Global Non-Volatile Memory Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Traditional Non-Volatile Memory (Flash Memory, EEPROM, SRAM, EPROM, and Others) and Next-Generation Non-Volatile Memory (MRAM, FRAM, ReRAM, 3D-X Point, Nano RAM, and Others)), by Wafer Size (200mm, 300mm, and 450mm), by Application (Consumer Electronics, Healthcare Monitoring, Automotive Application, Enterprise Storage, Industrial, and Others), by Industry Vertical (Telecom & IT, Healthcare, Automotive, Energy & Power, Manufacturing Industries, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9087 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 300 |

Global Non-Volatile Memory Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Traditional Non-Volatile Memory (Flash Memory, EEPROM, SRAM, EPROM, and Others) and Next-Generation Non-Volatile Memory (MRAM, FRAM, ReRAM, 3D-X Point, Nano RAM, and Others)), by Wafer Size (200mm, 300mm, and 450mm), by Application (Consumer Electronics, Healthcare Monitoring, Automotive Application, Enterprise Storage, Industrial, and Others), by Industry Vertical (Telecom & IT, Healthcare, Automotive, Energy & Power, Manufacturing Industries, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Non-Volatile Memory Market Overview

The Non-Volatile Memory (NVM) Market is poised for significant growth, with a projected increase from USD 58.3 billion in 2023 to USD 85.7 billion by 2030. This represents a remarkable compound annual growth rate (CAGR) of 9.2% during the forecast period spanning from 2025 to 2030.

Non-volatile memory is a type of computer memory that can retain and retrieve information even when the machine is turned off. It is mainly used for long-term or secondary data storage devices like memory chips for digital cameras and USB memory sticks. NVM eliminates the requirement for storage technologies that are somewhat sluggish like hard drives. In addition, it uses user-configurable technology that does not require memory updates regularly. The widespread adoption of non-volatile memory in the consumer electronics sector and automotive sector will bolster the growth of the market. Thus, the increased demand to have fast access, less power consumption, high speed, and high scalability will fuel the growth of non-volatile memory globally.

The COVID-19 outbreak has had an adverse impact on the non-volatile market owing to lockdowns and travel restrictions in various countries. The consumer electronics and enterprise sector has suffered a massive loss in terms of production. Furthermore, the non-volatile technology production was less, and non-volatile memory plants were standstill. These all factors have led to a slight decline in the growth of the non-volatile memory market. However, the non-volatile memory market will bounce back and product variation and development will take place.

Non-Volatile Memory Market Segmentation

Insight by Type

The global Non-Volatile Memory (NVM) market is divided by its type into traditional non-volatile memory and next-generation non-volatile memory segments. The traditional non-volatile memory is further categorized into flash memory, EEPROM, SRAM, EPROM, and others. The next-generation non-volatile memory segment, on the other hand, is divided into MRAM, FRAM, ReRAM, 3D-X Point, Nano RAM, and other segments. Out of the two major segmentations, traditional memory like flash memory will dominate the market being an alternative to magnetic storage or hard drive of a desktop computer. The growth is also attributed to higher demand and usage, growing penetration in the consumer electronics sector, and higher adoption in data centers due to the growth of cloud solutions.

Insight by Wafer Size

The global Non-Volatile Memory (NVM) market is also divided by the wafer size into 200mm, 300mm, and 450mm categories. Out of these categories, the 300mm segment is expected to grow more during the forecast period due to higher adoption in construction and all-new fab upgrade activities. It is also attributed to the rise in cloud computing, AI, and IoT technology adoption by almost all major organizations, as well as the rise in R&D activities.

Insight by Application

According to the application, the global Non-Volatile Memory (NVM) market is split into consumer electronics, healthcare monitoring, automotive application, enterprise storage, industrial, and other segments. Out of these applications, the consumer electronics segment will grow more during the forecast period due to growing applications and requirements in the consumer electronics sector to meet their higher memory and processing power needs. It is also expected to grow due to developments in AI, IoT, big data analytics, and other advanced technologies.

Insight by Industry Vertical

The different segmentation of the global Non-Volatile Memory (NVM) market based on the industry verticals include telecom & IT, healthcare, automotive, energy & power, manufacturing industries, and other segments. Out of these segments, the telecom & IT sector will witness higher growth during the forecast period due to rapid tech development, growing applications across different platforms, and higher demand for electronic products such as digital cameras, smartphones, and others.

Global Non-Volatile Memory Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 58.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 85.7 Billion |

|

Growth Rate |

9.2% |

|

Segments Covered in the Report |

By Type, By Wafer Size, By Application, By Industry Vertical. |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Non-Volatile Memory Industry Trends

The notable trends of the global Non-Volatile Memory (NVM) market include higher adoption of advanced technologies like IoT, AI, and others and the additional focus of organizations on R&D activities to develop next-generation memory technology.

