Global Semi-Trailer Market - Analysis and Forecast (2025-2030)

Industry Insights by Type (Flatbed, Lowboy, Dry Van, Refrigerated, Tankers, Others), by Number of Axles (<3 axles, 3-4 axles, 4 axles), and By Geography (North America ,Asia Pacific ,Europe,Rest of the World)

| Status : Published | Published On : Apr, 2024 | Report Code : VRAT4091 | Industry : Automotive & Transportation | Available Format :

|

Page : 220 |

Global Semi-Trailer Market - Analysis and Forecast (2025-2030)

Industry Insights by Type (Flatbed, Lowboy, Dry Van, Refrigerated, Tankers, Others), by Number of Axles (<3 axles, 3-4 axles, 4 axles), and By Geography (North America ,Asia Pacific ,Europe,Rest of the World)

Semi-Trailer Market Overview

The Global Semi-Trailer Market is expected to rise at a CAGR of 6.0 percent from USD 30.5 billion in 2023 to USD 54.5 billion in 2030.

The semi-trailer refers to a vehicle without the front axle and is typically used as a freight vehicle. There is a removable front axle or a tractor unit that supports most of the weight carried on these trailers, while the rest of the weight is supported by the semi-trainer itself.

The design of these trailers allows easy relocation in desired places instead of using a full trailer for frequent transporting of cargo. This is because the detachable design of the semi-trailer offers more flexibility than a full trailer.

These specific trailers integrate the key trends including electrification of vehicles, logistics, and autonomous trucks which makes it a favored choice for transporting both raw materials and finished goods. This enhances its demand for product delivery and utilization for cargo transportation.

This specific market is driven forward by different factors such as cost advantages, better networks and inland accessibility, increased manufacturing activities, efficient transportation, and rapid urbanization and expansion of rural areas compared to other modes of road transportation.

Semi-Trailer Market Segmentation

By Type

• Flatbed

• Lowboy

• Dry Van

• Refrigerated

• Tankers

• Others

According to the type, the global semi-trailer market is divided into flatbed, lowboy, dry van, refrigerated, tankers, and other segments. Out of all these segments, the dry van semi-trailer segment is used extensively in product logistics because it needs minimal protection from road and weather conditions. This specific segment is expected to grow at a faster rate during the forecast period due to its cost-effectiveness and flexibility which will enhance its use and demand among the LTL and FTL fleet operators and a wide range of industries for a variety of applications.

Dry van semi-trailers are mostly used in the logistics of products that need only minimal protection from weather and road conditions. Because of their flexibility and cost-effectiveness, LTL and FTL fleet operators use these trailers for their operations. Following its diverse applications in a variety of industries, the dry van segment is expected to account for the largest share of the semi-trailer industry.

By Number of Axles

• <3 axles

• 3-4 axles

• 4 axles

According to the number of axles, the global semi-trailer market is divided into lea than 3 axles, 3 to 4 axles, and 4 axles. Out of these segments, the less than three axles segment is expected to grow at a faster rate during the forecast period. This is due to their extensive demand and use in the European and Asia Pacific regions. These vehicles are favored mainly due to reasonably higher load-bearing capacity and the liberal weight-limit regulations of the government.

Insight by Length

According to the length, the global semi-trailer market is divided into below 45 feet and above 45 feet, where the former dominates the market and is expected to grow at a faster rate during the forecast period.

Insight by Tonnage

The global semi-trailer market is divided into 25 T to 50 T, 51 T to 100 T, and more than 100 T, based on tonnage. Out of these, the 25 T to 50 T segments dominate the market and are expected to grow at a faster rate during the forecast period due to their extensive use in flatbed semi-trailers and low-boy trailers, wide-scale applications across a diverse range of industries, and growing need for goods transport.

By Region

• North America

• Asia Pacific

• Europe

• RoW

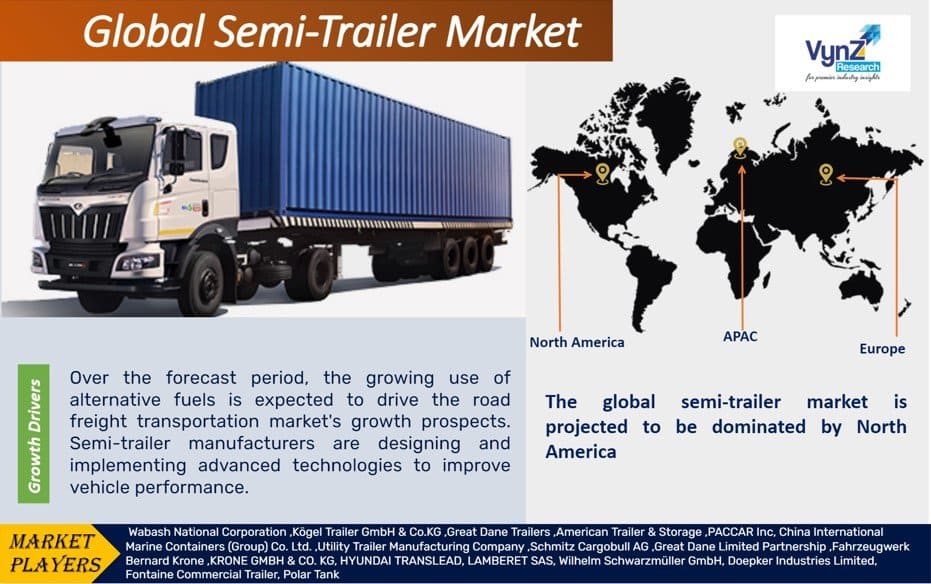

The global semi-trailer market is projected to be dominated by North America. This is due to factors such as improved road infrastructure, a growing supply chain industry, and government regulations governing semi-trailer weight carrying capacity and dimensions.

