

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. SAP SE

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.1. Meta Platforms Inc.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Autonomous AI and Autonomous Agents Market