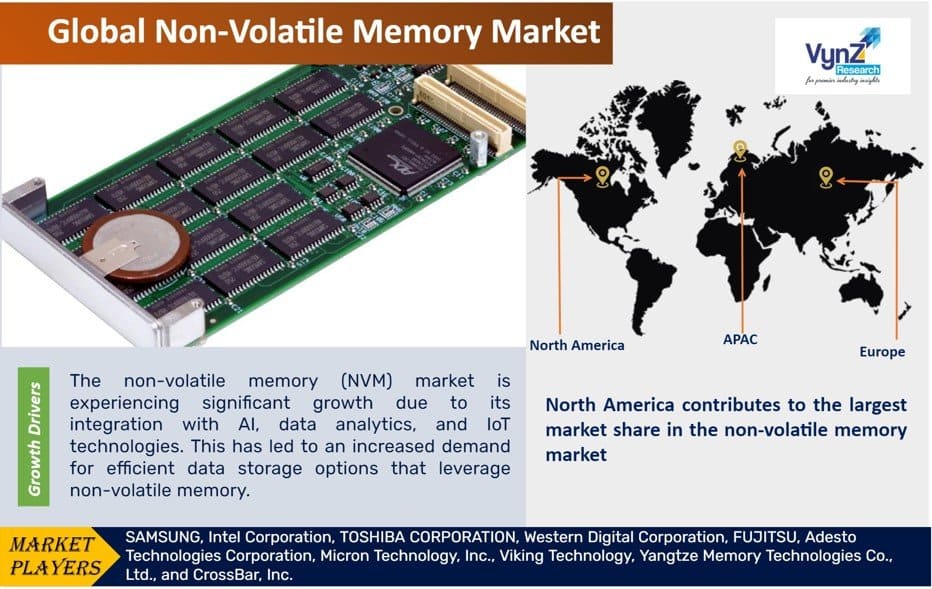

Non-Volatile Memory Market Growth Drivers

The global Non-Volatile Memory (NVM) market is growing at a rapid pace, mainly due to the notable growth and adoption of advanced technologies like AI, data analytics, and IoT. It is also the result of the growing demand for more efficient and faster data storage solutions. Additionally, the market is driven by the rise in popularity of optical discs, connected devices, wearables, flash drives, and computers, resulting in higher applications in the consumer electronics sector. On the other hand, in the automotive sector, the higher need for reliable and efficient data storage solutions is pushing the market forward. Some other significant growth factors for the market include higher disposable income among people, a growing need for convenient and fast data access, rising demand for portable systems, and the notable preference for low energy consumption.

Non-Volatile Memory Market Challenges

The most significant hindrance to the global Non-Volatile Memory (NVM) market growth is the limited storage capacity. In addition, the high cost of NVM, along with their lower endurance and limitations in data transfer due to deteriorating writing speed, opposes the growth of this market.

Non-Volatile Memory Market Opportunities

The technological advancements in the memory storage technologies such as MRAM, NRAM, 3D XPoint, and more present growth opportunities for the global Non-Volatile Memory (NVM) market. The growing adoption in the financial sector also provides novel growth opportunities due to ease of storage and its ability to store data even when the computer systems are shut off.

Non-Volatile Memory Market Geographic Overview

North America is expected to hold the largest share of the global Non-Volatile Memory (NVM) market since it is one of the largest producers of memory chips worldwide. It has higher disposable income and R&D support to develop and implement innovative technologies across industry verticals.

The Asia-Pacific market will grow at a higher CAGR during the forecast period due to new infrastructure construction, growing demand for online entertainment, voice call and video call services, and telecommuting. The significant growth in manufacturing in the consumer electronics and automotive sectors, as well as development of digitalization, requires building larger data centers, which need to use non-volatile memory. Additionally, China’s entry into the flash memory segment is expected to result in aggressive growth in this region.

Non-Volatile Memory Market Competitive Insight

The competition in the non-volatile memory market is huge and the entry of new players will further increase the competition. The strategies adopted by the industry players include acquisitions, expansion, and new partnerships. In a non-volatile memory market, competitive rivalry is mostly determined by a company's ability to maintain a competitive edge through innovation, market penetration, and the strength of its competitive strategy. Because the market is capital-intensive, the barrier to exit is significant.

TOSHIBA CORPORATION is one of the global leaders in the non-volatile memory industry. The company attempts to meet the ongoing demand for storage by introducing new memory products to meet the rising demand for Flash memory solutions. For its next-generation memories and 3D memories businesses, the company follows organic strategies and is significantly boosting its R&D spending. The company intends to expand its BiCS production capacity and concentrate more resources on SSD research and development.

Samsung Electronics is one of the leading innovators in the non-volatile memory market and is a leading producer of digital TVs, memory chips, mobile phones, and TFT-LCDs. Foundry, testing, packaging, and memory integration, such as DRAM, Flash, low-power memory, and end-user application products are all offered by the company. To reduce its reliance on the volatile memory chip industry and create semiconductors for self-driving cars and AI-enabled products, the business wants to invest USD 116 billion in non-memory chips by 2030.

Some of the key players operating in the non-volatile memory market are SAMSUNG, Intel Corporation, TOSHIBA CORPORATION, Western Digital Corporation, FUJITSU, Adesto Technologies Corporation, Micron Technology, Inc., Viking Technology, Yangtze Memory Technologies Co., Ltd., and CrossBar, Inc.

Recent Developments by Key Players

Samsung has started producing its latest 286-layer NAND chips, which brings it larger memory sizes and increased speed and energy performance.

Fujitsu Semiconductor Memory Solution Ltd has launched an I2C-interface 512kb FeRAM with automotive grade, MB85RC512LY which is a non-volatile memory with 512kb memory density and operates at a low power supply voltage.

The Non-Volatile Memory Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- Traditional Non-Volatile Memory

- Flash Memory

- EEPROM

- SRAM

- EPROM

- Others

- Next-Generation Non-Volatile Memory

- MRAM

- FRAM

- ReRAM

- 3D-X Point

- Nano RAM

- Others

- Traditional Non-Volatile Memory

- By Wafer Size

- 200mm

- 300mm

- 450mm

- By Application

- Consumer Electronics

- Healthcare Monitoring

- Automotive Application

- Enterprise Storage

- Industrial

- Others

- By Industry Vertical

- Telecom & IT

- Healthcare

- Automotive

- Energy & Power

- Manufacturing Industries

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Non-Volatile Memory Market