Industry Dynamics

Semi-Trailer Market Trends

There is an increase in the demand for semi-trailers across a wide range of industries such as construction, retail, automobile, and food & beverage to transport materials in bulk.

The manufacturers of these vehicles are trying to make vehicles according to the industry trends and future needs of the users. They are also trying to reduce weight to take advantage of the rising demand in the market for these specialized vehicles.

Moreover, there is significant growth noticed in the semi-trailer industry of developed and developing countries. Growing urbanization due to the rise in population base will boost the need for transportation of goods and use of these trailers, pushing this market forward.

Semi-Trailer Market Growth Drivers

The growth prospect of the global semi-trailer market is driven by the continual effort by the manufacturers to implement advanced technologies in designing to improve the performance of the vehicles.

Moreover, new governmental regulations and the extension of the manufacturing industry will also have a notable impact on the growth of the global semi-trailer market.

A few other factors that influence the growth of the global semi-trailer market include rapid urbanization and a growing population needing adequate transportation, growing manufacturing activity, widening of road networks in rural areas, and the growing adoption of cutting-edge technology.

The rise in population and higher disposable income among people in developing countries has increased the demand for cold chain products. As a result, there is a notable expansion in the cold chain industry that needs refrigerated trailers to transport their products, thereby boosting the global semi-trailer market.

Rapid urbanization and industrialization have resulted in the growth of trade, eCommerce, and heavy industries like construction in developing countries, that need semi-trailer vehicles as an effective transportation solution. This also fuels the growth of the global semi-trailer market.

Semi-Trailer Market Challenges

The high weight of an empty vehicle contributes significantly to fuel consumption and CO2 emissions during operation. The manufacturers face a lot of difficulty in reducing the weight of these semi-trailers, which might hinder the growth of the global semi-trailer market to some extent. However, they are trying hard to use stronger materials to reduce weight and carbon emissions, which brightens the prospects of this market.

Semi-Trailer Market Opportunities

Advanced technologies like telematics, electrification, digitalization, and autonomous driving are used in making semi-trailers now by the manufacturers. This creates new opportunities for the global semi-trailer market to grow. Also, the use of more sophisticated technologies like AI-based optimization will emerge during the forecast period which will reduce cost and congestion and help in temperature and fuel management. This will create new opportunities for further growth of this market.

Semi-Trailer Market Geographic Overview

North America dominates the global semi-trailer market and is expected to continue doing so during the forecast period due to upgraded road infrastructure, favorable government regulations regarding semi-trailer dimensions and weight-carrying capacity, expansion of logistics, and the evolving supply chain industry. The FMCG, construction, and other similar industries typically have a high demand for semi-trailers for goods transportation in this region, which also boosts the market growth.

The East Asia region is also expected to grow at a faster rate during the forecast period due to rapid industrialization, and growth of the agricultural and manufacturing sectors, all of which rely heavily on road freight transportation. Also, the significant economic development and integration in this region due to the growth of the clothing, textile, and electronic industries needs using roadways to transport their goods.

All these play a significant role in the growth of the global semi-trailer market.

Semi-Trailer Market Key Players

Some of the key players in the semi-trailer market

• Wabash National Corporation

• Kögel Trailer GmbH & Co.KG

• Great Dane Trailers

• American Trailer & Storage

• PACCAR Inc

• China International Marine Containers (Group) Co. Ltd.

• Utility Trailer Manufacturing Company

• Schmitz Cargobull AG

• Great Dane Limited Partnership

• Fahrzeugwerk Bernard Krone

• KRONE GMBH & CO. KG

• HYUNDAI TRANSLATED

• LAMBERET SAS

• Wilhelm Schwarzmüller GmbH

• Doepker Industries Limited

• Fontaine Commercial Trailer

• Polar Tank

• Trail King Industries

• Pitts Trailers

• East Manufacturing Corporation

• Mac Trailer Enterprises Inc.

• Strick Trailers

• STI HOLDINGS

• HEIL TRAILER INTERNATIONAL

• Vanguard National Trailer Corp.

Recent Developments by Key Players

Krone presents second generation 62 pallet Vario Liner Double-Deck trailer with better handling, more stability, shorter turnaround times and thus more efficiency in part-load transports. The innovative double-deck trailer was developed in close cooperation with the commercial vehicle manufacturers KRONE and Wiese. The tarpaulin semi-trailer named Vario Liner is designed for use in HUB and line haul transport. It is approved for ADR transports with its Code XL certified body. .

Fontaine Specialized has introduced its new Magnitude 65 lowbed trailer. The 3+2 modular multi-purpose trailer is designed and built to efficiently transport a wide array of loads, featuring three distinct deck options, flat (MFLD), drop side rail (MDSR) and beam (MBMD).

The Semi-Trailer Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- Type

- Flatbed

- Lowboy

- Dry Van

- Refrigerated

- Tankers

- Others

- Number of Axles

- <3 axles

- 3-4 axles

- 4 axles

Geographical Segmentation

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Semi-Trailer Market