TIC Market for Electronics & Electrical Products Industry Overview

The Electronics & Electrical Products Testing, Inspection, And Certification Market reached USD 28.6 billion in 2030, currently, the market in the year 2023 is USD 13.6 billion with a projected CAGR of 5.1% from 2025 to 2030. This market encompasses various services such as audit, inspection, testing, verification, quality assurance, and certification.

TIC market for electronics and electrical products is witnessing growth owing to the adoption of advanced technologies in the electronics and electrical sector and offering new services and solutions like virtual inspections, visual inspections, and remote auditing during the COVID-19 outbreak. Moreover globalization, rapid urbanization, and rising brand protection, regulatory compliance have propelled the growth of the TIC market for electronics & electrical products. Furthermore, owing to the integration of electronics infrastructure, there is an increasing demand for automotive testing, standards, and regulations to reduce greenhouse emissions from vehicles, rising energy conservation movement in the automotive sector. Also, the growing need for comfort and safety has led to innovations and R&D efforts from OEM and automotive dealers to test electronics parts and comply with regulations, resulting in the growth of the TIC market for electronics & electrical products. Thus, mounting demand for household appliance testing and the increasing need for equipment validation will drive the growth of the TIC market for electronics and electrical products.

The COVID-19 outbreak has led to reduced demand during the first quarter of 2020. However, TIC plays a significant role to assure that customers receive products & services according to safety and security standards.

TIC Market for Electronics & Electrical Products Industry Segmentation

Insight by Sourcing Type

Based on sourcing type, the TIC market for electronics & electrical products is bifurcated into in-house and outsourced. Among the two segments, the in-house segment is expected to witness the largest share over the projected period 2023-2030 owing to in-house capabilities in terms of specialists, technology, testing and measurement equipment. Thus, providing organizations to manage TIC activities such as on-site availability, ability to employ talent, and make custom practices as per the requirements of the organizations.

Insight by Service Type

Based on service type, the TIC market for electronics & electrical products is segmented into testing, inspection, and certification. Among these segments, the testing segment holds the largest share in the testing, inspection, and certification market in 2020 owing to the different product standards, mandatory regulations, improved safety & security, growing industrialization, and surge in brand protection policies. Electrical components are rigorously tested in a lab environment to ensure compliance with health and safety standards and discover faults at an early stage.

Insight by Industry Vertical

Based on industry vertical, the TIC market for electronics & electrical products is divided into audio, video & household appliances, battery, cells & accumulators, electrical toys & childcare, e-cigarettes, IoT & Information Technology, lighting & luminaries, machinery, microelectronics, solar energy technology, cybersecurity services, chemical & material services, and others. Owing to technological innovation, consumers expect that their household appliances and audio & video products should be safe, reliable, efficient, and should have high performance, resulting in significant growth in the TIC market for electronics & electrical products. Solar energy technology is the most important renewable energy and is growing at a faster pace owing to its uses such as generating electricity, heating, and cooling systems, lighting, and concentrating power.

Global TIC Market for Electronics & Electrical Products Industry Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 13.6 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 28.6 Billion

|

|

Growth Rate

|

5.1%

|

|

Segments Covered in the Report

|

By Sourcing Type, By Service Type and By Industry Vertical

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

TIC Market for Electronics & Electrical Products Industry Trends

The trends in the TIC market for electronics & electrical products are rising investment in AR and VR, usage of connected devices and cloud-based technology, and growing M&A by market players

TIC Market for Electronics & Electrical Products Industry Growth Drivers

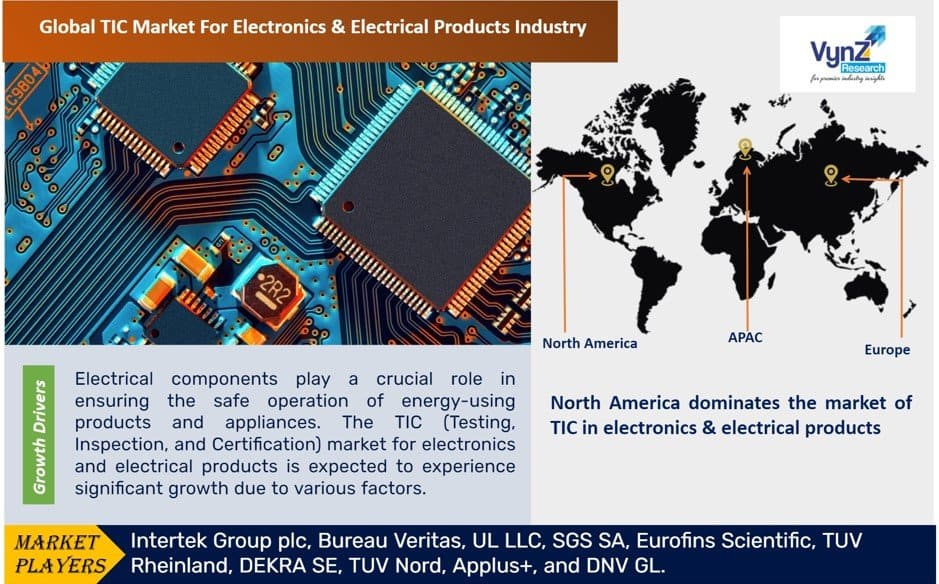

Electrical components play a crucial role in ensuring the safe operation of energy-using products and appliances. The TIC (Testing, Inspection, and Certification) market for electronics and electrical products is expected to experience significant growth due to various factors. These include the increasing demand for household appliance testing and equipment validation, the rise in smart home projects and IoT adoption, the use of cloud-based data storage, the enforcement of government regulations and compliance, and the advancement of smart cities.

Manufacturing and production companies are focusing on delivering high-quality products to satisfy consumers. Additionally, the emergence of digital platforms, the growing need for interoperability testing for connected devices and IoT, and the expansion of global trade will further contribute to the growth of the TIC market in the electronics and electrical products sector.

TIC Market for Electronics & Electrical Products Industry Challenges

The lack of global certification standards, growth fluctuations, trade wars, massive investment in automating and installing industrial safety systems, lack of testing facilities, and huge cost involved in TIC due to diverse standards and regulations may restrict the growth of the testing, inspection, and certification market in electronics & electrical products.

TIC Market for Electronics & Electrical Products Industry Opportunities

Testing, inspection, and certification offer promising opportunities in technologies like Artificial Intelligence, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity.

TIC Market for Electronics & Electrical Products Industry Geographic Overview

North America dominates the market of TIC in electronics & electrical products owing to strict testing and inspection regulations and standard certifications such as USTC, CEC, and NOM in the country which has contributed to the growth of TIC in the region. Moreover, the demand for TIC services has increased resulting in the growth of the TIC market for electronics & electrical products.

TIC Market for Electronics & Electrical Products Industry Competitive Insight

Key players are innovating digital payment technologies and services to a market and are aware of national and regional guidelines to verify that the products are safe and secure. The market players are taking advantage of the COVID-19 crisis to restructure their existing strategies and introduce new services and delivery models to facilitate demand. The market players are leveraging strategic collaborative initiatives to enhance their market share, increase their geographical presence, and improve their profitability.

Bureau Veritas provides electrical safety testing and certification services that help gain access to global markets. This certification program test products against recognized safety standards relating to criteria such as electric shock, excessive temperature, radiation, implosion, and mechanical hazards and fire.

UL Solutions helps to bring innovative technology and electronics products to the market with confidence that they meet applicable regulations and consumer demands for reliability and performance.

Some of the key players operating in the TIC market in the electronics & electrical products industry are Intertek Group plc, Bureau Veritas, UL LLC, SGS SA, Eurofins Scientific, TUV Rheinland, DEKRA SE, TUV Nord, Applus+, and DNV GL.

Recent Developments by Key Players

Intertek (a leading Total Quality Assurance provider to industries worldwide) has partnered with the Current/OS Foundation, a non-profit, independent and open foundation for the promotion and adoption of active Direct Current (DC) Microgrids based on the Current/OS set of rules.

Bureau Veritas has signed definitive agreements to acquire three players to diversify its position in testing and certification services for the Electrical and Electronics consumer products segment in South and North-East Asia provide services to a wide portfolio of domestic clients in Korea, including large manufacturers, exporters, and brands for electrical and electronic products, household appliances, and new mobility products.

GS Mexico stated its accreditation to perform full scope testing against the RoHS Directive of the European Union, which seeks to reduce the environmental effects of electrical and electronic equipment (EEE).

Bureau Veritas announced that they will provide their expertise to the Eolmed project. It will consist of three wind turbines with a combined capacity of 30MW and will be able to satisfy the energy needs of 50,000 people. The wind turbines will be mounted on floating platforms more than 18 km from the shore and grounded at an average depth of 60 meters.

The TIC Market for Electronics & Electrical Products Industry report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Audio, Video & Household Appliances

- Battery, Cells & Accumulators

- Electrical Toys & Childcare

- E-Cigarettes

- IoT & Information Technology

- Lighting & Luminaries

- Machinery

- Microelectronics

- Solar Energy Technology

- Cybersecurity Services

- Chemical & Material Services

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)

.png)